|

市場調查報告書

商品編碼

1640544

中國玻璃包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)China Glass Container Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

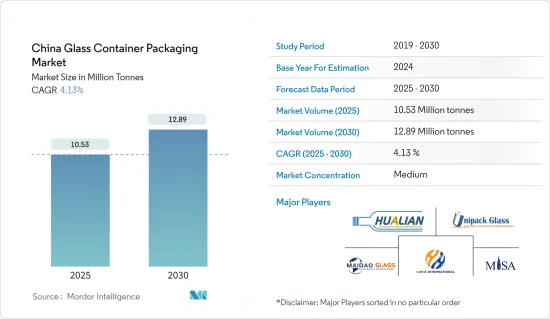

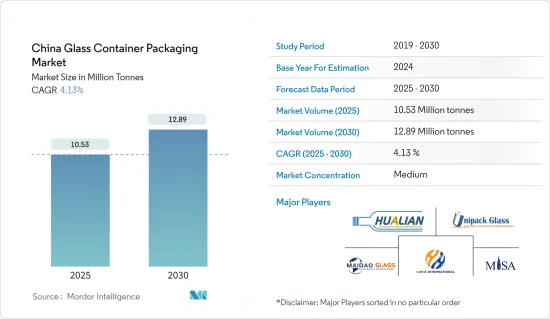

2025年中國玻璃容器包裝市場規模預估為1,053萬噸,預估2030年將達1,289萬噸,預測期(2025-2030年)複合年成長率為4.13%。

主要亮點

- 玻璃已成為包裝行業的主要組成部分,對玻璃容器市場的成長產生了重大影響。玻璃容器主要用於食品和飲料領域的儲存,具有耐用性、強度以及能夠保持口感和風味等優點。這些屬性使得玻璃容器特別適合需要長保存期限或對外部因素敏感的產品。

- 玻璃具有100%可回收的特性,在全球市場向環保包裝解決方案轉變的背景下,玻璃的永續性為中國的容器玻璃產業提供了良好的發展條件。這種可回收性不僅減少了廢棄物,而且還減少了生產對原料的需求。中國成熟的玻璃產業完全有能力滿足日益成長的對塑膠包裝永續替代品的需求。

主要亮點

- 根據世界主要出口商(WTEx)的數據,2023年,中國以約260億美元的玻璃出口領先全球。這一出口領先地位彰顯了中國在全球玻璃容器市場的重要角色及其影響產業趨勢的潛力。

- 酒精飲料經常使用玻璃包裝,因為其非反應特性可以保留飲料的香氣、濃度和風味。這種偏好在啤酒行業尤其明顯,因為大多數啤酒都是用玻璃容器運輸的。玻璃的惰性確保不會有化學物質滲入飲料中,從而長期保持飲料的品質。

主要亮點

- 根據東北銀行的報告,預計2023年中國年酒精飲料消費量將達到約516億公升。如此龐大的消費量凸顯了玻璃容器等可靠包裝解決方案在酒精飲料產業的重要性。

- 啤酒消費量的增加也是推動市場成長的因素。啤酒通常裝在深色玻璃瓶中,以防止內容物因紫外線而變質。深色玻璃起到屏障的作用,防止光線引起化學反應,從而改變啤酒的味道和品質。玻璃包裝的這種保護功能對於在儲存和運輸過程中保持光敏飲料的完整性至關重要。

- 受原物料價格波動影響,中國玻璃包裝市場面臨挑戰。佔玻璃容器製造總原料成本50%以上的堿灰成本一直在穩定上漲。這一趨勢可能會導致 PET 和生質塑膠等替代包裝材料的採用增加。然而,玻璃產業正在探索緩解這些挑戰的方法,包括提高生產效率、開發新的玻璃配方和投資回收基礎設施以減少對原料的依賴。

- 儘管面臨這些挑戰,中國的玻璃容器市場仍在不斷發展。製造商正在投資先進技術來生產更輕、更堅固的玻璃容器,以保持材料固有的優勢,同時解決對重量和運輸成本的擔憂。此外,化妝品和烈酒等各行業對高階和奢華包裝的日益重視,為高品質玻璃包裝產品創造了新的機會。

中國容器玻璃市場趨勢

酒精飲料佔了很大的市場佔有率

- 玻璃已成為酒精飲料行業的有效包裝選擇。玻璃容器可保護內容物免受光、溫度變化和空氣暴露等外部因素的影響,從而確保產品品質。這種保存能力對於對環境變化敏感的酒精飲料尤其重要。

- 隨著消費者擴大尋求環保解決方案,玻璃包裝提供了完全可回收的塑膠替代品。玻璃是100%可回收的,可以重複使用而不會造成任何品質損失,這使其成為有環保意識的消費者和企業的永續選擇。

- 中國都市區的酒精和非酒精飲料消費量正在增加。這一趨勢是由可支配收入的增加、生活方式的改變以及對多樣化飲料選擇的日益欣賞所推動的。

- 具有歷史根源的酒精飲料包括米酒、葡萄酒、啤酒、威士忌和各種蒸餾酒。每個類別都有其自身的文化意義和市場動態。白酒是一種中國傳統蒸餾酒,是中國消費量最大的烈酒,體現了其持久的文化重要性和廣泛的受歡迎程度。

- 根據港交所新聞報道,2021年,濃香型白酒銷售額約2,860億元(404.2億美元),佔中國白酒銷售額的一半以上。如此大的市場佔有率證實了這種特殊風味在中國消費者中的受歡迎程度。預計到 2026 年濃香型白酒銷售額將達到 3,129 億元(442.2 億美元),顯示白酒市場這一領域將穩定成長。

- 具有歷史根源的酒精飲料包括米酒、葡萄酒、啤酒、威士忌和各種蒸餾酒。每個類別都有其自身的文化意義和市場動態。白酒是一種中國傳統蒸餾酒,是中國消費量最大的烈酒,體現了其持久的文化重要性和廣泛的受歡迎程度。

- 由於鋁罐越來越受歡迎,玻璃包裝的成長速度比啤酒包裝慢。這種變化是由於罐頭更輕、運輸和儲存更容易以及消費者偏好改變等因素造成的。十多年來,中國金屬飲料罐市場一直以鋁罐為主,鋁罐在生產效率、成本效益上具有優勢。

- 然而,玻璃瓶預計將保持相當大的市場佔有率,特別是在高級啤酒和精釀啤酒領域。

- 根據聯合國商品貿易統計資料庫,2023年中國啤酒出口額將約為4.5176億美元,高於2022年的約3.2712億美元。出口量的大幅成長表明國際上對中國啤酒的需求不斷成長。隨著啤酒出口的增加,釀酒商可能會增加生產能力,這可能會導致對玻璃包裝的需求增加。

- 這一趨勢可能會鼓勵容器玻璃製造商擴大生產能力以滿足日益成長的市場需求。產能擴張可能涉及投資新製造設施、實施先進技術以及開發創新玻璃包裝解決方案,以滿足國內外市場不斷變化的消費者偏好。

化妝品:有望實現巨大成長的市場

- 消費者在美容產品上的支出增加,推動品牌擴大其產品範圍、創新並推出新產品。玻璃具有高度可客製化,並且是創新、美觀的化妝品包裝的首選,因此需求不斷成長。這一趨勢鼓勵玻璃容器製造商投資新設計、新材料和新技術,從而擴大市場。

- 根據中國國家統計局的報告,2022年中國人均化妝品年度總支出約407元人民幣(57.5美元)。預計到2025年,這數字將達到600元人民幣(84.8美元),超過中國居民可支配所得的成長速度。

- 人均化妝品支出的增加預計將推動中國電子商務產業的擴張並促進化妝品出口。玻璃容器因其耐用性和高檔外觀而受到青睞,在全球市場和電子商務平台的包裝產品中發揮越來越重要的作用,從而進一步加強了容器玻璃市場。

- 許多化妝品,包括香水、護膚霜、精華液和奢侈化妝品,都採用玻璃容器包裝,以彰顯其奢華、耐用和免受污染的特點。化妝品行業的擴張帶動了玻璃容器需求的增加,利好容器玻璃市場。

- 根據中國國家統計局的資料,預計2023年中國化妝品零售額將達到約585.4億美元,高於2022年的556.3億美元。

- 隨著消費者越來越追求高階、奢華的化妝品,品牌紛紛選擇玻璃包裝來提升產品展示效果和感知價值。化妝品市場優質化的趨勢推動了對高品質和獨特設計玻璃包裝的需求。

中國玻璃容器市場概況

中國玻璃容器包裝市場正趨於半固體,眾多參與者進入市場並佔有相當大的市場佔有率。參與的人員如下:麥道實業、上海維斯塔包裝、上海米莎玻璃等企業正專注於創新和建立戰略合作夥伴關係以維持其市場佔有率,並進行產能擴張、合併、收購和合作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 容器玻璃進出口資料

- 容器玻璃市場的PESTEL分析

- 玻璃包裝行業標準和法規

- 包裝玻璃的原料分析及材料考量

- 玻璃包裝的永續性趨勢

- 容器玻璃熔爐及位置

第5章 市場動態

- 市場促進因素

- 增加可支配收入並融入高階包裝

- 改進技術以提供更好的解決方案

- 市場挑戰

- 生產過程中的健康問題可能會抑制市場成長

- 貿易概況-中國容器玻璃產業過去與現在進出口模式分析

第6章 市場細分

- 按最終用戶產業

- 飲料

- 酒精飲料(葡萄酒、烈酒、啤酒、蘋果酒)

- 非酒精飲料(碳酸飲料、果汁、水、乳類飲料、調味飲料等)

- 食物

- 化妝品

- 藥品(不含管瓶和安瓿瓶)

- 其他最終用戶領域(例如消費應用)

- 飲料

第7章 競爭格局

- 公司簡介

- Maidao Industry Co. Ltd

- Shanghai Vista Packaging Co., Ltd

- ShangHai Misa Glass Co., Ltd

- Xuzhou Huihe International Trade Co., Ltd

- Jiangsu Rongtai Glass Products Co., Ltd

- Unipack Glass

- Hualian Glass Manufacturers Co., Ltd

- Chongqing Hechuan Jinxing Glass Products Co., Ltd

- DANFA GLASS LIMITED

- Zhangjiagang Guochao Glassware Co., Ltd

第 8 章 附加覆蓋範圍-該地區主要玻璃容器玻璃廠的主要窯爐供應商的分析

第9章:未來市場展望

The China Glass Container Packaging Market size is estimated at 10.53 million tonnes in 2025, and is expected to reach 12.89 million tonnes by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

Key Highlights

- Glass has become a key component in the packaging industry, significantly influencing the growth of the glass container market. Primarily used for storage in the food and beverage sector, glass containers offer advantages such as durability, strength, and the ability to preserve taste and flavor. These qualities make glass containers particularly suitable for products that require long shelf life or are sensitive to external factors.

- Glass's sustainability, being 100% recyclable, positions China's container glass sector favorably as global markets shift towards environmentally friendly packaging solutions. This recyclability not only reduces waste but also decreases the need for raw materials in production. China's established glass industry can meet the increasing demand for sustainable alternatives to plastic packaging.

- In 2023, China led global glass exports with a value of nearly USD 26 billion, according to the World's Top Exports (WTEx). This leadership in exports demonstrates China's significant role in the global glass container market and its potential to influence industry trends.

- Alcoholic drinks frequently use glass packaging due to its non-reactive properties, which preserve beverages' aroma, strength, and flavor. This preference is particularly evident in the beer industry, where most volume is transported in glass containers. The inert nature of glass ensures that no chemicals leach into the beverage, maintaining its quality over time.

- Banco do Nordeste reports that China's annual consumption of alcoholic beverages is expected to reach approximately 51.6 billion liters in 2023. This substantial consumption volume underscores the importance of reliable packaging solutions like glass containers in the alcoholic beverage industry.

- The increase in beer consumption is another factor driving market growth. Beer is typically packed in dark-colored glass bottles to protect the contents from UV light-induced spoilage. The dark glass acts as a barrier, preventing light from causing chemical reactions that can alter the beer's taste and quality. This protective feature of glass packaging is crucial for maintaining the integrity of light-sensitive beverages during storage and transportation.

- The China glass container packaging market faces challenges due to fluctuating raw material prices. The cost of soda ash, which comprises more than 50% of the overall raw material cost for glass container production, has been steadily increasing. This trend may lead to increased adoption of alternative packaging materials such as PET and bioplastics. However, the glass industry is exploring ways to mitigate these challenges, including improving production efficiency, developing new glass formulations, and investing in recycling infrastructure to reduce reliance on raw materials.

- Despite these challenges, the glass container market in China continues to evolve. Manufacturers are investing in advanced technologies to produce lighter, stronger glass containers that maintain the material's inherent benefits while addressing concerns about weight and transportation costs. Additionally, the growing emphasis on premium and luxury packaging in various sectors, including cosmetics and spirits, is creating new opportunities for high-quality glass container products.

Key Highlights

Key Highlights

China Container Glass Market Trends

Alcoholic Segment to Hold Significant Market Share

- Glass has emerged as an effective packaging option for the alcohol beverage industry. Glass containers maintain product quality by protecting contents from external factors such as light, temperature fluctuations, and air exposure. This preservation capability is particularly crucial for alcoholic beverages, which can be sensitive to environmental changes.

- As consumers increasingly seek eco-friendly solutions, glass packaging offers a fully recyclable alternative to plastic. Glass can be 100% recycled and reused without quality loss, making it a sustainable choice for environmentally conscious consumers and businesses alike.

- Major urban areas in China have experienced increased consumption of both alcoholic and non-alcoholic beverages. This trend is driven by factors such as rising disposable incomes, changing lifestyles, and a growing appreciation for diverse beverage options.

- Alcoholic beverages with historical roots include rice wine, grape wine, beer, whiskey, and various spirits. Each of these categories has its own cultural significance and market dynamics. Baijiu, a traditional Chinese spirit, remains the most consumed distilled spirit in China, reflecting its deep-rooted cultural importance and widespread popularity.

- According to HKEXnews, in 2021, Nongxiang flavor baijiu generated revenue of approximately CNY 286 billion (USD 40.42 billion), accounting for over half of China's baijiu sales revenue. This significant market share underscores the popularity of this particular flavor profile among Chinese consumers. The revenue from Nongxiang flavor baijiu is projected to reach CNY 312.9 billion (USD 44.22 billion) by 2026, indicating a steady growth trajectory for this segment of the baijiu market.

- Glass packaging has experienced slower growth than beer packaging due to the increasing popularity of aluminum cans. This shift is attributed to factors such as the lighter weight of cans, their convenience for transportation and storage, and changing consumer preferences. For over a decade, aluminum has dominated the metal can market for beverages in China, offering advantages in terms of production efficiency and cost-effectiveness.

- However, glass bottles are expected to maintain a significant market share, particularly in premium and craft beer segments, where glass packaging is often associated with higher quality and better taste preservation.

- According to UN Comtrade, in 2023, China exported beer worth approximately USD 451.76 million, up from around USD 327.12 million in 2022. This substantial increase in export value indicates growing international demand for Chinese beer. As beer exports grow, breweries may increase their production capacity, potentially leading to greater demand for glass packaging.

- This trend could encourage container glass companies to expand their production capabilities to meet the growing market needs. The expansion may involve investments in new manufacturing facilities, adoption of advanced technologies, and development of innovative glass packaging solutions to cater to evolving consumer preferences and regulatory requirements in both domestic and international markets.

Cosmetics Expected to Witness Major Growth

- Increased consumer spending on cosmetics prompts brands to expand product ranges, innovate, and launch new lines. Glass, being highly customizable and preferred for packaging innovative and aesthetically appealing cosmetic products, is experiencing growing demand. This trend encourages container glass manufacturers to invest in new designs, materials, and technologies, thereby expanding the market.

- The National Bureau of Statistics of China reports that in 2022, the total per capita annual spending on cosmetics in China was approximately CNY 407 (USD 57.5). This figure is projected to reach CNY 600 (USD 84.8) by 2025, outpacing the growth of per capita disposable income in China.

- The increase in per capita cosmetics spending is expected to drive the expansion of China's e-commerce sector and boost cosmetic product exports. Glass containers, valued for their durability and premium appearance, are becoming increasingly important for packaging products destined for global markets and e-commerce platforms, further strengthening the container glass market.

- Many cosmetic products, including perfumes, skincare creams, serums, and luxury makeup, are packaged in glass containers due to their premium appeal, durability, and protection from contaminants. The expansion of the cosmetics industry is leading to a corresponding increase in demand for glass containers, benefiting the container glass market.

- Data from the National Bureau of Statistics of China shows that retail cosmetics sales in China reached approximately USD 58.54 billion in 2023, an increase from USD 55.63 billion in 2022.

- As consumers increasingly seek high-end and luxury cosmetic products, brands are opting for glass packaging to enhance product presentation and perceived value. This trend towards premiumization in the cosmetics market is driving demand for high-quality and uniquely designed glass packaging.

China Container Glass Market Industry Overview

The China container glass packaging market is semi-consolidated, with many players operating in the market with considerable market share. The players such as Maidao Industry Co. Ltd, Shanghai Vista Packaging Co., Ltd., ShangHai Misa Glass Co., Ltd, and others are focusing on innovating and entering into strategic partnerships in order to retain their market share and undergoing capacity expansion, mergers, acquisitions, and collaboration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL Analysis of Container Glass Market

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace and Location

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Disposable Income and Integration in Premium Packaging

- 5.1.2 Improved Technology Offering Better Solutions

- 5.2 Market Challenges

- 5.2.1 Health Concerns Involved During Manufacturing may Restrain the Market Growth

- 5.3 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in China

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Bevarages

- 6.1.1.1 Alcoholic (Wines and Spirits, Beer, and Cider)

- 6.1.1.2 Non-alcoholic (Carbonated Drinks, Juices, Water, Dairy-based, Flavored Drinks, etc.)

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.5 Other End-User Vertical (Consumer Applications, etc.)

- 6.1.1 Bevarages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Maidao Industry Co. Ltd

- 7.1.2 Shanghai Vista Packaging Co., Ltd

- 7.1.3 ShangHai Misa Glass Co., Ltd

- 7.1.4 Xuzhou Huihe International Trade Co., Ltd

- 7.1.5 Jiangsu Rongtai Glass Products Co., Ltd

- 7.1.6 Unipack Glass

- 7.1.7 Hualian Glass Manufacturers Co., Ltd

- 7.1.8 Chongqing Hechuan Jinxing Glass Products Co., Ltd

- 7.1.9 DANFA GLASS LIMITED

- 7.1.10 Zhangjiagang Guochao Glassware Co., Ltd