|

市場調查報告書

商品編碼

1644842

二次包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Secondary Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

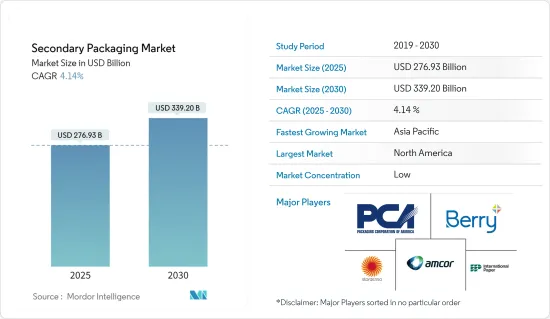

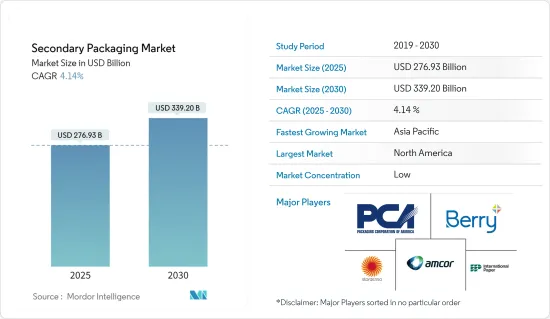

2025 年二次包裝市場規模預計為 2,769.3 億美元,預計到 2030 年將達到 3,392 億美元,預測期內(2025-2030 年)的複合年成長率為 4.14%。

關鍵亮點

- 二次包裝對於保護產品、保持產品完整以及最佳化運輸過程起著至關重要的作用。紙箱、托盤和薄膜捆包是一些具有多種形式和尺寸的二次包裝的例子。二次包裝對於品牌行銷和產品展示也很重要。

- 食品和飲料、藥品、化妝品、個人護理和家用產品等多個終端用戶行業中二次包裝的部署不斷增加,正在推動市場的成長。

- 二次包裝公司以循環性和永續性作為成長策略,以增加二次包裝應用的回收解決方案的可用性。 2023 年 6 月,利安德巴塞爾與 AFA Nord 建立夥伴關係,回收上市後的軟性二次包裝廢棄物。合資公司 LMF Nord GmbH 計劃建造一座回收工廠,將 LDPE廢棄物轉化為可用於包裝的高品質再生塑膠材料。

- 醫療保健中的二次包裝用於為瓶子、管瓶和泡殼等初級包裝提供額外的保護和組織。二次包裝還可以增加產品的需求,因為它提供有關產品的重要資訊,例如劑量說明、有效期和監管資訊,並有助於防止假冒和篡改。

- 各類二次包裝製造商都受到嚴格的監管,很難創新新產品。此外,消費者對二次包裝的偏好不斷變化可能會使製造商更難在市場上競爭。

二次包裝市場趨勢

折疊式紙盒預計將佔據主要市場佔有率

- 隨著人們的注意力轉向環保和永續實踐,食品和飲料、醫療保健、個人護理、居家醫療和零售等許多行業對折疊式紙盒的需求正在增加。折疊式紙盒的需求受到消費者對永續包裝的偏好、原料的可用性、紙張的輕質、生物分解性和可回收特性以及減少森林砍伐的推動。

- 各國旅遊業的快速成長導致加工食品、碳酸飲料和已調理食品的消費量增加。食品服務業的二次包裝要求正在改變並推動對食品藥物管理局批准紙箱的需求。用途廣泛且引人注目的紙質食品容器的出現推動了該產品的需求。

- 各公司紛紛透過投資併購作為擴大策略,以增加市場佔有率。 2023年9月,美國包裝公司Graphic Packaging宣布收購美國折疊紙盒公司Bell。此次收購還包括貝爾在美國的三家加工工廠,這可能會提升 Graphic 在食品包裝市場的佔有率。

- 各公司正在製造個人化和創新的折疊紙盒來包裝各種美容產品,如化妝品、護膚、護髮產品等,從而推動了需求。公司也致力於透過使用環保材料來製作紙箱,實現永續包裝。

- 根據美國林業和農業理事會的數據,2023年全球紙和紙板產能約為258,631,000噸。過去十年來,由於各終端用戶產業的需求不斷成長,紙和紙板的產量一直保持穩定。這些因素預計將為市場參與企業提供開發新產品以獲得市場佔有率的機會。

預計北美將佔據較大的市場佔有率

- 北美二次包裝市場受到二次包裝中環保材料的使用日益成長的推動。食品和飲料、製藥和化妝品行業等最終用戶越來越意識到需要使用環保包裝材料來滿足永續性的永續性需求。由紙板等可回收和生物分解性材料製成的紙質容器促進了永續性,從而促進了市場成長。

- 顧客支出的增加和網路購物銷售額的不斷成長正在影響電子商務的擴張。根據美國人口普查局預測,2024年第一季電子商務銷售額將占美國零售額的15.6%,超過2023年第一季,推動市場成長。

- 北美的製藥業正在蓬勃發展,一系列新藥的不斷開發推動了對二次包裝的需求。 2024 年 5 月,美國合約包裝公司Sharp Corporation Services 宣布將擴建製造地,以增加其無菌注射二次包裝的生產能力。

- 二次飲料包裝有多種用途。二次包裝用於保護重瓶子免於破損,並透過將多個物品一起運輸來降低成本。它還可以用作屏障或保護免受陽光照射和其他外部挑戰。二次飲料包裝有助於行銷產品並提高產品的知名度,從而推動市場成長。

二次包裝行業概況

二級包裝市場比較分散,主要參與者正在採用各種成長策略,如併購、新產品發布、業務擴張、合資和夥伴關係,以加強其市場地位。市場的主要企業包括 Amcor、國際紙業公司、雷諾包裝、斯道拉恩索、WestRock、Ball Corporation 和 Berry Global。

- 2024 年 5 月,Mondi 推出了 TrayWrap,一種新的紙質二次包裝解決方案,用於取代用於食品和飲料產品的塑膠收縮膜。 TrayWrap 由 100% 牛皮紙製成,完全可回收。

- 2023年9月,美國WestRock將與愛爾蘭Smurfit Kappa合併,成立永續包裝解決方案製造商Smurfit WestRock。成立合資公司是兩家公司的策略性舉措,旨在拓寬 Smurfit 在瓦楞紙板和箱板紙領域的產品系列,同時拓展各個終端用戶市場的地域覆蓋範圍。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治情勢如何影響市場

第5章 市場動態

- 市場促進因素

- 全球工業和消費者活動的擴張

- 安全交通的需求日益增加

- 市場限制

- 消費者對永續環境的需求和意識不斷改變

第6章 市場細分

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 塑膠盒

- 包裝和薄膜

- 按最終用戶產業

- 食物

- 飲料

- 醫療

- 家用電子電器

- 個人護理及家居產品

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Berry Global Inc.

- Packaging Corporation of America

- Stora Enso Oyj

- WestRock Company

- Ball Corporation

- International Paper Company

- Sealed Air Corporation

- Reynolds Group Holdings

- Mondi Group

- Multi-Pack Solutions LLC

第8章投資分析

第9章:市場的未來

The Secondary Packaging Market size is estimated at USD 276.93 billion in 2025, and is expected to reach USD 339.20 billion by 2030, at a CAGR of 4.14% during the forecast period (2025-2030).

Key Highlights

- Secondary packaging plays a pivotal role in product protection by holding them together and optimizing the product for transportation. Cartons, trays, and film bundles are a few examples of secondary packaging available in several shapes and sizes. Secondary packaging is also important for brand marketing and product display.

- The increasing deployment of secondary packaging for multiple end-user industries, including food and beverage, pharmaceuticals, cosmetics, personal care, and household care, is boosting market growth.

- Companies providing secondary packaging aim for circularity and sustainability as a growth strategy to increase the availability of recycled solutions for secondary packaging applications. In June 2023, LyondellBasell and AFA Nord entered a partnership to recycle post-commercial flexible secondary packaging waste. In the joint venture, LMF Nord GmbH planned to build a recycling plant to turn LDPE waste into quality recycled plastic material that can be used in packaging.

- Secondary packaging in healthcare is used to provide an additional level of protection and organization for primary packaging, including bottles, vials, and blisters. Secondary packaging can also provide important information about the product, such as dosage instructions, expiration dates, and regulatory information, and help prevent counterfeiting and tampering, thus boosting product demand.

- Various manufacturers of secondary packaging are subject to stringent regulations, which can make it challenging for them to innovate new products. Also, evolving consumer preferences for secondary packaging can make it difficult for manufacturers to compete in the market.

Secondary Packaging Market Trends

The Folding Cartons Segment is Expected to Hold a Significant Market Share

- Folding carton demand has been increasing across many industries, including food and beverage, healthcare, personal care, homecare, retail, and others, as the focus shifts to eco-friendly and sustainable practices. The need for folding cartons is driven by consumer awareness of sustainable packaging preferences, availability of raw materials, the lightweight, biodegradable, and recyclable nature of paper, and deforestation.

- Rapidly growing tourism in different countries has led to the high consumption of processed food, carbonated beverages, and ready-to-eat foods. The food service industry's requirement for secondary packaging has been reshaped, fueling the demand for folding cartons that are approved by the FDA (Food and Drug Administration). The availability of versatile and eye-catching food folding cartons boosts product demand.

- Various companies are investing in mergers and acquisitions as an expansion strategy to boost their market share. In September 2023, Graphic Packaging, a US packaging company, announced the acquisition of Bell Inc., a US folding carton company. The acquisition included Bell's three converting facilities in the United States, which is likely to grow Graphic's presence in the food service packaging market.

- Various companies are manufacturing personalized and innovative folding cartons to package different beauty products, including cosmetics, skincare, and haircare, boosting the demand. Companies are also aiming toward sustainable packaging by using eco-friendly materials to make folding cartons.

- According to the Forest and Agriculture Association of the United States, in 2023, the production capacity of paper and paperboard was approximately 258,631 thousand tons globally. The production of paper and paperboard has been stable over the past decade with respect to the growing demand in various end-user industries. Such factors are expected to create an opportunity for the players in the market to develop new products to capture market share.

North America is Expected to Hold a Significant Market Share

- The North American market for secondary packaging is being driven by the increasing usage of environment-friendly materials in secondary packaging. End users, such as the food and beverage, pharmaceutical, and cosmetic industries, are becoming increasingly aware of the need to utilize environment-friendly packaging materials to cater to growing sustainability demand. Folding cartons made from recyclable and biodegradable materials like paperboard promote sustainability, propelling market growth.

- Increasing customer spending and growing online shopping sales influence the expansion of e-commerce. According to the US Census Bureau, e-commerce sales accounted for 15.6% of all US retail sales in the first quarter of 2024, higher than the first quarter of 2023, propelling the market growth.

- The rapidly booming pharmaceutical industry in North America and the growing advancements in developing a variety of new drugs are driving the demand for secondary packaging. In May 2024, Sharp Services, a United States-based contract packaging company, announced the expansion of its Pennsylvania manufacturing site to increase its production capacity for sterile injectables secondary packaging.

- The secondary packaging for beverages serves different purposes. The secondary packaging is used to protect heavy bottles from breaking, and it reduces costs by shipping multiple items together. It may sometimes be used as a barrier or protection against sunlight exposure or other external challenges. The secondary packaging for beverages helps in product marketing and enhances product visibility, thus driving market growth.

Secondary Packaging Industry Overview

The secondary packaging market is fragmented, with major players adopting various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in the market. Some of the major players in the market are Amcor, International Paper Company, Reynolds Packaging, Stora Enso, WestRock, Ball Corporation, and Berry Global.

- May 2024: Mondi unveiled a new secondary paper packaging solution, "TrayWrap," to replace plastic shrink film used for food and beverage products. TrayWrap is made from 100% krafted paper, which is fully recyclable.

- September 2023: WestRock, a United States-based company, merged with Smurfit Kappa, an Ireland-based company, to create Smurfit WestRock to manufacture sustainable packaging solutions. The joint venture was a strategic move by the companies to expand Smurfit's product portfolio in corrugated and containerboard, along with regional expansion for various end-user markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Geo-Political Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Industrial and Consumer Activities across the World

- 5.1.2 Increased Need for Safe Transportation

- 5.2 Market Restraints

- 5.2.1 Changing Consumer Needs and Awareness Towards a Sustainable Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Plastic Crates

- 6.1.4 Wraps and Films

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Consumer Electronics

- 6.2.5 Personal Care and Household Care

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Packaging Corporation of America

- 7.1.4 Stora Enso Oyj

- 7.1.5 WestRock Company

- 7.1.6 Ball Corporation

- 7.1.7 International Paper Company

- 7.1.8 Sealed Air Corporation

- 7.1.9 Reynolds Group Holdings

- 7.1.10 Mondi Group

- 7.1.11 Multi-Pack Solutions LLC