|

市場調查報告書

商品編碼

1644890

泰國包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Thailand Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

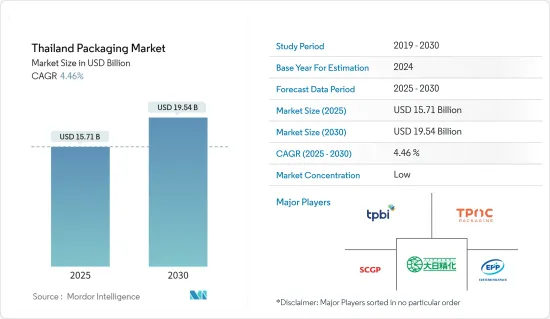

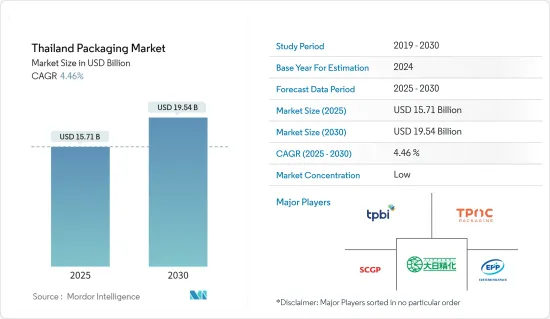

泰國包裝市場規模預計在 2025 年為 157.1 億美元,預計到 2030 年將達到 195.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.46%。

泰國的經濟擴張帶動包裝用品的生產和消費穩定成長。泰國的包裝產業正在不斷擴大並對經濟做出重大貢獻。這是由於適用於任何事物並且可以用來包裝任何事物的包裝用品的需求日益成長的結果。

主要亮點

- 由於基材偏好的改變、新市場的開發和所有權動態的轉變,泰國的包裝產業在過去十年中持續成長。隨著永續性和環境問題仍然受到重視,特別是在已開發國家,該行業正在看到各種針對紙和塑膠包裝的技術。

- 此外,不可回收塑膠包裝的消費量也在增加。這可能會減少對二次包裝的需求,並增加對紙和紙板、再生 PET(rPET)和生質塑膠等環保包裝材料的需求。

- 軟質包裝最終可能會取代傳統包裝。對於各種食品,高阻隔薄膜和自立殺菌袋可以與金屬罐和玻璃罐等硬質包裝形式競爭。可微波加熱的已調理食品、更便攜的包裝、方便攜帶的包裝以及易於打開和可重新密封的部件等便利功能可以滿足消費者對食品的便利性需求。

- 此外,零售業的複雜性和競爭程度也是影響市場的重要方面。冷凍食品越來越普及,在超級市場和便利商店等現代零售店中隨處可見。許多發展中國家正以過去難以想像的速度採用收縮膜、軟袋、蓋膜、高阻隔成型膜和保鮮膜等冷凍食品軟質包裝。

- 有關塑膠使用的新興法規可能會抑制泰國軟質包裝的成長;例如,2023 年 1 月,泰國工業標準協會 (TISI) 發布了關於食品塑膠袋的部長級法規草案 (TIS 1027-25xx (20xx))。它概述了材料中所含物質的安全要求、標記、標籤和測試標準的規範。這尤其適用於由原生樹脂製成的用於食品包裝的單層塑膠薄膜的塑膠袋。值得注意的是,該標準不適用於已用油墨自訂印刷的塑膠袋。

泰國包裝市場的趨勢

塑膠有望主導市場

- 泰國的包裝市場以增強產品效用的包裝為特色,特別是透過便攜包裝、永續包裝和客製化包裝。由於這些趨勢,該地區的聚乙烯(PE)市場正在擴大。常用聚乙烯包裝的材料有聚乙烯袋、塑膠薄膜、地工止水膜等。這種熱塑性樹脂較薄,略帶結晶質,具有良好的耐化學性、低吸濕性和隔音性。

- 預計預測期內包裝用 PE 樹脂的需求將激增,這主要受智慧價值鏈的推動。工業4.0和物聯網(IoT)正在改變工業生產,為PE價值鏈開闢新的視野。工業4.0提供的改進的可追溯性有望在確保包裝成分從製造到最終產品進入零售商店的過程中受到監控方面發揮關鍵作用,特別是當包裝包含再生材料時。

- 在熱餐中使用塑膠有長期使用而產生健康問題的風險。 TSH、HCY 和 A1C 均與每日使用塑膠加熱食物呈正相關,而維生素 E、鋅和硒的濃度則呈負相關。由於熱餐中使用塑膠而釋放的特定成分會引起複雜的荷爾蒙和代謝紊亂,而這些紊亂是這項技術未來研究的主要重點。

- 線型低密度聚乙烯(LLDPE)袋的特點是透明度適中,用於生產食品袋、報紙袋、購物袋和垃圾袋。中密度聚乙烯(MDPE)通常用於製作垃圾袋以及廁所用衛生紙和紙巾等紙製品的消費包裝。

食品業可望推動市場成長

- 根據世界銀行統計,食品飲料業佔泰國GDP的四分之一,是泰國經濟的重要貢獻者。主要出口食品包括米、鮪魚罐頭、糖、豬肉、木薯製品和鳳梨罐頭。根據泰國工業聯合會(FTI)、泰國商會(TCC)和國家食品研究所(NFI)的數據,預計 2023 年食品出口額將達到 1.55 兆泰銖,2024 年將達到 1.65 兆泰銖。

- 根據泰國塑膠工業協會報告顯示,泰國塑膠包裝市場正在擴大。預計會有需求的產品和行業包括藥品、家用產品、食品和飲料以及軟性塑膠計劃。塑膠價格低廉、易於加工、成型、耐化學性好、重量輕、物理性能多樣,是方便且流行的食品包裝材料。

- 過去幾年中,泰國人在已調理食品、咖啡和熱巧克力棒和袋裝、乾糧(速溶湯、肉汁和醬汁包、米飯、食品混合物)、零嘴零食和堅果、香辛料食品、巧克力和糖果零食、新冰淇淋、餅乾(餅乾)、蛋糕和薯片。

- 由於產品品質受到客戶的讚賞,市場對冷凍食品包裝的需求目前正在增加。隨著泰國經濟的不斷發展和生活方式的改變,冷凍食品包裝的需求也日益成長,未來幾年該行業將經歷盈利的擴張。

- 零售業的複雜性和競爭也嚴重影響市場。它們在現代零售位置更常見,例如超級市場和便利商店,這些地方儲存著各種各樣的冷凍食品。收縮膜、軟袋、蓋膜、高阻隔熱成型膜和保鮮膜都在一些新的國家以以前難以想像的速度被應用於冷凍食品包裝。

泰國包裝產業概況

泰國的包裝市場高度分散,由少數主要企業組成。 Dainichiseika Color &Chemicals Mfg.、Fagerdala Singapore Pte Ltd、Eastern Polypack、TPBI Public Company Limited 和 TPAC Packaging 等在市場上佔有重要佔有率的主要參與者正致力於透過採用各種技術來擴大海外基本客群。

- 2023 年 12 月-花王工業(泰國)有限公司(Kao)與兩家全球包裝專家新加坡化學有限公司(SCGC)和陶氏泰國Group Limited(Dow)合作開發可回收包裝。此次夥伴關係旨在為消費者提供更多永續的包裝選擇,並專注於高品質、低碳足跡和可回收包裝。三家公司今天在位於 True Digital Park West 的陶氏泰國總部簽署了合作備忘錄。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎疫情對產業的影響

第5章 市場洞察

- 市場促進因素

- 終端用戶產業需求不斷成長

- 便捷包裝需求不斷成長

- 市場限制

- 環境和回收問題

第6章 市場細分

- 按包裝材質

- 塑膠

- 紙和紙板

- 玻璃

- 金屬

- 按包裝類型

- 軟質包裝

- 小袋

- 包包

- 包裝膜

- 其他產品類型

- 硬包裝

- 瓶子和罐子

- 瓦楞紙箱和折疊式紙盒

- 金屬罐

- 鼓

- 散裝容器

- 軟質包裝

- 按最終用戶

- 食物

- 飲料

- 美容與個人護理

- 工業的

- 藥品

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- TBPI Public Company Limited

- TPAC Packaging

- SCG Packaging

- Dainichiseika Color & Chemicals Mfg. Co. Ltd

- Eastern Polypack Co. Ltd

- Huhtamaki Flexible Packaging

- Fagerdala Singapore Pte Ltd

- Sealed Air Corporation

- Amcor PLC

- Toppan(Thailand)Co. Ltd

第8章投資分析

第9章:市場的未來

The Thailand Packaging Market size is estimated at USD 15.71 billion in 2025, and is expected to reach USD 19.54 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

Thailand's economic expansion has led to a steady rise in both the production and consumption of packaging goods throughout time. The Thailand packaging industry is expanding and making a substantial economic contribution. This is a result of the growing need for packaging supplies that are appropriate for anything and can be used to pack anything.

Key Highlights

- The Thai packaging industry has consistently grown over the past 10 years due to changes in substrate preferences, the opening of new markets, and shifting ownership dynamics. Sustainability and environmental concerns may still be highlighted, especially in developed nations, and the industry is seeing a variety of technologies that cater to paper and plastic packaging.

- Moreover, consumption of non-recyclable plastic packaging is on the rise. As a result, there could be less need for secondary packaging and increasing demand for environmentally friendly packaging materials, including paper and board, recovered PET (rPET), and bioplastic.

- Flexible packaging may eventually supplant conventional packaging. For a variety of food goods, high-barrier films and stand-up retort pouches may compete with rigid pack forms like metal cans and glass jars. Consumers' need for convenience in food may be met via microwaveable ready meals, more portable packaging, packaging for consumption on the go, and convenience features like easy-open and reseal components.

- Furthermore, the complexity and level of competition in the retail industry are other important aspects that influence the market. Modern retail trade shops, such as supermarkets and convenience stores, which may stock a wider variety of frozen food goods, are more widely used. Flexible packaging for frozen foods, such as shrink films, flexible bags, lidding films, high barrier thermoforming films, and skin films, are being adopted at previously unheard-of rates in a number of growing countries.

- While regulations emerging on plastic usage could restrain the growth of flexible packaging in Thailand, for instance, in January 2023, the Thai Industrial Standards Institute (TISI) released the Draft Ministerial Regulation on Plastic Bags for Food (TIS 1027-25xx (20xx)). This outlines safety requirements for substances in the material, as well as specifications for marking, labeling, and testing criteria. It specifically applies to plastic bags made from virgin resin as single-layer plastic films for food packaging. It's important to note that this standard does not apply to custom-printed plastic bags with ink.

Thailand Packaging Market Trends

Plastic is Expected to Hold a Significant Share in the Market

- The Thai packaging market is distinguished by packaging that improves the usefulness of goods through, among other things, on-the-go packs, sustainable packs, or customized packs. The polyethylene (PE) market in the area is expanding as a result of this tendency. Plastic bags, plastic films, and geomembranes are commonly packaged with polyethylene. This thermoplastic resin is thin, somewhat crystalline, and has strong chemical resistance, little moisture absorption, and sound-insulating qualities.

- The country's need for PE resin for packaging is expected to soar during the forecast period, mostly because of the intelligent value chain. Industrial production is changing as a result of Industry 4.0 and the Internet of Things (IoT), and this is opening up new prospects for the PE value chain. The greater traceability provided by Industry 4.0 is expected to play a significant role in ensuring that the package composition can be monitored, particularly where recycled content is present, from the creation of the package through the end product being put on the retail shelf.

- The risk of health problems brought on by prolonged use of the materials is included in the usage of plastics with hot meals. TSH, HCY, and A1C are all favorably correlated with daily usage of plastics with hot meals, but vitamin E, zinc, and selenium concentrations are adversely correlated. The complicated hormonal and metabolic anomalies connected to the release of certain components caused by the usage of plastics with hot meals are the main focus of future studies on the technology.

- Linear low-density polyethylene (LLDPE) bags feature moderate clarity and are used to manufacture food bags, newspaper bags, shopping bags, and garbage bags. Medium-density polyethylene (MDPE) is commonly used to manufacture garbage bags and in consumer packaging for paper products, such as toilet paper or paper towels.

The Food Industry is Expected to Drive the Market's Growth

- One-fourth of Thailand's GDP is generated by the food and beverage sector, which makes a substantial economic contribution to the nation, as stated by the World Bank. Rice, canned tuna, sugar, pork, cassava products, and canned pineapple are some of the main food exports. Food exports were expected to reach THB 1.55 trillion in 2023 and THB 1.65 trillion in 2024, according to the Federation of Thai Industries (FTI), the Thai Chamber of Commerce (TCC), and the National Food Institute (NFI).

- The Thailand Plastics Industry Association reports that there is a growing market for plastic packaging in Thailand. Pharmaceuticals, home goods, food and beverage, and flexible plastic-based projects are among the items and industries that are projected to witness demand. Plastic is convenient and often used in food packaging because it is inexpensive, easily processed, formable, chemically resistant, lightweight, and has a wide range of physical qualities.

- Over the past few years, Thailand has seen a significant increase in spending on bakery goods and cereal bars, short-run ready meals and coffee or hot chocolate sticks and pouches, dry foods (instant soup, gravy and sauce packets, rice, and food mixes), snack foods and nuts, spice foods, chocolates and sweets, ice-cream novelty items, and bakery goods like cookies (biscuits), cakes, and chips.

- The market is now experiencing a rise in demand for frozen food packaging as a result of customer appreciation of the product quality. The need for frozen food packaging has expanded in Thailand due to the country's expanding economy and evolving lifestyles, and the industry is anticipated to expand profitably over the next years.

- The market is also significantly impacted by the retail industry's complexity and competitiveness. Modern retail trade locations with a wider selection of frozen food items, such as supermarkets and convenience stores, are more often used. Shrink films, flexible bags, lidding films, high barrier thermoforming films, and skin films are all being adopted at previously unheard-of rates in several new countries for frozen food packaging.

Thailand Packaging Industry Overview

The Thai packaging market is highly fragmented and consists of several major players. Major players with a prominent share in the market, including Dainichiseika Color & Chemicals Mfg. Co. Ltd, Fagerdala Singapore Pte Ltd, Eastern Polypack Co. Ltd, TPBI Public Company Limited, and TPAC Packaging, focus on expanding their customer base across foreign countries by adopting various technologies.

- December 2023 - Kao Industrial (Thailand) Co. Ltd (Kao) teamed up with two leading global packaging experts, SCG Chemicals Co. Ltd (SCGC) and Dow Thailand Group (Dow), to develop recyclable packaging. The goal of the partnership is to offer consumers more sustainable packaging choices, focusing on high-quality, lower carbon footprint, and recyclable packaging. Today, the three companies signed a Memorandum of Understanding (MoU) at Dow Thailand's headquarters in True Digital Park West.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Industry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from End-user Industries

- 5.1.2 Increased Demand for Convenient Packaging

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Packaging Material

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By Packaging Type

- 6.2.1 Flexible Packaging

- 6.2.1.1 Pouches

- 6.2.1.2 Bags

- 6.2.1.3 Packaging Films

- 6.2.1.4 Other Product Types

- 6.2.2 Rigid Packaging

- 6.2.2.1 Bottles and Jars

- 6.2.2.2 Corrugated Boxes and Folding Cartons

- 6.2.2.3 Metal Cans

- 6.2.2.4 Drums

- 6.2.2.5 Bulk Containers

- 6.2.1 Flexible Packaging

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Beauty and Personal Care

- 6.3.4 Industrial

- 6.3.5 Pharmaceutical

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TBPI Public Company Limited

- 7.1.2 TPAC Packaging

- 7.1.3 SCG Packaging

- 7.1.4 Dainichiseika Color & Chemicals Mfg. Co. Ltd

- 7.1.5 Eastern Polypack Co. Ltd

- 7.1.6 Huhtamaki Flexible Packaging

- 7.1.7 Fagerdala Singapore Pte Ltd

- 7.1.8 Sealed Air Corporation

- 7.1.9 Amcor PLC

- 7.1.10 Toppan (Thailand) Co. Ltd