|

市場調查報告書

商品編碼

1642066

法國包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)France Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

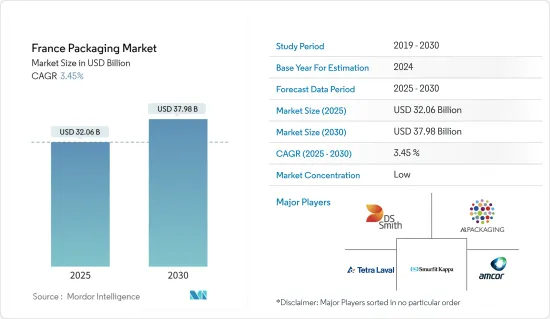

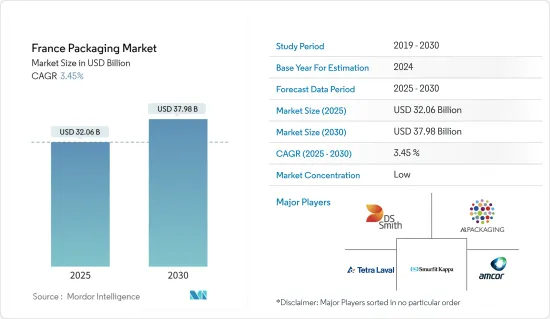

預計 2025 年法國包裝市場規模將達到 320.6 億美元,預計 2030 年將達到 379.8 億美元,在市場估計和預測期(2025-2030 年)內,複合年成長率為 3.45%。

法國對食品和飲料包裝的需求不斷成長,原因是重視便利、即食和高價格食品的遊客數量的增加。

關鍵亮點

- 根據美國農業部(USDA)的數據,2023 年國內生產總值(GDP)預計為 28,090 億美元。法國是世界第七大經濟體,歐盟第二大經濟體。法國擁有蓬勃發展的食品配料產業,生產各種各樣的配料供國內使用並出口到世界各地。

- 此外,前往法國旅遊的人數增加也刺激了對法國菜的需求,因為法國菜結合了豐富的風味和獨特的烹飪方法。法國烹飪在法國的不斷發展和擴大是該國食品產業發展的主要推動力。

- 法國包裝製造商致力於透過創新新的永續產品來減少包裝廢棄物。消費者對環保產品的需求正在推動永續包裝解決方案的明顯轉變。生物分解性、可堆肥和可回收的材料越來越受歡迎。同時,企業正在優先減少塑膠的使用並採取符合循環經濟的做法。

- 然而,該國對塑膠使用的監管日益嚴格,預計將對該國的塑膠包裝市場產生影響。例如,2020 年 12 月,法國議會下院通過了一項法律,規定從 2040 年起禁止使用所有一次性塑膠製品和包裝,此外還推出了多項增加重複使用和回收的舉措。

法國包裝市場的趨勢

軟包裝佔很大佔有率

- 軟包裝是一種使用非剛性材料包裝產品的方法,在法國可以提供更經濟、更可客製化的選擇。廉價、輕量包裝在該國的流行,鼓勵製造商在食品、化妝品、個人護理和電子商務等領域使用小袋、袋子和包裝紙等軟包裝。因此,這些因素正在推動市場的成長。

- 袋裝包裝在法國迅速流行起來,因為它是一種非常方便且便攜的解決方案。袋裝包裝越來越受歡迎,因為與其他容器相比,它使用的材料要少得多,而且可以減少食物廢棄物,從而推動了市場成長。過去十年來,消費者對立式袋(用於零食、食品和飲料、嬰兒食品以及工業用油和潤滑劑)的需求呈指數級成長。

- 法國軟包裝製造商如安姆科集團提供有助於延長生鮮食品保存期限的軟性紙包裝解決方案。 2023 年12 月,瑞士安姆科集團(Amcor Group) 將為法國起司製造商Fromagerie Milleret 提供可回收的紙質柔軟劑,用於生產其優質起司「Le Baron Brie」和「l'Ortolan Bio」。並提供包裝。 Amcor 的 AmFiber Matrix 包裝使軟乳酪生產商能夠控制其產品內的水分含量和成熟過程。

- 法國消費者越來越意識到包裝對環境的影響。他們正在尋找平衡功能性和環保性的包裝解決方案。根據法國紙板、造紙和纖維素工業聯合會(COPACEL)的數據,預計到 2020 年,法國包裝紙和紙板產量將增加 64.3%,到 2023 年將成長 70%。

- 因此,消費者偏好的變化推動了對永續和可回收軟包裝的需求。作為回應,軟包裝製造商正在適應這些不斷變化的需求並創造優先考慮環境因素的創新解決方案。

食品領域可望主導市場

- 法國快速發展的食品和餐飲服務業正在推動該國的包裝市場的發展。這些變化使得新包裝樣式的需求日益增加,包括多件裝和更小、更方便的單份包裝。軟包裝和硬質塑膠是法國包裝市場上最受歡迎的材料。

- 法國製造商正致力於擴大其紙張生產設施,以滿足該地區日益成長的紙質包裝需求。 2024 年 5 月,英國跨國公司 DS Smith 宣布將向其位於法國的 La Chevrolière 工廠投資 600 萬歐元(645 萬美元)。

- 據法國有機農業發展促進機構Agence Bio稱,法國有機食品市場(不包括餐廳和其他食品服務場所)的年銷售額預計在2019年和12年分別達到114億歐元(123.3億美元)。 ,其銷售額將達到8,000 萬歐元(137 億美元)。有機食品市場的興起也將帶動全國包裝產業市場的發展。

- 法國消費者欣賞簡潔、美觀且體現品質的設計。將功能性與美觀性結合的包裝越來越受到關注。該趨勢傾向於極簡主義,提倡減少標籤混亂並突出優質材料。

- 消費者對食品的來源和生產方式比以前更感興趣。品牌正在採用強調可追溯性、具有成分標籤和採購細節的包裝解決方案,包括單份包裝、可重新密封的袋子和專為份量控制而設計的產品。

法國包裝產業概況

法國包裝市場的競爭格局較為分散,主要參與者有 DS Smith PLC、AR Packaging Group AB、Smurfit Kappa Group PLC 和 Tetra Pak International SA 等。此外,由於各公司都在進行各種創新和投資,供應商之間的競爭水平也非常激烈。公司也透過收購來增強產品系列併擴大市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 人口變化和消費者偏好變化等宏觀經濟因素

- 旅遊業成長

- 市場問題

- 加強國內塑膠使用監管

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 材料

- 塑膠

- 玻璃

- 金屬

- 其他

- 包裝類型

- 軟包裝

- 硬包裝

- 按最終用戶產業

- 食物

- 飲料

- 醫療和製藥

- 美容與個人護理

- 其他最終用戶細分市場

第6章 競爭格局

- 公司簡介

- AR Packaging Group AB

- DS Smith PLC

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- Amcor PLC

- Ball Corporation(Rexam PLC)

- RPC Group PLC

- Owens Illinois Inc.

- Ardagh Group

- Mondi PLC

- Ametek Inc.

- Crown Holding Inc.

- Constantia Flexibles GmbH

第7章投資分析

第8章 市場機會與未來趨勢

The France Packaging Market size is estimated at USD 32.06 billion in 2025, and is expected to reach USD 37.98 billion by 2030, at a CAGR of 3.45% during the forecast period (2025-2030).

The growing demand for packaging in France for the food and beverage industry is attributable to increasing tourism with increased emphasis on convenience, ready-to-eat, and value-priced foods.

Key Highlights

- According to the United States Department of Agriculture (USDA), the gross domestic product (GDP) in 2023 is estimated at USD 2.809 trillion. France is the world's seventh-largest economy and the second-largest in the EU. France has a flourishing food ingredient industry, producing a wide range of ingredients used domestically and exported worldwide, which signifies the demand for packaging in the country.

- Additionally, the growth in the number of tourists in France has stirred the demand for French food, an amalgamation of rich flavors and unique processes. The constant development and expansion of French food options in the country significantly drive the food industry in the country.

- French packaging manufacturers focus on reducing packaging waste by innovating new sustainable products. Consumer demand for eco-friendly products propels a notable shift towards sustainable packaging solutions. Materials that are biodegradable, compostable, and recyclable are becoming increasingly favored. In tandem, companies are prioritizing reducing plastic usage and embracing practices aligned with the circular economy.

- However, increasing regulations in the country against the use of plastic are anticipated to affect the market for plastic packaging in the country. For instance, the French Parliament's lower chamber passed a law in December 2020 that banned all single-use plastic products and packaging after 2040, in addition to several initiatives to increase reuse and recycling.

France Packaging Market Trends

Flexible Packaging to Have a Significant Share

- Flexible packaging is a means of packaging products using non-rigid materials, which allows for more economical and customizable options in France. As cheap and lightweight packaging is gaining popularity in the country, manufacturers are encouraged to use flexible packaging such as pouches, bags, and wraps for food, cosmetics, personal care, and E-commerce applications. Hence, these factors are responsible for boosting the market's growth.

- Pouch packaging is rapidly gaining popularity in France, as it is a highly convenient and portable solution. The growing popularity of pouch packaging, as it significantly uses less material than other containers and reduces food waste, drives the market growth. Consumers drove the demand for stand-up pouches (for snacks, beverages, baby food, or industrial oils and lubricants) exponentially over the past decade.

- French flexible packaging manufacturers, such as Amcor Group, provide flexible paper packaging solutions that help extend the shelf life of perishable food products. In December 2023, Amcor Group, a Swiss-based brand, supplied France-based cheese producer Fromagerie Milleret with recycle-ready paper flexible packaging for the company's Le Baron Brie and l'Ortolan Bio premium cheeses. Amcor's AmFiber Matrix packaging allows soft cheese producers to control the level of moisture within the product and the ripening process.

- French consumers are increasingly aware of the environmental implications of packaging. They are on the lookout for packaging solutions that strike a balance between functionality and eco-friendliness. According to the French Union of Carboard, Paper and Cellulose Industries (COPACEL), the distribution of paper and paperboard production in France for packaging, in 2020 was 64.3% and it has increased to 70% in 2023.

- Therefore, this shift in consumer preference has led to a heightened demand for sustainable and recyclable flexible packaging materials. In response, manufacturers of flexible packaging are pivoting towards these evolving demands, crafting innovative solutions that prioritize environmental consciousness.

Food Segment Expected to Dominate the Market

- France's rapidly growing food and food service industry drives the country's packaging market. As a result of these changes, new packaging styles, such as multi-packs and more miniature and more convenient single-serve packs, are becoming increasingly necessary. Flexible packaging and rigid plastics are the most popular materials in the French packaging market.

- French manufacturers are focusing on expanding paper manufacturing facilities to cater to the region's increasing demand for paper packaging. In May 2024, DS Smith, a British multinational company, announced an investment of EUR 6 million (USD 6.45 million) in its La Chevroliere facility in France.

- According to Agence Bio, the French Agency for the Development and Promotion of Organic Agriculture, the annual turnover of the organic food market in France, excluding restaurants and other food service facilities, was EUR 11.4 billion (USD 12.33 billion) in 2019 and reached EUR 12.08 billion (USD 13.07 billion) in 2023. The rise in the organic food market also promotes the packaging industry market across the country.

- French consumers have a penchant for clean, attractive designs that exude quality. Packaging that marries functionality with aesthetic appeal captures attention. This trend leans towards minimalism, advocating for less clutter on labels and emphasizing premium materials.

- Consumers are more curious than ever about their food's origins and production methods. Brands adopt packaging solutions that underscore traceability, featuring ingredient labels and sourcing details, including single-serve packages, resealable bags, and products designed for portion control.

France Packaging Industry Overview

The competitive landscape of the French packaging market is fragmented, with major players such as DS Smith PLC, AR Packaging Group AB, Smurfit Kappa Group PLC, and Tetra Pak International SA vying for larger market share. Moreover, the competition level among these vendors is high due to the various innovations and investments made by the companies. Companies are also undergoing acquisitions to strengthen their product portfolios and increase their market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Macroeconomic Factors, such as Demographic Changes and Changing Consumer Preferences

- 4.2.2 Increasing Tourism in the Industry

- 4.3 Market Challenges

- 4.3.1 Increasing Regulations in the Country against the Use of Plastic

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Other Materials

- 5.2 Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.3 End-user Verticals

- 5.3.1 Food

- 5.3.2 Beverages

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Beauty and Personal Care

- 5.3.5 Other End-user Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AR Packaging Group AB

- 6.1.2 DS Smith PLC

- 6.1.3 Smurfit Kappa Group PLC

- 6.1.4 Tetra Pak International SA

- 6.1.5 Amcor PLC

- 6.1.6 Ball Corporation (Rexam PLC )

- 6.1.7 RPC Group PLC

- 6.1.8 Owens Illinois Inc.

- 6.1.9 Ardagh Group

- 6.1.10 Mondi PLC

- 6.1.11 Ametek Inc.

- 6.1.12 Crown Holding Inc.

- 6.1.13 Constantia Flexibles GmbH