|

市場調查報告書

商品編碼

1640449

高可見度包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Highly Visible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

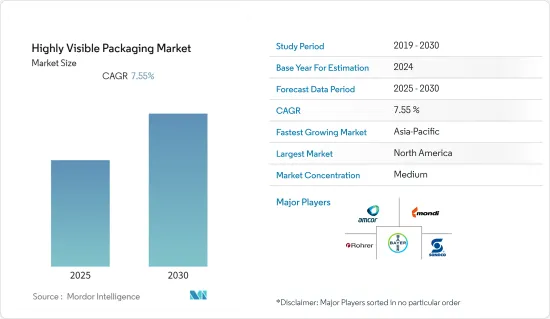

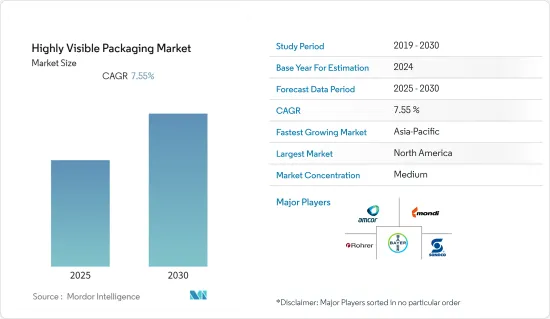

預計預測期內高能見度包裝市場複合年成長率將達到 7.55%。

主要亮點

- > 高可見度包裝具有高水準的保護性覆蓋和防篡改功能,經久耐用,對產品製造商而言是一種有益的選擇,並間接對消費者而言是一種有益的選擇。在新冠肺炎疫情期間,餐廳專注於外帶和送餐服務,並增加了顯眼的一次性塑膠食品容器的使用。

- 高可見度包裝對於製造業務而言是一種資產,因為快速識別產品可以帶來更高的銷售轉換率。此外,它還可以讓消費者在購買產品之前評估產品的視覺吸引力,幫助他們做出明智的決定。

- 簡便食品的需求促使製造商使用更多高可見度的包裝,因為易用性在客戶的購買決策中起著關鍵作用。然而,隨著所有包裝需求中塑膠的使用量不斷增加,包括 PE、HDPE、LLDPE、PP 和 LDPE,正逐漸迫使製造商選擇可回收的替代品,從而提高其產品的知名度。

- 在為減緩電子商務成長而實施的封鎖期間,電子商務的成長導致全球電子商務包裝中使用的塑膠數量增加。對改善消費者開箱體驗的關注導致了用於主要產品包裝的高視覺性包裝技術的興起。

高可見度包裝市場趨勢

快速消費品佔據很大市場佔有率

- 快速消費品包裝在飾面、尺寸、原料和外觀方面都具有創新性。

- 電子商務行業日益成長的需求正在塑造快速消費品包裝設計市場。

- 這一類別的成長歸因於對實用且可行的包裝的需求不斷成長,用於運送單一到小份產品以及便捷的快速消費品包裝替代品。

- 消費者偏好的變化推動了包裝材料的進步,包括產品可見度的提升。

- 食品包裝變得如此重要,以至於消費者行銷宣傳活動經常將其作為產品的主要特徵之一來強調,最終促進了高知名度包裝市場的成長。

- 然而,快速變化的成本壓力和更本地化的供應需求導致對高能見度包裝的投資以塑膠和紙質包裝類型為主。德國快速消費品企業漢高最近也報告了類似的趨勢。

北美佔據市場主導地位

- 食品和飲料行業的強勁成長迎合了時間緊迫的消費者的需求,便利商店和折扣店在該全部區域盛行,推動了快速消費品包裝的成長。過去幾年,美國對牛奶、起司和優格等乳製品的需求強勁。

- 為了減少包裝廢棄物,北美的製造商和客戶越來越傾向於使用可生物分解、透明的包裝,以便以環保的方式處理。這促使供應商進行創新並提供與傳統包裝技術相比產生更少廢棄物的永續包裝解決方案。

- 該地區的供應商可能會參與併購和創新包裝發布,這可能會改變市場格局。

- 政府政策提高了營商規則和準則的透明度,食品加工產業已經成熟,包括生物基塑膠和熱塑性塑膠在內的永續食品包裝解決方案正在推出。

- 消費者意識到保持食品新鮮和健康的健康益處,而高度可見的包裝有助於消費者的認知。該地區的工業研究和開發將帶來創新的新產品和製造新產品的技術。

高能見度包裝產業概況

預計高可見度包裝市場的競爭格局將保持適中。然而,由於消費者意識的提高和對高可見度包裝的需求,市場競爭預計將會加劇。公司正在投資開發透明和永續的包裝。

- 2021 年 10 月—加拿大塑膠包裝公司 Printex Transparent Packaging 推出了一系列全 PCR 聚對苯二甲酸乙二醇酯 (PET) 透明盒子。 Eco-PET 100 盒子可重複回收,並設計為原生 PET 的「合適」替代品。

- 2021 年 8 月 - Amcor 在亞洲和歐洲破土動工建設兩個新工廠並啟動了新計劃,以擴大其全球網路,補充其現有的北美研發中心。

- 2021 年 11 月 - 安姆科硬包裝 (ARP) 宣布技術進步,將能夠在美國回收日之前回收數十億個小瓶子。 ARP 以其可回收設計的包裝而聞名,並不斷尋找增加回收過程中所用材料數量的方法。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 確保安全的同時實現差異化

- 市場限制

- 增加佔用空間和資源的密封工藝

第5章 市場區隔

- 按類型

- 翻蓋包裝

- 泡殼包裝

- 收縮包裝

- 開窗包裝

- 塑膠容器和包裝

- 玻璃容器

- 瓦楞紙箱

- 按最終用戶產業

- 飲食

- 衛生保健

- 製造業

- 農業

- 服裝與時尚

- 電子產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 新加坡

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 科威特

- 卡達

- 南非

- 以色列

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Amcor Limited

- Mondi Group

- Reynolds Group Holdings Limited

- Rohrer Corporation

- Bayer AG

- Sonoco Corporation

- Bemis Corporation

- Anchor Packaging

- Drug Package Inc.

- Imex Packaging

第7章投資分析

第 8 章:未來展望

簡介目錄

Product Code: 53084

The Highly Visible Packaging Market is expected to register a CAGR of 7.55% during the forecast period.

Key Highlights

- >

- Moreover, the capability to be durable, such as highly protective covering and tamper-proof, makes it a profitable option for product manufacturers and indirectly for consumers. During the COVID-19 pandemic, restaurants focused on take-away and food deliveries during lockdowns, increasing the use of high visibility single-use plastic food containers. This affected the studied market and led to an increase in sales.

- High-visibility packaging acts as an asset to manufacturing operations where quick product identification results in high sale conversion numbers. Moreover, it allows the consumer to assess the product's visual appeal before purchasing the product and helps them make an informed decision.

- The demand for convenience foods drives manufacturers toward using more high visibility packaging as ease of use plays a vital role in customer purchase decisions.

- High visibility packaging offers clarity to improve product identification and protection from damage and contamination. In the case of pharmaceutical packaging, it facilitates patient compliance with drug regimens and improves inventory control, distribution, and recordkeeping for health care providers and institutions.

- However, increasing the use of plastics like PE, HDPE, LLDPE, PP, LDPE, and others for all packaging needs is gradually compelling manufacturers to opt for recyclable alternatives, reducing product visibility.

- During the lockdowns that were imposed to slow down the spread of COVID-19, the increase in e-commerce increased the volume of plastics used in e-commerce packaging across the world. With an emphasis on better consumer unpacking experience, high visibility packaging techniques for primary packaging of products witnessed a rise.

Highly Visible Packaging Market Trends

FMCG Holds a Major Market Share

- FMCG packaging is innovative in terms of finishing, size, raw materials, and looks.

- Increasing demand for the e-commerce industry is creating a market for FMCG packaging design.

- The category section growth is attributed to the rising demand for practical and feasible packaging for delivering single-serve to small serve products along with the convenient FMCG packaging alternatives.

- Changing preferences of consumers are leading to advances in packaging materials, such as the visibility of the product.

- Food packaging has become so vital that it is often highlighted in consumer marketing campaigns as one of a product's essential features, which ultimately leads to the growth of the highly visible packaging market.

- However, with quickly changing cost pressures and more regional supply needs, the investment for high visibility packaging is centered on plastic and paper packaging types. Henkel, a player in the German FMCG sector, reported a similar trend recently.

The North American Region Dominates the Market

- The strong growth rate in the food and beverage industry toward time-pressed consumers and the prevalence of convenience and discount retailers throughout the region are attributed to the growth of FMCG packaging. In the past few years, the United States witnessed strong demand for dairy products, including milk, cheese, and yogurt.

- To reduce the waste from packaging materials, manufacturers and customers in North America increasingly prefer the use of bio-degradable see-through packaging materials that can be disposed of in an eco-friendly way. This will induce vendors to innovate and provide sustainable packaging solutions that result in less waste compared to the conventional packaging techniques.

- Vendors in the region are involved in M&As and innovative packaging launches, which are likely to change the market landscape.

- Government policies increase transparency in rules and guidelines for business, the presence of a well-established food processing industry, and the deployment of sustainable food packaging solutions, including bio-based plastics and thermoplastics.

- Consumer awareness about the health benefits of keeping food fresh and healthy, and highly visible packaging help consumers recognize it. More research and development in the region within Industry leads to innovative new products and technology to manufacture new products.

Highly Visible Packaging Industry Overview

The competitive landscape for the highly visible packaging market is expected to be moderate. However, with the rising consumer awareness and the need to have a highly visible package, the market competition is expected to rise. Companies are investing in developing clear and sustainable packages.

- October 2021 - The Canadian plastic packaging company Printex Transparent Packaging introduced a range of fully PCR polyethylene terephthalate (PET) clear boxes. The Eco-PET 100 boxes can be recycled repeatedly and are designed to serve as a 'suitable' replacement for virgin PET.

- August 2021 - Amcor started a new project, building two new sites in Asia and Europe to expand the global network complement existing innovation centers in North America.

- November 2021 - Amcor Rigid Packaging (ARP), in conjunction with America Recycles Day, announced a technological advancement that makes it possible for billions of small bottles to be recycled. ARP, known for its designed-to-be-recycled packaging, is always looking for ways to increase the amount of material that makes it to - and through - the recycling process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Facilitate Differentiation While Maintaining Security

- 4.5 Market Restraints

- 4.5.1 Addition of Sealing Process that Consumes Space and Resources

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Clamshell Packaging

- 5.1.2 Blister Pack

- 5.1.3 Shrink Wrap

- 5.1.4 Windowed Packaging

- 5.1.5 Plastic Container Packaging

- 5.1.6 Glass Container

- 5.1.7 Corrugated Box

- 5.2 By End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Healthcare

- 5.2.3 Manufacturing

- 5.2.4 Agriculture

- 5.2.5 Fashion and Apparels

- 5.2.6 Electronics and Appliances

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Singapore

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Kuwait

- 5.3.5.4 Qatar

- 5.3.5.5 South Africa

- 5.3.5.6 Israel

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Limited

- 6.1.2 Mondi Group

- 6.1.3 Reynolds Group Holdings Limited

- 6.1.4 Rohrer Corporation

- 6.1.5 Bayer AG

- 6.1.6 Sonoco Corporation

- 6.1.7 Bemis Corporation

- 6.1.8 Anchor Packaging

- 6.1.9 Drug Package Inc.

- 6.1.10 Imex Packaging

7 INVESTMENT ANALYSIS

8 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219