|

市場調查報告書

商品編碼

1631589

包裝幫浦和分配器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Packaging Pumps And Dispensers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

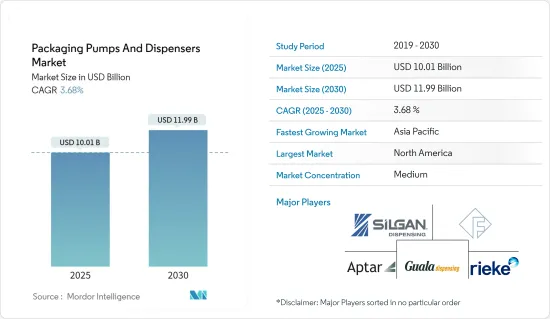

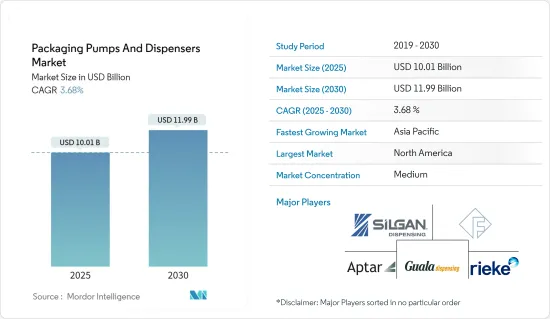

包裝幫浦和分配器市場規模預計到 2025 年為 100.1 億美元,預計到 2030 年將達到 119.9 億美元,預測期內(2025-2030 年)複合年成長率為 3.68%。

主要亮點

- 在化妝品需求激增的推動下,包裝幫浦和分配器正在經歷強勁成長。因此,品牌正在抓住增值機會並推出優先考慮功能性和便利性的創新飲水機解決方案。這項策略有助於品牌在擁擠的商品市場中建立權益。隨著對高階化和客製化的日益關注,最終用途產業正在投資先進的包裝解決方案,進一步推動預測期內的市場需求。

- 此外,包裝幫浦和分配器增強了產品功能。這項額外功能的價格很高,但它允許品牌將其產品作為奢侈品進行行銷。因此,許多關鍵應用正在從基本的螺旋蓋和封閉件轉向更複雜的分配器。

- 對液體、肥皂和消毒劑的需求不斷成長也推動了市場擴張。尤其是在冠狀病毒爆發和化學產量快速增加的背景下。 COVID-19 大流行加速了飯店和健身房等公共設施對固態皂而非液體肥皂的偏好。此外,自疫情爆發以來,電影院、購物中心和辦公室等設施預計將在多個地點安裝洗手液和洗手站,從而顯著提振市場。同時,許多新參與企業正在選擇可回收塑膠,這樣可以一次性回收整個瓶子,而無需拆卸泵和分配器。

- 由於最近的創新,塑膠泵和分配器在化妝品行業中越來越受歡迎。創新的激增催生了許多新的市場產品。無氣包裝在這些創新中脫穎而出。由於材料和配置的進步,真空包裝設備專為在使用前實現最佳配方儲存而量身定做,現在擁有多種包裝形式,包括瓶子、罐子和管子。

- 儘管包裝泵和分配器技術取得了進步,但挑戰仍然存在,特別是製造成本高。許多公司的開發團隊不斷重新評估無氣和大氣引擎,以提高其性能。隨著分配方法隨著配方的進步而發展,包裝公司正在積極尋找用於無氣和常壓引擎的新材料。

包裝幫浦和分配器市場趨勢

美容和個人護理正在顯著成長

- 美容和個人保健產品包裝的成長對於包裝幫浦和分配器市場的成長至關重要。包裝幫浦和分配器發揮重要作用,因為它們有助於增強視覺吸引力並提高產品的美學價值。這就是為什麼許多公司繼續投資於護髮、護膚和除臭劑等產品的視覺吸引力包裝。

- 近年來,使用泵浦和分配器進行包裝在化妝品行業已變得司空見慣。與所有其他行業相比,化妝品行業是包裝要求最複雜的行業之一。韓國、中國、日本和印度等亞洲國家也增加對美容和個人保健產品的投資,超越美洲和歐洲的已開發地區。

- 護髮品牌也正在成為包裝幫浦和分配器的重要採用者。許多洗髮精和護髮素製造商正在加大此類設備的投資。這標誌著化妝品領域的強勁成長,進一步推動了包裝中對泵浦和分配器的需求。

- 市場上美容和個人護理趨勢的興起幫助許多公司多年來顯著提高了銷售額。歐萊雅是化妝品和護髮市場的領導品牌之一,2017年至2022年除疫情期間外,其銷售額均呈現成長趨勢。 2023 年,該公司的銷售額達 411.8 億歐元(445.7 億美元),而 2017 年為 260.2 億歐元(281.6 億美元)。該公司是美容和個人護理領域的領導者,各種類別的產品對泵浦和分配器的需求持續成長。

- 無氣泵瓶因其優點在化妝品行業中越來越受歡迎,消費者也越來越意識到它們的日常益處。它的日益普及是由於其延長的產品壽命。這部分是由於取消了汲取管並用無空氣、非加壓室代替。

北美市場佔有率最高

- 由於消費者美容意識的增強和先進產品的廣泛供應,北美市場在預測期內顯示出巨大的成長潛力。在北美,由於越來越擔心合成成分的副作用,消費者,尤其是女性,擴大選擇更安全的護膚和護髮產品。這一趨勢正在推動該地區對包裝泵和分配器的需求。

- 該地區的人們對優質個人護理品牌越來越了解和感興趣,天然和有機化妝品也越來越受歡迎。消費者知識、透過數位媒體等提高對個人護理和化妝品益處的認知以及社交媒體的出現等因素正在促進該地區泵浦和分配器的成長。

- 洗髮精市場佔北美護髮產品銷售的大部分。在無氣泵瓶和封閉閥門等多項創新的支持下,該行業不斷擴大,對天然洗髮精的需求也有所增加。因此,隨著該地區洗髮精銷量的上升,該地區對塑膠瓶的需求預計也會增加。因此,預計未來一段時間市場對包裝幫浦和分配器的需求將會強勁。

- 這家為個人護理品牌提供分配器和包裝解決方案的美國製造商正在擴大其無氣產品線中消費後再生樹脂 (PCR) 的使用。此次擴展包括推出兩款新產品:Micro ECO 和 Meso ECO。這些產品的組合組件中含有高達 45% 的 PCR,並經過生態設計 Cotrep 認證。

- Aptar 本地生產的所有無氣解決方案均採用 100% 塑膠並通過 ECO 認證。這些解決方案提供最佳的配方保護,並滿足各種應用領域的需求,包括護膚、護髮、身體保養、彩妝品和洗手液。

- 根據美國人口普查局的數據,2023 年美國醫療個人護理專賣店銷售額將達到約 4,350 億美元,高於前一年的約 3,990 億美元。這種銷售成長標誌著產品製造和消費的增加,這可能會推動對有效包裝解決方案(包括泵浦和分配器)的需求增加。

- 銷售額的成長可歸因於消費者健康意識的增強、人口老化需要更多的醫療產品以及個人保健產品線的擴大等因素。為了滿足這種不斷成長的需求,製造商可能正在尋找創新且高效的包裝解決方案,以使其產品在競爭激烈的市場中脫穎而出。幫浦和分配器在這些情況下發揮重要作用,提供便利、精確的劑量控制並延長產品的保存期限。

包裝泵和分配器行業概述

包裝幫浦和分配器市場分散。市場上的主要參與企業包括 Silgan Dispensing Systems、AptarGroup Inc.、Rieke Packaging Systems、Frapak Packaging BV 和 Guala Dispensing SpA 等,在競爭激烈的市場空間中爭奪注意力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 高級產品的成長趨勢

- 提高效率、環保

- 市場限制因素

- 製造成本高

第6章 市場細分

- 依產品

- 乳液和霜泵

- 噴霧觸發泵

- 氣霧帽

- 閥塞

- 推拉閉合

- 其他飲水機

- 按最終用戶使用情況

- 食物

- 飲料

- 美容/個人護理

- 居家醫療

- 其他最終用戶用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Silgan Dispensing Systems(Silgan Holdings Inc.)

- AptarGroup Inc.

- Rieke Packaging Systems

- Frapak Packaging BV

- Guala Dispensing SpA

- Mitani Valve Co. Ltd

- Raepak Ltd

- Taplast Srl

- Zhejiang Sun-Rain Industrial Co. Ltd

- Wuxi Sunmart Science and Technology Co. Ltd

第8章投資分析

第9章市場的未來

The Packaging Pumps And Dispensers Market size is estimated at USD 10.01 billion in 2025, and is expected to reach USD 11.99 billion by 2030, at a CAGR of 3.68% during the forecast period (2025-2030).

Key Highlights

- Driven by a surging demand for cosmetics, packaging pumps and dispensers are witnessing robust growth. Consequently, brands are seizing value-added opportunities, introducing innovative dispensing solutions prioritizing functionality and convenience. This strategy aids brands in establishing equity within a crowded commodity market. With a rising emphasis on premiumization and customization, the end-use industry is channeling investments into advanced packaging solutions, further propelling market demand during the forecast period.

- Additionally, packaging pumps and dispensers enhance product functionality. While this added feature comes at a premium, it allows brands to market their products as high-end offerings. As a result, many key applications are witnessing a shift from basic screw caps and closures to more sophisticated dispensers.

- The market's expansion is also fueled by a heightened demand for liquids, soaps, and sanitizers, especially in light of reported coronavirus outbreaks and a surge in chemical production. The COVID-19 pandemic notably accelerated the preference for liquid soaps over bar soaps in public venues like hotels and gyms. Furthermore, since the outbreak, venues such as cinemas, malls, and offices have been expected to install hand sanitizers and hand washes at multiple points, significantly boosting the market. On the other hand, many new firms are opting for recyclable plastics, which can recycle an entire bottle in a single stream without disassembling the pump dispenser.

- Plastic pumps and dispensers are gaining traction in the cosmetics industry owing to recent innovations. This surge in innovation has led to a plethora of new market offerings. A standout among these innovations is airless packaging. Tailored for optimal formulation storage pre-application, airless packaging equipment now boasts diverse packaging formats, including bottles, jars, and tubes, owing to advancements in materials and configurations.

- Despite advancements in packaging pump and dispensing technologies, challenges remain, particularly due to high manufacturing costs. Many companies' development teams are in a constant loop of re-evaluating their airless and atmospheric engines to refine their performance. As dispensing methods evolve alongside formula advancements, packaging firms are actively scouting for novel materials tailored for airless and atmospheric engines.

Packaging Pumps And Dispensers Market Trends

Beauty and Personal Care to Show Significant Growth

- The growth of beauty and personal care product packaging is essential for the growth of the packaging pumps and dispensers market. Packaging pumps and dispensers play a significant role as they enhance the visual appeal and help enhance the aesthetic value of the product. Therefore, many players continue to invest in visually appealing packaging for products such as hair care, skin care, and deodorants.

- Packaging pumps and dispenses have become more common in the cosmetic industry in recent years. The cosmetic sector is one of the most complex in terms of packaging requirements compared to all other industries. Asian countries such as South Korea, China, Japan, and India are also increasing investment in beauty and personal care products beyond the developed regions of the Americas and Europe.

- Haircare brands are also emerging as significant adopters of packaging pumps and dispensers. Many shampoo and conditioner manufacturers are increasingly investing in these devices. This suggests strong growth for the cosmetics segment, further driving the demand for pumps and dispensers in packaging.

- The growing trends of beauty and personal care in the market have helped many companies to increase sales significantly throughout the years. Loreal is one of the leading brands in the cosmetic and hair care market, showing an upward trend in sales from 2017 to 2022, except during the pandemic. The company recorded sales of EUR 41.18 billion (USD 44.57 billion) in 2023 compared to EUR 26.02 million (USD 28.16 billion) in 2017. This company is driving the beauty and personal care segment and is constantly in demand for pumps and dispensers for various categories of products.

- Airless pump bottles are becoming increasingly popular in the cosmetics industry because of their advantages, and consumers are increasingly aware of their daily benefits. Their growing popularity is attributed to the added product life they provide. This is partly due to the absence of dip tubes replaced with airless, non-pressurized chambers.

North America to Hold the Highest Market Share

- The market shows significant growth potential during the forecast period, driven by increasing consumer beauty consciousness and the wider availability of advanced products. In North America, consumers, especially women, are increasingly choosing safe skin and hair care products due to rising concerns about synthetic ingredient side effects. This trend is boosting the region's demand for packaging pumps and dispensers.

- People in the region are becoming more aware and interested in luxury personal care brands, and natural and organic cosmetics are becoming more popular. Factors such as consumer knowledge, growing awareness of the benefits of personal care and cosmetic products through digital media and other sources, and the emergence of social media have contributed to the growth of pumps and dispensers in the region.

- The shampoo market accounted for most hair care product sales in North America. The industry has expanded on the back of several innovations, such as Airless pump bottles and valve Closures, and also the rising demand for natural shampoo. Therefore, with the rising sales value of shampoo in the region, there would be a rising demand for plastic bottles in the region. Therefore, in the period going forward, the market is expected to witness robust demand for packaging pumps and dispensers.

- American manufacturers of dispensing and packaging solutions for personal care brands are expanding their use of post-consumer recycled resin (PCR) in airless product lines. This expansion includes the launch of two new products: Micro ECO and Mezzo ECO. These products incorporate up to 45% PCR in their combined components and have received Cotrep certification for eco-design.

- Aptar's complete range of locally-produced airless solutions features 100% plastic construction and ECO-Cert approval. These solutions provide optimal formula protection and are compatible with various application fields, including skin, hair, and body care, color cosmetics, and hand sanitizers.

- According to US Census Bureau, in 2023, United States health and personal care store sales amounted to about USD 435 billion, up from the previous year's figure of about USD 399 billion. This growth in sales suggests a rise in product manufacturing and consumption, potentially driving higher demand for effective packaging solutions, including pumps and dispensers.

- The increase in sales may be attributed to factors such as growing health consciousness among consumers, an aging population requiring more healthcare products, and the expansion of personal care product lines. As manufacturers respond to this increased demand, they are likely to seek innovative and efficient packaging solutions to differentiate their products in a competitive market. Pumps and dispensers play a crucial role in this context, offering convenience, precise dosage control, and improved product preservation, which are essential features for many health and personal care items.

Packaging Pumps And Dispensers Industry Overview

The packaging pumps and dispensers market is fragmented. Some of the major players in the market are Silgan Dispensing Systems, AptarGroup Inc., Rieke Packaging Systems, Frapak Packaging BV, and Guala Dispensing SpA, which are vying for attention in a contested market space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Trend of Premium Products

- 5.1.2 Improved Efficiency and Eco-friendliness

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Cost

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Lotion and Cream Pumps

- 6.1.2 Spray and Trigger Pumps

- 6.1.3 Aerosol Caps

- 6.1.4 Valve Closures

- 6.1.5 Push-pull Closures

- 6.1.6 Other Dispensing Closures

- 6.2 By End-user Application

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Beauty and Personal Care

- 6.2.4 Homecare

- 6.2.5 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silgan Dispensing Systems (Silgan Holdings Inc.)

- 7.1.2 AptarGroup Inc.

- 7.1.3 Rieke Packaging Systems

- 7.1.4 Frapak Packaging BV

- 7.1.5 Guala Dispensing SpA

- 7.1.6 Mitani Valve Co. Ltd

- 7.1.7 Raepak Ltd

- 7.1.8 Taplast Srl

- 7.1.9 Zhejiang Sun-Rain Industrial Co. Ltd

- 7.1.10 Wuxi Sunmart Science and Technology Co. Ltd