|

市場調查報告書

商品編碼

1630253

西班牙包裝產業:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Packaging Industry in Spain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

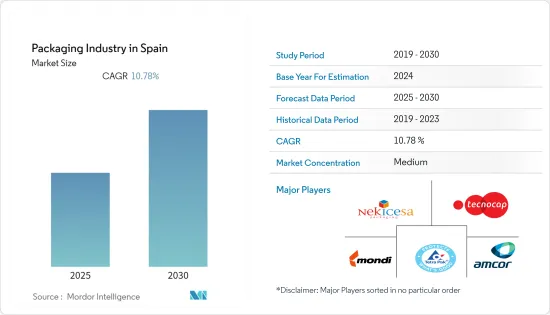

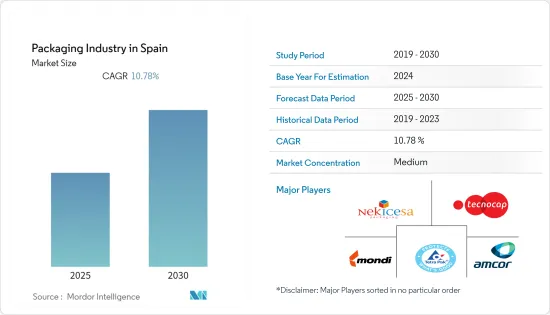

西班牙包裝產業市場預計在預測期內複合年成長率為10.78%。

主要亮點

- 良好的展示、強烈的視覺印像以及對緊湊、方便的包裝日益成長的需求是支持該國包裝行業擴張的一些因素。

- 例如,魚貝類生產商 Globalimar 憑藉 Cryovac VST Traskin(一種密封空氣真空包裝)取得了成功。包裝採用溫和的吸力,不會使托盤支撐變形,平衡成本和質量,保證產品保存期限,並由於頂部薄膜的強阻氧功能而減少零售收縮。

- 此外,疾病發生率的增加和營養意識的提高使西班牙公民更加注重健康,並鼓勵他們吃更新鮮的食物。

- 西班牙生鮮食品包裝領域的頂級公司包括 Mondi、DS Smith、Sonoko Products Company、Smurfit Kappa 和 International Paper。全球領先的蒙迪集團為生鮮食品提供瓦楞包裝,確保產品從農場到商店的新鮮度,同時提高運輸效率、延長保存期限並促銷。鑑於肉類消費量處於歷史高位,家禽及肉類產業預計將擁有廣闊的市場。

- 截至 2021 年的五年裡,推動工業需求的最大因素是 COVID-19 大流行的爆發,這對市場產生了積極影響。

西班牙包裝市場趨勢

紙質包裝預計將佔據較大佔有率

- 紙基材料使我們能夠有效率且經濟地運輸、儲存和包裝各種產品。許多最終用戶行業採用不同類型的紙包裝,包括運輸袋、紙板、紙袋和瓦楞紙板。

- 據歐洲漫畫製造商協會稱,據報道,歐洲各國政府和商人在 COVID-19 大流行期間已經意識到包裝的價值。尤其是折疊式紙盒,對於幫助品牌所有者在關鍵時刻向家庭和社區分發關鍵產品至關重要。例如,AR Packaging 於 2021 年 1 月收購了 FirstanHoldings Ltd,包括其子公司 FirstanLimited,透過增加本地折疊紙盒生產,增加了向英國食品和醫療保健客戶提案。這項策略選擇導致集團:

- 事實證明,回收包裝材料具有挑戰性,尤其是塑膠。這可能會鼓勵使用紙張等易於回收的材料,從而導致更多當地居民使用紙質包裝。

- 全球對品牌耐用品和快速消費品 (FMCG) 的需求導致包裝紙板的使用量增加。在食品和飲料領域,紙板最廣泛用於包裝加工產品,如麵包、零嘴零食、已調理食品(RTE)、肉品、水果、耐用食品以及食品和飲料。

- 公司正在創新新的包裝解決方案,以滿足客戶的不同需求。 2021 年 2 月,Mondi 推出了名為 BCoolBox 的創新紙板包裝解決方案。 BCoolBox 具有隔熱功能,無需冷卻車即可將食物冷藏在攝氏 7 度以下長達 24 小時。盒子完全由回收材料製成,100% 可回收。這使得線上零售商能夠擴大其送貨的地理範圍。

食品和飲料行業對包裝行業的成長做出了巨大貢獻

- 西班牙特別注重加工食品的品質、可追溯性和安全性,並擁有以國內市場為中心的現代食品加工業。在整個預測中,該地區的市場預計將走強。

- 由於上門限制放寬後,酒類消費量預計將穩定成長,市場可能會更關注店外消費而不是店內消費。外部部署酒精消費有利於軟包裝紙市場的成長。用於單劑量消費的袋裝飲料是在所研究的市場中越來越受歡迎的一些值得注意的例子。

- 經濟環境的改善和人們可支配收入的增加是預測期內推動包裝產業擴張的兩個主要因素。例如,2021年西班牙的食品零售額達到274億美元。

- 包裝行業的主要公司正在增加在該地區的業務,對包裝用品的需求預計將全面增加。

- 例如,2022 年 5 月,卡夫亨氏與 Pulpex 合作開發了一種紙質、可再生和可回收的瓶子,完全由永續來源的木漿製成。 CPG 巨頭亨氏表示,它是第一個評估 Pulpex 醬料永續紙瓶包裝潛力的醬料品牌。幾乎所有食品和飲料 CPG 都使用包裝來減少對環境的影響。

西班牙包裝產業概況

西班牙包裝產業較為分散,主要參與者如下: Nekicesa Packaging SL、Tecnocap SpA. 和 Mondi Group、Tetra Pak International SA.、Amcor PLC 在該市場上營運。

- 2022 年 4 月 - Amcor 宣布投資擴大其位於愛爾蘭斯萊戈的醫療包裝工廠的醫療包裝熱成型新產能。擴張加強了 Amkor 在不斷發展的無菌包裝行業的領導地位,並提供了一個新的地點,為歐洲和北美的客戶提供全面的醫療保健解決方案。

- 2022 年 5 月 - Buenvato 是世界上第一款採用 94% 回收材料製成的紙板瓶龍舌蘭酒,將於 2022 年 7 月在歐洲(主要是瑞典市場)首次亮相。 Tequila Buen Batou 的使命是透過投資永續製造、運輸和企業社會責任計畫來徹底改變飲料產業。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 市場定義

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 引領市場的創新與優質包裝

- 對小型便利包裝的需求不斷成長

- 市場限制因素

- 關於包裝材料的嚴格規則和規定

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按包裝材料分

- 塑膠

- 紙

- 玻璃

- 金屬

- 封裝層數分類

- 更

- 雙層

- 三層

- 按最終用戶產業

- 飲食

- 醫療保健和製藥

- 美容/個人護理

- 工業

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Nekicesa Packaging SL

- Tecnocap SpA

- Mondi PLC

- Tetra Pak International SA

- Amcor PLC

- Sealed Air Corporation

- COVINIL SA

- Wipak Group

- Plastipak Holdings Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 66436

The Packaging Industry in Spain Market is expected to register a CAGR of 10.78% during the forecast period.

Key Highlights

- Excellent presentation, a powerful visual impression, and the growing demand for compact and convenient packages are some elements that will support the expansion of the packaging sector in the country.

- As an illustration, the fish and shellfish producer Globalimar has succeeded with Sealed Air's vacuum packing, the Cryovac VST tray skin. The package utilizes a gentle suction that doesn't distort the tray support, striking a balance between cost and quality, ensuring the product's shelf life and a reduction in retail shrinkage due to the strong oxygen barrier capabilities of the top film.

- Additionally, due to the increased frequency of diseases and growing nutrition awareness, the Spanish population is becoming more health concerned, encouraging them to eat more fresh foods.

- Among Spain's top companies that offer fresh food packaging are Mondi, DS Smith, Sonoco Products Company, Smurfit Kappa, and International Paper. As a global leader, Mondi Group offers corrugated packaging for fresh produce that keeps the product fresh from the farm to the shop while enhancing transport effectiveness, extending the shelf life, and promoting sales. Due to the nation's historically high consumption of fresh meat, the poultry and meat products industry is expected to have a sizeable market.

- The biggest driver of industrial demand throughout the five years leading up to 2021 had been the start of the COVID-19 pandemic has positively impacted the market.

Spain Packaging Market Trends

Paper Based Packaging is Expected Hold a Significant Share

- A range of goods can be efficiently and affordably transported, preserved, and packaged using paper-based materials. Many end-user sectors employ different types of paper packaging, including shipping sacks, paperboard, paper bags, and containerboard.

- According to the European Cartoon Makers Association, European governments and shops reportedly realized the value of packaging during the COVID-19 pandemic. Particularly folding cartons have been crucial in helping brand owners distribute important goods to families and communities at essential times. For instance, AR Packaging increased its offering to UK food and healthcare customers by adding local folding carton production in January 2021 with the acquisition of FirstanHoldings Ltd, including its subsidiary FirstanLimited. This strategic choice has resulted in the Group being.

- It hasn't proven easy to recycle packaging materials, particularly when it comes to plastic. This may encourage the use of readily recyclable materials like paper, which could result in more people in the area using paper packaging.

- Worldwide demand for branded consumer durables and fast-moving consumer goods (FMCG) is driving an increase in the use of corrugated boards for packaging. In the food and beverage sector, boards are most widely used to package processed goods, such as bread, snacks, ready-to-eat (RTE) meals, meat products, fruits, durable foods, and beverages.

- The companies are innovating new packaging solutions to meet the different needs of customers. In February 2021, Mondi launched an innovative Corrugated packaging solution called BCoolBox, featuring thermo-insulation that keeps food chilled below 7° Celsius for up to 24 hours without a cooling truck. This box is entirely made from recycled material and 100% recyclable. It allows online retailers to expand their geographical reach for deliveries.

Food and Beverage Industry to Contribute Significantly for the Growth of Packaging Industry

- The quality, traceability, and safety of processed food products are particularly prioritized in Spain, where a modern food processing industry with a domestic market-centric focus exists. Throughout the forecast, this is anticipated to strengthen the market in the area.

- With an expected steady increase in alcohol consumption after the lockdown restrictions are eased out, the market is expected to see more focus on off-premise consumption compared to on-premise consumption. The off-premise consumption of alcohol is favorable for the growth of the flexible paper packaging market. Beverages packaged in pouches for single-serve consumption are a few notable examples that have become increasingly popular in the market studied.

- The improving economic environment and the increase in people's disposable income are two major factors propelling the packaging industry's expansion during the projection period. For instance, retail food sales in Spain reached USD 27.4 billion in 2021.

- The region is seeing some major firms in the packaging sector grow their presence, which is predicted to increase demand for packaging supplies across the board.

- For instance, in May 2022, KraftHeinz collaborated with Pulpex to develop a paper-based, renewable, and recyclable bottle made entirely of sustainably sourced wood pulp. According to the CPG giant, Heinz is the first sauce brand to evaluate the possibilities of Pulpex'ssustainable paper bottle packaging for its sauces. Packaging has been used by nearly every food and beverage CPG to lessen its environmental impact.

Spain Packaging Industry Overview

The packaging Industry in Spain is moderately fragmented, with players such as Nekicesa Packaging SL, Tecnocap SpA., and Mondi Group, Tetra Pak International SA., Amcor PLC. operating in the market. The packaging market comprises several global and regional players vying for attention in a contested market.

- April 2022 -Amcor announced an investment to expand its new thermoforming capabilities for medical packaging in its Sligo, Ireland, healthcare packaging facility. The expansion will strengthen Amcor's leadership in the growing industry for sterile packaging, providing customers in Europe and North America with another site with inclusive healthcare solutions.

- May 2022 - Buen Vato, the world's first tequila in a cardboard bottle manufactured from 94% recycled material, will debut in Europe in July 2022, focusing on the Swedish market. Tequila Buen Vatois on a mission to revolutionize the beverage business by investing in sustainable manufacturing, transportation, and CSR initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Innovative and Premium Packaging to Drive the Market

- 4.3.2 Rising Demand for Small and Convenient Packaging

- 4.4 Market Restraints

- 4.4.1 Stringent Rules and Regulations Regarding Packaging Materials

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Packaging Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Glass

- 5.1.4 Metal

- 5.2 By Layers of Packaging

- 5.2.1 Primary Layer

- 5.2.2 Secondary Layer

- 5.2.3 Tertiary Layer

- 5.3 By End-user Industry

- 5.3.1 Food and Beverage

- 5.3.2 Healthcare and Pharmaceutical

- 5.3.3 Beauty and Personal Care

- 5.3.4 Industrial

- 5.3.5 Other End-user Industry

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nekicesa Packaging SL

- 6.1.2 Tecnocap S.p.A

- 6.1.3 Mondi PLC

- 6.1.4 Tetra Pak International S.A

- 6.1.5 Amcor PLC

- 6.1.6 Sealed Air Corporation

- 6.1.7 COVINIL S.A.

- 6.1.8 Wipak Group

- 6.1.9 Plastipak Holdings Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219