|

市場調查報告書

商品編碼

1640575

拉丁美洲軟性飲料包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

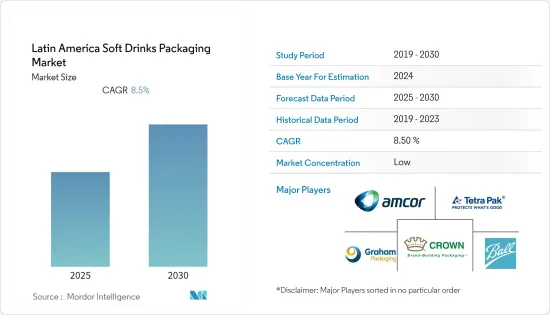

預計預測期內拉丁美洲軟性飲料包裝市場複合年成長率將達到 8.5%。

主要亮點

- 拉丁美洲對軟性飲料的需求受到 GDP 成長和消費者購買力增強的推動。拉丁美洲的軟性飲料消費對於軟性飲料品牌所有者和瓶裝商來說是一個亮點,即飲茶和瓶裝水是關鍵的機會領域。

- 軟性飲料是繼水之後消費量第二大的飲料,而軟性飲料包裝最常用的材料是塑膠。人口成長和可支配收入上升推動了整個全部區域對軟性飲料產品的需求。然而,政府對非生物分解包裝解決方案的使用限制正在抑制軟性飲料包裝的成長。

- 高效的包裝解決方案具有易於使用、易於處理和改善使用者體驗等優勢。這些優勢導致對軟性飲料包裝解決方案的需求增加。推動需求的另一個趨勢是推出新的替代產品,幫助製造商提高品牌知名度,同時實現產品的差異化。例如,2022 年 4 月,Honest Tea 推出了一款含咖啡因的即飲飲料 Honest Yerba Mate,擴大了其試飲瓶裝飲料的產品組合。

- 根據巴西衛生署調查,超過一半的巴西成年人口體重超標。巴西消費者將此問題歸咎於飲酒,並將限制酒精攝取量作為個人健康管理的一部分。這為軟性飲料公司提供了更多機會向注重健康的人群銷售酒精替代品。

COVID-19疫情對軟性飲料包裝市場產生了負面影響。在新冠疫情期間,由於供應鏈中斷、消費者的可支配所得減少,消費量下降。景氣衰退以及疫情過後對衛生健康的重視可能會對該行業產生負面影響。此外,疫情也使軟性飲料公司的重點從精簡產品範圍轉向投資更大的形式並專注於直接面對消費者的銷售。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

拉丁美洲軟性飲料包裝市場趨勢

塑膠預計將佔很大佔有率

- 塑膠瓶是軟性飲料的首選包裝,因為它們價格便宜、易於運輸且安全。與其他替代材料相比,塑膠製造時更節能,而且重量也更輕。

- 與玻璃相比,使用寶特瓶有助於減輕重量,使運輸過程更加經濟。此外,它們的機械性能比PE和PP瓶更好,從而減輕了重量。此外,再生塑膠是該地區最便宜的塑膠。這也提高了該地區的 PET 回收率。

- 隨著拉丁美洲軟性飲料市場的擴大,對果汁、能量飲料、運動飲料等營養產品的需求明顯增加,從而推動了軟性飲料包裝市場的發展。例如,2021年9月,百事可樂宣布將投資6,400萬美元,增加烏拉圭科洛尼亞德爾沙加緬度自由貿易區的產量。

然而,隨著人們對軟性飲料包裝中使用有害塑膠的環境問題的日益擔憂,拉丁美洲的製造商和消費者開始轉向環保的塑膠替代品。例如,2022年5月,SIG與巴西最大的牛奶公司之一Frimesa合作推出了組合式紙盒包裝。

巴西佔有較大的市場佔有率

- 巴西的聚對苯二甲酸乙二醇酯 (PET) 拉伸吹塑成型行業正在經歷強勁成長,這得益於碳酸飲料、保健飲料以及最近的牛奶飲料等無菌灌裝產品的推動。

- 這些公司正在投資以更好地在巴西定位,從而滿足客戶對軟性飲料罐日益成長的需求。例如,2022年7月,Canpack SA宣布將在巴西波科斯迪卡爾達斯市投資約7.1億巴西雷亞爾(約1.4億美元)新建一家生產鋁製飲料罐的生產工廠,並宣布將增加產能。該工廠最初的生產能力約為每年13億罐。

- 此外,2022 年 2 月,金屬包裝領導者 Trivium Packaging 宣布投資兩家新製造工廠,以擴大鋁沖壓罐和瓶的生產。 2023 年,俄亥俄州揚斯敦和巴西伊圖佩瓦的工廠將增加新生產線。這將為這些設施提供新的容量和更多的空間。

- 可口可樂公佈2022年第二季軟性飲料銷售成長8%。這是由所有地區業務部門的成長所推動的,其中墨西哥和巴西是主要推動力。此外,能量飲料、果汁、乳製品和植物飲料的銷量成長了 6%,其中拉丁美洲的 Del Valle 銷量領先。

拉丁美洲軟性飲料包裝產業概況

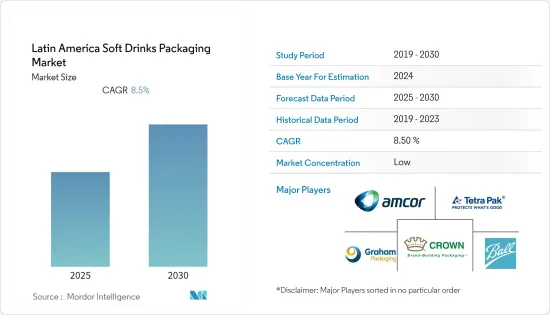

由於大量國內和國際參與者的存在,拉丁美洲的軟性飲料包裝市場較為分散。市場較為分散,參與者在價格、產品設計、產品創新等方面競爭。市場的主要企業包括 Amcor Ltd、Sealed Air Corporation、Tetra Pak International、Graham Packaging Company 和 Crown Holdings Incorporated。

2022年10月,包裝解決方案提供商西得樂將推出一系列永續性再生寶特瓶,稱為「我們發布了「1SKIN」。這款 1 公升瓶裝飲料主要針對敏感果汁、茶和調味飲料的蓬勃發展的市場。

2022 年 2 月,海尼根宣布將向巴西聖保羅州投資 3.2 億雷亞爾(6,380 萬美元)。回收玻璃包裝也是喜力啤酒的首要任務,該公司將宣布新的舉措,為 2025 年實現其餐廳和酒吧包裝 100% 回收的目標做出貢獻。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 全球軟性飲料包裝市場概況

第5章 市場動態

- 市場促進因素

- 增加可支配所得和經濟成長

- 即飲飲料需求不斷成長

- 市場限制

- 政府對非生物分解產品的嚴格監管

第6章 市場細分

- 按材質

- 塑膠

- 金屬

- 玻璃

- 紙和紙板

- 依產品類型

- 瓶子

- 能

- 盒子

- 紙盒

- 按類型

- 瓶裝水

- 碳酸飲料

- 汁

- 即飲飲料

- 運動飲料

- 按國家

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Graham Packaging Company

- Ball Corporation

- Crown Holdings Incorporated

- Tetra Pak International

- CAN-PACK SA

- Refresco Group NV

- Ardagh Group SA

- Victory Packaging

- Trivium Packaging

第8章投資分析

第9章:市場的未來

The Latin America Soft Drinks Packaging Market is expected to register a CAGR of 8.5% during the forecast period.

Key Highlights

- The demand for soft drinks in Latin America is attributed to GDP growth and increasing consumer purchasing power. Ready-to-drink teas and bottled water will be key opportunity areas, as soft drink consumption in Latin America has been the bright spot for soft drink brand owners and bottlers.

- Soft drinks are the second most consumed drink after water, with plastic being the most used material for soft drink packaging. The increasing population and rising disposable income have led to an increase in demand for soft drink products across the region. However, government regulations for the use of non-biodegradable packaging solutions are restraining the growth of soft drink packaging.

- Efficient packaging solutions offer benefits like ease of use, disposal, and enhanced user experience. These advantages have resulted in an increase in demand for soft drink packaging solutions.The other trend augmenting demand is the introduction of new and alternative products, which helps manufacturers enhance their brand visibility while offering product differentiation. For instance, in April 2022, Honest Tea expanded its testing bottled beverage portfolio with a new caffeinated ready-to-drink, Honest Yerba Mate.

- According to a survey conducted by the Brazilian Ministry of Health, more than half of the adult population in Brazil is overweight. Brazilian consumers blame alcohol consumption for the problem, so they limit their alcohol consumption as part of personal health management.This gives soft drink companies more chances to sell alcohol alternatives to people who care about their health.

The COVID-19 pandemic impacted the soft drink packaging market negatively. The pandemic situation disrupted the supply chain and reduced customers' disposable income, resulting in less consumption during the COVID-19 pandemic period. Sharp recessionary effects, as well as post-pandemic wellness and health priorities, would have a negative impact on the industry. In addition, the pandemic has shifted the focus of soft drink companies from range rationalization to investment in larger formats and working around direct-to-consumer marketing. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Latin America Soft Drinks Packaging Market Trends

Plastic is Expected to Hold the Significant Share

- Plastic bottles are usually preferred for packaging soft drinks as they are cheaper, easier to transport, and safer. Also, plastics are energy efficient to manufacture, and they are also lighter than alternative materials.

- The adoption of PET plastic bottles helps in weight reduction as compared to glass, allowing for a more economical transportation process. Additionally, better mechanical qualities reduce weight compared to PE and PP bottles. Further, the availability of recycled plastic in the region is considered among the cheapest. This has also helped increase the rate of recycling PET in the region.

- With the expansion of the soft drinks market in Latin America, it is clear that nutritional product demand, such as juices, energy drinks, and sports drinks, is increasing and driving the soft drinks packaging market. For example, in September 2021, Pepsi Cola said it would invest USD 64 million to increase production in the Colonia del Sacramento free trade zone in Uruguay.

However, because of the growing environmental concern about the use of plastic for soft drink packaging, which is hazardous, manufacturers and consumers in Latin America are turning to environmentally friendly alternatives to plastic. For instance, in May 2022, SIG launched combistyle carton packaging with Frimesa, one of Brazil's largest milk companies.

Brazil to Contribute Significant Market Share

- Brazil's polyethylene terephthalate (PET) stretch blow molding industry is significantly growing, propelled by carbonated soft drinks, health drinks, and most recently, aseptically filled products like milk beverages, fueled by rising incomes for large segments of the world's fifth-most populous nation that are making things like bottled water and soda newly accessible to everyday Brazilians.

- The companies are investing in Brazil to maintain a better position to serve their customers' growing needs for beverage cans for soft drinks. For instance, in July 2022, Canpack S.A. announced that it would increase its manufacturing capacity of aluminum beverage cans with a new production plant in Pocos de Caldas, Brazil, with an investment of approximately BRL 710 million (USD 140 million), which will be operational in 2024. The capacity of the plant will initially be around 1.3 billion cans per year.

- Furthermore, in February 2022, metal packaging leader Trivium Packaging announced an investment in two of its new manufacturing plants to expand the production of aluminum impact-extruded cans and bottles. In 2023, new lines will be added to the facilities in Youngstown, Ohio, and Itupeva, Brazil. This will give the facilities new capabilities and a lot more space.

- Coca-Cola's report for the second quarter of 2022 says that sales of soft drinks have gone up by 8%. This is due to growth in all geographic operating segments, but Mexico and Brazil have led the way. In addition, nutrition, juice, dairy, and plant-based beverages grew by 6%, led by Del Valle in Latin America.

Latin America Soft Drinks Packaging Industry Overview

The Latin America Soft Drinks Packaging market is fragmented, owing to the presence of many domestic and international players. The market is fragmented with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Sealed Air Corporation, Tetra Pak International, Graham Packaging Company, and Crown Holdings Incorporated among others.

In October 2022, Sidel, a packaging solution provider, launched 1SKIN, a label-less recycled PET bottle to help Sidel's customers achieve their sustainability goals and drive sales of high-end products. The one-liter bottle is destined for the booming market in sensitive juices, teas, and flavored drinks.

In February 2022, Heineken announced that it would invest BRL 320 million (USD 63.8 million) in the Brazilian state of Sao Paulo. Recycling glass packaging is also among the priorities of the company, which would present new initiatives for contributing to the goal of reaching 100% recycling of its packaging used in restaurants and bars by 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Overview of the Global Soft Drinks Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Growing Economies

- 5.1.2 Growing Demand for Ready-to-use Drinks

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations Against Non-biodegradable Products

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paper and Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Boxes

- 6.2.4 Cartons

- 6.3 By Type

- 6.3.1 Bottled Water

- 6.3.2 Carbonated Drinks

- 6.3.3 Juices

- 6.3.4 RTD Beverages

- 6.3.5 Sport Drinks

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Argentina

- 6.4.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Graham Packaging Company

- 7.1.3 Ball Corporation

- 7.1.4 Crown Holdings Incorporated

- 7.1.5 Tetra Pak International

- 7.1.6 CAN-PACK SA

- 7.1.7 Refresco Group NV

- 7.1.8 Ardagh Group SA

- 7.1.9 Victory Packaging

- 7.1.10 Trivium Packaging