|

市場調查報告書

商品編碼

1641838

遠端資訊處理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

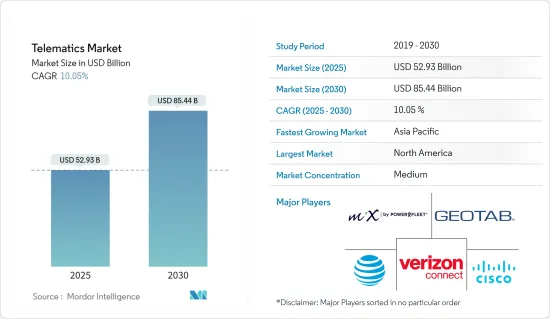

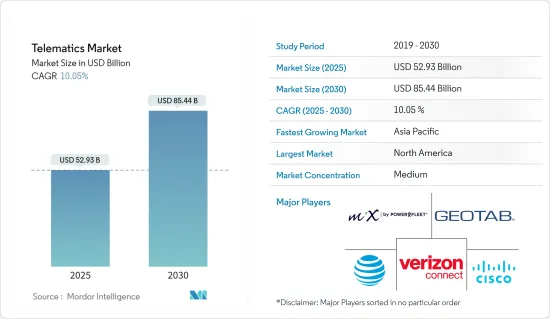

預計 2025 年遠端資訊處理市場規模為 529.3 億美元,到 2030 年將達到 854.4 億美元,預測期內(2025-2030 年)的複合年成長率為 10.05%。

遠端資訊處理市場是汽車產業內一個快速發展的領域,由技術進步和對即時資料解決方案日益成長的需求推動。遠端資訊處理技術能夠將車輛的資料傳輸到外部系統,使公司能夠監控和管理車輛,追蹤車輛性能並確保安全。隨著物聯網 (IoT) 功能的整合,遠端資訊處理系統變得越來越複雜,可以透過資料分析更深入地了解車輛的運作。這些解決方案涵蓋各種應用,包括車隊管理、GPS 追蹤和汽車保險。

遠端資訊處理主要企業與創新:

主要亮點

- 持續創新:MiX Telematics、Geotab Inc.、Verizon Telematics 等主要企業不斷創新,以提供更精準、更全面的資訊服務。

- 消費應用:遠端資訊處理技術在個人消費者中也越來越受歡迎,目標商標產品製造商 (OEM) 和售後市場供應商都提供嵌入式和攜帶式設備。消費者興趣的增加是由於對增強安全功能、車輛診斷和提高燃油經濟性的需求不斷成長。

- 雲端基礎的解決方案:此外,對雲端基礎的遠端資訊處理解決方案的需求日益增加,允許遠端資訊處理資料與企業系統無縫整合。這不僅簡化了車隊管理,而且還降低了營運成本。

遠端資訊處理市場細分:

主要亮點

- OEM)和售後市場參與者:遠端資訊處理市場按OEM)和售後市場參與者提供的解決方案進行細分,包括基於智慧型手機、可攜式和嵌入式設備。這些設備專為滿足不同的消費者需求而量身定做,包括入門級、中層級和高階解決方案。

- 按地區分類的市場:北美、歐洲和亞太地區主導著車用通訊系統市場。消費者對遠端資訊處理技術優勢的認知不斷提高,加上有關車輛安全和效率的嚴格規定,推動了該技術的採用。

連網型設備的激增擴大了市場潛力

主要亮點

- 連網型設備的興起正在極大地影響遠端資訊處理市場。隨著越來越多的車輛配備了支援物聯網的遠端資訊處理系統,車輛與基礎設施之間的資料傳輸變得更加順暢和高效。

- 商業遠端資訊處理這對於依靠即時資料來管理大型車隊的商業遠端資訊處理解決方案尤其重要。公司可以監控績效指標並提高業務效率,從而受益於最佳化的路線、燃料使用和維護。

- 消費者對連網汽車的需求:連網汽車遠端資訊處理正在經歷顯著成長,消費者選擇提供 GPS 追蹤、即時交通更新和緊急應變能力等先進功能的汽車。基於智慧型手機的遠端資訊處理應用程式為消費者提供了輕鬆存取車輛資料的途徑,進一步推動了這一成長。

- 雲端基礎的平台:雲端基礎的遠端資訊處理平台的採用透過實現遠端資料存取徹底改變了車隊管理。這些平台具有擴充性和適應性,可滿足從交通運輸到個人車輛所有權等多個行業的需求。

汽車診斷需求推動創新

主要亮點

- 對無縫車輛診斷的需求不斷成長,推動了遠端資訊處理系統的進步,尤其是在車隊管理方面。

- 車隊健康監測:管理大型車隊的公司需要即時車輛健康資料,以避免代價高昂的故障並減少停機時間。遠端資訊處理資料分析使車隊管理人員能夠追蹤引擎健康狀況、燃油消費量和輪胎壓力等關鍵性能指標,從而實現預防性保養。

- 預防性診斷:對於消費者而言,車輛內建的遠端資訊處理系統將實現主動診斷,並自動發出定期維護警報。這大大降低了車輛意外故障的風險並提高了安全性。這些簡單的診斷工具正在成為連網汽車應用的重要組成部分,進一步推動需求。

- 遠端資訊處理創新:隨著對更智慧、資料主導的診斷的需求不斷增加,遠端資訊處理軟體和硬體創新正在推動成長,使商用車主和個人車主都受益。

遠端資訊處理市場趨勢

智慧型手機解決方案可望佔據主要市場佔有率

隨著連網汽車解決方案的發展以及汽車、運輸和物流等行業的日益應用,全球遠端資訊處理市場正在經歷快速成長。影響市場的關鍵趨勢包括基於智慧型手機的遠端資訊處理日益成長的重要性以及亞太地區的顯著擴張。

- 基於智慧型手機的解決方案:這些解決方案由於其效率和可近性而成為主流。車隊管理遠端資訊處理越來越依賴智慧型手機應用程式來提供 GPS 追蹤、駕駛員行為監控和車輛診斷等功能,而無需專用硬體。

- 燃油經濟性和性能分析:智慧型手機應用程式中的遠端資訊處理資料分析透過提供有關燃油消耗、駕駛行為和車輛性能的即時洞察來改變業務營運。

- 基於使用情況的保險 (UBI):智慧型手機遠端資訊處理還支援 UBI,遠端資訊處理資料可協助保險公司根據駕駛行為更準確地計算保費。這種節省成本的效果正在推動 UBI 在保險業廣泛採用。

亞太地區可望強勁成長

亞太地區的遠端資訊處理應用正在顯著成長,這主要得益於對聯網汽車和物聯網遠端資訊處理解決方案的需求不斷成長。

- 中國汽車市場中國正經歷連網汽車遠端資訊處理的蓬勃發展,其系統提供即時追蹤和診斷等先進功能。政府推行的促進遠端資訊處理以減少排放氣體和改善交通流量的政策促進了這一成長。

- 印度物流業隨著越來越多的公司希望透過雲端基礎的系統來最佳化路線和提高燃油效率,印度的物流和運輸領域擴大採用遠端資訊處理技術。

- 日本遠端資訊處理創新:日本持續引領遠端資訊處理領域的創新,特別是在連網汽車生態系統的遠端資訊處理與物聯網的整合方面。日本汽車製造商處於開發下一代遠端資訊處理解決方案的前沿。

車聯網產業概況

遠端資訊處理市場是一個半綜合市場,由全球企業集團和專業參與者組成。

多樣化的市場參與者:AT&T、Geotab Inc.、Cisco Systems Inc.、Verizon 和 MiX Telematics 等主要參與者提供一系列遠端資訊處理解決方案。全球通訊公司正在利用網路基礎設施,而專業公司則專注於車輛追蹤和管理。

新興策略:市場參與者的關鍵成功因素包括整合人工智慧預測分析、進軍電動車用通訊系統處理領域以及提供更具擴充性的雲端基礎的解決方案。與汽車製造商合作並實現服務多樣化對於未來的成長至關重要。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 連網型設備的興起

- 對便利車輛診斷的需求龐大

- 市場限制

- 資料外洩的威脅

- 高成本

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 按頻道

- 目的地設備製造商(OEM)

- 售後市場

- 按解決方案

- 智慧型手機

- 可攜式的

- 嵌入式

- 依產品類型

- 硬體

- 服務(入門級、中層級、高階)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Mix Telematics

- AT&T Inc.

- Geotab Inc.

- Verizon Telematics

- Cisco Systems Inc.

- Aplicom Oy

- Microlise Ltd

- LG Electronics Inc.

- Trimble Inc.

- Ctrack Global(Inseego Corp. Company)

第7章投資分析

第8章 市場機會與未來趨勢

The Telematics Market size is estimated at USD 52.93 billion in 2025, and is expected to reach USD 85.44 billion by 2030, at a CAGR of 10.05% during the forecast period (2025-2030).

The telematics market is a rapidly evolving sector within the automotive industry, driven by advancements in technology and rising demand for real-time data solutions. Telematics technology enables the transmission of data from vehicles to external systems, allowing companies to monitor and manage their fleets, track vehicle performance, and ensure safety and security. With the integration of Internet of Things (IoT) capabilities, telematics systems are becoming increasingly sophisticated, providing deeper insights into vehicle operations through data analytics. These solutions span across various applications such as fleet management, GPS tracking, and automotive insurance.

Key Players and Innovations in Telematics:

Key Highlights

- Ongoing innovation: Key players like MiX Telematics, Geotab Inc., and Verizon Telematics are continuously innovating to offer more accurate and comprehensive data services, which are essential for businesses relying on vehicle operations.

- Consumer applications: Telematics technology is also gaining popularity among individual consumers, with original equipment manufacturers (OEMs) and aftermarket providers offering both embedded and portable devices. This surge in consumer interest is attributed to the increasing demand for enhanced safety features, vehicle diagnostics, and improved fuel efficiency.

- Cloud-based solutions: Additionally, cloud-based telematics solutions are growing in demand, allowing for seamless integration of telematics data with enterprise systems. This not only simplifies fleet management but also reduces operational costs.

Telematics Market Segmentation:

Key Highlights

- OEMs and aftermarket players: The telematics market is segmented by the solutions provided by OEMs and aftermarket players, which include smartphone-based, portable, and embedded devices. These devices are tailored to meet the needs of diverse consumers, with entry-level, mid-tier, and high-end solutions available.

- Geographical markets: North America, Europe, and Asia-Pacific dominate the automotive telematics market. The widespread adoption is driven by stringent regulations concerning vehicle safety and efficiency, alongside rising consumer awareness of telematics technology benefits.

Surge in Connected Devices Expands Market Potential

Key Highlights

- The rise of connected devices is significantly shaping the telematics market. With more vehicles now equipped with IoT-enabled telematics systems, data transmission between vehicles and infrastructure has become smoother and more efficient.

- Commercial telematics: This is particularly crucial for commercial telematics solutions, which rely on real-time data to manage large fleets. Companies benefit from optimized routing, fuel usage, and maintenance, thanks to the ability to monitor performance metrics and enhance operational efficiency.

- Consumer demand for connected vehicles: Connected car telematics is seeing substantial growth, with consumers increasingly opting for vehicles that offer advanced features like GPS tracking, real-time traffic updates, and emergency response capabilities. Smartphone-based telematics applications have further boosted this growth by providing consumers with easy access to vehicle data.

- Cloud-based platforms: The adoption of cloud-based telematics platforms has transformed vehicle management by allowing remote data access. These platforms provide scalability and adaptability, catering to the needs of diverse industries, from transportation to personal vehicle ownership.

Demand for Vehicle Diagnostics Fuels Technological Innovation

Key Highlights

- The growing demand for seamless vehicle diagnostics is pushing advancements in telematics systems, particularly within fleet management.

- Fleet health monitoring: Companies managing large fleets require real-time vehicle health data to avoid costly breakdowns and reduce downtime. By using telematics data analytics, fleet managers can track key performance indicators such as engine health, fuel consumption, and tire pressure, enabling preventive maintenance.

- Proactive diagnostics: For consumers, telematics systems embedded in vehicles allow for proactive diagnostics, with automatic alerts for routine maintenance. This significantly reduces the risk of unexpected vehicle failures and enhances safety. These easy diagnostics tools are becoming an integral part of connected car applications, further fueling demand.

- Telematics innovation: The market continues to see innovations in telematics software and hardware as the demand for smarter, data-driven diagnostics grows, benefiting both commercial and personal vehicle owners.

Telematics Market Trends

Smartphone Solution is Expected to Hold a Major Market Share

The global telematics market is experiencing rapid growth, driven by advancements in connected vehicle solutions and their increased adoption across industries such as automotive, transportation, and logistics. Key trends shaping the market include the rising importance of smartphone-based telematics and significant expansion in the Asia-Pacific region.

- Smartphone-based solutions: These solutions are becoming dominant due to their efficiency and accessibility. Fleet management telematics increasingly relies on smartphone apps, offering features such as GPS tracking, driver behavior monitoring, and vehicle diagnostics without needing specialized hardware.

- Fuel efficiency and performance analytics: Telematics data analytics within smartphone apps is transforming business operations by providing real-time insights into fuel consumption, driving behavior, and vehicle performance.

- Usage-based insurance (UBI): Smartphone telematics also supports UBI, where telematics data helps insurers calculate premiums more accurately based on driving behavior. This cost-saving benefit is driving its adoption within the insurance industry.

Asia Pacific is Expected to Witness Significant Growth

The Asia-Pacific region is witnessing significant growth in telematics adoption, largely driven by the rising demand for connected cars and IoT-enabled telematics solutions.

- China's automotive market: China is experiencing a boom in connected car telematics, with systems offering advanced features like real-time tracking and diagnostics. Government policies promoting telematics to reduce emissions and enhance traffic flow are contributing to this growth.

- India's logistics sector: In India, telematics adoption in logistics and transportation is increasing as companies seek to optimize routes and improve fuel efficiency through cloud-based systems.

- Japan's telematics innovation: Japan continues to lead telematics innovation, particularly in integrating telematics with IoT for connected car ecosystems. Japanese automakers are at the forefront of developing next-generation telematics solutions.

Telematics Industry Overview

The telematics market is semi consolidated, featuring a mix of global conglomerates and specialized players.

Diverse market players: Major players like AT&T, Geotab Inc., Cisco Systems Inc., Verizon, and MiX Telematics offer various telematics solutions. Global telecommunications companies leverage their network infrastructure, while specialized firms focus on fleet tracking and management.

Emerging strategies: Key success factors for market players include integrating AI-driven predictive analytics, expanding into electric vehicle telematics, and offering more scalable cloud-based solutions. Partnerships with automotive manufacturers and diversification of services will be critical for future growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Connected Devices

- 4.2.2 Huge Demand of Easy Vehicle Diagnostics

- 4.3 Market Restraints

- 4.3.1 Threat of Data Breaches

- 4.3.2 High Costs Associated With Installations

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 impact on the market

5 MARKET SEGMENTATION

- 5.1 By Channel

- 5.1.1 Original Equipment Manufacturers (OEM)

- 5.1.2 Aftermarket

- 5.2 By Solution

- 5.2.1 Smartphone

- 5.2.2 Portable

- 5.2.3 Embedded

- 5.3 By Offering Type

- 5.3.1 Hardware

- 5.3.2 Services (Entry-level, Mid-tier, High-end)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mix Telematics

- 6.1.2 AT&T Inc.

- 6.1.3 Geotab Inc.

- 6.1.4 Verizon Telematics

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Aplicom Oy

- 6.1.7 Microlise Ltd

- 6.1.8 LG Electronics Inc.

- 6.1.9 Trimble Inc.

- 6.1.10 Ctrack Global (Inseego Corp. Company)