|

市場調查報告書

商品編碼

1641932

服務提供自動化:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Service Delivery Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

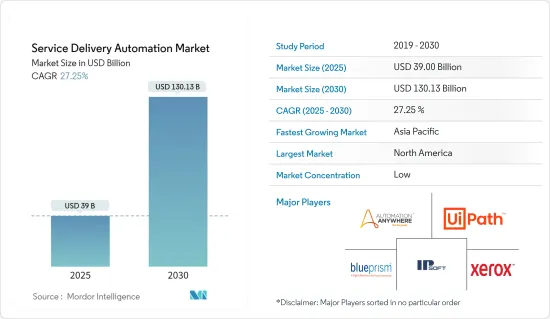

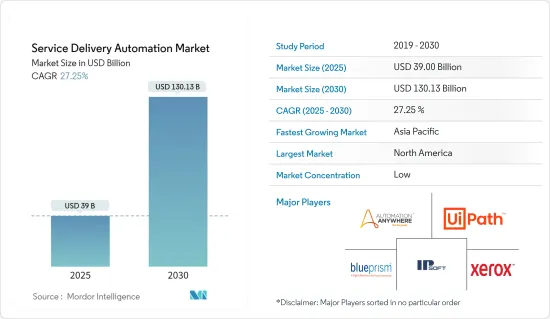

服務提供自動化市場規模在 2025 年預計為 390 億美元,預計到 2030 年將達到 1301.3 億美元,預測期內(2025-2030 年)的複合年成長率為 27.25%。

自動化使數位化企業能夠轉變其服務交付和營運,從而節省成本、提高準確性和生產力。它還透過最佳化當前流程和操作,以及預測何時、何地以及如何提供新產品和服務來產生有價值的資料,以推動更聰明、更快速的決策。

主要亮點

- 由於數位化勞動力的日益普及以及業務流程自動化解決方案在各個終端用戶領域的功能優勢,服務提供自動化市場正在不斷擴大。

- 市場上的供應商正在透過添加新功能(例如自動生命週期管理、工作負載管理、憑證管理、基於 SLA 的自動化、Citrix 自動化和新的資料API)來增強其產品,從而提供更強大的營運和安全功能功能。

- 智慧流程自動化、巨量資料、物聯網、與其他工具的整合以及服務自動化工具的日益採用是推動自動化成長的關鍵因素。此外,自動化有可能創造大量就業機會,從而推動各行各業對技術純熟勞工的需求。

- 然而,隨著新技術的迅速採用,對更多熟練的專業人員來開發和管理自動化流程的需求可能會阻礙該市場的發展。老齡勞動力需要重新接受培訓才能跟上自動化技術的進步。

- 由於網路零售額的成長,COVID-19 疫情對市場產生了正面影響。此外,人工智慧 (AI) 和機器學習 (ML) 使創新領導者和商業先鋒能夠為從人員配置到財務、開發和生產等各個方面開發最佳框架。

服務提供自動化市場趨勢

零售和消費品佔據市場主導地位

- 隨著交貨時間縮短和訂單量增加,零售流程自動化可以降低成本並加快訂單履行速度。零售商和電子商務公司正在轉向自主移動機器人 (AMR) 來滿足不斷成長的客戶需求並提高業務效率。

- 這些機器人利用視覺攝影機、感測器、整合倉庫地圖和執行軟體系統,在物流中心內選擇、移動和運送貨物,無需人工協助,完成各種任務。

- 亞馬遜的倉庫機器人也是減少對體力勞動力需求的有效方法,也是零售業如何採用服務交付自動化的一個很好的例子。這些機器人主要用於設施內的重物起重、拾取、運輸和其他業務。隨著物聯網、人工智慧和機器學習在倉儲領域的應用越來越廣泛,機器人市場預計很快就會擴大。

- 隨著顧客的購買行為發生變化並傾向於在線訂購,當日送達和取貨的需求增加,電子商務行業看到了大多數倉庫機器人的使用。

亞太地區將經歷最高成長

- 亞太地區仍然是服務提供自動化的關鍵市場。隨著大中型企業擁抱自動化,亞太市場正經歷健康擴張。

- 數位技術的爆炸性成長和向工業4.0的轉型目前正在影響亞洲的製造業。一些機器人製造商正在生產租賃模式,明確目的是加速中小型製造公司對機器人的採用。

- 會計和流程管理對自動化的日益成長的需求正在推動印度自動化的擴張。印度的 BFSI、電信和醫療保健產業是自動化技術的早期採用者。

- 銀行業的一個重要進步就是自動化。它正在演變成一項重大的技術進步,並將影響金融業。印度的一些銀行已經實現了部分銀行業務的自動化。

服務提供自動化產業概覽

服務提供自動化市場非常複雜,許多大公司都在爭奪主導地位。隨著企業越來越希望降低成本並提高客戶滿意度,對自動化服務的需求很高,導致產業成長和競爭加劇。該市場的主要企業包括 Blueprism、Nice Systems 和 IBM,它們都提供服務於各個行業的服務。服務提供自動化市場中的許多供應商正在採用併購策略來企業發展全球並滲透新市場。

2023 年 1 月,UiPath 宣布對其平台進行重大升級,使客戶能夠透過將測試遷移到 UiPath 業務自動化平台來實現軟體測試實踐的現代化。 UiPath 讓所有客戶都可以在本地使用精簡、全面的軟體測試,從而幫助 CIO 和 IT 決策者在單一平台上整合和自動化測試,從而降低成本。這項發展表明UiPath致力於為客戶提供創新且高效的解決方案,並進一步鞏固了其作為服務提供自動化市場主要企業的地位。

2022年10月,Blue Prism宣布與SS&C合作,提供結合機器人流程自動化(RPA)、業務流程管理(BPM)、人工智慧(AI)和無程式碼服務的全面智慧解決方案,提供自動化套件。該產品組合使公司能夠利用流程智慧、人工智慧 (AI)/機器學習 (ML) 和智慧文件處理 (IDP) 等最尖端科技,在整個組織內擴展和最佳化員工隊伍。員工和用戶旅程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 提高業務效率的需求

- 降低整個產業的成本

- 市場限制

- 熟練勞動力短缺

第6章 市場細分

- 按類型

- IT流程自動化

- 業務流程自動化

- 按組織規模

- 大型企業

- 中小型企業

- 按最終用戶產業

- BFSI

- IT

- 通訊與媒體

- 飯店與交通

- 零售和消費品

- 醫療保健和醫藥

- 製造和物流

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Automation Anywhere Inc.

- Uipath SRL

- IPsoft Inc.

- Blue Prism

- Xerox Corporation

- NICE Systems Ltd

- Celaton Limited

- Automation Anywhere Inc.

- Arago GmbH

- Accenture Inc.

- AutomationEdge Technologies Inc.

第8章投資分析

第9章:市場的未來

The Service Delivery Automation Market size is estimated at USD 39.00 billion in 2025, and is expected to reach USD 130.13 billion by 2030, at a CAGR of 27.25% during the forecast period (2025-2030).

Automation enables digitally equipped enterprises or businesses to transform their service delivery and operations, bringing cost savings, accuracy, and increased productivity. It generates valuable data, facilitating smarter and faster decision-making by optimizing current processes and operations and predicting when, where, and how to provide new products and services.

Key Highlights

- The market for service delivery automation is expanding due to the growing adoption of a digital workforce and the functional advantages of automation solutions for business process automation across various end-user sectors.

- Market vendors enhance their offerings by adding new features such as automation lifecycle management, workload management, credential management, SLA-based automation, Citrix automation, and new data APIs, attracting new industries looking for higher operational and security capabilities.

- Smart process automation, big data, IoT, integration with other tools, and an increase in the adoption of service automation tools are the primary factors driving automation's growth. Furthermore, automation can create many jobs, driving demand for skilled workforces in different industries.

- However, the need for more skilled professionals to develop and manage automation processes might hinder this market's growth as new technologies get introduced exponentially. There is a need to re-skill the aging workforce to keep pace with automation's evolution.

- The COVID-19 pandemic positively impacted the market as online retail sales increased. Furthermore, using artificial intelligence (AI) and machine learning (ML), innovation leaders and business pioneers can develop the best frameworks for everything from staffing to finance and development to production.

Service Delivery Automation Market Trends

Retail and Consumer Goods to Dominate the Market

- With decreasing expected delivery times and increasing order volumes, automating the retail process can reduce costs and speed up order handling. Retailers and e-commerce organizations are turning to autonomous mobile robots (AMRs) to meet growing customer demands and increase operational efficiencies.

- These robots select, move, and organize goods inside distribution centers without human assistance, using vision cameras, sensors, integrated warehouse maps, and execution software systems to carry out various tasks.

- Amazon's warehouse robots are also an effective way to reduce the demand for manual labor and provide an excellent example of how the retail sector is adopting service delivery automation. These robots are primarily used for heavy lifting, package retrieval, transportation, and other duties within the establishment. The market for robots is expected to expand shortly due to the increasing usage of the Internet of Things, artificial intelligence, and machine learning in the warehouse sector.

- The e-commerce industry uses most warehouse robots as demand for same-day delivery or pickup increased with COVID-19 changing customer purchasing behavior, leading customers to prefer online ordering.

Asia-Pacific to Witness the Highest Growth

- Asia Pacific area continues to be a significant market for automated service delivery. Due to large- and medium-sized businesses' increasing acceptance of automation, the Asia-Pacific market is expanding healthily.

- The explosion of digital technology adoption and the transition to Industry 4.0 are now affecting the Asian manufacturing industry. Leasing models are being produced by several robot manufacturers with the express purpose of accelerating the adoption of the robot by small- to medium-sized manufacturers.

- The rising need to automate accounting and process management is what is causing automation to expand in India. BFSI, telecom, and the healthcare industries in India were among the first to implement automation technologies.

- One of the significant advancements in the banking sector is automation. It has evolved into a crucial technological advancement that has an impact on the financial industry. In the nation, some banks have already automated some of their banking procedures.

Service Delivery Automation Industry Overview

The market for service delivery automation is fragemented, with a number of major players vying for dominance. As companies increasingly seek to cut costs and improve customer satisfaction, automation services are in high demand, leading to growth in the industry and increased competition. Some of the key players in this market include Blueprism, Nice Systems, and IBM, all of which offer services that benefit a variety of industries. To expand their global outreach and tap into new markets, many vendors in the service delivery automation market are using merger and acquisition strategies..

In January 2023, UiPath announced significant upgrades to their platform, allowing customers to modernize their software testing practices by migrating testing to the UiPath Business Automation Platform. With streamlined and comprehensive software testing natively available to all customers, UiPath enables CIOs and IT decision-makers to save costs by consolidating and automating testing in a single platform. This development demonstrates UiPath's commitment to providing innovative and efficient solutions to its clients and further solidifies its position as a major player in the service delivery automation market.

In October 2022, Blue Prism announced a collaboration with SS&C to deliver a comprehensive intelligent automation package that combines robotic process automation (RPA), business process management (BPM), artificial intelligence (AI), and no-code services. This portfolio enables businesses to scale across the entire organization, unify the workforce, and improve customer, employee, and user journeys through the use of cutting-edge technologies like process intelligence, artificial intelligence (AI)/machine learning (ML), and intelligent document processing (IDP).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Operational Efficiency

- 5.1.2 Cost-cutting Across Industries

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Personnel

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 IT Process Automation

- 6.1.2 Business Process Automation

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small & Medium Enterprises (SMEs)

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT

- 6.3.3 Telecommunication and Media

- 6.3.4 Hospitality and Transportation

- 6.3.5 Retail and Consumer Goods

- 6.3.6 Healthcare and Pharmaceuticals

- 6.3.7 Manufacturing and Logistics

- 6.3.8 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Automation Anywhere Inc.

- 7.1.2 Uipath SRL

- 7.1.3 IPsoft Inc.

- 7.1.4 Blue Prism

- 7.1.5 Xerox Corporation

- 7.1.6 NICE Systems Ltd

- 7.1.7 Celaton Limited

- 7.1.8 Automation Anywhere Inc.

- 7.1.9 Arago GmbH

- 7.1.10 Accenture Inc.

- 7.1.11 AutomationEdge Technologies Inc.