|

市場調查報告書

商品編碼

1643057

歐洲風電 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

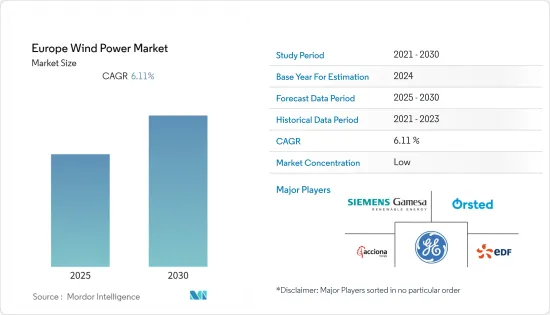

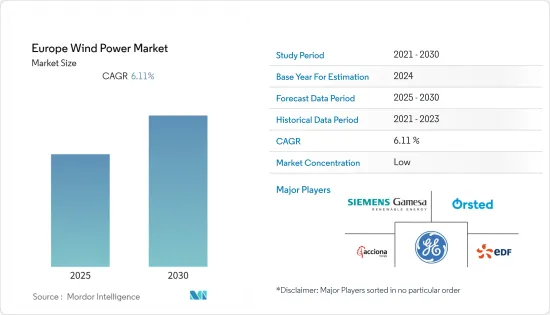

預計預測期內歐洲風電市場複合年成長率為 6.11%。

2020 年,市場並未受到 COVID-19 的任何重大影響。現在,市場可能會達到疫情前的水準。

關鍵亮點

- 從長遠來看,風電成本下降、對環境問題敏感性的提高以及世界各國政府透過財政獎勵提供的支持等因素預計將在預測期內增加對風電的需求。

- 另一方面,預計太陽能和燃氣發電廠的替代將繼續抑制市場。太陽能產業的成本降低速度遠高於風力發電產業。

- 海上風力發電機效率技術的進步和生產成本的下降預計將為歐洲市場參與企業創造充足的機會。

- 在歐洲國家中,德國在2021年的裝置容量最高,預計在預測期內將成為最大的市場,這得益於陸上風電裝置容量的擴大和即將到來的離岸風發電工程的一定成長。

歐洲風電市場趨勢

海上市場大幅成長

- 歐洲在離岸風電領域處於領先地位,擁有世界上最大的在運作電場。該地區的海上發電能力足以滿足歐洲的電力需求,預計未來幾年將進一步成長。

- 由於風速高於陸上風速,離岸風電場安裝正成為一個利潤豐厚的市場。

- 展望未來,引進離岸風電將成為實現歐洲綠色交易的關鍵。鑑於歐盟到2030年每年需要新增32吉瓦風電裝置容量才能達到2050年達到碳中和的目標,歐洲累積離岸風力發電裝置容量將在2021年終達到最高28吉瓦左右。

- 歐盟委員會也於2022年1月啟動了關於可再生能源許可證的公開諮詢,以加速實現2030年40%可再生能源的目標。這將帶動全國風電裝置容量增加。

- 此外,2022年4月,英國首相鮑里斯·約翰遜宣布了加強英國能源安全的計劃,包括到2030年將離岸風電運作的目標提高到50吉瓦。這將支持英國各地離岸風電的發展。

- 此外,2022 年 7 月,英國商業、能源和工業戰略部授予 Orsted 一份 Hornsea 3 離岸風電場的合約。該計劃的發電能力為 2,852 兆瓦,可生產足夠的低成本、清潔、再生能源,為 320 萬英國家庭供電。

- 因此,預計預測期內離岸風電市場將實現正成長。

德國將主導市場

- 德國擁有豐富的優質、具成本競爭力的風力發電資源蘊藏量。這持有德國成為歐洲風電裝置容量最大的國家,2021年總設備容量將達到63.8吉瓦。此裝置容量足以為該國350多萬戶家庭供電。

- 隨著對廉價、可靠、清潔和多樣化電力的需求不斷成長,全國各地的政府和公用事業公司都開始將風力發電作為解決方案。此外,該國擁有無與倫比的風能資源,有充足的機會最大限度地實現風力發電開發帶來的經濟和環境效益。

- 此外,該國也制定了65%電力來自可再生能源的目標,並計畫在2022年關閉核能發電廠,到2038年逐步淘汰燃煤發電。離岸風電產業的預期成長不足以實現這一目標。此外,陸域風電產業發展放緩也是實現可再生能源目標的一個主要問題。

- 2022年9月,Vattenfall AB行使其進入權並獲得了德國北海沿岸N-7.2離岸發電工程的開發權。該計劃計劃於 2027 年試運行,裝置容量為 980 兆瓦,每年可產生足夠的電力為超過一百萬德國家庭消費量。

- 2021 年 11 月,BASF與 Orsted 簽署了一份為期 25 年的購電協議,根據該協議,BASF將從 Orsted 計劃在德國北海的 Borkum Riffgrund 3 離岸風電場購買 186 兆瓦電力。

- 有鑑於此,預計德國將在預測期內主導歐洲風力發電市場。

歐洲風電產業概況

歐洲風電市場適度細分。主要參與企業(不分先後順序)包括 Acciona Energia SA、Orsted AS、EDF SA、通用電氣公司、Vestas Wind Systems AS、E.ON SE 和西門子歌美颯可再生能源。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 風電裝置容量及預測(GW,至2027年)

- 風力發電機安裝量(2019-2027)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 位置

- 陸上

- 海上

- 地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- 風力發電廠營運商

- Acciona Energia SA

- Orsted AS

- EDF SA

- E.ON SE

- 設備供應商

- General Electric Company

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems AS

- 風力發電廠營運商

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 69533

The Europe Wind Power Market is expected to register a CAGR of 6.11% during the forecast period.

The market didn't witness any significant impact due to COVID-19 in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors such as the declining cost of wind power generation, growing sensitivity toward environmental issues, and support from various governments worldwide through financial incentives are expected to increase the demand for wind power during the forecast period.

- On the flip side, substitution from solar energy and gas-fired power plants is expected to continue restraining the market. The solar energy industry achieved cost reduction at a significantly higher rate than the wind energy sector.

- The technological advancements in efficiency and decrease in the production cost of offshore wind turbines are expected to create ample opportunity for European market players.

- Among European countries, Germany had the highest installed capacity in 2021 and is expected to be the largest market during the forecast period, bolstered by constant growth in onshore wind power additions and upcoming offshore wind power projects.

Europe Wind Power Market Trends

Offshore Segment to Witness Significant Growth in the Market

- Europe is the leader in offshore wind and is home to the largest operational wind farms across the globe. The region's offshore capacity is large enough to meet the electricity needs in Europe, which will only continue to grow within the upcoming years.

- Installation of wind farms in the offshore area is becoming a lucrative market because of the higher wind speed compared to onshore wind speed.

- In the future, deploying offshore wind energy is at the core of delivering the European Green Deal. Europe's cumulative offshore wind energy capacity reached a peak of around 28 gigawatts at the end of 2021, considering that the European Union needs 32 GW of new wind capacity each year until 2030 to reach its carbon neutrality target by 2050.

- Also, the European Commission launched a public consultation on renewables permitting in January 2022 to accelerate progress towards the 40% renewable energy target by 2030. This, in turn, culminates in the growth of wind power installations across the country.

- Moreover, in April 2022, UK Prime Minister Boris Johnson presented a plan to boost Britain's energy security, including an increased target of up to 50 GW of operating offshore wind capacity by 2030. This will, in turn, support the growth of offshore wind energy generation across the country.

- Furthermore, in July 2022, the United Kingdom Department for Business, Energy, and Industrial Strategy awarded Orsted a contract for difference for its Hornsea 3 offshore wind farm. The project has a capacity of 2,852 MW and will produce enough low-cost, clean, renewable electricity to power 3.2 million UK homes.

- Hence, the offshore wind power market is expected to be positive during the forecast period.

Germany Likely to Dominate the Market

- Germany has vast reserves of high-quality, cost-competitive wind energy resources. Owing to this, Germany held the first-largest installed wind power capacity in the European region, with a total installed capacity of 63.8 GW in 2021. This installed capacity is enough to power more than 3.5 million homes in the country.

- With the increasing need for an affordable, reliable, clean, and diverse electricity supply, the government and utilities across the nation are increasingly considering wind power as a solution. Moreover, with the country's unparalleled wind resources, there are ample opportunities to maximize the economic and environmental benefits associated with wind energy development.

- Moreover, the country has set a target to achieve 65% of the power generation from renewable energy and plans to shut down nuclear power plants by 2022 and phase-out coal power by 2038. The expected growth in the offshore wind industry is insufficient for achieving this target. Adding to this, the slowdown in the onshore wind industry has become a significant concern for meeting the renewable energy target.

- In September 2022, Vattenfall AB obtained the right to develop the N-7.2 offshore wind power project off the German North Sea coast after having exercised its right of entry. The project is expected to get commissioned by 2027, and will be having an output of 980 MW with annual generation corresponding to the consumption of more than one million German households.

- In November 2021, BASF and Orsted concluded a 25-year power purchase agreement, under which BASF will offtake the output of 186 MW from Orsted's planned Borkum Riffgrund 3 Offshore Wind Farm in the German North Sea.

- Owing to the such points, Germany is expected to dominate the European Wind Energy Market during the forecast period.

Europe Wind Power Industry Overview

The Europe Wind Power Market is moderately fragmented. Some of the key players (not in particular order) are Acciona Energia SA, Orsted AS, EDF SA, General Electric Company, Vestas Wind Systems AS, E.ON SE, and Siemens Gamesa Renewable Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Power Installed Capacity and Forecast in GW, until 2027

- 4.3 Number of Wind Turbines Installed, 2019-2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wind Farm Operators

- 6.3.1.1 Acciona Energia SA

- 6.3.1.2 Orsted AS

- 6.3.1.3 EDF SA

- 6.3.1.4 E.ON SE

- 6.3.2 Equipment Suppliers

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens Gamesa Renewable Energy

- 6.3.2.3 Vestas Wind Systems AS

- 6.3.1 Wind Farm Operators

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219