|

市場調查報告書

商品編碼

1643059

亞太風電-市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia-Pacific Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

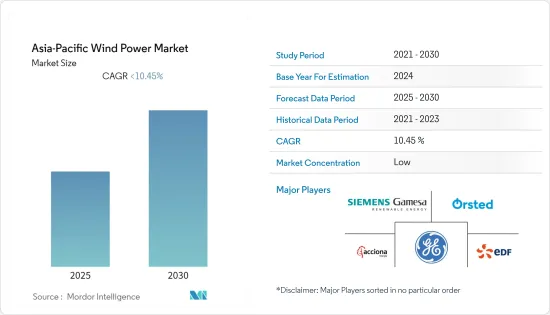

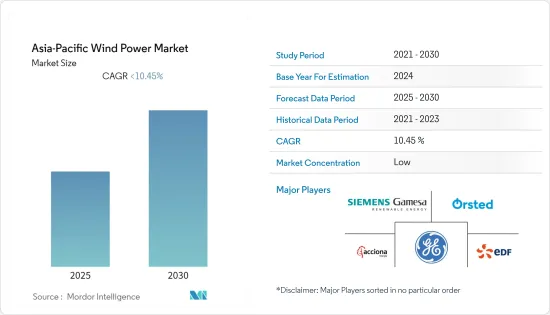

預計預測期內亞太風電市場複合年成長率約為10.45%。

2020 年,COVID-19 並未對市場造成重大影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從長遠來看,政府的優惠政策、對風發電工程的投資增加以及風力發電成本的下降是導致風力發電採用率增加的關鍵成長因素,從而對風力發電需求產生積極的貢獻。

- 然而,天然氣發電和太陽能等替代能源能源的日益普及可能會阻礙市場的成長。

- 預計海上風力發電機效率技術的進步和製造成本的降低將為亞太地區的市場參與企業創造充足的機會。

- 中國在風電市場佔據主導地位,仍是最大的陸域風電市場,新增裝置容量為21.2GW。政府的政策和獎勵使中國成為投資的熱點。

亞太風電市場趨勢

陸上市場佔主導地位

- 在過去五年中,陸上風電技術不斷發展,最大程度地提高每兆瓦裝置容量的發電量,以覆蓋更多風速較低的地區。此外,近年來風力發電機越來越大,輪轂高度更高、直徑更寬、風力發電機葉片也更大。

- 2021年亞洲陸域風電新增裝置容量將達到357.574GW。 2026年亞洲新增裝置容量可能超過10吉瓦,2030年達到近15吉瓦。到 2050 年,亞洲新增風電裝置容量預計將增加 9 倍,達到離岸風電 613 吉瓦和陸上風電 2,646 吉瓦。

- 展望未來,中國北方地區陸域風電潛力大。青海、新疆、內蒙古和東北地區的功率密度最高(平均每平方公尺400-600 瓦(W/m2)),預計將成為大部分新增陸上風電部署的地區。

- 此外,2022 年 11 月,維斯塔斯風力系統公司 (Vestas Wind Systems A/S) 贏得了台灣 wpd AG 的 21MW 訂單,為兩個風發電工程訂單五台 V117-4.2MW風力發電機和 91.5 公尺高的塔架。該訂單還包括一份長期服務協議,以最佳化風電場的性能。

- 此外,2022 年 12 月,TagEnergy 和 Vestas 宣佈建立合作夥伴關係,為位於澳洲維多利亞州的 756 兆瓦計劃Golden Plains 風電場的第一階段提供工程、採購和施工服務。工程完工後,維斯塔斯將簽訂為期30年的服務和維護契約,以最佳化計劃的能源生產。

- 由於這些因素,陸域風電預計將佔據市場主導地位,並成為未來幾年內成長最快的領域。

中國主導市場

- 在中國,近70%的發電量來自火力發電廠。由於火力發電污染日益加重,國家正努力提高清潔、可再生能源來源在發電中的比重。

- 根據中國能源網數據顯示,2014年至2021年,中國風電裝置容量年複合成長率為15.71%。作為「十四五」規劃(2021-2025年)的一部分,中國計劃在2025年滿足全國33%的電力消耗,其中非水電可再生能源佔18%。此外,該國還計劃在 2030 年將可再生能源發電提高到 3,300 TWh。

- 截至2021年,中國風電裝置容量為328.48吉瓦。風電場分佈在風力較強的北部和西部省份,但電網接取延遲和電網管理不善仍是主要問題。

- 此外,2022年10月,中國政府宣布建設計畫世界上最大的風電場,可為整個挪威供電。中國廣東省潮州市公佈了雄心勃勃的計劃,將在台灣海峽對岸建造一座 43.3 吉瓦的發電廠。

- 此外,2022年5月,中國海洋石油集團公司(CNOC)在中國海南省中海油青島施工現場開始建造海浮動式風力發電平台。該計劃將由中國海洋石油總公司北京新能源分公司下屬的中海油榮豐能源開發。

- 鑑於上述情況,預計中國將在預測期內主導亞太風力發電市場。

亞太風電產業概況

亞太風電市場中等細分化。主要企業(不分先後順序)包括 Acciona Energia SA、Orsted AS、EDF SA、通用電氣公司和西門子歌美颯可再生能源。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至2027年裝置容量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 位置

- 陸上

- 海上

- 地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- 風力發電廠營運商

- Acciona Energia SA

- Orsted AS

- EDF SA

- 設備供應商

- Envision Energy

- General Electric Company

- Siemens Gamesa Renewable Energy

- Suzlon Energy Limited

- Xinjiang Goldwind Science & Technology Co. Ltd(Goldwind)

- Vestas Wind Systems AS

- China Longyuan Power Group Corporation Limited

- 風力發電廠營運商

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 69534

The Asia-Pacific Wind Power Market is expected to register a CAGR of less than 10.45% during the forecast period.

The market didn't have any significant impact due to COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, major factors attributing to the growth include favorable government policies, the increasing investment in wind power projects, and the reduced cost of wind energy, which led to increased adoption of wind energy, thereby positively contributing to the demand for wind energy.

- On the other note, the increasing adoption of alternate energy sources, such as gas-based power and solar power, is likely to hinder market growth.

- The technological advancements in efficiency and decrease in the production cost of offshore wind turbines are expected to create ample opportunity for the market players in Asia-Pacific.

- China dominates the wind power market and remains the largest onshore market with 21.2 GW of new capacity additions. The government policy and incentives made China a favorable hotspot for investment; therefore, the wind power market is expected to flourish in the coming years.

Asia-Pacific Wind Power Market Trends

Onshore Segment to Dominate the Market

- Over the last five years, onshore wind power generation technology evolved to maximize electricity produced per megawatt capacity installed to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become larger with taller hub heights, broader diameters, and larger wind turbine blades.

- In 2021, Asia reached 357.574 GW of onshore wind energy installations. New installations in Asia are likely to exceed 10 GW in 2026 and reach nearly 15 GW by 2030. By 2050, Asia is projected to increase new wind power installations by nine folds, totaling 613 GW of offshore and 2,646 GW of onshore wind power.

- Going ahead, China's northern regions have abundant onshore wind potential. The provinces of Qinghai, Xinjiang, Inner Mongolia, and the country's northeast have the highest power density (average values between 400 and 600 watts per square meter (W/ m2)), and most new onshore installations are expected to be deployed in these areas.

- Moreover, in November 2022, Vestas Wind Systems A/S won a 21 MW order with wpd AG in Taiwan that includes the supply of five V117-4.2 MW wind turbines with 91.5m towers in two wind projects. The order also includes a long-term service agreement for the wind farms to ensure optimized performance.

- Furthermore, in December 2022, TagEnergy, and Vestas has announced a partnership for delivering Engineering Procurement and Construction services for the first stage of Golden Plains Wind Power Plant, a 756 Megawatt project in Victoria, Australia. Upon completion, Vestas will deliver a 30-year service and maintenance agreement to optimize the project's energy production.

- From all these factors, it can be concluded that the onshore segment is expected to gain significant traction in the market in the coming years and is expected to be the fastest-growing segment.

China to Dominate the Market

- In China, nearly 70% of the electricity produced is from thermal sources of energy. Owing to the increasing pollution from thermal sources, the country has been making efforts to increase the share of cleaner and renewable sources in power generation.

- According to China Energy Portal, during 2014-2021, China's total installed wind capacity registered a CAGR of 15.71%. As part of its 14th five-year plan (2021-2025), the country aims to supply 33% of national power consumption by 2025 and for non-hydro renewables to contribute 18%. Additionally, the country aims to increase renewable energy generation to 3,300 TWh by 2030.

- As of 2021, China had an installed wind power capacity of 328.48 gigawatts. Though the wind farms are in the country's wind-rich northern and western provinces, delays in grid connection and improper grid management continue to be the major issues.

- Moreover, in October 2022, the government of China announced its plan to construct the world's largest wind farm, a facility that could power the whole of Norway. Chaozhou - a city in China's Guangdong province, has revealed ambitious plans for a 43.3-gigawatt facility in the Taiwan Strait.

- Furthermore, In May 2022, China National Offshore Oil Corporation (CNOC) started construction of the offshore floating wind power platform at the construction site of CNOOC Qingdao in Hainan Province, China. The project will be developed by CNOOC Rongfeng Energy Co. Ltd, affiliated with the new energy branch of CNOOC Beijing, China.

- Owing to the above points, China is expected to dominate the Asia-Pacific Wind Energy Market during the forecast period.

Asia-Pacific Wind Power Industry Overview

The Asia-Pacific Wind Power Market is moderately fragmented. Some of the key players (not in particular order) include Acciona Energia SA, Orsted AS, EDF SA, General Electric Company, and Siemens Gamesa Renewable Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, until 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Australia

- 5.2.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wind Farm Operators

- 6.3.1.1 Acciona Energia SA

- 6.3.1.2 Orsted AS

- 6.3.1.3 EDF SA

- 6.3.2 Equipment Suppliers

- 6.3.2.1 Envision Energy

- 6.3.2.2 General Electric Company

- 6.3.2.3 Siemens Gamesa Renewable Energy

- 6.3.2.4 Suzlon Energy Limited

- 6.3.2.5 Xinjiang Goldwind Science & Technology Co. Ltd (Goldwind)

- 6.3.2.6 Vestas Wind Systems AS

- 6.3.2.7 China Longyuan Power Group Corporation Limited

- 6.3.1 Wind Farm Operators

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219