|

市場調查報告書

商品編碼

1644501

德國國內宅配、快捷郵件和小包裹(CEP) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Germany Domestic Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

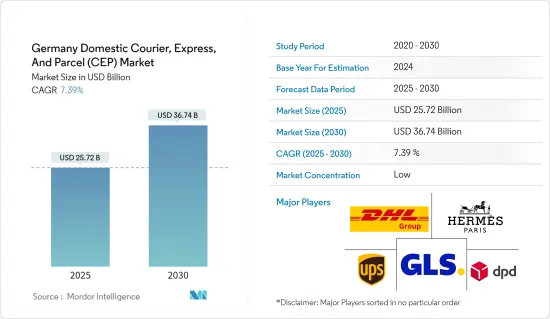

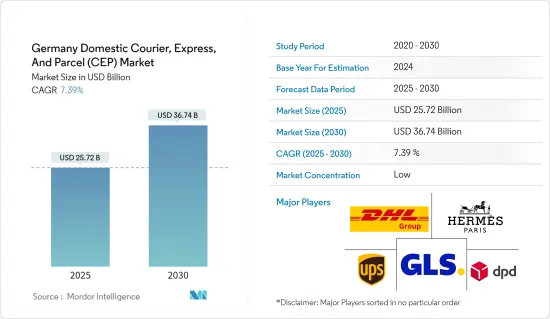

德國國內宅配、快捷郵件和小包裹市場規模預計在 2025 年為 257.2 億美元,預計到 2030 年將達到 367.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.39%。

關鍵亮點

- 德國宅配市場主要受電子商務的興起和網際網路的高普及率所推動。

- 德國在物流和運輸方面有著豐富的歷史,這使得其成為一個充滿活力且成熟的小包裹市場。各種經濟和政治因素影響著這個市場的發展。因此,德國是歐洲最大的小包裹市場。

- 德國的小包裹市場由眾多中小企業組成的活躍格局所支撐。超過 12,000 家公司在德國 CEP 市場上營運,其中北萊茵-威斯特法倫州的公司集中度最高。該市場由德國郵政DHL、愛馬仕集團和DPD集團主導。即使在德國 CEP 行業激烈的競爭和技術不斷創新的情況下,過去 20 年來,各公司每批貨物的收益一直保持穩定。仔細觀察收益來源就會發現,小包裹服務是德國 CEP 市場的主要收益驅動力。

- 不斷的技術創新正在推動規模收益的提高。歷史趨勢表明,經濟受益於投資創新。在德國CEP市場,企業為了確保技術創新和可觀的收益,持續投入大量資源進行研發。這項承諾是明確的:德國 CEP 市場每年平均在創新方面投資超過 2.5 億歐元(2.7309 億美元),將其視為對未來利益的策略投資。

- 隨著數位化重塑全球社會和經濟格局,個人和商業活動越來越依賴網路和智慧型設備。在過去十年中,企業對消費者(B2C)領域一直主導著德國的小包裹運輸,約佔總量的三分之二。 B2C 銷售額的激增凸顯了企業與消費者之間直接交易日益成長的重要性。

德國國內宅配、快遞與小包裹(CEP) 市場趨勢

B2C 市場佔據很大佔有率

B2C電子商務持續連年爆炸性成長。在德國,大型網路商店佔該國電子商務總銷售額的40%以上。

由於產品種類和競爭因素的增加,德國消費者擴大轉向網路購物。在此背景下,amazon.de脫穎而出,成為德國網路購物的首選,並擁有最高的收益。

說到網上購物,電子產品位居最受歡迎的商品之首。此外,網路購物的頻率也引人注目,超過20%的德國人每月購物數次。德國電子商務各細分領域收益成長預測表明,網路購物趨勢持續,時尚和電子產品等類別的收益顯著成長。

總而言之,德國 B2C 電子商務格局顯示出穩健的成長指標和消費者偏好的變化。但經濟壓力迫使企業做出策略調整。作為歐洲最大的電子商務市場之一,即使面臨當前挑戰,德國仍有望繼續成長。

基礎建設投資推動市場

2024年,德國政府將大力投資加強基礎設施,其中570億歐元(622.6億美元)將用於綠色計畫。此舉對於改善運輸網路並提高宅配、快遞和小包裹(CEP)市場的效率至關重要。

漢堡地鐵 U5 線路的開發和 A281 高速公路的拓寬等重大計劃旨在提高都市區的連接性和可及性。這種升級對於物流業務至關重要,以確保小包裹及時可靠地遞送。

改善的公路和鐵路系統預計將縮短運輸時間並降低營運成本。透過更順暢的物流業務,CEP 公司可以擴大規模,以滿足快速成長的電子商務產業日益成長的需求。

這項基礎建設將會在CEP領域創造就業機會。廣泛的物流網路將需要更多的勞動力來滿足日益成長的配送需求,在經濟成長和彌合產業技能差距方面發揮關鍵作用。

德國國內宅配、快捷郵件與小包裹(CEP) 產業概況

德國國內 CEP 市場較為分散,存在多家參與者,但沒有一家大型參與者佔據大部分市場佔有率。國內快遞主要由 DHL、Hermes、DPD、GLS 和 UPS 等公司主導。 DHL和Hermes等德國公司在國內市場影響,在國際上也擁有強大的影響力。

宅配業者和第三方小包裹營運商正在投資技術,以在全國範圍內取得優勢並擴大其服務範圍。疫情爆發後,網路配送量大幅增加,宅配公司正在尋求利用此機會。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- CEP 產業的技術趨勢與自動化

- 政府法規和舉措

- 德國物流倉儲市場概況

- 德國貨運市場概況

- 德國電商板塊亮點(國內電商說明)

- 地緣政治與疫情將如何影響市場

第5章 市場動態

- 市場促進因素

- 電子商務快速擴張推動市場

- 高網路普及率推動市場

- 市場限制

- 影響市場的監管問題

- 影響市場的全球事件

- 市場機會

- 市場驅動的技術進步

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按經營模式

- B2B(B2B)

- B2C(B2C)

- 客戶對客戶 (C2C)

- 按類型

- 電子商務

- 非電子商務

- 按最終用戶

- 服務業(BFSI(銀行、金融服務、保險))

- 批發零售(電子商務)

- 醫療

- 製造業

- 其他

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- Deutsche Post DHL

- Hermes

- DPD

- GLS

- UPS

- Steinfurth & Co. GmbH

- Kurierdienst Dago Express

- Overnight Courier Uhlenbrock GmbH

- CCD-Kurier Hamburg

- SPEED Courier Service GmbH*

- 其他公司

第 8 章:市場的未來

第 9 章 附錄

- GDP 分佈(按活動和地區分類)

- 洞察資本流動

- 經濟統計-運輸和倉儲業對經濟的貢獻

The Germany Domestic Courier, Express, And Parcel Market size is estimated at USD 25.72 billion in 2025, and is expected to reach USD 36.74 billion by 2030, at a CAGR of 7.39% during the forecast period (2025-2030).

Key Highlights

- The German courier market is mainly driven by increasing e-commerce and high internet penetration.

- Germany boasts a rich history in logistics and transportation, leading to a vibrant and well-established parcel market. Various economic and political influences have shaped the evolution of this market. Consequently, Germany stands as Europe's largest parcel market.

- Germany's parcel market is bolstered by a vibrant landscape of numerous small and medium-sized firms. Over 12,000 companies operate in Germany's CEP market, with North Rhine-Westphalia housing the densest concentration. Dominating the scene are Deutsche Post DHL, Hermes Group, and DPD Group. Even amidst fierce competition and relentless innovation in Germany's CEP industry, firms have managed to maintain consistent revenue per shipment over the past twenty years. A closer look at the revenue streams reveals that parcel services are the primary revenue drivers in Germany's CEP market.

- Continuous innovations drive increasing returns to scale. Historical trends show that economies benefit from investing in innovation. In Germany's CEP market, firms consistently allocate significant resources to research and development, aiming to innovate and secure substantial earnings. This commitment is evident, with the German CEP market investing an average of over EUR 250 million (USD 273.09 Million) annually in innovation, viewing it as a strategic investment for future gains.

- As digitalization reshapes social and economic landscapes globally, there's a heightened dependence on the internet and smart devices for both personal and business activities. Over the past decade, the business-to-consumer (B2C) segment has dominated parcel shipments in Germany, accounting for approximately two-thirds of the total. This surge in B2C sales underscores the growing significance of direct transactions between businesses and consumers.

Germany Domestic Courier, Express, And Parcel (CEP) Market Trends

B2C segment holding a significant share in the market

B2C e-commerce continues to witness explosive growth year after year. In Germany, leading online shops account for over 40 percent of the nation's total e-commerce revenue.

German consumers have a clear affinity for online shopping, driven by factors like a broader product selection and competitive pricing. Dominating this landscape, amazon.de stands out as the top choice for German online shoppers, boasting the highest revenue.

When it comes to online purchases, electronics emerge as the frontrunner in popularity. Additionally, online shopping frequency is notable, with over 20% of Germans making purchases several times a month. Segment-wise forecasts for revenue growth in German e-commerce indicate a lasting trend in online shopping, with categories like fashion and electronics poised for substantial revenue increases.

In summary, Germany's B2C e-commerce landscape showcases robust growth metrics and shifting consumer preferences. However, economic pressures are prompting businesses to make strategic adjustments. As one of Europe's largest e-commerce markets, Germany holds promise for continued growth, even in the face of present challenges.

Infrastructure investments driving the market

In 2024, the German government is channeling substantial funds into infrastructure enhancements, notably dedicating EUR 57 billion (USD 62.26 billion) to green initiatives. This move is pivotal for refining the transportation network, which in turn, boosts the efficiency of the Courier, Express, and Parcel (CEP) market.

Major projects like the U5 Hamburg Subway Line Development and the expansion of Highway A281 aim to bolster connectivity and accessibility in urban areas. Such upgrades are essential for logistics operations, ensuring parcels are delivered timely and reliably.

Improvements in highways and rail systems promise reduced delivery times and lower operational costs. As logistics operations smoothen, CEP companies can scale up to meet the surging demands of the booming e-commerce sector.

These infrastructure upgrades are set to generate jobs in the CEP sector. A broadened logistics network will necessitate a bigger workforce to handle rising delivery demands, playing a vital role in economic growth and bridging skill gaps in the industry.

Germany Domestic Courier, Express, And Parcel (CEP) Industry Overview

The domestic CEP market in Germany is fragmented considering that there are several companies operating in the market with major players not holding most of the market share. Domestic deliveries are dominated by companies like DHL, Hermes, DPD, GLS, and UPS. Companies like DHL and Hermes, which are German companies, have a strong market presence in the country and also a strong international presence.

The delivery and third-party parcel companies are investing in technology to gain an edge and scale up their services in the country. After the pandemic, the volume of online deliveries has increased significantly, and delivery companies are trying to capitalize on this opportunity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation in the CEP Industry

- 4.3 Government Regulations and Initiatives

- 4.4 Overview of the Logistics and Warehousing Market in Germany

- 4.5 Brief on Germany Freight Forwarding Market

- 4.6 Spotlight on Germany E-commerce Sector (Commentary on Domestic eCommerce)

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid e-commerce expansion driving the market

- 5.1.2 High internet penetration driving the market

- 5.2 Market Restraints

- 5.2.1 Regulatory challenges affecting the market

- 5.2.2 Global events affecting the market

- 5.3 Market Opportunities

- 5.3.1 Technological advancements driving the market

- 5.4 Value Chain/Supply Chain Analysis

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Business Model

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Customer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 eCommerce

- 6.2.2 Non-eCommerce

- 6.3 By End User

- 6.3.1 Services (BFSI (Banking, Financial Services and Insurance))

- 6.3.2 Wholesale and Retail Trade (E-commerce)

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Deutsche Post DHL

- 7.2.2 Hermes

- 7.2.3 DPD

- 7.2.4 GLS

- 7.2.5 UPS

- 7.2.6 Steinfurth & Co. GmbH

- 7.2.7 Kurierdienst Dago Express

- 7.2.8 Overnight Courier Uhlenbrock GmbH

- 7.2.9 CCD-Kurier Hamburg

- 7.2.10 SPEED Courier Service GmbH*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution, by Activity and Region

- 9.2 Insights on Capital Flows

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy