|

市場調查報告書

商品編碼

1644504

中國宅配、快捷郵件和小包裹(CEP) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)China International Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

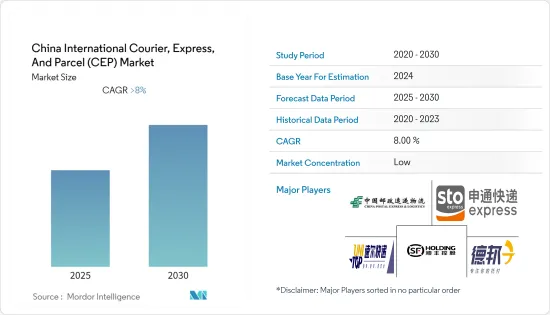

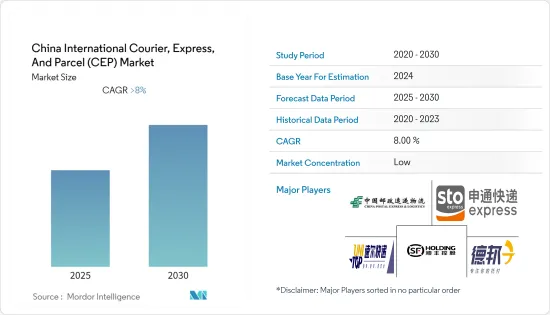

預計預測期內中國國際宅配、快捷郵件和小包裹市場複合年成長率將超過 8%

關鍵亮點

- 數位化正在對市場產生重大影響。隨著電子商務的興起,過去十年來中國宅配的小包裹數量增加了一倍以上。電子商務行業的蓬勃發展、跨境貿易的不斷成長、技術進步以及群眾外包交付模式正在推動中國國際 CEP 市場的成長。

- 隨著電子商務的日益普及以及新數位工具推動的區域物流網路的不斷擴張,中國的快捷郵件行業正在快速成長。由於對宅配服務的需求推動市場發展,該行業具有強勁的成長潛力。受益於中國強勁的經濟表現和不斷擴張的電子商務,宅配行業在過去五年中實現了快速成長。

中國國際宅配及快捷郵件(CEP )市場趨勢

電子商務領域不斷擴大,推動中國國際 CEP 市場發展

自2013年以來,中國零售電子商務市場已成為全球最大市場。 2022年,中國電商平台經歷了顯著的成長。此外,電商平台和宅配業者擴大貨源和快遞管道,為處於封鎖狀態的上海居民運送食品和其他必需品。為減輕疫情影響,上海市政府承諾保障2,500萬市民的生活必需品供應,解決好上海市的配送問題。

根據京東統計,運往上海的生活必需品包括奶粉、紙尿褲等嬰幼兒奶粉8萬餘包、藥品及防疫用品近10萬件、羊肉10噸。除京東外,全國還有近 4,000 家門市提供線上食品配送平台。這些線上平台正在推動國內宅配包裹市場的發展。

同時,2022年10月,中國電子商務帶動快遞物流年均成長超過4.9%。這一成長是由中國最大的網路購物節期間網上銷售的成長所推動的。此外,2022年,根據國家統計局公佈的數據,2021年雙11購物節期間總出貨量達6.96億件,成長率為18%。營收成長也得益於中國航空貨運量最快的復甦。 2022年第三季度,中國B2C電商平台呈現明顯成長,其中天貓為領先平台之一,佔B2C平台網路零售交易金額的63%以上,其次是京東、唯品會等。

中國也是世界上人口最多的國家,因此擁有最多的線上買家和賣家。其最大的電子商務平台阿里巴巴的奧寶在全國擁有450萬活躍賣家。中國超過90%的電子商務銷售是透過行動裝置進行的。

三、層級層級城市正在推動中國電子商務的成長。隨著難以接觸實體店的新興中等收入消費者轉向電子商務,中國農村地區出現了強勁成長。新冠疫情危機導致整體消費支出下滑,但電子商務購買量卻增加。

此外,社會消費品零售總額也受到電子商務的推動。 2021年,受實體商品在線上購買強勁成長的推動,電子商務在零售額中的佔有率將超過24.5%。

中國小包裹運輸量增加

隨著行動裝置的使用和普及,透過智慧型手機和平板電腦購物已成為中國網路用戶的新常態。除了技術升級之外,小城市和農村居民購買力的提升也顯著改變了中國的網路零售格局。電子商務的興起導致中國小包裹數量的增加。

根據國家郵政局統計,12月份,中國宅配業包裹寄送量突破1,000億件。這項艱難成績既體現了中國宅配行業的韌性,也體現了中國疫情防治和經濟社會發展同步推進的成果。

12月前12天,全國共收寄小包裹超過43億件,較去年同期成長5.6%。我國快遞網路覆蓋範圍廣泛,有41萬個快遞服務站,快遞總里程達4,300萬公里。我們每天為近7億人提供服務。

今年以來,受新冠肺炎疫情影響,宅配業壓力巨大。相關部門採取多項措施確保物流暢通,包括全面取消高速公路出入口臨時檢查、建立白名單機制、進行即時監控等。

此外,宅配產業的企業也積極採取措施,透過調整快遞路線、建立緊急應變系統等,確保快捷郵件網路順暢運作。

中國宅配小包裹( CEP)產業概況

市場較為分散,預計預測期內將會成長。市場競爭激烈,國際CEP市場的大部分佔有率被少數參與企業佔據。中國在國際CEP市場上持續的價格競爭,一定程度上侵蝕了快捷郵件承運商的盈利。主要參與企業包括深圳順豐泰森控股(集團)、速遞易、中國郵政速遞物流、德邦物流、申通快遞等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 技術趨勢和自動化

- 政府監管

- 物流及倉儲市場概況

- 中國跨境運輸

- 貨運市場概況

- 價值鏈/供應鏈分析

- CEP業務儲存功能及附加價值服務詳情

- 電子商務領域聚焦

- COVID-19 對 CEP 市場的影響(對市場和經濟的短期和長期影響)

第5章 市場動態

- 市場促進因素

- 電子商務崛起推動中國國際CEP市場發展

- 中國小包裹運輸量增加

- 市場限制/挑戰

- 基礎設施薄弱,物流成本高

- 製造商對物流服務缺乏控制

- 市場機會

- 國際貿易和 B2C 貨運量增加

- 快速都市化推動市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按業務

- B2B(B2B)

- B2C(B2C)

- 客戶對客戶 (C2C)

- 按類型

- 電子商務

- 非電子商務

- 按最終用戶

- 服務

- 批發和零售

- 醫療

- 製造業

- 其他

第7章 競爭格局

- 公司簡介

- China Postal Express & Logistics Co. Ltd

- STO Express Co. Ltd

- Shenzhen SF Taisen Holdings(Group)Co. Ltd

- Seino Super Express

- YTO Express Group Co. Ltd

- ZTO Express

- STO Express Co. Ltd

- Kerry EAS Logistics Ltd

- FedEx

- Guangzhou Shenzhen Yuanfeihang Logistics Co. Ltd*

第 8 章:市場的未來

第 9 章 附錄

The China International Courier, Express, And Parcel Market is expected to register a CAGR of greater than 8% during the forecast period.

Key Highlights

- >

- Digitalization has had a significant impact on the market. With the rise of ecommerce, the number of delivered parcels in China more than doubled in the past 10 years. Growth in the e-commerce sector, rising cross-border trade, technological advancements, and crowdsourced delivery models are driving the growth of the Chinese international CEP market.

- China's express delivery industry is showing rapid growth due to the increasing popularity of e-commerce and the mushrooming local logistics networks, empowered by new digital tools. The sector has strong growth potential, as the demand for delivery services is boosting the market. The courier industry has recorded rapid growth over the past five years, benefiting from China's strong economic performance and growing e-commerce expansion.

China International Courier, Express, And Parcel (CEP) Market Trends

Rising E-commerce Sector to Boost the International CEP Market in China

China's retail e-commerce market has been the largest in the world since 2013. In 2022, e-commerce platforms witnessed significant growth in China. In addition, e-commerce platforms and couriers multiplied their supply and express channels to deliver food and other essentials to Shanghai residents during the lockdown. Shanghai authorities promised to ensure daily supplies for all 25 million residents and solve delivery problems in the city to mitigate the pandemic's impact.

As per JD.com, daily necessities transported to Shanghai included more than 80,000 packs of maternity and infant products such as infant formula powders and diapers, nearly 100,000 medicines and virus prevention supplies, 10 tons of mutton, etc. Along with JD.com, nearly 4,000 stores are providing online food delivery platforms in the country. These online platforms drive the courier express market in the country.

Meanwhile, in October 2022, China's e-commerce drove express logistics by more than 4.9% annually. This surge was due to increased online sales during China's biggest annual online shopping festival. In addition, in 2022, as per the State Bureau of China, total shipments during the 2021 Double 11 shopping festival reached 696 million at a growth rate of 18%. The fastest recovery of China's air freight also supported this sales growth. In Q3 2022, Chinese B2C e-commerce platforms witnessed significant growth, and Tmall is one of the major platforms that made more than 63% of online retail transactions on B2C platforms, followed by JD.com, Vipshop, etc.

In addition, China has the most online buyers and sellers, as it is the world's most populous nation. Its largest e-commerce platform, Alibaba's Taobao, has 4.5 million active sellers in the country. Over 90% of e-commerce sales in China are done through mobile devices.

E-commerce growth in China is driven by tier 3 and 4 cities. Rural China saw significant growth as emerging middle-income group consumers with limited access to physical retail outlets turned to e-commerce. Although the COVID-19 crisis has led to a slump in overall consumer spending, it has increased e-commerce purchases.

Moreover, total retail sales of consumer goods are driven by e-commerce. In 2021, the e-commerce share in retail sales accounted for more than 24.5%, driven by strong growth in online purchases of physical goods.

Increasing Volume of Parcel Shipments in China

Along with the ever-increasing use and distribution of mobile devices, shopping on smartphones or tablets has become a new norm for Chinese internet users. Apart from technology upgrades, the rise of small-town and rural residents' purchasing power has also reshuffled the online retail landscape in China. Due to the increase in e-commerce, there is an increase in the number of parcels in China.

According to State Post Bureau figures, China's courier industry delivered more than 100 billion items in December. This arduous accomplishment demonstrated both the tenacity of the Chinese courier sector and the results of China's synchronisation of COVID-19 policy with economic and social development.

Over 4.3 billion parcels were collected nationally in the first 12 days of December, increasing 5.6 per cent from the same period last year. China has a sizable express delivery network with 410,000 service stations and a total mileage of 43 million kilometres. It provides daily service to close to 700 million people.

Since this year, the courier sector has been under extreme pressure due to the COVID-19 pandemic. Relevant departments adopted a number of measures to ensure uninterrupted logistics, including the removal of all temporary checks at motorway entrances and exits, the establishment of a whitelist mechanism, and the start of real-time monitoring.

Additionally, businesses in the courier sector actively worked to guarantee the express delivery network operated without hiccups by rerouting delivery routes and setting up emergency response systems.

China International Courier, Express, And Parcel (CEP) Industry Overview

The market is fragmented and is expected to grow during the forecast period. The market is highly competitive, with a few players occupying the major share in the international CEP market. The continuous price war within China's international CEP market has harmed the profitability of express delivery firms to some extent. Some of the major players are Shenzhen SF Taisen Holdings (Group) Co. Ltd, Sure Express Co. Ltd, China Postal Express & Logistics Co. Ltd, Deppon Logistics Co. Ltd, and Sto Express Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation

- 4.3 Government Regulations

- 4.4 Overview of the Logistics and Warehousing Market

- 4.5 Spotlight on Cross-border Transportation in China

- 4.6 Brief on Freight Forwarding Market

- 4.7 Value Chain/Supply Chain Analysis

- 4.8 Elaboration on Storage Functions and Value-added Services in CEP Business

- 4.9 Spotlight on E-commerce Sector

- 4.10 Impact of COVID-19 on the CEP Market (Short-term and Long-term Impact on the Market and on the Economy)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising E-commerce Sector to Boost the International CEP Market in China

- 5.1.2 Increasing Volume of Parcel Shipments in China

- 5.2 Market Restraints/Challenges

- 5.2.1 Poor infrastructure and higher logistics costs

- 5.2.2 Lack of control of manufacturers on logistics services

- 5.3 Market Opportunities

- 5.3.1 Rise in International Trade and B2C shipments

- 5.3.2 Rapid Urbanization Boosting the growth of the Market

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Business

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Consumer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 E-commerce

- 6.2.2 Non-e-commerce

- 6.3 By End User

- 6.3.1 Services

- 6.3.2 Wholesale and Retail Trade

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 China Postal Express & Logistics Co. Ltd

- 7.2.2 STO Express Co. Ltd

- 7.2.3 Shenzhen SF Taisen Holdings (Group) Co. Ltd

- 7.2.4 Seino Super Express

- 7.2.5 YTO Express Group Co. Ltd

- 7.2.6 ZTO Express

- 7.2.7 STO Express Co. Ltd

- 7.2.8 Kerry EAS Logistics Ltd

- 7.2.9 FedEx

- 7.2.10 Guangzhou Shenzhen Yuanfeihang Logistics Co. Ltd*