|

市場調查報告書

商品編碼

1644505

日本國際 CEP -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan International CEP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

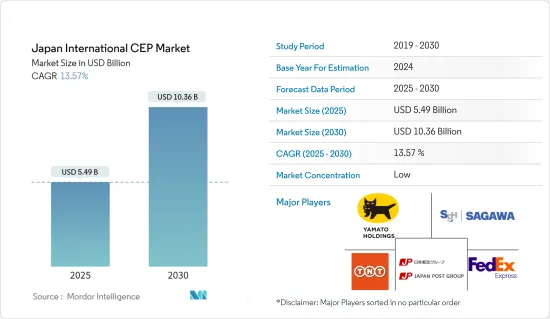

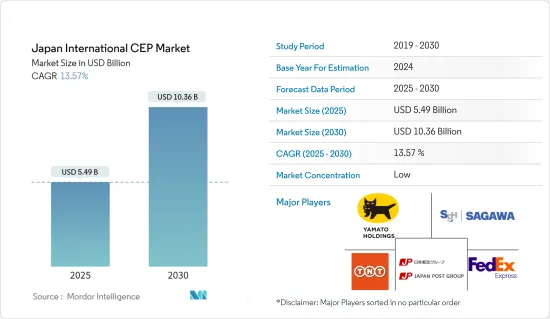

日本國際CEP市場規模預計在2025年為54.9億美元,預計到2030年將達到103.6億美元,預測期內(2025-2030年)的複合年成長率為13.57%。

日本是美國的主要貿易和投資夥伴。電子設備和汽車是日本兩大出口產品。與其他國家的貿易對日本經濟也非常重要。

關鍵亮點

- 2022年日本的出口包括機動車輛(886億美元)、積體電路(360億美元)、機動車輛;零件及配件(8701和8705)(334億美元)、離散機械(220億美元)和攝影實驗室設備(185億美元)。

- 建立經濟特區(SEZ)和自由貿易區(FTZ)是為了促進國際貿易並促進宅配、快捷郵件和小包裹公司(CEP)產生收入。

- 國際CEP市場的關鍵驅動力是電子商務領域。日本是全球最大的網路購物市場,日本電商市場以B2B交易為主,B2C銷售日益受到重視,C2C市場正在興起。過去十年,B2C 銷售額成長了一倍以上。

- 2023年初日本的網路普及率將達到82.9%,使用網路的人數將達到1.025億人。截至2023年1月,日本將有9,200萬人使用社群媒體,佔總人口的74.4%。

- 2022年11月,日本將啟動太空宅配服務。總部位於東京的 ISpace 公司計劃於本月稍後發射一艘月球著陸器,搭載包括兩輛探測車在內的一系列商業和政府有效載荷。

日本國際CEP市場趨勢

跨境電子商務成長推動市場

日本的國際電子商務正在崛起,根據PPRO的一項調查,中國是日本消費者的首選電子商務目的地。美國位居第二,佔全球電子商務銷售額的 30%。美國和中國是日本產品的最大市場。根據經濟產業省統計,2021年對華線上銷售額達2.13兆日圓(143.7億美元),與前一年同期比較成長10%;對美國線上銷售額則成長26%,達1.22兆日圓(840億美元)。除去20萬日圓(1,370.99美元)的網路交易,兩國出口總額約佔日本全年出口總額的10%。

日本是成長最快的電子商務和行動商務市場之一,其數位意識強的民眾擴大進行跨境購買。它是跨境電子商務企業的理想市場。如果跨境電子商務公司能夠在地化客戶體驗,包括真實且正確的語言翻譯、網站架構、產品清單和優質的客戶服務,那麼他們就能在這個市場上取得成功。

日本宅配遞送量不斷增加

日本2022年小包裹包裝貨物處理量達91億件,較上年的92億件下降1.1%。平均每秒鐘有 289 起,每天有 2500 萬起。 2022年小包裹總收入為270億美元,與前一年同期比較增17%,但每件小包裹的收入下降了-16%。平均每人處理宅配數量為73件,平均每戶處理宅配數量為173件。到2022年,近一半(48.2%)的日本兩人或兩人以上的家庭將透過電子商務購買商品和服務,這一數字為過去十年來的最高水準。近年來,電子商務家庭數量穩定成長,休閒相關商品和服務成為最受歡迎的線上購物之一。

日本國際CEP產業概況

日本的國際CEP市場是細分的,全球和參與企業參與企業混雜,競爭非常激烈。主要參與企業包括大和號、佐川急便、TNT快遞、日本郵政和聯邦快遞。全球智慧物流解決方案供應商GeekPlus為Nike在日本實現當日送達服務,並宣佈為Nike在中國的新配送中心提供先進的機器人解決方案,部署了200多台「貨到人」系列機器人。智慧機器人將把耐吉產品和包裹直接運送給倉庫工人,從而降低成本,提高揀選效率,使他們的日常工作更加輕鬆。 2022年,日本郵政在小包裹包裝貨物市場佔有率最高(46%),大和航空的佔有率最低(34%)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 科技趨勢

- 政府監管

- 日本物流倉儲市場概況

- 日本跨境運輸

- 日本貨運市場概況

- 日本電商板塊亮點(國內及跨境電商說明)

- COVID-19 對 CEP 市場的影響(對市場和經濟的短期和長期影響)

第5章 市場動態

- 市場促進因素

- 電子商務成長推動市場

- 航空貨運量增加刺激市場

- 市場限制

- 宅配配送業務透明度低

- 市場機會

- 技術進步:採用先進的追蹤系統

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 供應鏈/價值鏈分析

第6章 市場細分

- 按業務

- B2B(B2B)

- B2C(B2C)

- 客戶對客戶 (C2C)

- 按類型

- 電子商務

- 非電子商務

- 按最終用戶

- 服務

- 批發和零售

- 醫療

- 製造業

- 其他

第7章 競爭格局

- 公司簡介

- YAMATO HOLDINGS CO. LTD

- Sagawa Express Co. Ltd

- TNT Holdings BV

- JAPAN POST Co. Ltd

- FedEx

- DHL

- Seino Transportation Co. Ltd

- United Parcel Service of America Inc.

- DB Schenker

- Nippon Express Co. Ltd

- Takuhai

- Agility

- KERRY LOGISTICS NETWORK LIMITED

- National Air Cargo Inc.*

第 8 章:市場的未來

第 9 章 附錄

The Japan International CEP Market size is estimated at USD 5.49 billion in 2025, and is expected to reach USD 10.36 billion by 2030, at a CAGR of 13.57% during the forecast period (2025-2030).

Japan is a major trading and investing partner for the United States. Electronic equipment and cars are two of Japan's biggest exports. Trade with other countries is also very important for Japan's economy.

Key Highlights

- In 2022, Japan's exports are Cars (USD 88.6 billion), Integrated circuits (USD 36 billion), Motor vehicles; parts & accessories (8701 and 8705) (USD 33.4 billion), Machinery having individual functions (USD 22 billion) and Photo lab equipment (USD 18.5 billion) among others.

- To facilitate international commerce, Trade Special Economic Zones (SEZ) and Free Trade Zones (FTZ) are established, which facilitate the revenue generation of the Courier, Express, and Parcel companies (CEP).

- The main driving factor for the International CEP market is the E-commerce Sector. Japan is the world's largest online shopping market, Japan's e-commerce market is dominated by B2B transactions, with a growing emphasis on B2C sales and an emerging C2C market. B2C sales have more than doubled over the past decade.

- Japan's internet penetration rate was 82.9% at the beginning of 2023, with 102.5 million people using the internet. In January 2023, 92.00 million people in Japan were using social media, making up 74.4% of the population.

- In November 2022, Japan is launching a space-based courier service. ISpace Inc. the company, based in Tokyo, is planning to launch a moon lander later this month that will be carrying a bunch of commercial and government stuff, including two rovers.

Japan International CEP Market Trends

Growth in Cross Border E-commerce is driving the market

Japan's international e-commerce is on the rise, a study by PPRO found that China was the top e-commerce destination for Japanese shoppers. The US came in second with 30% of the global e-commerce sales. The United States and China are the country's largest markets for Japanese goods. In 2021, online sales to China reached JPY 2.13 trillion (USD 14.37 billion), a 10% increase from the previous year, while online sales to the United States increased by 26% to JPY 1.22 trillion (USD 84 billion), according to the Ministry of Economics, Trade and Industry (METI). The two countries combined accounted for about 10% of Japan's total exports for the year, excluding online transactions of JPY 200,000 (USD 1370.99).

Japan is one of the fastest-growing e-commerce & m-commerce markets with a digitally savvy population that is increasingly buying across borders. It is an ideal market for cross-border e-commerce businesses. Cross-border e-commerce companies will be successful in this market if they localize the customer experience, including genuine and correct language translations, website architecture, product listing, and superior customer service.

Increase in Volume of Parcel Shipments in Japan

In Japan, the volume of parcels and packets generated in 2022 reached 9,1 billion, a decrease of -1,1% compared to the previous year's 9,2 billion parcels. This represents an average of 289 parcels per second, equivalent to 25 million parcels per day. The total revenue generated from parcels in 2022 was USD 27 billion, an increase of 17% year-on-year, however, the revenue per parcel decreased by -16%, largely due to the strong US Dollar-Yen exchange rate in 2022. The average parcel generated per person was 73, while the average parcel generated per household remained at 173. Nearly half of Japanese households (48.2%) with 2 or more people purchased goods or services through e-commerce in 2022, a record high in the last decade. The number of e-commerce-using households has been steadily rising in recent years, and leisure-related products and services are among the most popular online purchases.

Japan International CEP Industry Overview

The Japanese international CEP market is fragmented, with a mix of global and local players, making it highly competitive. Some of the strong players include Yamato, Sagawa Express, TNT Express, Japan Post, and FedEx. Geek+, a global provider of smart logistics solutions, announced that it had powered same-day delivery for Nike in Japan, providing advanced robotics solutions to Nike's new distribution center in China and deploying more than 200 robots from its goods-to-person P series line. The smart robots carry Nike products and packages directly to the warehouse worker, reducing costs, increasing picking efficiency, and making daily work easier on the warehouse operators. In 2022, Japan Post has the highest market share (46%) for parcels and packets, while Yamato has the lowest market share (34%).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations

- 4.4 Overview of the Logistics and Warehousing Market in Japan

- 4.5 Spotlight on Cross-Border Transportation in Japan

- 4.6 Brief on Japan Freight Forwarding Market

- 4.7 Spotlight on Japan E-commerce Sector (Commentary on Domestic and Cross-border E-commerce)

- 4.8 Impact of COVID-19 on the CEP Market (Short-term and Long-term Impact on the Market and on the Economy)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in E-commerce is driving the market

- 5.1.2 The market is fueled by the growing number of Air Freights

- 5.2 Market Restraints

- 5.2.1 Poor Visibility on the Courier Delivery Operations

- 5.3 Market Opportunities

- 5.3.1 Advancements in Technology: Introduction of Advanced tracking Systems

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

- 5.5 Supply Chain/Value Chain Analysis

6 MARKET SEGMENTATION

- 6.1 By Business

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Customer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 E-commerce

- 6.2.2 Non-e-commerce

- 6.3 By End User

- 6.3.1 Services

- 6.3.2 Wholesale and Retail Trade

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 YAMATO HOLDINGS CO. LTD

- 7.2.2 Sagawa Express Co. Ltd

- 7.2.3 TNT Holdings BV

- 7.2.4 JAPAN POST Co. Ltd

- 7.2.5 FedEx

- 7.2.6 DHL

- 7.2.7 Seino Transportation Co. Ltd

- 7.2.8 United Parcel Service of America Inc.

- 7.2.9 DB Schenker

- 7.2.10 Nippon Express Co. Ltd

- 7.2.11 Takuhai

- 7.2.12 Agility

- 7.2.13 KERRY LOGISTICS NETWORK LIMITED

- 7.2.14 National Air Cargo Inc.*