|

市場調查報告書

商品編碼

1644641

中東智慧卡:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Middle East Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

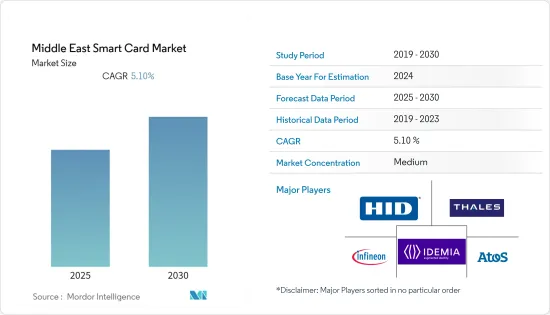

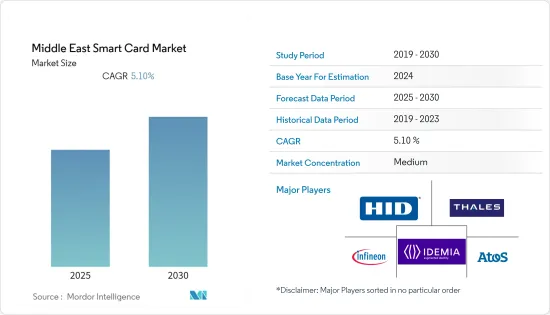

預測期內,中東智慧卡市場預計複合年成長率為 5.1%

關鍵亮點

- 該地區已引入多種智慧卡解決方案,以增強多個部門和人員的功能。例如,根據杜拜舉措兼執行委員會主席謝赫·哈姆丹·本·穆罕默德·本·拉希德·阿勒馬克圖姆殿下的計劃“我的社區...人人享有的城市”,社區發展局 (CDA) 發行了 Sanad 智慧卡。 「人人享有的城市」旨在根據 2022 年第 3 號《杜拜酋長國殘障人士權利保護法》將杜拜轉變為殘障人士友善城市。

- 2022年4月,為方便服務要求和尊重伊朗僑民而發放智慧ID卡的計畫進入實施階段。他補充說,候選人可以在法蘭克福、吉隆坡和維也納的領事館登記領取ID卡,很快就會在更多國家推出。根據伊朗海外僑胞高級委員會秘書處2020年的報告,共有4,377,258名伊朗人居住在國外,其中76%居住在美洲和歐洲國家。總統把協助海外伊朗人回國當作首要任務,政府高級官員也不斷重申要為他們回國鋪路。

- 由於區塊鏈的安全性能增強,該地區的智慧卡市場預計將迎來更多的商機。區塊鏈是一項可以讓許多企業受益的技術。區塊鏈可以實現快速且安全的應用程式開發。透過智慧卡可以實現區塊鏈交易。更有效率、更安全地管理您的加密付款。只要您有網路連接,同步就會處於活動狀態。智慧卡有望協助推動區塊鏈市場的發展。智慧卡有助於降低網路風險並改善區塊鏈截斷。此類智慧卡應用可能會帶來成長。推動市場擴張的另一個因素是智慧政府身分證和電子護照中的智慧卡。

- 分產業分析 疫情期間,以通訊、醫療為重點的智慧卡業務受到的影響相較於其他產業較小。醫療資料的爆炸性成長給提供高效的患者照護和隱私帶來了新的挑戰。智慧卡透過提供安全儲存(磁條卡上儲存超過 150 個位元組)和輕鬆的資料分發解決了這兩個挑戰。預計該地區醫療保健支出的增加將推動醫療保健領域的智慧卡發展。

- 此外,過去兩年由於新冠肺炎疫情,沙烏地阿拉伯為防止病毒傳播,將前往朝覲的人數限制為僅6萬名公民和居民。 2022年6月,沙烏地阿拉伯朝覲和副朝大臣陶菲克·拉比阿博士宣布將於2022年推出朝覲智慧卡,並指出數位技術將有助於有效組織今年的朝覲。陶菲克·拉比亞也在記者會上宣布,將推出電子服務,讓人們在沙烏地阿拉伯境外申請朝覲。沙烏地阿拉伯部長補充說,朝覲訪問簽證現在可在 24 小時內簽發。陶菲克·拉比亞博士透露,2022 年朝覲季將接待 100 萬名朝覲者,我們將努力確保他們的健康。他補充說,「2030願景」旨在方便接待更多的朝聖者。朝覲卡旨在確保朝覲者的安全和健康,以及為朝覲者工作的人員的安全。

- 然而,高昂的設置成本以及對資料竊取和安全的擔憂是全球智慧卡產業發展的主要限制因素。

中東智慧卡市場趨勢

個人和旅行識別的廣泛應用將推動市場成長

- 智慧卡為乘客帶來許多好處,包括減少旅程時間和提高服務效率。它還允許政府和交通部門快速收集通勤旅行資料。

- 2022年4月,科威特內政部安全關係和媒體總局表示,港口安全部與外交部協調宣布,科威特公民和海灣合作理事會國家公民將被允許使用智慧國民身份證在兩國之間旅行。外交部澄清說,公民可以在檢查完所要前往國家的入境要求後,使用智慧國民身份證往返海灣合作理事會成員國,就像新冠肺炎疫情之前的情況一樣。

- 2021 年 12 月,公民資訊公共管理局 (PACI) 宣布根據第 20 條(家庭就業)為居住者推出新的公民ID卡。 PACI 表示,與現有的卡片不同,新卡將配備智慧晶片。

- 此外,智慧卡在基於身分的領域正在迅速普及。阿拉伯聯合大公國聯邦地位、公民、海關和港口安全局在該國發揮重要作用。其成立於2004年,其任務之一是管理公民的身份、就業和其他傳記資料。阿拉伯聯合大公國身分證是阿拉伯聯合大公國生活不可或缺的一部分,同時也是居住證明和健康保險卡。它很可能很快也會被用作旅行證件。隨著今年該國人口突破 1,000 萬,阿拉伯聯合大公國當局宣布對綠卡進行重大更新,自 2022 年 4 月 1 日起,綠卡將取代居住者護照上的簽證貼紙。此舉是簡化居民與政府互動的另一步。

- 隨著人員、貨物和資金流動越來越快,犯罪和詐騙變得越來越難以追蹤。也許近年來身分證件安全方面最顯著的變化是加入了臉部辨識、指紋和眼部掃描器等生物特徵資料。在阿拉伯聯合大公國,此類記錄以加密形式儲存以增加安全性。官方文件的其他物理變化包括複雜的全像圖、凹版印刷(僅在特定角度可見的圖像)、頁面邊緣的複雜邊緣設計、水印以及比紙張更難篡改或複製的聚碳酸酯材料。

預計 BFSI 產業將實現高速市場成長

- 資訊和通訊技術(ICT)的進步導致對資料和資訊交換的需求增加。特別是在銀行和金融領域,出現了複雜的資料安全問題。解決這些問題需要有效和適當的解決方案,而銀行和金融智慧卡提供了這種解決方案——這是推動全球銀行和金融智慧卡市場向前發展的關鍵因素。由於政府法律的嚴格,銀行金融界對銀行、金融IC卡的使用有嚴格的限制。

- 例如,最新推出的生物識別支付卡包括萬事達卡於 2022 年 4 月在摩洛哥推出的 Aspirational Card,這是首張面向企業的生物識別付款卡,以及 Idemiaservices 的加速入職流程,以促進金融科技和付款的進步。與此同時,Idea 和 Thales 正在競爭埃及政府的一份業務數位化重大合約。

- 銀行和金融智慧卡市場成長的主要驅動力之一是資料安全威脅的出現頻率和複雜程度的增加。隨著資料安全威脅的頻率和複雜性不斷增加,包括未加密的資料、不安全的新技術、第三方服務、駭客攻擊和不安全的行動銀行,實施資料安全解決方案以確保用戶資料和資產受到保護的需求日益增加。

- 此外,2021 年 2 月,阿布達比第一銀行 (FAB) 與萬事達卡簽署了一份為期五年的策略合作協議,涵蓋企業卡和付款服務。兩家公司希望共同努力,讓該國的企業更輕鬆、更安全、更方便地進行 B2B付款。銀行客戶將可以使用萬事達卡的企業卡和付款管道,以及一系列商業和員工產品福利。

- EMV晶片、個人識別碼(PIN)卡和行動錢包等新型付款機制的出現正在推動卡片產業的數位化轉型。隨著這些方法的使用增加,迫切需要限制身份複製等詐欺活動,從而需要開發解決方案來減輕安全問題。智慧卡中儲存的資料難以破譯,只能透過 PIN 碼訪問,而 PIN 碼極難破解,從而使交易更加安全,更難偽造,這將推動市場在預測期內大幅擴張。

中東智慧卡產業概況

中東智慧卡市場的競爭適中。該市場中的參與企業傾向於投資新產品創新以滿足不斷變化的行業需求。此外,參與企業正在採取夥伴關係、合併和收購等策略活動來擴大其影響力。近期市場發展趨勢如下:

- 2022 年 4 月 - IDEX Biometrics ASA 宣布與智慧卡技術和創新參與企業E-Kart 合作,在東歐商業化生物辨識付款解決方案。 E-Kart 是 Eczacbas Holding 與全球卡片製造商 Gisecke & Devrient (G+D) 的合資企業。 E-Kart 是土耳其的高科技卡片製造中心,每年可生產 6,000 萬張智慧卡,全部區域的客戶提供服務。

- 2021 年 6 月—杜拜聯邦地位和公民身份局 (ICA) 推出了新的電子阿拉伯聯合大公國身分證。新的進化身份證將在 ICA UAE Smart 應用程式上提供。新ID卡上將有2D碼,可供政府部門讀取以用於官方目的。 ICA 建議所有居民在印刷實體卡之前使用電子版來獲取所有政府服務。電子版卡與實體卡具有同等效力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- 評估新冠肺炎對市場的影響

第5章 市場動態

- 市場促進因素

- 擴大身分和存取控制應用程式中的部署

- 廣泛應用於旅行識別和交通運輸

- 市場限制

- 隱私和安全問題以及標準化問題

- 市場機會

- 非接觸式付款需求不斷成長

第6章 市場細分

- 按類型

- 接觸

- 非接觸式

- 按最終用戶

- BFSI

- 資訊科技/通訊

- 政府

- 運輸

- 其他

- 按地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

第7章 競爭格局

- 公司簡介

- IDEMIA(Advent International)

- Secura Key

- Infineon Technologies AG

- Thales Group

- Atos Se

- Texas Instruments

- American Express Company

- HID Global Corporation

- EASTCOMPEACE

- giesecke & devrient

第8章投資分析

第9章:未來展望

簡介目錄

Product Code: 91005

The Middle East Smart Card Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The region is witnessing several smart card solutions to enhance the functioning of several departments and people. For instance, the Community Development Authority (CDA) has issued the Sanad smart card in accordance with His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of the Executive Council of Dubai's initiative "My Community... A City for Everyone," which aims to transform Dubai into a disability-friendly city in accordance with Law No. 3 of 2022 concerning the Protection of the Rights of Persons with Disabilities in the Emirate of Dubai.

- In April 2022, the plan to distribute smart identity cards entered the implementation phase to facilitate service requirements and honor Iranian ex-pats. The candidates can register for the identity cards at the consulates in Frankfurt, Kuala Lumpur, and Vienna, and they would be accessible in more countries soon, he added. According to the Secretariat of the High Council of Iranians Abroad's 2020 report, 4,37,258 Iranians are living abroad, with 76% of them living in the Americas and European countries. President has placed the issue of facilitating the return of Iranians living abroad to their home country high on its agenda, with government officials constantly reiterating the need to pave the way for the expatriates to return.

- The opportunities in the Smart Cards Market in the region are anticipated to rise due to Blockchain's enhanced security characteristics. Blockchain is a technology that many businesses may benefit from. Blockchain allows for the development of quick and secure apps. Blockchain transactions are possible with smart cards. They can better manage cryptographic payments more efficiently and safely. Synchronization is effective while connected to the internet. Smart cards will aid the market's rise in Blockchain. Smart cards can help to reduce cyber dangers and improve Blockchain truncation. These smart card applications may result in increased growth. Another factor driving market expansion is smartcards in smart government IDs and e-passports.

- During the COVID-19 pandemic, the business for smart cards specific to telecommunications and healthcare was less affected than other verticals. The upsurge of healthcare data brings new challenges in providing efficient patient care and privacy. Smart cards solved both challenges by providing secure storage (dramatically more than 150 bytes stored on a magnetic stripe card) and easy data distribution. Increasing healthcare expenditure in the region is anticipated to propel smart cards in the healthcare segment.

- Further, for the past two years, due to the coronavirus pandemic, Saudi Arabia limited the number of attendees allowed to perform Hajj to only 60,000 citizens and residents to prevent the virus from spreading. In June 2022, the Saudi Minister of Hajj and Umrah, Dr. TawfiqAl-Rabiah, announced that the Hajj smart card would be implemented in 2022, noting that digital technologies will help organize this year's Hajj efficiently. Dr. TawfiqAl-Rabiahrevealed in a press conference that the launch of an electronic service to apply for Umrah away from campaigns could be submitted from outside Saudi Arabia. The Saudi minister added that the visit visa for Umrah is issued within 24 hours now. Dr. TawfiqAl-Rabiahconfirmed that the year 2022 Hajj season would accommodate one million pilgrims while working to ensure the health of pilgrims. He added that "Vision 2030" aims to facilitate the reception of pilgrims in larger numbers. The Hajj cards aim to ensure the safety and health of pilgrims and the safety of personnel working in the service of pilgrims.

- However, high set-up costs and, data theft & security concerns are significant major restraints to the global smart card industry.

Middle-East Smart Card Market Trends

Growing Deployment in Personal Identification and Travel Identity is Expected to Boost the Market Growth

- Smart cards offer numerous advantages to commuters, including reduced traveling time and improved service efficiency. They also facilitate governments and transport services to collect commuters' travel data quickly.

- In April 2022, The General Department of Security Relations and Media at the Kuwaiti Ministry of Interior stated that the Ports Security Sector announced, based on coordination with the Ministry of Foreign Affairs, that citizens of Kuwait and citizens of the GCC countries are allowed to travel to and from the GCC countries using the smart national identity card. The ministry clarified that citizens could travel to and from the Cooperation Council for the Arab Gulf States countries utilizing the smart national identity card, as it was before the COVID-19 pandemic, after verifying the entry requirements for the countries to which they want to travel.

- In December 2021, The Public Authority for Civil Information PACI announced the launch of a new Civil ID card for residents under Article 20 (Domestic employment).PACI informed that, unlike the current card, the new card contains a smart chip.

- Also, smart cards are rapidly being adopted in the personal identification segment. The UAE's Federal Authority for Identity, Citizenship, Customs, and Port Security plays a vital job in the nation. Set up in 2004, one of its duties is managing identity, employment, and other biographical data for the country's population. The Emirates ID is a fundamental part of UAE life, used as proof of residency and even as a health insurance card. Soon, it would be used as a travel document, too. This year, as the population exceeds 10 million, the authorities of UAE are implementing a major update to the card, announcing that from April 1, 2022, it will serve as a replacement for visa stickers inserted into foreign residents' passports. The move is another step toward simplifying how residents interact with the government.

- As people, goods, and money become more mobile, keeping track of crime and fraud is harder. Perhaps the most notable security change to identity documents in recent years has been biometric data, including facial recognition, fingerprints, and eye scanners, a technology endorsed heavily by the International Civil Aviation Organization. In the UAE, such records are stored in encrypted formats for added security. Other physical changes to official documents include complex holograms, intaglio printing (images that can only be seen at particular angles), sophisticated edge design on the ends of pages, watermarks, and crucially polycarbonate materials, which are far harder to tamper with and replicate than paper.

The BFSI Sector is Anticipated to Witness a High Market Growth Rate

- The demand for data and information interchange has increased as information and communication technology (ICT) has progressed. Complex data security concerns arise, particularly in the banking and finance sectors. To combat these concerns, an effective and appropriate solution is required, which banking and financial smart cards give-this major driver driving the global banking and financial smart card market forward. Due to stringent government laws, the banking and financial sectors have imposed rigorous limits on the usage of banking and financial smart cards.

- For instance, in April 2022, Mastercard's aspirational card in Morocco, the first corporate biometric payment card, and an accelerated service acquisition procedure for Idemiaservices to enable fintech and neobanksmove ahead are among the newest biometric payment card announcements. Meanwhile, Idemiaand Thales compete for a significant contract to digitize banking from the Egyptian government.

- One of the primary driving factors in the growth of the Banking and Financial Smart Card market is the increase in the frequency and complexity of data security threats. With the increased frequency and complexity of data security threats such as unencrypted data, new technology without security, third-party services, hacking, and unsecured mobile banking, the need for implementing a data security solution that ensures that the user's data and assets are well protected is growing.

- Furthermore, in February 2021, First Abu Dhabi Bank (FAB) signed a five-year strategic collaboration agreement with Mastercard for corporate cards and payment services. The two companies want to work together to make B2B payments easier, safer, and more accessible for businesses in the country. Clients of the banking institution will have access to Mastercard's corporate cards and payment platforms, as well as a variety of product perks for firms and employees.

- With the advent of new payment mechanisms such as EMV chips, personal identification number (PIN) cards, and mobile wallets, the card industry has experienced a digital transition. With the increased use of these methods, there is a pressing need to limit fraudulent actions such as identity duplication, necessitating the development of a solution that reduces security concerns. The data stored on smart cards is difficult to decipher and can only be accessed with a PIN code that is exceedingly tough to decode, making transactions more secure and counterfeiting more difficult, propelling the market to significant expansion over the forecast period.

Middle-East Smart Card Industry Overview

The Middle East Smart Card market is moderately competitive. The players in the market tend to invest in innovating new product offerings to cater to the industry's changing demands. Moreover, players adopt strategic activities like partnerships, mergers, and acquisitions to expand their presence. Some of the recent developments in the market are:

- April 2022 - IDEX Biometrics ASA has announced a partnership with E-Kart, a player in smart card technology and innovation, to commercialize biometric payment solutions in Eastern Europe. E-Kart is a joint venture between EczacbasHolding and global card manufacturer Gisecke&Devrient(G+D). E-Kart, a high-tech card manufacturing center in Turkey, can produce 60 million smart cards annually and serves customers across the region.

- June 2021 - The Federal Authority for Identity and Citizenship (ICA), Dubai, launched a new e-version of Emirates ID. The new advanced version of the ID will be made available on the ICA UAE Smart app. The new ID card has a QR code, which enables its reading for official purposes at government departments. ICA advised all residents to use the e-version for all government services till their physical cards are printed. The e-version of the card is as valid as the physical one.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment in Personal Identification and Access Control Applications

- 5.1.2 Extensive Use in Travel Identity and Transportation

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues and Standardization concerns

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Contactless Payments

6 MARKET SEGEMENATION

- 6.1 By Type

- 6.1.1 Contact-Based

- 6.1.2 Contact Less

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 IT and Telecommunication

- 6.2.3 Government

- 6.2.4 Transportation

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 UAE

- 6.3.2 Saudi Arabia

- 6.3.3 Rest of Middle-East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IDEMIA (Advent International)

- 7.1.2 Secura Key

- 7.1.3 Infineon Technologies AG

- 7.1.4 Thales Group

- 7.1.5 Atos Se

- 7.1.6 Texas Instruments

- 7.1.7 American Express Company

- 7.1.8 HID Global Corporation

- 7.1.9 EASTCOMPEACE

- 7.1.10 giesecke & devrient

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219