|

市場調查報告書

商品編碼

1644839

美國即時付款:市場佔有率分析、行業趨勢、統計數據、成長預測(2025-2030 年)United States Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

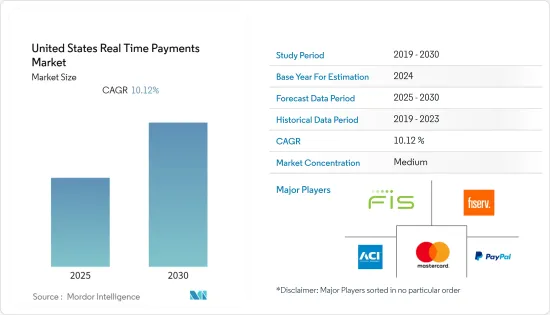

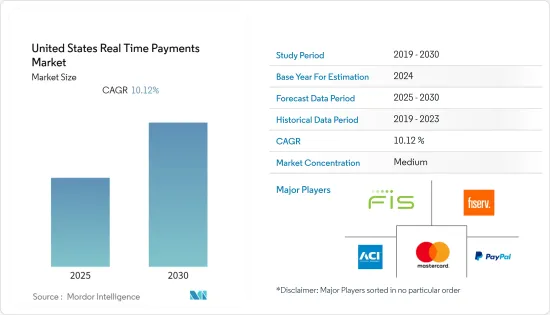

預計預測期內美國即時付款市場的複合年成長率為 10.12%。

主要亮點

- 全國範圍內智慧型手機普及率的快速成長和客戶期望的不斷提高預計將支持長期市場成長。人們對能夠隨時隨地(包括週末和節日)付款的智慧型手機的期望不斷上升,這推動了市場需求。此外,對更快付款的需求不斷成長,以及政府和金融機構為支持採用即時付款解決方案而增加的投資,預計將推動市場成長。

- 隨著客戶尋求更靈活、便利的付款方式,對傳統業務的依賴急劇下降。現有的銀行基礎設施無法應付付款頻率。新的金融科技付款提供者和安全閘道器的出現正在加強即時付款市場。

- 它將提高付款系統的效率和便利性,特別是取代支票等高成本的付款方式。即時付款還可以釋放金融體系中被困的資金,並刺激引入更多新功能的競相湧現。

- 即時付款的安全問題和付款詐騙是可能對市場產生負面影響的因素之一。這給用戶帶來了不確定性,並可能限制未來即時付款技術的採用。

- 新冠肺炎疫情在這一轉變中扮演了重要角色。各國政府一直在擴大即時付款方式的範圍,從而帶來改變消費者行為的機會,進一步推動市場成長。

美國即時付款市場的趨勢

P2B付款的興起

- P2B付款是指客戶和企業之間的金融交易。電子商務和行動商務的持續成長是推動該領域成長的關鍵因素。例如,根據 Monetate;Kibo 的數據,2021 年美國網路購物訂單的平均價值與 2020 年同期相比有所增加。 2021年第三季度,桌上型電腦線上訂單的平均金額為177.38美元,高於去年同期的139.67美元。透過行動電話單的平均價格為 125.57 美元。

- 付款和行動付款正在徹底改變付款方式。例如,在汽車購買等高價值 P2B付款中,資金的即時可用性和交易後確認的需求對於消費者和企業都至關重要。

- 此外,Google等公司正在為智慧型手機用戶提供更便利的付款。該技術使用相容於智慧型手機和智慧型手錶上的近距離場通訊(NFC)。用戶將簽帳金融卡和信用卡資訊保存在他們的 Android Pay 帳戶中。用戶只需將智慧型手機或手錶靠近商店的銷售點終端,即可支付服務或產品費用,並透過 NFC 硬體從客戶的帳戶中扣除款項。

- 美國即時付款市場的需求很大程度上是由人們對該技術的認知不斷增強所推動的。自從清算所 (TCH) RTP 網路運作以來,美國眾多大型銀行已進入即時付款,預計數百家小型金融機構也將加入。

- 付款行為的改變很大程度是由於疫情。美國即時付款的引入加速了從店內商務向線上商務的轉變。由於政府的政策鼓勵數位付款的成長,這種轉變為付款參與者創造了新的機會。

零售和電子商務行業的成長

- 雖然即時付款主要引入零售和消費市場,但其優勢現在也受到了企業、商業和政府付款的青睞。這導致了該地區在過去幾年中的採用速度加快。

- 零售商正在利用數位技術和資料來為個人客製化服務、產品、體驗和促銷活動,從最大化供應鏈轉向個人化需求鏈。預計這將在預測期內促進行動付款的發展。

- 此外,由於電子商務供應商提供預付款和月度計劃的折扣,美國的銷售額正在成長。例如,亞馬遜在主要市場的銷售額正在成長。 2021年,美國是亞馬遜最大的市場,銷售額達3,140億美元。預計此舉將促進美國的即時付款。

- 商家和零售商對即時付款的需求不斷成長,推動了即時付款解決方案的採用。這些解決方案透過提供經濟實惠且高效的付款方式為零售商帶來了競爭優勢。此外,美國各地的行動購物普及也是推動該領域成長的主要因素。

美國即時付款產業概況

市場相當分散,有 ACI Worldwide 和 Worldpay 等多家主要參與者,此外還出現了新興企業。

- 2021 年 9 月 - 亞洲最大的 API 基礎設施公司 M2P Solutions 與總部位於多倫多的全球金融科技公司 Buckzy Payments, Inc. 建立策略夥伴關係關係,後者提供業界領先的付款解決方案。 M2P 平台透過 Buckzy 安全、可靠、便利的生態系統為北美、加拿大、拉丁美洲和歐洲市場的中東和北非地區的合作夥伴提供跨境付款。

- 2021 年 8 月—全球付款巨頭摩根大通推出了即時支付付款,希望在金融業處理更多蓬勃發展的全球數位付款的競爭中佔據優勢。新產品「Request for Pay」使企業客戶能夠透過應用程式或網站向約 5,700 萬零售客戶發送付款請求,從而降低企業收到付款所需的成本和時間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 國內付款環境的演變

- 與日本無現金交易擴張相關的主要市場趨勢

- COVID-19 對該國付款市場的影響

第5章 市場動態

- 市場促進因素

- 智慧型手機普及率不斷提高

- 減少對傳統銀行業務的依賴

- 提高便利性

- 市場挑戰

- 付款詐騙

- 對現金的依賴

- 市場機會

- 政府鼓勵數位付款發展的政策預計將推動一般民眾即時付款的成長

- 數位付款產業的關鍵法規和標準

- 全球監管狀況

- 可能成為監管障礙的經營模式

- 隨著商業環境的變化而有發展空間

- 關鍵用案例和使用案例分析

- 分析實際支付交易占全國總交易的百分比

- 實際支付交易占國內非現金交易的百分比分析

第6章 市場細分

- 按類型

- P2P

- P2B

第7章 競爭格局

- 公司簡介

- ACI Worldwide, Inc.

- FIS

- Fiserv, Inc.

- Mastercard Inc.

- PayPal Holdings, Inc.

- Visa Inc.

- Worldpay, Inc.

- Temenos AG

- Volante Technologies Inc

- Montran Corporation

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91282

The United States Real Time Payments Market is expected to register a CAGR of 10.12% during the forecast period.

Key Highlights

- Surging smartphone penetration across the country and rising customer expectation are expected to support market growth in the long run. The rising expectation of individuals from smartphones to make a payment from anywhere and at any time, including on weekends and public holidays, will bolster market demand. In addition, the increasing demand for quicker payment settlements and rising investments from government and financial institutes to support the adoption of real-time payment solutions are anticipated to accelerate the market's growth.

- The dependence on traditional banking has fallen dramatically in the past, as customers demand more flexibility and convenient ways to make payments. The existing banking infrastructure fails to cope with the payment frequency. The emergence of new fin-tech payment providers and secure gateways has enhanced the real-time payments market.

- Increase efficiencies in the payments system and ease of convenience, particularly where they displace high-cost instruments such as cheques. Real-time payments can also release money locked up in the financial system and boost competition to incorporate more new features.

- Security concerns in real-time payment and payment frauds are some of the factors that might affect the market adversely. It can cause uneasiness amongst come users and thus, restricts the adoption of the real-time payment technology in the future.

- Also, the COVID-19 played a massive role in this shift; the government got the opportunity to expand the scope of real-time payment methods and change consumer behaviors, which further supported the market growth.

US Real Time Payments Market Trends

Rise in the P2B Payment

- P2B payments refer to transactions of money between customers and businesses. The constant growth of e-commerce and mobile commerce is a key factor driving the segment's growth. For instance, as per Monetate; Kibo, The average value of U.S. online shopping orders in 2021 is increased on desktop compared to the same quarter in 2020. In the third quarter of 2021, online orders from a desktop computer had an average value of USD 177.38, up from USD 139.67 in the same period of the previous year. The orders fulfilled from the mobile phone were worth USD 125.57 on average.

- Real-time payment and mobile payment is revolutionizing the way payments are made today. For instance, the P2B high-value payment such as a car purchase, the demand for real-time availability of funds, and confirmation after transaction is very important for both consumer and the business.

- Additionally, companies like Google have made payments more convenient for smartphone users. The technology uses near-field communication (NFC) on supported smartphones and smartwatches. The user stores the debit or credit card information on the Android Pay account; the user can then pay for a service or item by simply placing the phone or watch near the retailer's point-of-sale terminal, which deducts the money from the customer account through NFC hardware.

- The demand for real-time payments market in the United States is highly contributed by the increasing awareness regarding the technology. Since the first wave of early adoption went live with The Clearing House (TCH) 's RTP network, numerous large banks in the United States have signed up for real-time payment, with hundreds of smaller institutions slated to follow.

- The shifts in payment behavior were majorly due to the pandemic. The U.S experienced the adoption of real-time payments and migration to online commerce from in-store. These shifts create new opportunities for payment players as government policies encourage the growth of digital payments, which is anticipated to aid the growth of real-time payment methods amongst consumers.

Growth in the Retail and E-commerce Sector

- Real-time payments were introduced primarily for retail/consumer, but now the benefits it can offer, corporate, business, and government payments are taking advantage of them. This has accelerated the adoption in the last few years in the region.

- The retail sector is growing exponentially; retail companies are using digital technologies and data to tailor services, products, experiences, and promotions to the individual and shift from maximizing supply chains to personalizing demand chains. This will boost the mobile payments method in the forecast time frame.

- Additionally, the United States is experiencing growth in sales as the eCommerce vendors are providing discounts on prepayments and monthly subscriptions. For instance, Amazon has witnessed growth in sales across selected leading markets. The net sales in the United States were Amazon's biggest market in 2021as; it generated USD 314 billion in net sales. This is expected to promote real-time payment methods in the United States.

- The surging demand for instant payment settlement from merchants and retailers has augmented the adoption of real-time payment solutions. These solutions provide a competitive edge to the retailers by offering them an affordable and efficient mode of payment. The proliferation preference for mobile-based shopping across the United States is also emerging as a major driver for the growth of this segment.

US Real Time Payments Industry Overview

The market is moderately fragmented with the presence of various large players like ACI Worldwide, Worldpay and the emergence of new start-ups.

- September 2021 - M2P Solutions, Asia's largest API infrastructure company, signed a strategic partnership with Buckzy Payments, Inc, a Toronto-based global fintech delivering industry-leading payment solutions. M2P's platform will enable cross-border payments for its partners in the MENA region through Buckzy's safe, secure and convenient ecosystem to markets spanning North America, Canada, Latin America, and Europe.

- August 2021 - JPMorgan Chase & Company, a global payments giant has launched a real-time payments option that it hopes will increase its edge in the financial industry's battle to handle more of the surging volumes of global digital payments. The new product, Request for Pay, lets corporate clients send payment requests to the bank's roughly 57 million retail clients who use its app or website, cutting the cost and time it takes for those companies to get paid.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Dependence on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions in the Country

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions in the Country

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide, Inc.

- 7.1.2 FIS

- 7.1.3 Fiserv, Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 PayPal Holdings, Inc.

- 7.1.6 Visa Inc.

- 7.1.7 Worldpay, Inc.

- 7.1.8 Temenos AG

- 7.1.9 Volante Technologies Inc

- 7.1.10 Montran Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219