|

市場調查報告書

商品編碼

1644882

新加坡的網路安全:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Singapore Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

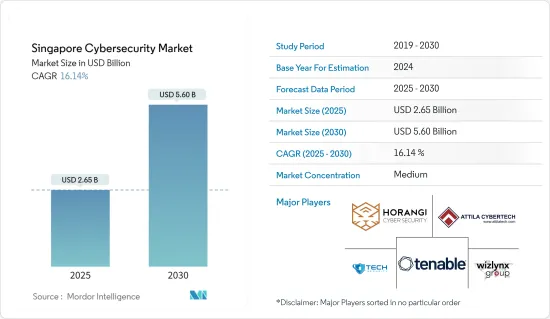

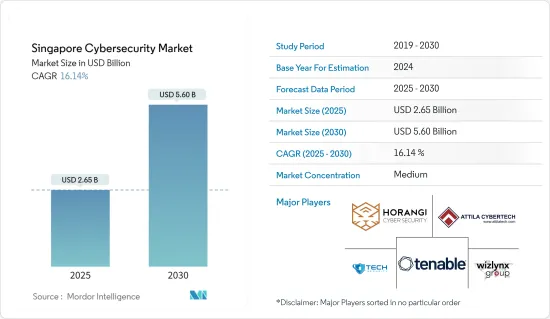

新加坡網路安全市場規模預計在 2025 年為 26.5 億美元,預計到 2030 年將達到 56 億美元,預測期內(2025-2030 年)的複合年成長率為 16.14%。

主要亮點

- 隨著人們對安全和隱私的擔憂日益加深,隨著新威脅的出現,網路安全市場預計將繼續擴大和多樣化。此外,還需要更多整合的解決方案來滿足全國各地日益成長的需求。

- 網路威脅是利用網路透過間諜軟體、惡意軟體和網路釣魚造成破壞、破壞資訊系統或竊取敏感資訊的威脅。為了保護資料的機密性,網路安全解決方案可協助企業監控、偵測、報告和應對網路威脅。隨著網路在開發中國家的普及率不斷提高,網路安全解決方案的採用率可能會增加。

- 連網設備的增加預計將增加新威脅和攻擊的出現,推動對易受網路攻擊的家用電器提高安全性的需求,並進一步暴露物聯網設備作為端點的脆弱性。

- 大型企業正在為安全和銷售部署更多資料驅動的人工智慧解決方案。網路安全專家正在利用地理空間資料來加強他們的防線。透過將地理空間資料納入現有的安全系統,公司可以增強緊急管理、國家情報、基礎設施保護和國防平台。

- 各領域缺乏經過訓練的網路安全人員是網路攻擊增加的主要原因之一。特別是在亞太地區,對經驗豐富的網路安全專業人員的需求,並不像對應對金融機構、政府和工業公司網路威脅所需的安全人員的需求那麼大。

- COVID-19 疫情和在家工作的興起是造成這種成長的主要原因,因為在家工作的人沒有像在職場環境中那樣同等程度的保護/威懾措施。網路攻擊者將疫情視為利用在家工作者弱點的機會,利用公眾對冠狀病毒新聞的強烈興趣來活性化他們的犯罪活動。

新加坡的網路安全市場趨勢

雲端部署推動市場成長

- 在新加坡,隨著越來越多的企業意識到需要透過將資料遷移到雲端而不是建置和維護新的資訊儲存來節省成本和資源,對雲端解決方案的需求日益增加,按需安全服務的採用也日益增多。

- 由於這些優勢,雲端基礎的解決方案在全國範圍內擴大被採用,從大型企業到中小型企業。未來幾年,雲端平台和生態系統有望成為數位創新速度和規模爆炸性成長的跳板。

- 網路頻寬需求波動的企業需要能夠在短時間內增加或減少容量。雲端技術允許網路容量擴大或縮小以滿足業務需求。這種方法可以幫助公司削減成本並在競爭中佔據優勢。作為國內中小企業的基地,保全服務雲端部署近年來呈現興起趨勢。

- 雲端技術使公司可以根據業務需求自由選擇如何以及何時擴大或縮小網路容量。它降低了商業成本並使您比競爭對手更具優勢。

- 此外,新加坡和澳洲還簽署了一份合作備忘錄,以打擊詐騙和垃圾通訊。隨著政府注重加強網路安全以及企業加大對雲端運算的採用,這一領域預計將推動市場成長。

BFSI 佔最高市場佔有率

- BFSI 是一個關鍵基礎設施行業,由於其龐大的基本客群和持有的財務資訊,面臨多次資料外洩和網路攻擊。它是該國重要的金融服務和保險業之一。

- 網路犯罪分子利用其極其有利可圖的營運模式來提供驚人的回報以及相對較低的風險和可檢測性,從而最佳化一系列邪惡的網路攻擊,以破壞金融部門。這些攻擊威脅包括木馬、惡意軟體、ATM 惡意軟體、勒索軟體、行動銀行惡意軟體、資料外洩、組織入侵、資料竊取、財務外洩等。

- 網路犯罪分子正在最佳化各種惡意的網路攻擊,以鎖定金融領域,這是一個利潤豐厚的經營模式,可以帶來驚人的回報以及相對低風險和低檢測的好處。

- 隨著各機構擴大採用雲端運算、人工智慧 (AI) 和物聯網 (IoT) 等技術,新加坡政府已承諾到 2023 年將在網路安全和資料安全系統上投資 10 億新加坡元(7.4 億美元)。

新加坡網路安全產業概況

新加坡的網路安全市場處於半固體。 Horangi Cyber Security、Wizlynx Pte Ltd、Attila Cybertech Pte Ltd、Tech Security 和 Tenable Singapore 等市場參與者正在透過併購、合作和新產品推出等策略性舉措來應對企業對行動安全日益增強的認知。

- 2024 年 3 月,風險管理公司 Tenable 宣布對 Tenable One 風險管理平台內的生成式 AI 功能和服務 Exposure AI 進行創新增強。新功能使客戶能夠快速摘要相關的攻擊媒介,向AI助理提出問題,並獲得具體的緩解指導,以根據情報採取行動降低風險。

- 2023年8月,Bitdefender宣布收購Horangi Cyber Security。這將使我們能夠擴展我們的網路安全解決方案和服務組合,並為我們的客戶提供更好的服務、創新和價值,以滿足他們不斷變化的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業指引及政策

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 網路安全事件和報告法規迅速增加

- 日益增加的 M2M/IoT 連線要求企業加強網路安全措施

- 市場挑戰

- 網路安全專家短缺

- 高度依賴傳統身分驗證方法且缺乏準備

第6章 市場細分

- 依產品類型

- 解決方案

- 應用程式安全

- 雲端安全

- 消費者安全軟體

- 資料安全

- 身分和存取管理

- 基礎設施保護

- 綜合風險管理

- 網路安全設備

- 其他解決方案

- 按服務

- 解決方案

- 按部署

- 在雲端

- 本地

- 按最終用戶產業

- 航太和國防

- 銀行、金融服務和保險

- 衛生保健

- 製造業

- 零售

- 資訊科技/通訊

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Horangi Cyber Security

- wizlynx Pte Ltd

- Attila Cybertech Pte Ltd

- Tech Security

- Tenable Singapore

- InsiderSecurity

- Ensign InfoSecurity(Singapore)Pte Ltd

- iCyberwise

- A Very Normal Company

- GROUP8

- Blackpanda

- MK Cybersecurity

- WebOrion

- i-Sprint Innovations

第8章投資分析

第9章 市場機會與未來趨勢

The Singapore Cybersecurity Market size is estimated at USD 2.65 billion in 2025, and is expected to reach USD 5.60 billion by 2030, at a CAGR of 16.14% during the forecast period (2025-2030).

Key Highlights

- With increasing security and privacy concerns, the market for cyber safety is expected to keep expanding and diversifying with new threats coming upstream. More integrated solutions will also be required in order to respond to rising demand from all parts of the country.

- Cyber threats are those that exploit the Internet for damage, disrupt information systems, or steal vital information through spyware, malware, and phishing. For the protection of data confidentiality, cybersecurity solutions assist enterprises in monitoring, detecting, reporting, and dealing with cyber threats. With the increasing penetration of the Internet in developing and developed countries, there is a chance that the adoption of cybersecurity solutions will increase.

- The increasing number of connected devices is expected to increase the occurrence and emergence of new threats and attacks, thereby creating an increased demand for improved security on consumer electronics that are highly vulnerable to cyber attacks, which further reveals the vulnerabilities of IoT devices as endpoints.

- Large businesses are implementing more data-based AI solutions for security and sales. Cybersecurity experts have turned to geospatial data to shore up the lines of defense. By implementing geospatial data into pre-existing security systems, companies can strengthen emergency management, national intelligence, infrastructure protection, and national defense platforms.

- The lack of trained cybersecurity staff in all sectors is one of the major causes of increased cyber attacks. The demand for experienced cybersecurity professionals, particularly in Asia-Pacific, is not as great as that of security staff who are needed to tackle cyber threats related to finance institutions and governments or industrial enterprises.

- The COVID-19 pandemic and the increase in work-from-home were the primary causes of this increase, as individuals working at home do not have the same level of protection/deterrent measures from a working environment. Cyber-attackers saw the pandemic as an opportunity to exploit the employees working from home's vulnerability and exploit the public's strong interest in coronavirus news so they would step up their criminal activities.

Singapore Cyber Security Market Trends

Cloud Deployment Drives Market Growth

- The demand for cloud solutions is high, and the adoption of on-demand security services is growing as more and more companies in Singapore recognize the need to save money and resources by moving data into a cloud rather than creating or maintaining new information storage.

- Due to these advantages, large and small domestic companies are increasingly adopting cloud-based solutions. Over the next couple of years, cloud platforms and ecosystems are expected to serve as starting points for an explosive increase in the pace and scale of digital innovation.

- Within a short timeframe, enterprises that experience fluctuations in demand for network bandwidth must be able to increase or decrease their capacity. In order to cope with business needs, cloud technologies enable enterprises to increase or decrease network capacity. This approach can help businesses to stand out from the competition in terms of cost savings. In view of the country's small and medium-sized enterprises being based here, cloud deployment of cybersecurity services has tended to increase in recent years.

- With cloud technology, companies are free to choose how and when they want to boost or reduce their network capacity according to business needs. It can reduce the cost of doing business and give businesses an advantage over their competitors.

- Moreover, an MoU was signed between Singapore and Australia to battle scam and spam communications. With the government's focus on building cybersecurity strength and the companies implementing cloud deployments, the segment is forecasted to drive market growth.

BFSI Holds the Highest Market Share

- BFSI is a critical infrastructure segment that faces multiple data breaches and cyber attacks, owing to its huge customer base and the financial information that it holds. It is one of the country's significant financial services and insurance sectors.

- Being a highly lucrative operation model with phenomenal returns and the added upside of relatively low risk and detectability, cybercriminals are optimizing a plethora of diabolical cyberattacks to immobilize the financial sector. These attacks' threat landscape includes trojans, malware, ATM malware, ransomware, mobile banking malware, data breaches, institutional invasion, data thefts, and fiscal breaches.

- In order to immobilize the financial sector as a highly lucrative business model with phenomenal returns and an added advantage of relatively low risk and detection, cybercriminals optimize various diabolical cyberattacks.

- The Singaporean government stated that it would invest SGD 1 billion (0.74 USD billion) until 2023 in its cyber and data security systems, as various agencies are increasingly adopting technologies such as cloud, artificial intelligence (AI), and Internet of Things (IoT).

Singapore Cyber Security Industry Overview

The Singaporean cybersecurity market is semi-consolidated. Players in the market such as Horangi Cyber Security, Wizlynx Pte Ltd, Attila Cybertech Pte Ltd, Tech Security, and Tenable Singapore adopt cater to strategic initiatives such as mergers and acquisitions, partnerships, and new product offerings due to increasing awareness regarding mobility security among enterprises.

- March 2024: Tenable, an exposure management company, announced innovative enhancements in exposure AI, the generative AI capabilities and services within its Tenable One Exposure Management platform. The new features enable customers to quickly summarize relevant attack paths, ask questions of an AI assistant, and receive specific mitigation guidance to act on intelligence and reduce risk.

- August 2023: Bitdefender announced the acquisition of Horangi Cyber Security, enabling it to offer customers an expanded portfolio of cybersecurity solutions and services and provide an even greater level of service, innovation, and value to meet evolving needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Guidelines and Policies

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting

- 5.1.2 Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 5.2 Market Challenges

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Solutions

- 6.1.1.1 Application Security

- 6.1.1.2 Cloud Security

- 6.1.1.3 Consumer Security Software

- 6.1.1.4 Data Security

- 6.1.1.5 Identity Access Management

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Integrated Risk Management

- 6.1.1.8 Network Security Equipment

- 6.1.1.9 Other Solution Types

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Deployment

- 6.2.1 On-Cloud

- 6.2.2 On-Premise

- 6.3 By End-user Industry

- 6.3.1 Aerospace and Defense

- 6.3.2 Banking, Financial Services, and Insurance

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 IT and Telecommunication

- 6.3.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Horangi Cyber Security

- 7.1.2 wizlynx Pte Ltd

- 7.1.3 Attila Cybertech Pte Ltd

- 7.1.4 Tech Security

- 7.1.5 Tenable Singapore

- 7.1.6 InsiderSecurity

- 7.1.7 Ensign InfoSecurity (Singapore) Pte Ltd

- 7.1.8 iCyberwise

- 7.1.9 A Very Normal Company

- 7.1.10 GROUP8

- 7.1.11 Blackpanda

- 7.1.12 MK Cybersecurity

- 7.1.13 WebOrion

- 7.1.14 i-Sprint Innovations