|

市場調查報告書

商品編碼

1644894

印尼的網路安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Indonesia Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

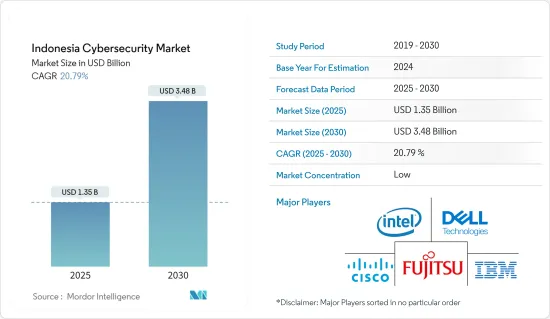

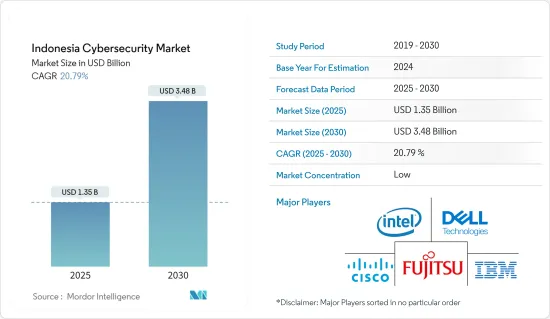

印尼網路安全市場規模預計在 2025 年為 13.5 億美元,預計到 2030 年將達到 34.8 億美元,預測期內(2025-2030 年)的複合年成長率為 20.79%。

主要亮點

- 網路安全涉及保護組織、其人員和資產免受網路威脅而實施的策略和措施。隨著網路攻擊的頻率和複雜程度不斷增加,以及企業網路變得越來越複雜,對有效對抗這些風險的各種網路安全解決方案的需求激增。

- 數位化和可擴展IT基礎設施的需求是網路安全市場的主要驅動力。由於印尼很大一部分人口使用網際網路,企業和政府擴大轉向數位平台來提高效率和增強客戶服務。網路連結性的增強,加上印尼數位經濟的快速擴張,凸顯了對強大的IT基礎設施進行管理所產生的大量資料的必要性。

- 在物聯網 (IoT) 領域,網路安全至關重要。一次入侵就可能讓整個網路面臨風險,或讓網路犯罪者獲得不受限制的存取權限。政府和國防等透過物聯網處理高度敏感資料的部門尤其容易受到攻擊。如果被利用,薄弱的入口點或受損的設備可能會讓駭客提取敏感訊息,甚至造成物理傷害。因此,物聯網網路安全的重點是保護設備和網路以及它們傳輸的資料。

- 印尼擁有四家科技獨角獸企業,每家企業的收益均超過 10 億美元。這些新興企業正在利用公有雲來縮短上市時間以及順利整合人工智慧和機器學習,從而實現快速擴張。

- 印尼企業在利用雲端處理優勢的同時,也努力應對威脅偵測和預防日益嚴峻的挑戰,需要投入更多的時間和資源。 Palo Alto Networks 2024 年的報告顯示,高達 98% 的組織將其敏感資料儲存在多個位置,從內部私有雲端和多個端點。這種多樣性凸顯了面臨的重大安全挑戰。

- 隨著智慧型手機和網路的普及,印尼經濟快速成長, IT基礎設施投資也蓬勃發展。但該國正面臨重大的網路安全挑戰,並經常成為駭客的攻擊對象。物聯網連接性的不斷成長進一步加劇了這種脆弱性,推動了對嚴格的網路安全措施的需求。然而,網路安全專業人員的短缺可能會阻礙市場成長。印尼的網路普及率較高,而網路安全支出相對較少,這使其成為網路犯罪分子的熱門目標。

印尼網路安全市場趨勢

印尼雲端領域大幅擴張

- 在印度尼西亞,雲端技術正在成為企業網路和技術基礎設施的基礎,有助於推動該國IT產業的快速擴張。隨著印尼公司將業務轉移到雲端,它們變得越來越容易受到攻擊。這包括潛在的安全漏洞、雲端平台上的無意錯誤配置以及各個超超大規模資料中心業者和雲端服務中身分存取管理 (IAM) 和特權存取管理 (PAM) 覆蓋範圍不均衡。

- 印尼企業正在應對前所未有的網路威脅和勒索軟體攻擊。這些挑戰可能危及組織的完整性並導致災難性的後果,例如大量資料遺失和機密資訊外洩。來自印尼國家網路安全和資料保護辦公室的資料凸顯了其嚴重性:在印度尼西亞,網路攻擊相關的流量異常在 2023 年 8 月達到頂峰,達到約 7,846 萬起。

- 鑑於風險日益增大,我們迫切需要採取行動應對這一數位威脅。這些日益嚴峻的挑戰促使主要雲端供應商和地區網路安全公司增加投資。

- 隨著對雲端服務的依賴日益成長,對強大的網路安全措施的需求也在急劇增加。根據 CBN Cloud IT 的報告,過去五年來,印尼雲端運算產業的複合年成長率高達 45% 以上,超過全球平均。這種爆炸性成長不僅凸顯了印尼雲端運算的崛起,也預示著網路安全解決方案市場的蓬勃發展。隨著越來越多的企業轉向雲端,保護敏感資料的高階安全通訊協定至關重要。這一趨勢凸顯了加強網路安全基礎設施以抵禦潛在威脅的必要性。

- 在印度尼西亞,隨著混合雲端和多重雲端環境變得越來越普遍,安全管理變得越來越複雜。各組織正在使其雲端平台選項多樣化,轉向 AWS、Google Cloud 和 Microsoft Azure 等主要雲端供應商,但每個供應商都面臨自身的安全挑戰。這種複雜的情況推動了對全面的雲端安全解決方案的需求,這些解決方案包括加密、存取控制和監控工具,以確保跨不同平台的資料保護。

政府和國防部門引領網路安全採用

- 先進的網路安全解決方案也擴大被 IT 和通訊、BFSI、零售、政府和國防領域採用。這一趨勢受到政府數位化舉措和快速演變的威脅情況的推動,從而推動了市場成長。

- 隨著政府為公共服務部署數位技術,對網路安全解決方案的需求將會飆升。隨著越來越多的服務轉移到線上,對強大的資料保護和安全的數位基礎設施的需求也日益成長。來自印尼反網路釣魚資料交換的資料凸顯了這種迫切性。 2023 年第四季度,政府組織佔網路釣魚攻擊目標的 0.65%。這凸顯了對雲端安全、資料保護和身分存取管理等安全解決方案日益成長的需求,這些解決方案對於保護敏感的政府資料和公民資訊免受網路威脅至關重要。

- 印尼政府採取重大舉措,於 2024 年 1 月宣布了推出九個超級應用程式的計畫。這些超級應用將涵蓋數位身分、醫療保健、教育和社會救助等基本公共服務。這些舉措凸顯了政府對其數位戰略的承諾,並進一步擴大了對網路安全解決方案的需求,以應對威脅和保護敏感資料。

- 人們意識到這種緊迫性,開始注重強而有力的安全投資,這不僅可以加強各個政府機構,還可以幫助整個市場成長。國防部門反映了這一趨勢,需要多樣化的網路安全解決方案來保護關鍵基礎設施和敏感資料。一些備受追捧的工具包括入侵偵測系統、用於增強網路安全的VPN以及先進的端點偵測和回應機制。

印尼網路安全產業概況

印尼的網路安全市場競爭激烈且分散,既有國際參與者,也有地區參與者。這些公司可以透過創新獲得永續的競爭優勢。巨量資料和物聯網等新興領域正在影響安全趨勢,預計將在預測期內推動企業集中度。主要參與者包括 IBM 公司、思科系統公司、戴爾科技公司、富士通有限公司和英特爾公司。

雖然新參與企業的進入門檻很高,但一些公司已成功開拓出利基市場。該市場的特點是產品差異化程度中等至高度,競爭激烈。解決方案通常捆綁在一起並作為單一服務出現。

許多用戶傾向於簽訂年度合約來控制成本。最近,人們明顯轉向承諾快速安全更新的服務。這一趨勢推動了對能夠即時更新的雲端基礎的服務的需求激增,同樣的趨勢也出現在服務型行業中。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素如何影響市場

第5章 市場動態

- 市場促進因素

- 數位化和對可擴展IT基礎設施日益成長的需求

- M2M/IoT 連線的增加要求企業採取更強力的網路安全措施

- 市場限制

- 網路安全專家短缺

第6章 市場細分

- 依產品類型

- 安全類型

- 網路安全

- 端點安全

- 雲端安全

- 資料安全

- 身分存取管理

- 其他解決方案

- 服務

- 專業服務

- 託管服務

- 安全類型

- 按部署

- 雲

- 本地

- 按組織規模

- 大型企業

- 中小企業

- 按最終用戶產業

- BFSI

- 衛生保健

- 製造業

- 政府和國防

- 資訊科技/通訊

- 媒體與娛樂

- 零售與電子商務

- 教育

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- FUJITSU Limited

- Dell Technologies Inc.

- Intel Corporation

- Fortinet Inc.

- AVG Technologies(Avast Software SRO)

- Trend Micro Incorporated

- Palo Alto Networks Inc.

- Xynexis International

第8章投資分析

第9章:市場的未來

The Indonesia Cybersecurity Market size is estimated at USD 1.35 billion in 2025, and is expected to reach USD 3.48 billion by 2030, at a CAGR of 20.79% during the forecast period (2025-2030).

Key Highlights

- Cybersecurity encompasses the strategies and measures implemented to shield organizations, their personnel, and assets from cyber threats. As cyberattacks become more frequent and sophisticated, and as corporate networks grow increasingly intricate, the demand for varied cybersecurity solutions to effectively counter these risks has surged.

- Digitalization and the need for scalable IT infrastructure are major drivers of the cybersecurity market. With a significant portion of the population online, both businesses and the government in Indonesia are turning to digital platforms to boost efficiency and enhance customer service. This uptick in internet engagement, combined with the rapid expansion of the nation's digital economy, underscores the need for a robust IT infrastructure to manage the vast data being generated.

- In the realm of the Internet of Things (IoT), cybersecurity is paramount. A single breach can jeopardize the entire network or, more concerning, provide cybercriminals with unfettered access. Sectors such as government and defense, which handle highly sensitive data through IoT, are particularly vulnerable. An exploited weak entry point or a compromised device could allow hackers to extract crucial intelligence or even cause physical harm. Thus, IoT cybersecurity emphasizes protecting both devices and networks, as well as the data they transmit.

- Indonesia is home to four technology unicorns, each boasting revenues surpassing USD 1 billion. These startups harness the public cloud, reaping benefits like expedited market entry and the smooth integration of AI and machine learning, facilitating rapid expansion.

- While Indonesian organizations are tapping into the advantages of cloud computing, they're grappling with heightened challenges in threat detection and prevention, demanding more time and resources. A 2024 report from Palo Alto Networks reveals that a staggering 98% of organizations are storing sensitive data in varied locales, from on-premises servers and public clouds to SaaS applications with local storage, third-party hosted private clouds, and multiple endpoints. This diversity underscores the substantial security challenges at hand.

- Indonesia, a rapidly growing economy, is witnessing heightened investments in IT infrastructure alongside a boom in smartphone and internet usage. Yet, the nation grapples with significant cybersecurity challenges, often falling prey to hackers. This vulnerability is further magnified by the expanding number of IoT connections, driving the demand for stringent cybersecurity measures. However, a looming shortage of cybersecurity professionals could stifle the market's growth. With high internet penetration and relatively modest cybersecurity spending, Indonesia stands out as a prime target for cybercriminals.

Indonesia Cyber Security Market Trends

Cloud Segment Sees Significant Expansion in Indonesia

- In Indonesia, cloud technology is becoming a cornerstone of enterprise networks and technological infrastructure, propelling a swift expansion in the nation's IT sector. As Indonesian entities transition their operations to the cloud, they encounter heightened vulnerabilities. These include potential security breaches, inadvertent misconfigurations on cloud platforms, and uneven coverage in identity access management (IAM) and privileged access management (PAM) across various hyperscalers and cloud services.

- Indonesian enterprises are grappling with unprecedented cyber threats and ransomware assaults. These challenges jeopardize organizational integrity and can lead to dire repercussions, such as significant data loss and exposure of sensitive information. Data from Badan Siber dan Sandi Negara highlights the severity: August 2023 marked a peak for Indonesia, with cyber attack-related traffic anomalies hitting approximately 78.46 million.

- Given the escalating risks, combating this digital threat is urgent. Such mounting challenges are poised to attract heightened investments from leading cloud providers and regional cybersecurity firms.

- As reliance on cloud services deepens, the demand for robust cybersecurity measures has surged. Reports from CBN Cloud IT indicate that Indonesia's cloud sector has witnessed a staggering compounded annual growth rate (CAGR) of over 45% over the past five years, outpacing the global average. This explosive growth not only highlights the cloud's ascent in Indonesia but also signals a burgeoning market for cybersecurity solutions. With an increasing number of organizations migrating to the cloud, the imperative for advanced security protocols to shield sensitive data becomes paramount. This trend accentuates the necessity of bolstering cybersecurity infrastructure to fend off potential threats.

- As hybrid and multi-cloud environments gain traction in Indonesia, the intricacies of managing security have intensified. Organizations are diversifying their cloud platform choices, turning to giants like AWS, Google Cloud, and Microsoft Azure, each introducing its own set of security challenges. This complex scenario amplifies the demand for comprehensive cloud security solutions, which include encryption, access control, and monitoring tools to ensure data protection across diverse platforms.

Government and Defense Sectors Lead in Cybersecurity Adoption

- Alongside IT, telecommunications, BFSI, and retail, the government and defense sectors are increasingly adopting advanced cybersecurity solutions. This trend is spurred by government digitalization initiatives and a swiftly evolving threat landscape, propelling market growth.

- As the government rolls out digital technologies for public services, the demand for cybersecurity solutions is set to surge. With a growing number of services transitioning online, there's an escalating need for robust data protection and secure digital infrastructures. Data from Indonesia's Anti-Phishing Data Exchange highlights this urgency: in Q4 2023, government institutions constituted 0.65% of phishing attack targets. This emphasizes the heightened demand for security solutions-be it cloud security, data protection, or identity access management-all crucial for safeguarding sensitive government data and citizen information from cyber threats.

- In a significant move, the Indonesian government, in January 2024, unveiled plans for nine super-apps, set to launch by Q3 2024. These super-apps will encompass vital public services, including digital IDs, healthcare, education, and social assistance. Such initiatives underscore the government's commitment to its digital strategy, further amplifying the demand for cybersecurity solutions to counter threats and safeguard sensitive data.

- Recognizing this urgency, there's a pronounced emphasis on robust security investments, which not only bolster individual agencies but also catalyze overall market growth. The defense sector mirrors this trend, seeking diverse cybersecurity solutions to shield critical infrastructure and sensitive data. Tools in demand include intrusion detection systems, VPNs for enhanced network security, and advanced endpoint detection and response mechanisms.

Indonesia Cyber Security Industry Overview

The Indonesian cybersecurity market is competitive and fragmented, featuring a mix of international and regional players. These firms can achieve a sustainable competitive edge through innovation. Emerging domains like big data and IoT influence security trends, and we anticipate a rise in the firm concentration ratio during the forecast period. Some of the major players include IBM Corporation, Cisco Systems Inc., Dell Technologies Inc., FUJITSU Limited, and Intel Corporation.

While the market presents significant entry barriers for newcomers, several have successfully carved out a niche. The market is characterized by moderate to high product differentiation and intense competition. Solutions are often bundled, appearing as integral services.

Many users are leaning towards annual contracts to manage costs. Recently, there's been a noticeable shift towards services that promise quicker security updates. This trend has spurred a surge in demand for cloud-based services that enable real-time updates, a preference echoed by the service-based industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Security Type

- 6.1.1.1 Network Security

- 6.1.1.2 End-point Security

- 6.1.1.3 Cloud Security

- 6.1.1.4 Data Security

- 6.1.1.5 Identity Access Management

- 6.1.1.6 Other Solutions

- 6.1.2 Services

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 SMEs

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Manufacturing

- 6.4.4 Government and Defense

- 6.4.5 IT and Telecommunication

- 6.4.6 Media and Entertainment

- 6.4.7 Retail and E-commerce

- 6.4.8 Education

- 6.4.9 Other End-users Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 FUJITSU Limited

- 7.1.4 Dell Technologies Inc.

- 7.1.5 Intel Corporation

- 7.1.6 Fortinet Inc.

- 7.1.7 AVG Technologies (Avast Software SRO)

- 7.1.8 Trend Micro Incorporated

- 7.1.9 Palo Alto Networks Inc.

- 7.1.10 Xynexis International