|

市場調查報告書

商品編碼

1645032

歐洲醫藥倉儲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

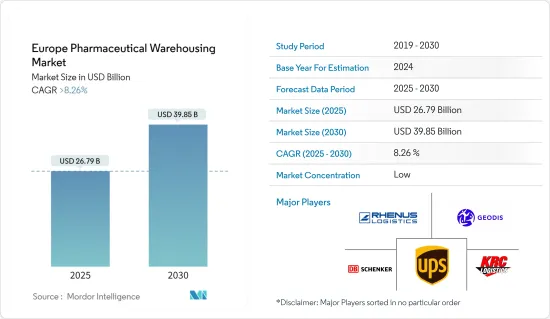

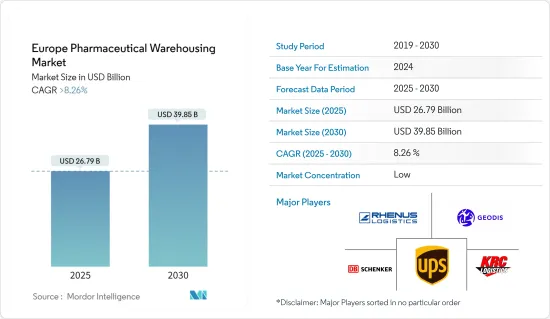

歐洲醫藥倉儲市場規模預計在 2025 年為 267.9 億美元,預計到 2030 年將達到 398.5 億美元,預測期內(2025-2030 年)的複合年成長率將超過 8.26%。

歐洲醫藥倉儲市場正在發生快速變化,主要受對溫度敏感物流的需求不斷增加以及遵守嚴格監管標準的需求所推動。歐洲藥品管理局 (EMA) 報告稱,截至 2024 年 10 月,該地區核准的 85% 以上的藥品需要特定的儲存條件,包括精確的溫度和濕度控制。這項要求正在刺激對尖端倉庫管理技術的投資。此外,歐盟良好分銷規範 (GDP) 指南強調了嚴格監控和記錄藥品儲存的重要性。作為回應,許多設施開始整合支援物聯網的系統以確保合規性。

根據歐盟委員會的資料,2023年受管制的藥品中將有近60%對溫度敏感。因此,全部區域冷藏設施的安裝數量顯著增加。 2023年1月至2024年8月期間,德國、法國和英國將共同建造超過20萬立方公尺的冷藏容量。此外,為了解決勞動力短缺問題並提高業務效率,該行業正在採用機器人分類和氣候控制區等自動化技術。

永續性措施也在整個市場引發了連鎖反應。歐盟的一項新指令將於2024年中期生效,要求在2030年將氫氟碳化冷媒的使用量減少40%。這正在加速向更綠色的冷卻技術的轉變。到 2023 年,西班牙和荷蘭 30% 以上的設施將採用太陽能供電。預計這些措施每年將減少至少 20% 的營運排放,與歐洲全面的環境目標相呼應。

歐洲醫藥倉儲市場趨勢

醫藥低溫運輸倉庫擴建

由於嚴格的監管標準和對生技藥品的需求激增,歐洲製藥業高度重視低溫運輸物流。生技藥品,包括疫苗和細胞/基因療法,對溫度變化極為敏感,需要仔細的溫度控制。歐洲藥品管理局 (EMA) 指出,截至 2024 年 3 月,生技藥品佔新藥認證的近 30%,凸顯了強大的低溫運輸基礎設施的重要性。此外,歐盟 2023 年更新的良好分銷規範 (GDP) 指南強調在整個供應鏈中嚴格控制溫度,以保護產品效力並確保病患安全。

推動這一趨勢的關鍵因素是對技術主導的低溫運輸系統的投資不斷增加。德國和荷蘭等國家已宣布計劃在2024年2月前加強低溫運輸能力。尤其是德國,將從2022年起將其冷藏容量提高15%以上。透過物聯網設備進行即時溫度監控等進步正在湧現,重點是減少產品損失並確保遵守法規。這些努力與歐洲保持全球醫藥出口主導地位的雄心相呼應,預計 2023 年歐洲醫藥出口額將達到驚人的 2,230 億歐元(2,489 億美元)。

永續性舉措推動物流變革

在消費者需求和監管要求的推動下,永續性已成為歐洲醫藥物流領域關注的重點。 《歐洲綠色新政》旨在2030年實現,引導物流業走向電動車和替代燃料等低排放解決方案。歐盟委員會2024年3月發布的報告顯示,物流業務佔貨運相關溫室氣體排放的25%以上,凸顯了永續實踐的迫切需求。法國和瑞典等國家正處於領先地位,法國在 2024 年 1 月取得了巨大進步,宣布投資 20 億歐元(22 億美元)用於綠色物流基礎設施。

其中一個值得注意的舉措是轉向電氣化最後一哩配送解決方案。 2024 年 2 月,荷蘭實現了一個重要里程碑,在全國推出了 10,000 多輛電動送貨車。此外,鐵路運輸的發展勢頭日益強勁,眾所周知,鐵路運輸排放的溫室氣體比道路運輸少。截至2024年3月,奧地利通過鐵路運輸的藥品數量與前一年同期比較大幅增加了20%。這些努力不僅減少了醫藥物流的碳排放,也與歐洲整體永續性目標相呼應。

歐洲醫藥倉儲產業概況

歐洲醫藥倉儲市場是一個分散的市場,由全球和本地參與者混合組成。大部分進出口產品在冷藏運送過程中都需要進行監控。供應商正在實施各種策略,例如策略聯盟、夥伴關係、併購、地理擴張和產品/服務發布,以擴大其在市場上的影響力。主要企業包括 Bio Pharma Logistics、Rhenus SE and Co.KG、GEODIS SA 和 United Parcel Service Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 外包醫藥倉儲服務需求不斷增加

- 製藥公司要求效率、可視性和產品安全性

- 市場限制

- 新興國家缺乏高效率的物流支持

- 市場機會

- 政府加強加強醫藥倉儲業務

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按類型

- 低溫運輸倉庫

- 非低溫運輸倉庫

- 按應用

- 藥廠

- 藥局

- 醫院

- 其他

- 按地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 歐洲

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Alloga

- Bio Pharma Logistics

- Rhenus SE and Co. KG

- DB Schenker

- FedEx Corp.

- GEODIS SA

- Hellmann Worldwide Logistics SE and Co KG

- KRC Logistics

- Kuehne Nagel Management AG

- United Parcel Service Inc.

- XPO Logistics Inc.

第7章:未來市場展望

第 8 章 附錄

- 宏觀經濟指標(GDP分佈,依活動分類)

- 經濟統計 - 運輸及倉儲業對經濟的貢獻

- 對外貿易統計 - 按商品、目的地和原產國分類的進出口數據

The Europe Pharmaceutical Warehousing Market size is estimated at USD 26.79 billion in 2025, and is expected to reach USD 39.85 billion by 2030, at a CAGR of greater than 8.26% during the forecast period (2025-2030).

The European pharmaceutical warehousing market is undergoing rapid changes, primarily due to the rising demand for temperature-sensitive logistics and the need to adhere to stringent regulatory standards. The European Medicines Agency (EMA) reported that, as of October 2024, more than 85% of the region's approved pharmaceutical products necessitate specific storage conditions, such as exact temperature and humidity controls. This requirement has led to heightened investments in cutting-edge warehousing technologies. Furthermore, the European Union's Good Distribution Practice (GDP) guidelines stress the importance of rigorous monitoring and documentation in pharmaceutical storage. In response, many facilities have begun integrating IoT-enabled systems to ensure compliance.

Cold chain warehousing is a primary focus, with data from the European Commission indicating that almost 60% of pharmaceuticals managed in 2023 were temperature-sensitive. Consequently, there's been a notable uptick in the establishment of refrigerated facilities across the region. Between January 2023 and August 2024, Germany, France, and the UK together contributed over 200,000 cubic meters to the cold storage capacity. In addition, to address labor shortages and boost operational efficiency, the industry is embracing automation advancements, including robotic sorting and climate-controlled zones.

Sustainability initiatives are also making waves in the market. New directives from the EU, effective mid-2024, call for a 40% cut in hydrofluorocarbon refrigerant usage by 2030. This has catalyzed a move towards greener cooling technologies. Renewable energy is becoming the norm for warehouses; in 2023, over 30% of facilities in Spain and the Netherlands adopted solar panels. Such measures are anticipated to reduce operational emissions by a minimum of 20% each year, resonating with Europe's overarching environmental ambitions.

Europe Pharmaceutical Warehousing Market Trends

Expansion of Cold Chain Storage for Pharmaceuticals

The European pharmaceutical sector is increasingly prioritizing cold chain logistics, driven by stringent regulatory standards and a surging demand for biologics. Biologics, which encompass vaccines and cell and gene therapies, are highly sensitive to temperature fluctuations, underscoring the need for meticulous temperature-controlled logistics. As of March 2024, the European Medicines Agency (EMA) highlighted the significance of a robust cold chain infrastructure, noting that biologics constituted nearly 30% of new drug approvals. Furthermore, the European Union's Good Distribution Practice (GDP) guidelines, updated in 2023, emphasize stringent temperature controls throughout the supply chain to safeguard product efficacy and ensure patient safety.

A pivotal factor fueling this trend is the escalating investment in technology-driven cold chain systems. By February 2024, nations like Germany and the Netherlands unveiled plans to bolster their cold chain capabilities. Notably, Germany has augmented its refrigerated storage capacity by over 15% since 2022. With a focus on reducing product spoilage and ensuring regulatory compliance, advancements like real-time temperature monitoring via IoT devices have emerged. These initiatives resonate with Europe's ambition to uphold its stature as a dominant player in global pharmaceutical exports, which reached an impressive EUR 223 billion (USD 248.9 billion) in 2023.

Sustainability Initiatives Driving Logistics Evolution

Sustainability has emerged as a pivotal focus in Europe's pharmaceutical logistics sector, propelled by consumer demand and regulatory mandates. The European Green Deal, targeting 2030, is steering the logistics industry towards low-emission solutions, such as electric vehicles and alternative fuels. Reports from the European Commission in March 2024 revealed that logistics operations account for over 25% of freight-related greenhouse gas emissions, highlighting the pressing need for sustainable practices. Leading the charge, countries like France and Sweden are making significant strides, with France unveiling a EUR 2 billion (USD 2.2 billion) investment in green logistics infrastructure in January 2024.

Among the notable initiatives is the shift towards electrified last-mile delivery solutions. The Netherlands marked a significant achievement in February 2024, rolling out over 10,000 electric delivery vehicles across the country. Furthermore, there's a growing momentum for rail transport, known for its lower greenhouse gas emissions compared to road transport. As of March 2024, Austria reported a 20% year-on-year surge in pharmaceutical goods transported via rail. These initiatives not only curtail the carbon footprint of pharmaceutical logistics but also resonate with Europe's overarching sustainability ambitions.

Europe Pharmaceutical Warehousing Industry Overview

The Europe Pharmaceutical Warehousing market is fragmented in nature, with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. Major Players include Bio Pharma Logistics, Rhenus SE and Co. KG, GEODIS SA, and United Parcel Service Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in demand for outsourcing pharmaceutical warehousing services

- 4.2.2 Demand for efficiency, visibility, and product safety from pharmaceutical companies

- 4.3 Market Restraints

- 4.3.1 Lack of efficient logistics support in emerging economies

- 4.4 Market Oppurtunites

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Europe

- 5.3.1.1 Germany

- 5.3.1.2 UK

- 5.3.1.3 France

- 5.3.1.4 Russia

- 5.3.1.5 Spain

- 5.3.1.6 Rest of Europe

- 5.3.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Alloga

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 DB Schenker

- 6.2.5 FedEx Corp.

- 6.2.6 GEODIS SA

- 6.2.7 Hellmann Worldwide Logistics SE and Co KG

- 6.2.8 KRC Logistics

- 6.2.9 Kuehne Nagel Management AG

- 6.2.10 United Parcel Service Inc.

- 6.2.11 XPO Logistics Inc.*

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin