|

市場調查報告書

商品編碼

1683523

菲律賓二手車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Philippines Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

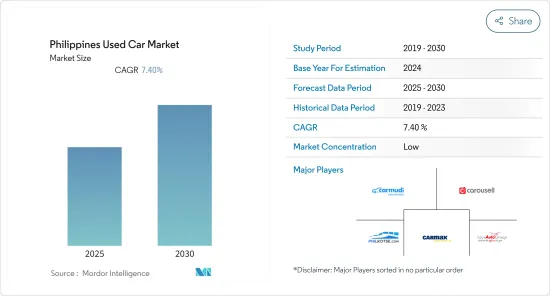

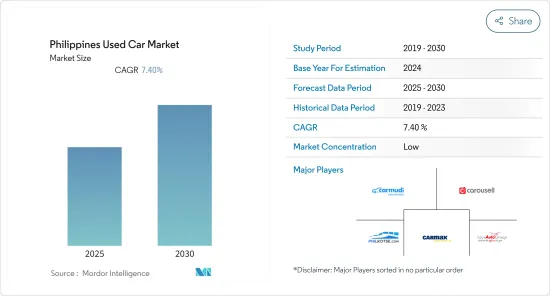

預計預測期內菲律賓二手車市場複合年成長率將達到 7.4%。

新冠疫情使得消費者更加重視個人健康和衛生。這導致人們更傾向於選擇私家車而不是公共交通工具。消費者行為和偏好的改變為菲律賓二手車市場創造了新的機會。考慮到這些機會,預計將有數家新參與企業和OEM進入市場。此次疫情表明,雖然新車市場更容易受到衝擊,但二手車市場卻更具韌性。

過去十年來,菲律賓二手車銷售以驚人的速度發展。與已開發國家相比,菲律賓等新興國家已經創造了更有利的二手車所有權生態系統。菲律賓是該地區成長最快的市場之一,由於人口成長、成長機會改善、負擔能力提高和 GDP 成長上升,二手車銷售飆升。

雖然二手乘用車銷售量呈上升趨勢,但購買二手車總是存在風險因素。買家和賣家之間對二手車品質的信任尚未完全建立,這可能會影響目標市場的成長。

菲律賓二手車市場的趨勢

有組織的參與者預計在預測期內實現更高的成長率

非正規公司控制菲律賓大部分二手車市場。此外,非正規參與者不提供二手車保固。一些賣家會透過重新噴漆或修復凹痕來掩蓋車輛損壞情況並抬高其價值,從而實施詐騙。這導致詐欺率高,非正規經銷商的市場佔有率過大,對二手車市場的成長構成威脅。

然而,近年來,有組織的參與者的二手車銷量有所增加。與無組織的貿易商相比,有組織的貿易商為客戶提供更好的服務和價值。他們為買家提供多樣化的二手車選擇。我們的品質工程師已經認證了這些播放器上可用的車輛。因此,購買低品質二手車的風險大大降低。有組織的參與者幫助實現了二手車市場的透明度,並為買賣雙方提供了公平的價格。這有助於菲律賓二手乘用車銷售量的成長。例如

- 豐田在菲律賓擁有強大的基本客群,而豐田認證二手車(TCUV,或簡稱豐田認證)的設立是為了獎勵客戶忠誠度,在客戶出售或以舊換新車時提供最優惠的價格。豐田客戶還可以使用 TCUV 購買符合豐田高品質標準的二手車。

根據這些新興市場的發展,目標市場的有組織部分預計在預測期內將大幅成長。

預測期內,線上銷售管道預計將顯著成長

網際網路的開放、使用電子商務網站/應用程式來推動商業需求以及混合動力汽車和電動車的引入等技術發展正在改變買方在市場上的地位。由於線上技術,消費者對車輛、車輛殘值、第三方利潤和其他因素的了解越來越多。

此外,機器學習和人工智慧預計將在增加收益和降低營運成本方面發揮關鍵作用,從而對預測期內的市場成長產生積極影響。

菲律賓二手車產業概況

菲律賓二手車市場高度分散,擁有大量新興企業和區域參與者。然而,為了獲得競爭優勢,各大租賃公司正在組建合資企業和聯盟來推出新的產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 供應商類型

- 組織

- 無組織

- 按車型

- 掀背車

- 轎車

- 運動型多用途車 (SUV) 和多用途車 (MPV)

- 按燃料類型

- 汽油

- 柴油引擎

- 其他

- 按銷售管道

- 線上

- 離線

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Carmudi

- Carousell

- CarMax Enterprise Services, LLC

- Carmix(LausAutoGroup)

- Toyota Motor Philippines Corporation

- Automart

- Philkotse.com

- Zigwheels

- Tsikot.com

- Car Empire

第7章 市場機會與未來趨勢

The Philippines Used Car Market is expected to register a CAGR of 7.4% during the forecast period.

With the COVID-19 outbreak, consumers were seen to be more concerned about personal health and hygiene. As a result, the preference for private transportation increased rather than the public transportation system. The shift in consumer behavior and preferences created new opportunities for the Philippines' used car market. Considering these opportunities several new players and OEMs are expected to enter the market. The pandemic demonstrated that, while the new car market becomes more vulnerable, the used car market becomes more resilient.

Used car for sale in the Philippines has evolved at an incredible rate over the last decade. Emerging countries, such as the Philippines, create a favorable ecosystem for used car ownership when compared to developed countries. The Philippines is one of the region's fastest-growing markets, with used car sales skyrocketing as a result of a rising population, improved opportunities, affordability, and a higher GDP growth rate.

Despite the fact that used passenger car sales are increasing, there is always a risk factor involved in purchasing a used car. The trust between buyers and sellers regarding the quality of used cars has not been completely established, which may have an impact on target market growth.

Philippines Used Car Market Trends

Organized Players are expected to witness higher growth rates during the forecast period

The unorganized players control the majority of the used car market in Philippines. Furthermore, the unorganized players do not provide any warranty on pre-owned vehicles. Some sellers commit fraud by re-painting and removing dents from accident vehicles in order to conceal their damage and obtain a falsely inflated value, which causes buyers to be wary of purchasing used cars. As a result, the higher rate of malpractices and unorganized dealers' larger market share pose a threat to the growth of the used car market.

However, used car sales through organized players have increased in recent years. When compared to unorganized market players, organized players provide better service and value to the customer. They offer buyers a diverse selection of used vehicles to choose from. Quality engineers have certified the vehicles available with these players. As a result, the risk of purchasing low-quality used cars has been significantly reduced. Organized players have contributed to the transparency of the used car market and the establishment of fair prices for both sellers and buyers. This has contributed to an increase in used passenger car sales in the Philippines. For instance

- Toyota has a strong customer base in the Philippines, and the Toyota Certified Used Vehicle (TCUV, or simply Toyota Certified) was created to reward customer loyalty by providing the best price for their vehicles when they sell or trade in. Toyota customers can also use TCUV to purchase used cars that have met Toyota's high-quality standards.

Based on such developments, the organized segment in the target market is expected to grow significantly during the forecast period.

Online sales channel is expected to grow with significant rate over the forecast period

Advances in technology, such as the development of the internet, the use of e-commerce sites/applications to boost business demand, and the introduction of hybrid and electric vehicles, have altered buyer positions in the market. Consumers are becoming more knowledgeable about the vehicle, its residual value, third-party profit margin, and other factors thanks to online technologies. For instance,

- Carsome intends to enter the market in the near future and provide an online platform for used car sales in the Philippines.

Additionally, Machine learning and Artificial Intelligence are expected to play an important role in increasing revenues and decreasing costs of operation, which will positively impact the market growth during the forecast period.

Philippines Used Car Industry Overview

The used car market in the Philippines is highly fragmented, with numerous startups and regional players. Although, in order to gain a competitive advantage, major rental companies are establishing joint ventures and partnerships to launch newer products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Restraints

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 Vendor Type

- 5.1.1 Organized

- 5.1.2 Unorganized

- 5.2 By Vehicle Type

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 Sports Utility Vehicles (SUV) and Multi-Purpose Vehicles (MPV)

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Others

- 5.4 By Sales Channel

- 5.4.1 Online

- 5.4.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Carmudi

- 6.2.2 Carousell

- 6.2.3 CarMax Enterprise Services, LLC

- 6.2.4 Carmix (LausAutoGroup )

- 6.2.5 Toyota Motor Philippines Corporation

- 6.2.6 Automart

- 6.2.7 Philkotse.com

- 6.2.8 Zigwheels

- 6.2.9 Tsikot.com

- 6.2.10 Car Empire