|

市場調查報告書

商品編碼

1683885

美國電動公車電池組:市場佔有率分析、行業趨勢和統計、成長預測(2025-2029 年)US Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

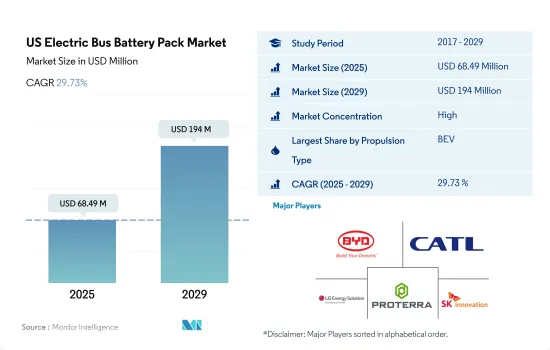

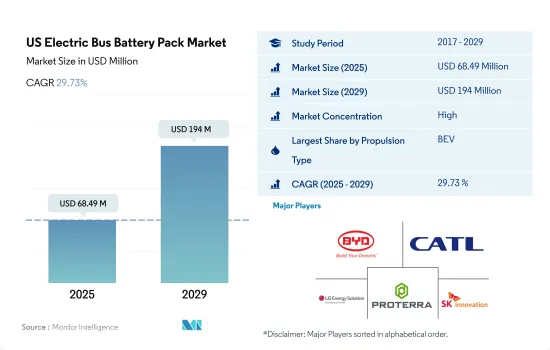

預計 2025 年美國電動公車電池組市場規模為 6,849 萬美元,到 2029 年將達到 1.94 億美元,預測期間(2025-2029 年)的複合年成長率為 29.73%。

不斷成長的需求和政府的大力支持將推動美國電動公車的普及。

- 2017年至2023年,美國的電動公車銷量和採用量將激增。根據彭博新能源財經的報告,2020 年電池電動公車 (BEB) 佔所有新公車銷量的 16%,高於 2015 年的 1%。同年,加州、紐約州和華盛頓州成為電動公車普及率領先的州,總合佔全國銷售量的 57%。美國國家可再生能源實驗室 (NREL) 指出,2017 年美國上有大約 2,200 輛電動公車,到 2020 年這一數字將成長到 5,500 多輛。

- 電動公車的激增主要是由於人們對更清潔、更永續的交通運輸的需求不斷成長。在雄心勃勃的氣候變遷目標的推動下,許多城市和州正在增加政府資金和獎勵,以鼓勵人們使用電池式電動車。隨著電池成本下降,BEB 與柴油汽車相比更具成本競爭力。各國政府也正在製定法規來推動電動公車的普及。例如,加州空氣資源委員會的目標是到 2040 年將所有州內公車轉變為零排放汽車。

- 預計到2030年,電動公車將占美國新車銷量的50%以上。紐約、洛杉磯和溫哥華等北美主要城市已經開始轉型為電動公車。隨著電池技術的進步,電動公車將變得更有效率和經濟。為滿足日益成長的電動公車隊的充電站網路可能會進一步刺激全部區域對電動公車的需求。

美國電動公車電池組市場趨勢

特斯拉、豐田、福特、現代和本田主導美國電動車電池組市場

- 電動車市場高度整合,五大主要參與者——特斯拉、豐田集團、福特集團、現代汽車和本田——預計到2023年將佔據近75%的市場佔有率。特斯拉是美國最大的電動車銷售商,控制著約30%的市場佔有率。該公司專注於創新技術,並與各種電動車零件(例如電池)製造商建立了強大的策略夥伴關係。作為一家美國公司,我們在美國擁有強大的基本客群,為他們提供優質的產品和服務。

- 豐田集團是美國第二大電動車銷售商,約占美國電動車總銷量的28%。該公司擁有強大的供應和分銷網路,透過提供各種不同的電動車,成為客戶信賴的品牌。福特集團在美國電動車整體銷售中排名第三,市場佔有率約 10%。作為本土品牌,其在美國擁有廣泛的產品和服務網路,贏得了客戶的強烈信賴。

- 現代汽車則位居第四,約占美國電動車總銷量的 5.4%。該公司擁有強大的生產和供應鏈網路,使其能夠以比其他品牌更合理的價格提供廣泛的創新產品。本田是電動車市場第五大參與者,市場佔有率約 5%。在美國銷售電動車的其他公司包括起亞、吉普、寶馬和沃爾沃。

特斯拉佔據主導地位,並為美國電池組的需求做出了巨大貢獻。

- 美國是北美最受歡迎的國家之一,2017 年至 2023 年間對電動車的需求穩定成長。隨著消費者偏好逐漸轉向更具運動感、更具冒險精神的駕駛體驗和其他優勢,且價格分佈與轎車等其他電動車相當,電動 SUV 市場正在穩步擴大。 SUV 吸引顧客是因為它們提供了更多的腿部和餘量,而舒適的乘坐體驗是其優先考慮因素之一。

- 在美國電動車電池組市場,特斯拉Model Y的銷售量大幅成長。這款車吸引了那些尋求續航里程長、座位多、行李容量大的電動車的客戶。提供電動轎車的公司也獲得了美國民眾的良好反應。特斯拉 Model 3 也憑藉其全電動技術、高性能、快速充電技術和良好的續航里程,被評為 2023 年美國電動車電池組市場最暢銷車款之一。

- 在美國電動車電池組市場,國際品牌也提供電動 SUV 和轎車。 Toyota RAV4 插電式混合動力車是受歡迎的車輛之一,在 2023 年表現出強勁的銷售勢頭。良好的服務網路、比其他品牌更低的價格以及值得信賴的品牌形像是豐田汽車銷售不斷成長的原因。豐田在美國電動車電池組市場的另一個暢銷產品是配備混合動力傳動系統的 Sienna。那些想要購買七人座汽車的大家庭消費者對於豐田 Sienna 的反應非常好。美國電動車電池組市場的其他競爭對手包括豐田漢蘭達、吉普牧馬人、豐田凱美瑞、本田雅閣和福特野馬 Mach-E。

美國電動大巴電池組產業概況

美國電動公車電池組市場相當集中,前五大公司佔88%的市場。該市場的主要企業是:比亞迪股份有限公司、寧德時代新能源科技股份有限公司(CATL)、LG 能源解決方案有限公司、Proterra Operating Company Inc. 和 SK Innovation(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動公車銷量

- 電動公車銷售(依OEM)

- 最暢銷的電動車車型

- 首選電池化學OEM

- 電池組價格

- 電池材料成本

- 不同電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Econtrols LLC

- Imperium3 New York(IM3NY)

- LG Energy Solution Ltd.

- NFI Group Inc.

- Proterra Operating Company Inc.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- TOSHIBA Corp.

- XALT Energy

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The US Electric Bus Battery Pack Market size is estimated at 68.49 million USD in 2025, and is expected to reach 194 million USD by 2029, growing at a CAGR of 29.73% during the forecast period (2025-2029).

Rising demand and robust government backing propel the adoption of battery electric buses in the United States

- From 2017 to 2023, electric bus sales and adoption surged in the US. A Bloomberg NEF report highlighted that in 2020, battery electric buses (BEBs) constituted 16% of all new bus sales, a significant jump from a mere 1% in 2015. In the same year, California, New York, and Washington emerged as the leading states for electric bus uptake, collectively accounting for 57% of the national sales. The National Renewable Energy Laboratory (NREL) noted that the US had around 2,200 electric buses in operation in 2017, a figure that swelled to over 5,500 by 2020.

- A key driver behind the electric bus surge is the mounting demand for cleaner and sustainable transportation. Driven by ambitious climate targets, numerous cities and states have ramped up government funding and incentives to encourage the adoption of battery electric vehicles. As battery costs decline, BEBs are becoming increasingly cost-competitive with their diesel counterparts. Governments are also enacting regulations to spur electric bus adoption. For instance, the California Air Resources Board aims to transition all transit buses in the state to zero-emission vehicles by 2040.

- Projections indicate that by 2030, electric buses will make up over 50% of new bus sales in the US. Major North American cities like New York City, Los Angeles, and Vancouver have already embarked on the electric bus transition. Electric buses are poised to become more efficient and economical as battery technology advances. The burgeoning network of charging stations, catering to the rising fleet of electric buses, may further fuel the demand for these vehicles across the region.

US Electric Bus Battery Pack Market Trends

Tesla, Toyota, Ford, Hyundai, and Honda dominate the US electric vehicle battery pack market

- The electric vehicle market is highly consolidated, with five major players, Tesla, Toyota Group, Ford Group, Hyundai, and Honda, accounting for almost 75% of the market in 2023. Tesla is the largest seller of electric vehicles in the United States, accounting for around 30% of the market. The company focuses on innovative technologies and has strong strategic partnerships with manufacturers of various EV components (such as batteries). Being a US-based company, it has a strong customer base with great product and service offerings across the United States.

- Toyota Group is the second largest seller of electric vehicles, accounting for around 28% across the United States. The company has a strong supply and distribution network and operates as a reliable brand among customers with wide product offerings of various electric cars. The Ford Group holds 3rd place in EV sales across the United States, with around 10% of the market share. Being a domestic brand, the company has strong goodwill among customers with a wide product and service network in the United States.

- Hyundai is the fourth-largest player, accounting for around 5.4% of the market share in EV sales across the United States. The company has a strong production and supply chain network, with wide innovative products offered at reasonable prices over other brands. Honda is the fifth-largest player in the EV market, maintaining its market share at around 5%. Other players selling EVs in the United States include Kia, Jeep, BMW, and Volvo.

Tesla maintains dominance, holding the majority share, and contributes to the major demand for battery packs in the United States

- The United States is one of the most popular countries in North America, where the demand for EVs steadily increased during 2017-2023. The market for electric SUVs is steadily increasing as consumer preferences gradually move to a more sporty and adventurous drive and other benefits at a comparable price point as other EVs like sedans. SUVs offer more leg and headroom, which attracts customers as a comfortable ride is one of the main priorities.

- In the US EV battery pack market, sales of the Tesla Model Y have grown significantly. The car attracts customers seeking an electric car with long-range, good seating capacity, and large cargo capacity. Companies offering electric sedans are also getting good responses from the US population. Tesla Model 3 was also among the best sellers in the US EV battery pack market in 2023, owing to its full electric technology, high-performance capabilities, fast charging technology, and good range offerings.

- International brands also offer electric SUVs and sedans in the US EV battery pack market. Toyota RAV4 plug-in hybrid is one of the popular cars and witnessed good sales in 2023. A good service network, lower prices than other brands, and a reliable brand image are reasons for the growing sales of Toyota cars. Another good-selling car by Toyota in the US EV battery pack market is the Sienna, offered with a hybrid powertrain; consumers with big families looking for 7-seater cars have positively responded to the Toyota Sienna. Other vehicles competing in the US EV battery pack market include the Toyota Highlander, Jeep Wrangler, Toyota Camry, Honda Accord, and Ford Mustang Mach-E.

US Electric Bus Battery Pack Industry Overview

The US Electric Bus Battery Pack Market is fairly consolidated, with the top five companies occupying 88%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Proterra Operating Company Inc. and SK Innovation Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 US

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 Econtrols LLC

- 6.4.4 Imperium3 New York (IM3NY)

- 6.4.5 LG Energy Solution Ltd.

- 6.4.6 NFI Group Inc.

- 6.4.7 Proterra Operating Company Inc.

- 6.4.8 Samsung SDI Co. Ltd.

- 6.4.9 SK Innovation Co. Ltd.

- 6.4.10 TOSHIBA Corp.

- 6.4.11 XALT Energy

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms