|

市場調查報告書

商品編碼

1685785

建築化學品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

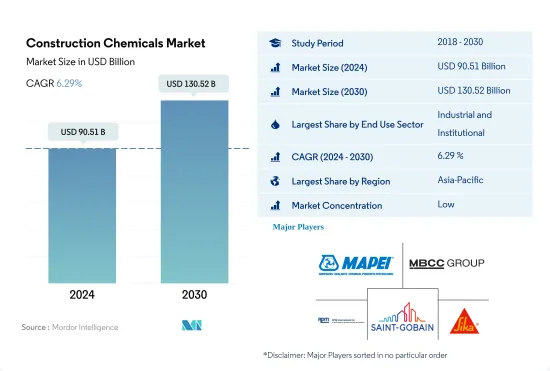

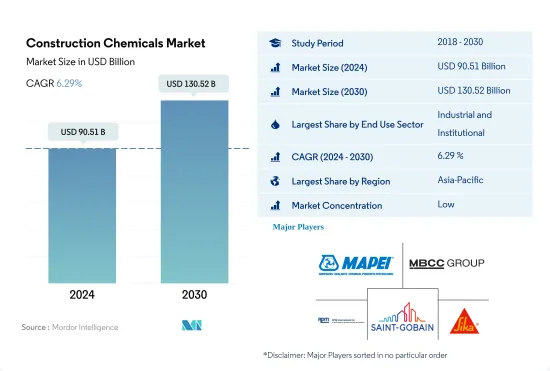

預計 2024 年建築化學品市場規模為 905.1 億美元,到 2030 年將達到 1,305.2 億美元,預測期內(2024-2030 年)的複合年成長率為 6.29%。

預計主要國家的政府在住宅領域的投資和政策將推動建築化學品的需求。

- 建築化學品是指與水泥、混凝土和其他建築材料一起使用的化學製劑。 2022年全球建築化學品消費量預估年增率約4.37%,2023年預估年增率為5.57%。這一成長是由工業、機構和住宅建築領域的需求增加所推動的。

- 2022 年,工業和設施產業成為建築化學品的最大消費產業,約佔全球消費量的 34.8%。對醫療保健、教育和工業基礎設施的投資將促進該行業的成長。此外,全球都市化和工業化趨勢正在成為市場擴張的催化劑。預計 2023 年該產業的新增占地面積將達到約 90 億平方英尺,預計 2030 年將達到 110 億平方英尺。因此,預計 2023 年至 2030 年間,工業和機構部門對建築化學品的需求將增加 140 億美元。

- 預計住宅領域將成為建設化學品成長最快的消費領域,預測期內最高複合年成長率為 6.90%。這一成長歸因於持續的住宅需求、不斷增加的投資和政府的支持性政策。例如,印尼政府已設定在2025年建造100萬套住宅的目標,預計該國的住宅需求將達到3,000萬套。在全球範圍內,住宅領域的新占地面積預計在預測期內實現 3.81% 的複合年成長率,這將進一步推動對建築化學品的需求。

印度、巴西、印尼和越南等亞太主要國家可能會推動全球對建築化學品的需求。

- 建築化學品包括混凝土外加劑、防水溶液、錨固劑和水泥漿、地板樹脂等,在增強建築物和結構的功能方面發揮著至關重要的作用。預計 2022 年全球建築化學品市場將成長約 4.37%,其中亞太地區的成長率最高,為 42.8%,歐洲的成長率為 25.3%。預計 2023 年全球建築化學品市場將較 2022 年成長 5.57%。

- 到 2023 年,亞太地區將成為最大的建築化學品消費地區,佔全球市場的 43.0%。由於住宅需求不斷增加以及工業和設施領域的投資增加,建設活動正在增加。例如,工業和機構占地面積預計將在 2023 年達到 45.9 億平方英尺,到 2030 年將進一步成長到 57.6 億平方英尺。因此,該地區的建築化學品市場預計到 2030 年將比 2023 年成長 62.2%。

- 亞太地區是建築化學品成長最快的消費地區,預計在預測期內最高複合年成長率將達到 7.15%。預計這一成長將由該地區的住宅部門推動。例如,到2030年,預計印度40%以上的人口將居住在都市區,這將帶來約2500萬套經濟適用住宅的需求。該地區的住宅占地面積預計將大幅成長,到 2030 年將比 2023 年增加 42.3 億平方英尺。因此,到 2030 年該地區的建築化學品市場預計將大幅成長 4.96 億美元。

全球建築化學品市場趨勢

亞太地區大型辦公大樓建設計劃激增,將推動全球專用商業占地面積成長

- 2022年,全球占地面積將與前一年同期比較去年小幅成長0.15%。歐洲表現突出,增幅高達 12.70%,這得益於歐洲各國為實現 2030 年二氧化碳排放目標而大力推行節能辦公大樓的政策。隨著員工重返辦公室,歐洲公司正在重新簽訂租約,刺激 2022 年新辦公大樓建造 450 萬平方英尺。預計這一勢頭將在 2023 年繼續,全球成長率預計為 4.26%。

- 新冠疫情造成勞動力和材料短缺,導致商業建築計劃取消和延遲。然而,隨著停工緩解和建設活動的恢復,2021年全球新建商業占地面積激增11.11%,其中亞太地區以20.98%的成長率領先。

- 展望未來,全球新建商業占地面積的複合年成長率將達到4.56%。預計亞太地區的複合年成長率為 5.16%,超過其他地區。這一成長背後的驅動力是中國、印度、韓國和日本商業建築計劃的活性化。尤其北京、上海、香港、台北等中國主要城市甲級辦公室建設正在加速。此外,2023 年至 2025 年間,印度七大城市計劃開幕約 60 家購物中心,總建築面積約 2,325 萬平方英尺。總合,到 2030 年,亞太地區的這些措施預計將比 2022 年增加 15.6 億平方英尺的新零售占地面積。

預計南美洲的住宅將出現最快的成長,這得益於政府加大對經濟適用住宅計畫的投資,這將促進全球住宅產業的發展。

- 2022 年,全球新建住宅占地面積與 2021 年相比減少了約 2.89 億平方英尺。這是由於土地稀缺、勞動力短缺和建築材料價格不永續的高企造成的住宅危機。這場危機對亞太地區產生了嚴重影響,2022 年新占地面積與 2021 年相比下降了 5.39%。不過,2023 年的前景更加光明,預計全球新建占地面積將比 2022 年成長 3.31%,這要歸功於政府投資,這些投資可以在 2030 年前為 30 億人提供建造新的經濟適用住宅的資金。

- 新冠疫情造成經濟放緩,大量住宅建設計劃取消或推遲,導致2020年全球新建占地面積較2019年下降4.79%。隨著2021年限制措施解除,住宅計劃被壓抑的需求得到釋放,新建占地面積較2020年成長11.22%,其中歐洲增幅最高,為18.28%,其次是南美洲,2021年較2020年成長17.36%。

- 預測期內,全球住宅新建占地面積預計複合年成長率為 3.81%,其中南美洲的複合年成長率最快,為 4.05%。巴西的Minha Casa Minha Vida 計畫於2023年宣布實施,政府計畫投資19.8億美元,為低收入家庭提供可負擔住宅;智利的FOGAES計畫也於2023年宣布實施,初期投資為5,000萬美元。

建築化學品產業概況

建設化學品市場較為分散,前五大公司佔了27.13%的市佔率。市場的主要企業是:MAPEI SpA、MBCC Group、RPM International Inc.、Saint-Gobain 和 Sika AG(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 最終用途趨勢

- 商業

- 業/設施

- 基礎設施

- 住宅

- 重大基礎設施計劃(目前和已宣布)

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 最終使用領域

- 商業

- 業/設施

- 基礎設施

- 住宅

- 產品

- 膠水

- 按子產品

- 熱熔膠

- 反應性

- 溶劑型

- 水性

- 錨固和水泥漿

- 按子產品

- 水泥基固定材料

- 樹脂固定

- 其他類型

- 混凝土外加劑

- 按子產品

- 加速器

- 引氣劑

- 高效減水劑(塑化劑)

- 阻燃

- 減縮劑

- 黏度調節劑

- 減水劑(塑化劑)

- 其他類型

- 混凝土保護漆

- 按子產品

- 丙烯酸纖維

- 醇酸

- 環氧樹脂

- 聚氨酯

- 其他樹脂

- 地板樹脂

- 按子產品

- 丙烯酸纖維

- 環氧樹脂

- 聚天冬醯胺

- 聚氨酯

- 其他樹脂類型

- 修復和再生化學品

- 按子產品

- 光纖纏繞系統

- 水泥漿材料

- 微混凝土砂漿

- 改質砂漿

- 鋼筋保護材料

- 密封材料

- 按子產品

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽膠

- 其他樹脂

- 表面處理化學品

- 按子產品

- 硬化劑

- 脫模劑

- 其他產品類型

- 防水解決方案

- 按子產品

- 化學產品

- 膜

- 膠水

- 按地區

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

- 中東和非洲

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 南美洲其他地區

- 亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Ardex Group

- Arkema

- CEMEX, SAB de CV

- Fosroc, Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Jiangsu Subote New Material Co., Ltd.

- LATICRETE International, Inc.

- MAPEI SpA

- MBCC Group

- MC-Bauchemie

- Oriental Yuhong

- RPM International Inc.

- Saint-Gobain

- Sika AG

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 47467

The Construction Chemicals Market size is estimated at 90.51 billion USD in 2024, and is expected to reach 130.52 billion USD by 2030, growing at a CAGR of 6.29% during the forecast period (2024-2030).

Government investments and policies for the housing sector in leading economies are expected to drive the demand for construction chemicals

- Construction chemicals refer to chemical formulations used in conjunction with cement, concrete, or other construction materials. In 2022, the global consumption value of construction chemicals witnessed a growth of approximately 4.37%, and it was expected to register an annual growth rate of 5.57% in 2023. This surge can be attributed to the increased demand from the industrial & institutional and residential construction sectors.

- The industrial & institutional sector emerged as the largest consumer of construction chemicals in 2022, accounting for about 34.8% of the global consumption. Investments in healthcare, education, and industrial infrastructure are poised to bolster this sector's growth. Additionally, the global trends of urbanization and industrialization are acting as catalysts for the market's expansion. The sector's new floor area was projected to reach around 9 billion sq. ft in 2023, and it is expected to reach an estimated 11 billion sq. ft by 2030. Consequently, the demand for construction chemicals in the industrial & institutional sector is projected to witness a USD 14 billion increase from 2023 to 2030.

- The residential sector is expected to be the fastest-growing consumer of construction chemicals, recording the highest CAGR of 6.90% during the forecast period. This surge can be attributed to sustained housing demand, increasing investments, and supportive government policies. For instance, the Government of Indonesia (GOI) has set a target to construct 1 million housing units by 2025, with the country's housing requirements projected to reach 30 million units. Globally, the new floor area in the residential sector is anticipated to witness a CAGR of 3.81% during the forecast period, further fueling the demand for construction chemicals.

Leading countries in Asia-Pacific, such as India, Brazil, Indonesia, and Vietnam, are likely to boost the global demand for construction chemicals

- Construction chemicals, including concrete admixtures, waterproofing solutions, anchors & grouts, flooring resins, and others, play a pivotal role in enhancing the functionality of buildings and structures. The global construction chemicals market witnessed a growth of approximately 4.37% in 2022, with Asia-Pacific and Europe having the highest growth of 42.8% and 25.3%, respectively. Construction chemicals globally were estimated to grow by 5.57% in 2023 compared to 2022.

- By 2023, Asia-Pacific was the largest consumer of construction chemicals, accounting for a 43.0% share of the global market. Construction activities continued to increase in line with the growing demand for housing units and rising investments in the industrial and institutional sector. For instance, the industrial and institutional floor area was set to reach 4.59 billion square feet in 2023; it is expected to further increase to 5.76 billion square feet by 2030. As a result, the region's construction chemicals market is expected to grow 62.2% by 2030 compared to 2023.

- Asia-Pacific is expected to be the fastest-growing consumer of construction chemicals, recording the highest CAGR of 7.15% during the forecast period. This growth is expected to be driven by the region's residential sector. For instance, by 2030, it is anticipated that over 40% of India's population will reside in urban areas, creating a demand for approximately 25 million affordable housing units. The residential floor area in the region is expected to witness a significant surge, adding 4.23 billion sq. ft by 2030 compared to 2023. Consequently, the construction chemicals market in the region is projected to witness a substantial increase of USD 496 million by 2030.

Global Construction Chemicals Market Trends

Asia-Pacific's surge in large-scale office building projects is set to elevate the global floor area dedicated to commercial construction

- In 2022, the global new floor area for commercial construction witnessed a modest growth of 0.15% from the previous year. Europe stood out with a significant surge of 12.70%, driven by a push for high-energy-efficient office buildings to align with its 2030 carbon emission targets. As employees returned to offices, European companies, resuming lease decisions, spurred the construction of 4.5 million square feet of new office space in 2022. This momentum is poised to persist in 2023, with a projected global growth rate of 4.26%.

- The COVID-19 pandemic caused labor and material shortages, leading to cancellations and delays in commercial construction projects. However, as lockdowns eased and construction activities resumed, the global new floor area for commercial construction surged by 11.11% in 2021, with Asia-Pacific taking the lead with a growth rate of 20.98%.

- Looking ahead, the global new floor area for commercial construction is set to achieve a CAGR of 4.56%. Asia-Pacific is anticipated to outpace other regions, with a projected CAGR of 5.16%. This growth is fueled by a flurry of commercial construction projects in China, India, South Korea, and Japan. Notably, major Chinese cities like Beijing, Shanghai, Hong Kong, and Taipei are gearing up for an uptick in Grade A office space construction. Additionally, India is set to witness the opening of approximately 60 shopping malls, spanning 23.25 million square feet, in its top seven cities between 2023 and 2025. Collectively, these endeavors across Asia-Pacific are expected to add a staggering 1.56 billion square feet to the new floor area for commercial construction by 2030, compared to 2022.

South America's estimated fastest growth in residential constructions due to increasing government investments in schemes for affordable housing to boost the global residential sector

- In 2022, the global new floor area for residential construction declined by around 289 million square feet compared to 2021. This can be attributed to the housing crisis generated due to the shortage of land, labor, and unsustainably high construction materials prices. This crisis severely impacted Asia-Pacific, where the new floor area declined 5.39% in 2022 compared to 2021. However, a more positive outlook is expected in 2023 as the global new floor area is predicted to grow by 3.31% compared to 2022, owing to government investments that can finance the construction of new affordable homes capable of accommodating 3 billion people by 2030.

- The COVID-19 pandemic caused an economic slowdown, due to which many residential construction projects got canceled or delayed, and the global new floor area declined by 4.79% in 2020 compared to 2019. As the restrictions were lifted in 2021 and pent-up demand for housing projects was released, new floor area grew 11.22% compared to 2020, with Europe having the highest growth of 18.28%, followed by South America, which rose 17.36% in 2021 compared to 2020.

- The global new floor area for residential construction is expected to register a CAGR of 3.81% during the forecast period, with South America predicted to develop at the fastest CAGR of 4.05%. Schemes and initiatives like the Minha Casa Minha Vida in Brazil announced in 2023 with a few regulatory changes, for which the government plans an investment of USD 1.98 billion to provide affordable housing units for low-income families, and the FOGAES in Chile also publicized in 2023, with an initial investment of USD 50 million, are aimed at providing mortgage loans to families for affordable housing and will encourage the construction of new residential units.

Construction Chemicals Industry Overview

The Construction Chemicals Market is fragmented, with the top five companies occupying 27.13%. The major players in this market are MAPEI S.p.A., MBCC Group, RPM International Inc., Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Adhesives

- 5.2.1.1 By Sub Product

- 5.2.1.1.1 Hot Melt

- 5.2.1.1.2 Reactive

- 5.2.1.1.3 Solvent-borne

- 5.2.1.1.4 Water-borne

- 5.2.2 Anchors and Grouts

- 5.2.2.1 By Sub Product

- 5.2.2.1.1 Cementitious Fixing

- 5.2.2.1.2 Resin Fixing

- 5.2.2.1.3 Other Types

- 5.2.3 Concrete Admixtures

- 5.2.3.1 By Sub Product

- 5.2.3.1.1 Accelerator

- 5.2.3.1.2 Air Entraining Admixture

- 5.2.3.1.3 High Range Water Reducer (Super Plasticizer)

- 5.2.3.1.4 Retarder

- 5.2.3.1.5 Shrinkage Reducing Admixture

- 5.2.3.1.6 Viscosity Modifier

- 5.2.3.1.7 Water Reducer (Plasticizer)

- 5.2.3.1.8 Other Types

- 5.2.4 Concrete Protective Coatings

- 5.2.4.1 By Sub Product

- 5.2.4.1.1 Acrylic

- 5.2.4.1.2 Alkyd

- 5.2.4.1.3 Epoxy

- 5.2.4.1.4 Polyurethane

- 5.2.4.1.5 Other Resin Types

- 5.2.5 Flooring Resins

- 5.2.5.1 By Sub Product

- 5.2.5.1.1 Acrylic

- 5.2.5.1.2 Epoxy

- 5.2.5.1.3 Polyaspartic

- 5.2.5.1.4 Polyurethane

- 5.2.5.1.5 Other Resin Types

- 5.2.6 Repair and Rehabilitation Chemicals

- 5.2.6.1 By Sub Product

- 5.2.6.1.1 Fiber Wrapping Systems

- 5.2.6.1.2 Injection Grouting Materials

- 5.2.6.1.3 Micro-concrete Mortars

- 5.2.6.1.4 Modified Mortars

- 5.2.6.1.5 Rebar Protectors

- 5.2.7 Sealants

- 5.2.7.1 By Sub Product

- 5.2.7.1.1 Acrylic

- 5.2.7.1.2 Epoxy

- 5.2.7.1.3 Polyurethane

- 5.2.7.1.4 Silicone

- 5.2.7.1.5 Other Resin Types

- 5.2.8 Surface Treatment Chemicals

- 5.2.8.1 By Sub Product

- 5.2.8.1.1 Curing Compounds

- 5.2.8.1.2 Mold Release Agents

- 5.2.8.1.3 Other Product Types

- 5.2.9 Waterproofing Solutions

- 5.2.9.1 By Sub Product

- 5.2.9.1.1 Chemicals

- 5.2.9.1.2 Membranes

- 5.2.1 Adhesives

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 By Country

- 5.3.1.1.1 Australia

- 5.3.1.1.2 China

- 5.3.1.1.3 India

- 5.3.1.1.4 Indonesia

- 5.3.1.1.5 Japan

- 5.3.1.1.6 Malaysia

- 5.3.1.1.7 South Korea

- 5.3.1.1.8 Thailand

- 5.3.1.1.9 Vietnam

- 5.3.1.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 By Country

- 5.3.2.1.1 France

- 5.3.2.1.2 Germany

- 5.3.2.1.3 Italy

- 5.3.2.1.4 Russia

- 5.3.2.1.5 Spain

- 5.3.2.1.6 United Kingdom

- 5.3.2.1.7 Rest of Europe

- 5.3.3 Middle East and Africa

- 5.3.3.1 By Country

- 5.3.3.1.1 Saudi Arabia

- 5.3.3.1.2 United Arab Emirates

- 5.3.3.1.3 Rest of Middle East and Africa

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ardex Group

- 6.4.2 Arkema

- 6.4.3 CEMEX, S.A.B. de C.V.

- 6.4.4 Fosroc, Inc.

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Jiangsu Subote New Material Co., Ltd.

- 6.4.8 LATICRETE International, Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 MBCC Group

- 6.4.11 MC-Bauchemie

- 6.4.12 Oriental Yuhong

- 6.4.13 RPM International Inc.

- 6.4.14 Saint-Gobain

- 6.4.15 Sika AG

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219