|

市場調查報告書

商品編碼

1686548

印尼黏合劑和密封劑:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Indonesia Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

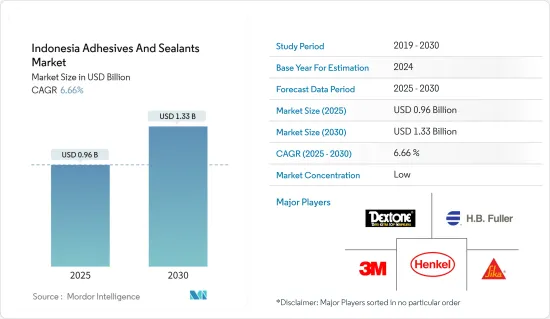

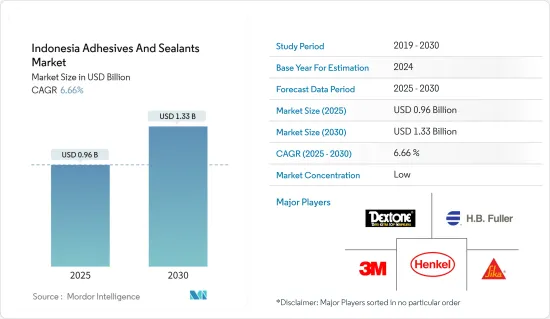

印尼黏合劑和密封劑市場規模預計在 2025 年為 9.6 億美元,預計到 2030 年將達到 13.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.66%。

COVID-19疫情對印尼黏合劑和密封劑市場產生了負面影響。全國範圍的封鎖和嚴格的社交隔離措施導致航太、汽車、建築、醫療保健、包裝和鞋類行業關閉,從而影響了印尼的黏合劑和密封劑市場。然而,在新冠疫情爆發後,限制措施一旦解除,市場就恢復良好。由於航太、汽車、建築、醫療保健、包裝和鞋類等各個應用領域對黏合劑和密封劑的消費增加,市場出現強勁復甦。

主要亮點

- 預測期內,印尼的黏合劑和密封劑市場預計將受到建設產業需求成長和包裝產業需求成長的推動。

- 另一方面,過度依賴進口原料可能會阻礙市場成長。

- 生物基黏合劑的技術創新和發展以及向複合材料黏合的轉變可能會成為預測期內探索市場的機會。

印尼黏合劑和密封劑市場趨勢

市場主導的水性黏合劑技術

- 水性黏合劑使用水作為載體或稀釋介質來分散樹脂。透過讓水蒸發或被基質吸收,它就會變硬。這些黏合劑以水作為稀釋劑而不是揮發性有機溶劑配製而成,可以被視為低VOC黏合劑。

- 水性黏合劑由水溶性合成聚合物(纖維素醚、聚乙烯醇、甲基纖維素、羧甲基纖維素、聚乙烯吡咯烷酮等聚合物)或天然聚合物(植物性,如澱粉和糊精;蛋白質來源,如血液、魚、乳清、大豆;以及動物基,如骨骼和皮革)製成。

- 在印度尼西亞,水性黏合劑技術比溶劑型黏合劑更受歡迎的主要原因是其環保特性,因為它通常產生較少的揮發性有機化合物(VOC),從而劣化。

- 根據 Mordor Intelligence 的分析,在印度尼西亞,水基黏合劑技術預計在 2024 年至 2029 年期間以 6.50% 的速度成長。水性黏合劑和丙烯酸水基黏合劑主要用於建設產業的各種應用。丙烯酸水性黏合劑主要用於建築領域,作為標籤和膠帶形式的壓敏黏著劑,用於磁磚黏合和層壓。

- 2024 年 5 月,漢高股份公司宣布其黏合劑和塗料創新將實現循環經濟並減少其碳足跡。其中一個產品亮點是 Aquence PS 3017 RE,這是一種專為清洗寶特瓶上的烯烴薄膜標籤開發的水性丙烯酸黏合劑。 Aquence PS 3017 RE 是一種水性丙烯酸黏合劑,專為清洗寶特瓶上的烯烴薄膜標籤而開發,使從瓶子上去除標籤的過程更容易、更節能,同時提高回收寶特瓶的純度和價值。

- 由於水溶性黏合劑具有上述所有優點,因此水溶性黏合劑技術可望主導國內黏合劑和密封劑市場。

包裝產業佔據市場主導地位

- 印尼黏合劑和密封劑市場的最大消費產業是包裝產業。黏合劑和密封劑在造紙和包裝行業中發揮著至關重要的作用。例如,黏合劑可用於層壓紙張或紙板、黏貼標籤或內襯食品包裝(例如飲料罐)。

- 包裝黏合劑和密封劑對各種表面具有出色的黏附性和黏合性,並廣泛應用於從紙盒到食品和飲料包裝。

- 包裝黏合劑和密封劑可實現更快的黏合和更可靠的密封,從而簡化您的製造流程。此外,快速固化包裝密封劑為各種包裝材料提供了靈活可靠的解決方案。

- 根據 Moldo Intelligence 估計,印尼的包裝量預計將從 2023 年的 168.34 噸增加到 2022 年的 160.55 噸。由於電子商務領域的興起,包裝行業預計未來將繼續成長,電子商務領域在過去幾年中為包裝行業帶來了巨大的推動力,因為運輸貨物需要專門的包裝。

- 各公司正在包裝領域進行各種投資。例如,2022年,中國包裝公司Lamipak開始在印尼建造第二家工廠。該公司計劃在2024年投資2億美元,分兩階段擴大產能,達到每年180億包。

- 最近,PT Sariguna Primatirta Tbk。生產 Cleo 品牌瓶裝水的印尼公司 Tanobel 計劃在 2023 年投入 3,000 億印尼盾(1,988 萬美元)的資本支出,用於建造工廠和擴大分銷網路。

- 因此,推動包裝產業成長的這種趨勢可能會進一步促進該國黏合劑和密封劑的消費。

印尼黏合劑和密封劑產業概況

印尼的黏合劑和密封劑市場高度分散。市場的主要企業(不分先後順序)包括 3M、HB Fuller Company、Henkel AG &Co.KGaA、Sika AG 和 DEXTONE INDONESIA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 包裝產業需求不斷成長

- 建設產業需求增加

- 限制因素

- 過度依賴進口原料

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂專用黏合劑

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- VAE,EVA

- 其他樹脂專用黏合劑

- 黏合劑(按技術分類)

- 熱熔膠

- 反應性

- 溶劑型

- UV固化型

- 水性

- 樹脂專用密封膠

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽膠

- 其他樹脂密封劑

- 最終用戶產業

- 航太

- 車

- 建築與施工

- 鞋類和皮革

- 衛生保健

- 包裝

- 木製品和配件

- 其他最終用戶產業

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- ALTECO co., ltd.

- ARKEMA

- DEXTONE INDONESIA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Mapei Inc

- Pamolite Adhesive Industry

- Pidilite Industries Ltd.

- Sika AG

第7章 市場機會與未來趨勢

- 生物基黏合劑的創新與發展

- 向複合黏合的轉變

The Indonesia Adhesives And Sealants Market size is estimated at USD 0.96 billion in 2025, and is expected to reach USD 1.33 billion by 2030, at a CAGR of 6.66% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market for Indonesia adhesives and sealants. Nationwide lockdowns and strict social distancing measures led to the closure of aerospace, automotive, construction, healthcare, packaging, and footwear industries consequently affecting the Indonesia adhesives and sealants market. However, after the COVID-19 pandemic, the market recovered well following the lifting of restrictions. It rebounded significantly due to the increased consumption of adhesives and sealants in various applications such as aerospace, automotive, construction, healthcare, packaging, footwear, and others.

Key Highlights

- Growing demand from the construction industry and increasing demand from the packaging industry in the country are expected to drive the market for Indonesia's adhesives and sealants market during the forecast period.

- On the flip side, the over-reliance on the import of raw materials is likely to hinder the market's growth.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to act as opportunities for the market studied over the forecast period.

Indonesia Adhesives and Sealants Market Trends

Water-borne Adhesives Technology to Dominate the Market

- Water-borne adhesives use water as a carrier or diluting medium to disperse a resin. They are set by allowing the water to evaporate or be absorbed by the substrate. These adhesives are compounded with water as a diluent rather than a volatile organic solvent, and they can be considered low-VOC adhesives.

- Water-borne adhesives are produced from either soluble synthetic polymers (from polymers such as cellulose ethers, polyvinyl alcohol, methylcellulose, carboxymethylcellulose, and polyvinylpyrrolidone) or natural polymers (from vegetable sources such as starches and dextrins, protein sources such as blood, fish, milk albumen, and soybean, and animal sources such as bones and hides).

- In Indonesia, the major reason for their preference for waterborne adhesive technology over solvent-borne is due to their eco-friendly nature, as it is generally lower in volatile organic compounds (VOCs), which degrade the environment.

- In Indonesia, the market for water born adhesive technology is growing at a a rate of 6.50% for the period of 2024 to 2029 as per the Mordor Intelligence analysis. The waterborne adhesives, and acrylic water-borne adhesives are majorly employed for different applications in the building and construction industry. Acrylic water-borne adhesives are majorly used as pressure-sensitive adhesives in the construction sector in the form of labels and tapes for tile bonding and laminating purposes.

- In May 2024, Henkel AG & Co. KGaA presented adhesive and coating innovations enable circularity and reduce carbon footprint. One of the product highlights is Aquence PS 3017 RE, a water-based acrylic adhesive that was developed for olefin-based film labels on washable PET bottles. It makes the process of removing the labels from the bottles easier and more energy efficient, while the purity and value of the recycled PET bottle are also increased.

- All the aforementioned benefits offered by water borne adhesives, the water borne adhesive technology is expected to dominate the market for adhesives and sealants in the country.

Packaging Industry to Dominate the Market

- The packaging industry is the largest consumer of the Indonesia adhesives and sealants market. Adhesives and sealants play a crucial role in the paper and packaging industries. Adhesives are used for example in laminating paper and cardboard, gluing labels, and lining food packages such as beverage cans.

- Packaging adhesives and sealants provide excellent adhesion and bonding to a wide variety of surfaces and are used in applications ranging from folding cartons to food and beverage packaging.

- Adhesives and sealants for packaging simplify manufacturing processes by enabling faster bonding and secure seals. Additionally, fast-curing packaging sealants provide flexible and reliable solutions for a wide range of packaging materials.

- According to the Mordor Intelligence estimates, the packaging volume of Indonesia has grown from 168.34 tons in 2023 to 160.55 tons in 2022. It is expected that the packaging industry will keep growing as there has been a rise in the e-commerce sector which has given a significant boost to the packaging industry in the past few years as special packaging is required for shipping goods.

- There are various investments done in the packaging sector by various companies. For instance, in 2022, China-based packaging company Lamipak kicked off the construction of its second factory in Indonesia. It plans to expand its capacity to up to 18 billion packs per year in two phases with an investment of USD 200 million by 2024.

- More recently, PT Sariguna Primatirta Tbk., also known as Tanobel, the Indonesian company behind the Cleo-branded bottled water, has set IDR 300 billion (USD 19.88 million) in capital expenditure in 2023 to build factories and expand its distribution network.

- Hence, such trends driving the growth of packaging industry is likely to further fuel the consumption of adhesives and sealants in the country.

Indonesia Adhesives and Sealants Industry Overview

Indonesia adhesives and sealants market is highly fragmented. Some of the major players (not in any particular order) in the market include 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG, and DEXTONE INDONESIA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Growing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Over-reliance on Import of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Adhesives by Resin

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Sealants by Resin

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ALTECO co., ltd.

- 6.4.3 ARKEMA

- 6.4.4 DEXTONE INDONESIA

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 Mapei Inc

- 6.4.9 Pamolite Adhesive Industry

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials