|

市場調查報告書

商品編碼

1637836

中東和非洲黏合劑和密封劑:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)MEA Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

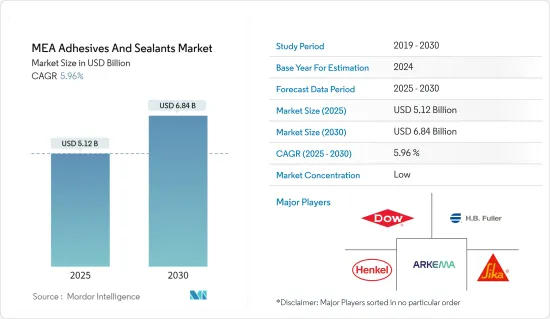

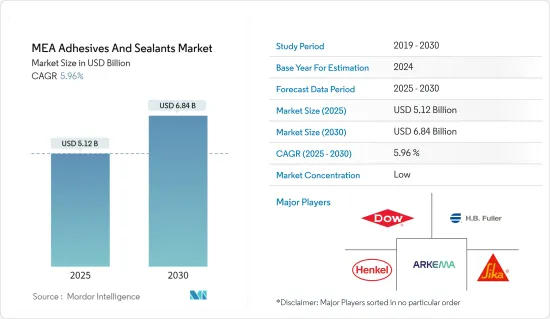

中東和非洲黏合劑和密封劑市場規模預計在 2025 年為 51.2 億美元,預計到 2030 年將達到 68.4 億美元,預測期內(2025-2030 年)複合年成長率為 5.96%。

COVID-19 疫情擾亂了原料供應鏈,對黏合劑和密封劑市場產生了負面影響。疫情過後,建築、醫療保健和包裝行業的需求增加預計將重振黏合劑和密封劑市場。

主要亮點

- 短期內,對黏合劑和密封劑的需求主要受到建設產業需求成長、醫療保健基礎設施建設增加以及包裝行業使用量增加的推動。

- 然而,對化學品使用的環境問題的日益擔憂可能會阻礙市場的成長。

- 生物基黏合劑的創新和發展以及向複合材料黏合劑黏合的轉變可能會為該地區的黏合劑和密封劑市場創造機會。

- 沙烏地阿拉伯是該地區最大的黏合劑和密封劑市場,消費主要由建築、醫療保健和包裝等終端用戶產業推動。

中東和非洲膠合劑和密封劑市場的趨勢

包裝終端用戶產業主導市場

- 包裝產業是黏合劑和密封劑市場的最大消費者。包裝產業正見證著食品和飲料、化妝品、消費品和文具等終端用戶產業的強勁需求。

- 根據全球創新指數(GII),2022年中東和非洲美容及個人護理產業的市場規模約為354.5億美元。

- 此外,由於人口成長、對優質產品的需求、都市化以及消費者對技術的偏好,對化妝品、食品和飲料的需求預計還會成長。從而刺激了包裝產業的需求。

- 根據國際貨幣基金組織 (IMF) 的數據,2023 年至 2028 年間,阿拉伯聯合大公國的消費者在食品和非酒精飲料上的支出預計將增加 99.6 億美元,即 17.36%。預計到 2028 年,食品相關支出將達到 673 億美元。

- 根據加拿大農業和農業食品部的數據,2022年阿拉伯聯合大公國人均食品和非酒精飲料的年度支出為 2,337.2 美元。預計到 2023 年將升至 2,400 美元以上。

- 此外,到 2025 年,中東和非洲的奢侈品包裝市場價值預計將升至 12 億美元以上。奢侈品包裝是指任何奢侈品品牌商品的包裝。最近的市場發展包括永續和生物分解性的包裝。

- 因此,隨著全部區域包裝行業的強勁成長,預測期內對黏合劑和密封劑市場的需求預計也將增加。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯在該地區黏合劑和密封劑消費中佔據主導地位。建設活動、汽車產量的成長以及醫療保健和航太工業的消費增加是推動該國黏合劑和密封劑消費的主要因素。

- 沙烏地阿拉伯政府的各項建設計劃包括耗資5,000億美元的未來特大城市「Neom」計劃,以及紅海計劃一期,預計於2022年完工。投資組合還包括分佈在五個島嶼的14 家豪華和超豪華酒店,共有3,000 間客房,兩個內陸度假村,Qiddiya 娛樂城,超豪華健康目的地Amaala,讓·努維爾在埃爾奧拉的Charmant 度假村,其中包括住宅部的 Sakai住宅和吉達塔。預計預測期內此類計劃將推動各種建築業應用對黏合劑的需求。

- 根據世界衛生組織預測,沙烏地阿拉伯的醫療保健支出預計2022年將達到607億美元,2027年將達到771億美元。

- 沙烏地阿拉伯正在向電動車領域投資超過 2.2 億美元,並營運三家工廠,這可能會在未來幾年增加對汽車黏合劑的需求。例如,汽車產量預計將從 2021 年的 9,800 輛增加到 2028 年的 12,800 輛。預計這將推動該國黏合劑和密封劑市場的發展。

- 根據沙烏地阿拉伯統計總局的數據,2022 年沙烏地阿拉伯「建築施工」產業的銷售收入約為 288.7 億美元。

- 因此,預計所有這些趨勢將在預測期內推動該國黏合劑和密封劑市場的成長。

中東和非洲膠合劑和密封劑產業概況

中東和非洲的黏合劑和密封劑市場是一個分散的市場。市場的主要企業(不分先後順序)包括阿科瑪 (Arkema)、漢高 (Henkel AG &Co.KGaA)、西卡 (Sika AG)、HB Fuller Company 和陶氏 (Dow)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 沙烏地阿拉伯建設產業的需求不斷成長

- 擴大包裝行業的應用

- 其他促進因素

- 限制因素

- 日益嚴重的環境問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 黏合劑:樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- 乙烯-醋酸乙烯共聚物,

- 其他樹脂

- 黏合劑:依技術分類

- 熱熔膠

- 反應性

- 溶劑型

- UV固化型

- 水性

- 密封劑:樹脂

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽膠

- 其他樹脂

- 最終用戶產業

- 航太

- 車

- 建築和施工

- 鞋類和皮革

- 衛生保健

- 包裝

- 木製品和配件

- 其他最終用戶產業

- 地區

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- Henkel AG & Co. KGaA

- HB Fuller Company

- Huntsman International LLC

- Illinois Tool Works Inc.

- MAPEI SpA

- Permoseal(Pty)Ltd

- Sika AG

- The Industrial Group Ltd

第7章 市場機會與未來趨勢

- 生物基膠黏劑的創新與發展

- 向複合黏合的轉變

The MEA Adhesives And Sealants Market size is estimated at USD 5.12 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The COVID-19 pandemic disrupted the raw materials supply chain network, negatively affecting the adhesives and sealants market. Post-pandemic, the rising demand for construction, healthcare, and packaging industries is excepted to revive the market for adhesives and sealants.

Key Highlights

- Over the short term, the demand for adhesives and sealants is extensively driven by the growing demand from the construction industry, increasing healthcare infrastructure, and growing usage in the packaging industry.

- However, the market growth is likely to be hindered by the rising environmental concerns regarding the usage of chemicals.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials will likely offer opportunities for the adhesives and sealants market in the region.

- Saudi Arabia is the region's largest market for adhesives and sealants, where the end-user industries, such as construction, healthcare, and packaging, majorly drive consumption.

MEA Adhesives and Sealants Market Trends

Packaging End User Industry to Dominate the Market

- The packaging segment is the largest consumer of the adhesives and sealants market. The packaging industry is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, and others.

- According to the Global Innovation Index (GII), the beauty and personal care industry in Africa and the Middle East in 2022 was worth around USD 35.45 billion.

- Moreover, the demand for cosmetics and food and beverage products is expected to grow due to the growing population and demand for quality products, urbanization, and consumers inclining toward technology. Hence, fueling the demand for the packaging industry.

- According to the International Monetary Fund, overall consumer expenditure on food and non-alcoholic drinks in the United Arab Emirates is expected to rise by USD 9.96 billion (+17.36%) between 2023 and 2028. Food-related spending is expected to reach USD 67.3 billion in 2028.

- According to Agriculture and Agri-Food Canada, the annual per capita expenditure in the United Arab Emirates on food and non-alcoholic beverages was USD 2,337.2 in 2022. It was expected to rise to over USD 2.4 thousand by 2023.

- Additionally, the market value of luxury packaging in the Middle East and Africa is expected to rise to over USD 1.2 billion by 2025. Luxury packaging refers to any packaging for luxury brand items. Recent market developments include sustainable and biodegradable packaging.

- Hence, with such robust growth of the packaging industry across the Middle East and Africa region, the demand in the adhesives and sealants market is also expected to increase during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia dominates the consumption of adhesives and sealants in the region. Growing construction activities, automotive vehicle production, and increasing consumption in the healthcare and aerospace industries are the key factors driving the consumption of adhesives and sealants in the country.

- The Saudi Arabian government includes various construction projects, like a USD 500 billion futuristic mega-city 'Neom' project, the Red Sea Project - Phase 1, due to be completed in 2022. It also includes 14 luxury and hyper-luxury hotels that may comprise 3,000 rooms across five islands, and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, Jean Nouvel's Sharman resort in Al-Ula, Ministry of Housing's Sakai homes, and Jeddah Tower. Such projects will likely drive the demand for adhesives from various construction sector applications over the forecast period.

- According to the WHO, Saudi Arabia's healthcare spending was USD 60.7 billion in 2022 and is expected to be USD 77.1 billion in 2027.

- Saudi Arabia is investing more than USD 220 million in electric vehicles by operating three potential factories to increase automotive adhesives demand over the coming years. For instance, automotive production is expected to reach 12.8 thousand units by 2028 from 9.8 thousand units in 2021. It is expected to drive the market for adhesives and sealants in the country.

- According to the General Authority for Statistics (Saudi Arabia), in 2022, the revenue of the industry "construction of buildings" in Saudi Arabia was around USD 28.87 billion.

- Hence, all such trends are expected to drive the growth of the adhesives and sealants market in the country over the forecast period.

MEA Adhesives and Sealants Industry Overview

The Middle East and Africa Adhesives and Sealants Market is a fragmented market. Some of the key players in the market (not in any particular order) include Arkema, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, and Dow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Saudi Arabia

- 4.1.2 Growing Usage in the Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns

- 4.2.2 Other Restrains

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

- 5.5 Geography

- 5.5.1 Saudi Arabia

- 5.5.2 South Africa

- 5.5.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 AVERY DENNISON CORPORATION

- 6.4.3 Dow

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 H.B. Fuller Company

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 MAPEI S.p.A

- 6.4.9 Permoseal (Pty) Ltd

- 6.4.10 Sika AG

- 6.4.11 The Industrial Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials