|

市場調查報告書

商品編碼

1630227

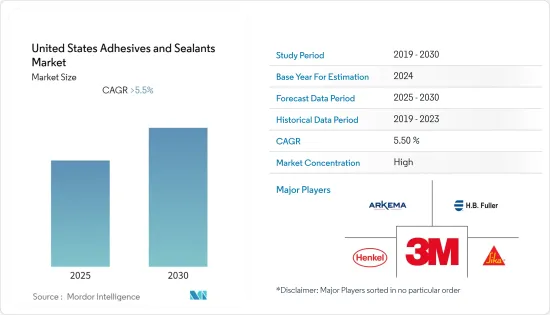

美國黏合劑和密封劑:市場佔有率分析、行業趨勢和成長預測(2025-2030)United States Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

美國黏合劑和密封劑市場預計在預測期內複合年成長率將超過 5.5%

主要亮點

- 該地區包裝行業的擴張可能會在未來幾年顯著推動市場發展。

- 然而,有關無揮發性有機化合物使用的嚴格規定預計將阻礙市場成長。

- 生物基和混合黏合劑的發展預計將是一個機會。

美國黏合劑和密封劑市場趨勢

包裝產業需求增加

- 就保護和提高產品安全性和壽命而言,包裝在設計和技術方面是一個快速發展的行業。

- 消費者忙碌的生活方式、不斷成長的消費能力以及相關因素正在推動該國對快速和攜帶式包裝商品的需求。由於整個國家進入封鎖狀態,製造設施暫時關閉,COVID-19 大流行帶來了多項挑戰,包括供應鏈、進出口中斷。

- 對公共衛生的日益擔憂,以及美國各地電子商務活動的增加,可能會繼續推動食品加工業的成長,這將進一步推動未來幾年的包裝需求。

- 近年來,美國包裝業受到食品和飲料行業快速成長的推動。 2021年,食品和飲料零售商的包裝產品銷售額達到約8,800億美元,較2020年成長約3.5%。

- 美國的瓦楞包裝也正在經歷顯著成長。例如,該國2021年紙板包裝出貨量為4,160億平方英尺,較2017年成長約8%。

- 因此,由於上述因素,包裝產業的擴張可能會在預測期內推動市場。

擴大水性黏合劑的採用

- 水基黏合劑因其在多種應用和最終用戶行業中的優勢特性而成為全國消費的主要黏合劑技術。

- 水基黏合劑通常被設計為分散體或乳化。分散的聚合物(乳膠)顆粒呈球形,直徑50至300 nm。高分子量通常在乳液聚合中實現,因為每個膠乳顆粒內形成的鏈的濃度很淺。

- 這些黏合劑通常用於木工和製鞋行業,以黏合木材、紙張、紡織品、皮革和其他多孔基材。

- 丙烯酸水性黏合劑因其成本低廉、環保性能好而成為主要的樹脂類型。它還易於在多種基材上使用,並且具有適度的強度以及對溫度和其他環境因素的抵抗力。

- 水性黏合劑是環保的,VOC 含量可以忽略不計,因此不會損害生產車間工人的安全,並且比其他類型的技術更便宜。

- 因此,預計這些因素將在未來幾年推動水性黏合劑的需求。

美國黏合劑和密封劑產業概況

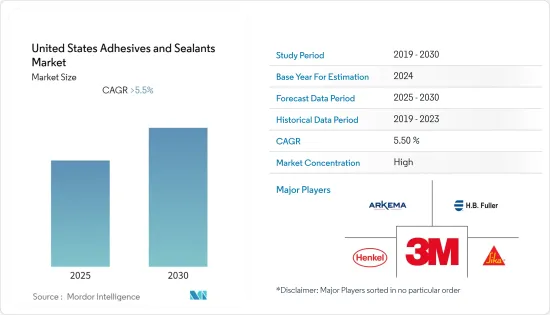

美國黏合劑和密封劑市場本質上是整合的。主要企業包括(排名不分先後)3M、阿科瑪集團、西卡股份公司、HB Fuller Company 和漢高股份公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 包裝產業需求增加

- 其他司機

- 抑制因素

- 關於使用不含 VOC 成分的嚴格規定

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(以金額為準、以銷售額為準))

- 樹脂黏合劑

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽膠

- 氰基丙烯酸酯

- VAE/EVA

- 其他

- 黏合劑的技術

- 溶劑型被覆劑

- 反應性

- 熱熔膠

- UV固化膠

- 樹脂密封劑

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽膠

- 其他

- 最終用戶產業

- 建築/施工

- 紙/紙板包裝

- 運輸

- 木工/細木工

- 鞋類/皮革

- 醫療保健

- 電力/電子

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema Group

- Illinois Tool Works Inc.

- Avery Dennison Corporation

- Huntsman International LLC

- Dow

- MAPEI SpA

- Sika AG

- Technical Adhesives

- HB Fuller Company

- Henkel AG & Co. KGaA

第7章 市場機會及未來趨勢

- 生物基黏合劑和混合黏合劑的開發

簡介目錄

Product Code: 64051

The United States Adhesives and Sealants Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Key Highlights

- The expanding packaging industry in the region will likely drive the market significantly in the coming years.

- However, the strict regulations on the usage of VOC-free content are expected to hinder the market's growth.

- The development of bio-based and hybrid Adhesives is expected to be an opportunity.

US Adhesives & Sealants Market Trends

Increasing Demand from Packaging Industry

- Packaging is a fast-growing industry in terms of design and technology for protecting and enhancing products' safety and longevity.

- The demand for quick and on-the-go packaged items is increasing due to consumers' busier lifestyles, greater spending power, and related factors in the country. Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions in supply chains, imports, and exports.

- The growing interest in public health, along with the emerging e-commerce activities across the nation, is likely to continue boosting the growth of the food processing industry, which will further drive the packaging demand over the coming years.

- The United States packaging industry has been driven by the rapid growth of the food and beverage industry in recent years. The sales of packaging products to retail food and beverage stores amounted to around USD 880 billion in 2021, representing a growth of nearly 3.5% compared to 2020.

- Also, corrugated packaging in the United States is growing significantly. For example, the country shipped 416 billion square feet of corrugated packaging in 2021, representing a growth of nearly 8% compared to 2017.

- Thus, owing to the aforementioned factors, expanding the packaging industry will likely drive the market during the forecast period.

Growing Adoption of Water-borne Adhesives

- Water-borne is the majorly consumed adhesive technology across the country due to its favorable properties for multiple applications or end-user industries.

- Water-borne adhesives are often designed as dispersions or emulsions. The distributed polymer (latex) particles have a spherical form with a diameter of 50 - 300 nm. Since the concentration of the developing chains within each latex particle is shallow, high molecular weights are typically attained in emulsion polymerization.

- These adhesives are commonly used in the woodworking and footwear industries for bonding wood, paper, textiles, leather, and other porous substrates.

- Acrylic waterborne adhesives are the major resin type due to their cheaper cost and favorable environmental properties. They are also easier to use with multiple substrates and have moderate strength and resistance to temperature and other environmental factors.

- Waterborne adhesives are more environmentally friendly, have negligible VOC content that does not hamper the safety of workers at manufacturing sites, and are less expensive than other types of technologies.

- Thus, these factors are expected to boost demand for waterborne adhesives over the coming years.

US Adhesives & Sealants Industry Overview

The United States adhesives and sealants market is consolidated in nature. The major companies include 3M, Arkema Group, Sika AG, HB Fuller Company, and Henkel AG & Co. KGaA, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Packaging Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Regulations on the Usage of VOC-free Contents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Revenue)

- 5.1 Adhesives by Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Solvent-Borne Coatings

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-Cured Adhesives

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Paper, Board, and Packaging

- 5.4.3 Transportation

- 5.4.4 Woodworking and Joinery

- 5.4.5 Footwear and Leather

- 5.4.6 Healthcare

- 5.4.7 Electrical and Electronics

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Illinois Tool Works Inc.

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Huntsman International LLC

- 6.4.6 Dow

- 6.4.7 MAPEI S.p.A.

- 6.4.8 Sika AG

- 6.4.9 Technical Adhesives

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based and Hybrid Adhesives

02-2729-4219

+886-2-2729-4219