|

市場調查報告書

商品編碼

1640525

歐洲黏合劑和密封劑:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

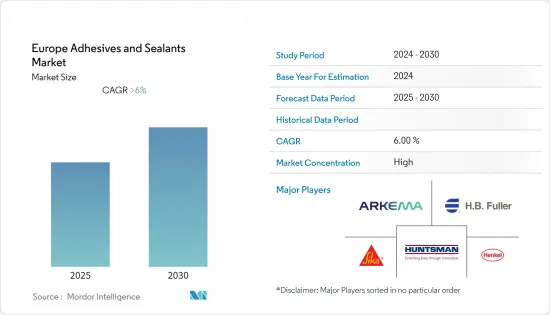

預計預測期內歐洲黏合劑和密封劑市場的複合年成長率將超過 6%。

主要亮點

- 對黏合劑和密封劑的需求主要受到建設產業和醫療保健基礎設施不斷成長的需求的推動。

- 然而,對化學品使用的環境問題的日益擔憂可能會阻礙市場的成長。

- 預計包裝終端用戶領域將佔據受調查市場的主導地位。然而,預計預測期內航太終端用戶領域將成為該地區成長最快的領域。

- 生物基黏合劑的創新和發展以及向複合材料黏合劑黏合的轉變可能會為該地區的黏合劑和密封劑市場提供機會。

- 德國是該地區最大的黏合劑和密封劑市場,消費主要由汽車、建築、電子和包裝等終端用戶產業推動。

歐洲膠黏劑和密封劑市場的趨勢

包裝領域主導市場需求

- 在歐洲,包裝產業是黏合劑和密封劑的最大消費產業。包裝領域正見證著食品和飲料、化妝品、消費品和文具等終端用戶應用的強勁需求。

- 此外,由於人口成長、對優質產品的需求、都市化和消費者的技術導向,對化妝品、食品和飲料的需求預計會增加,從而推動對包裝行業的需求。

- 德國的回收能力大幅擴張,部分原因是中國禁止進口廢棄塑膠包裝,以及回收技術產業的成長。因此,再生塑膠包裝製品使用量的增加也會導致黏合劑使用量的增加。此外,德國政府也設定了2025年實現90%家庭塑膠包裝可回收或重複使用的目標,這將導致該國塑膠包裝數量增加。德國包裝產量預計將增加,到 2021 年將達到 2.0301 億噸,而 2020 年為 1.952 億噸,這將導致 2021 年黏合劑消費量約 8%。

- 新冠疫情爆發後,法國對零售電子商務的需求增加。預計 2021 年零售電商銷售額將達到 927.1 億美元,而 2020 年為 803.1 億美元,2025 年將達到 1,432 億美元。預計這將增加該國對包裝產品的需求,從而在預測期內增加對包裝黏合劑的需求。

- 同樣,英國將在 2021 年生產約 190 萬噸包裝紙和紙板以及 530 萬噸瓦楞紙板,從而增加該國對包裝黏合劑的需求。

- 因此,推動包裝行業成長的這種趨勢可能會進一步促進該地區的黏合劑和密封劑消費。

德國佔據市場主導地位

- 由於汽車產量顯著成長、建設活動增加以及包裝、航太和醫療保健等終端用戶行業的成長,德國在粘合劑和密封劑消費方面佔據該地區的主導地位。

- 德國擁有歐洲最大的建築業。 2021年,德國政府在德國黑森州法蘭克福-費興海姆開始興建費興海姆數位園區,佔地10.7公頃、總占地面積10萬平方公尺,投資11.79億美元。該建設計劃預計將於2028年第四季完工。

- 德國是歐洲最大的電子商務市場之一,也是歐洲第二人口大國,這將推動包裝製造市場的發展。與歐洲平均相比,德國的網路購物數量更多、網路使用者比例更高、年平均消費額也更高。 2021 年線上商品銷售總額將達到約 991 億歐元,高於 2020 年的 833 億歐元。

- 國內包裝生產主要由塑膠驅動,到 2021 年,塑膠將佔包裝產量的約 79%。此外,由於塑膠的可回收性不斷提高,塑膠生產領域在預測期內可能會錄得最快的成長率,即 3.32% 的複合年成長率。

- 德國是歐洲最大的醫療設備市場之一。 2021年,德國醫療設備市場價值約392億美元,預計2022年將達到約419億美元。因此,它可能會推動該國的黏合劑市場的發展。

- 因此,預計終端用戶行業的此類趨勢將在預測期內推動該國黏合劑和密封劑的消費。

歐洲黏合劑和密封劑產業概況。

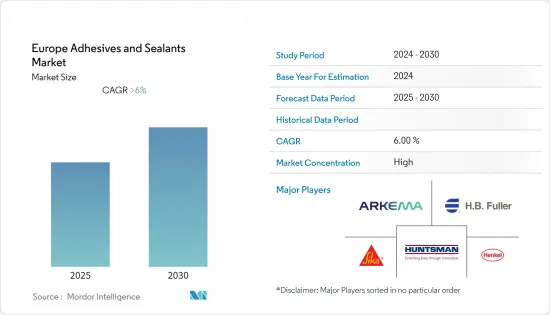

歐洲黏合劑和密封劑市場正在整合,市場競爭良性。主要企業包括阿科瑪集團、西卡股份公司、富樂公司、漢高股份公司和亨斯邁國際有限責任公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 德國建設產業需求不斷成長

- 擴大包裝行業的應用

- 限制因素

- 日益嚴重的環境問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 樹脂專用黏合劑

- 丙烯酸纖維

- 氰基丙烯酸酯

- 環氧樹脂

- 聚氨酯

- 矽膠

- 乙烯-醋酸乙烯共聚物,

- 其他樹脂

- 黏合劑(按技術分類)

- 熱熔膠

- 反應性

- 溶劑型

- UV固化型

- 水性

- 樹脂專用密封劑

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 矽膠

- 其他樹脂

- 按最終用戶產業

- 航太

- 車

- 建築和施工

- 鞋類和皮革

- 衛生保健

- 包裝

- 木製品和配件

- 其他最終用戶產業

- 按地區

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema Group

- Avery Dennison Corporation

- Beardow Adams

- Dow

- Dymax Corporation

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jowat AG

- Mapei Inc.

- Tesa SE(A Beiersdorf Company)

- MUNZING Corporation

- Sika AG

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 生物基膠黏劑的創新與發展

- 向複合黏合的轉變

簡介目錄

Product Code: 54250

The Europe Adhesives and Sealants Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The demand for adhesives and sealants is extensively driven by the growing demand from the construction industry and increasing healthcare infrastructure.

- However, the market growth is likely to be hindered by the rising environmental concerns regarding the usage of chemicals.

- In the studied market, the packaging end-user segment is expected to dominate the market. However, the aerospace end-user segment is expected to be the fastest-growing segment in the region during the forecast period.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to offer opportunities for the adhesives and sealants market in the region.

- Germany stands to be the largest market for adhesives and sealants in the region, where the consumption is driven by the end-user industries, such as automotive, construction, electronics, and packaging.

Europe Adhesives and Sealants Market Trends

Packaging Segment Dominates the Market Demand

- In Europe, the packaging segment is the largest consumer of adhesives and sealants. The packaging sector has been witnessing strong demand from end-user applications, such as food and beverages, cosmetics, consumer goods, stationery, and other end-user industries.

- Moreover, the demand for cosmetics and food and beverage products is expected to grow due to the growing population and demand for quality products, urbanization, and consumers inclining toward technology, hence, fueling the demand for the packaging industry.

- In Germany, the recycling technology sector grew as recycling capacities expanded dramatically, partly due to China's ban on importing waste plastic packaging. Therefore, increasing the use of recycled plastic packaging products increases the use of adhesives. In addition, the German government set a goal of having 90% of home plastic packaging recyclable or reusable by 2025, which will increase the plastic packaging in the country. Packaging production in Germany increased, reaching 203.01 million tons in 2021 compared to 195.2 million tons of production in 2020, thereby increasing the adhesives consumption volume by around 8% in 2021 compared to 2021.

- In France, post-COVID-19 pandemic, the demand for retail e-commerce sales increased. The retail eCommerce revenue increased in 2021, reaching USD 92.71 billion compared to USD 80.31 billion in 2020, and is likely to reach USD 143.2 billion by 2025. This increases the demand for packaging products in the country and is expected to increase the demand for packaging adhesives over the forecast period.

- Similarly, the United Kingdom produced around 1.9 million tons of packaging paper and paperboard and 5.3 million tons of corrugated board in 2021, thereby increasing the demand for packaging adhesives in the country.

- Hence, such trends driving the growth of the packaging industry is likely to further fuel the consumption of adhesives and sealants in the region.

Germany to Dominate the Market

- Germany dominates the region in the consumption of adhesives and sealants, owing to the presence of prominent automotive production, rising construction activities, and growth in the packaging, aerospace, and healthcare end-user industries in the country.

- Germany has the largest construction industry in Europe. In 2021, the German government initiated the construction of the Digital Park Fechenheim on a 10.7ha area, with a gross floor area of 100,000 m2, in Frankfurt-Fechenheim, Hesse, Germany, with an investment of USD 1,179 million. The construction project is expected to be completed by Q4 2028.

- Germany is one of the biggest e-commerce markets in Europe and has the second largest population in Europe, which will drive the packaging production market. Compared to Europe's average, Germany has a high number of online shoppers, the percentage of people using the internet, and the average annual spending. Total sales of goods sold online reached around EUR 99.1 billion in 2021, an increase compared to EUR 83.3 billion in 2020.

- Packaging production is majorly driven by plastics in the country, which nearly accounts for around 79% of the packaging produced in 2021. In addition, with the advancement of plastic recyclability, the plastic production segment is likely to register the fastest growth rate of around 3.32% CAGR during the projected period.

- Germany is one of the largest markets for medical devices in Europe. In 2021, the German medical devices market accounted for about USD 39.2 billion and is expected to reach about USD 41.9 billion in 2022.Thus, it will likely to drive the market for adhesives in the country.

- Hence, such trends in end-user industries are expected to drive the consumption of adhesives and sealants in the country over the forecast period.

Europe Adhesives and Sealants Industry Overview

Europe Adhesives and Sealants Market is consolidated in nature, with much healthy competition in the market. The major companies are Arkema Group, Sika AG, H.B. Fuller Company, Henkel AG & Co. KGaA, and Huntsman International LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Germany

- 4.1.2 Growing Usage in the Packaging Industry

- 4.2 Restraints

- 4.2.1 Rising environmental concerns

- 4.2.2 Other Restrains

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

- 5.5 Geography

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 Russia

- 5.5.5 Spain

- 5.5.6 United Kingdom

- 5.5.7 Rest Of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 Dymax Corporation

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Jowat AG

- 6.4.11 Mapei Inc.

- 6.4.12 Tesa SE (A Beiersdorf Company)

- 6.4.13 MUNZING Corporation

- 6.4.14 Sika AG

- 6.4.15 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Towards Adhesive Bonding for Composite Materials

02-2729-4219

+886-2-2729-4219