|

市場調查報告書

商品編碼

1687054

電動汽車電池組:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

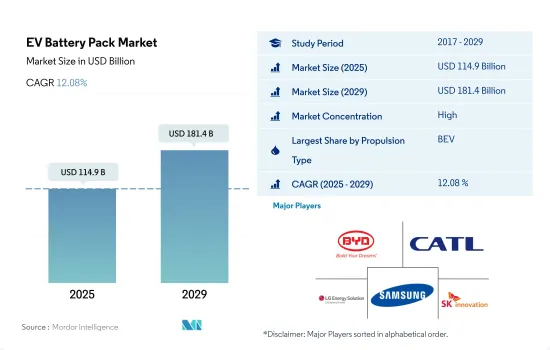

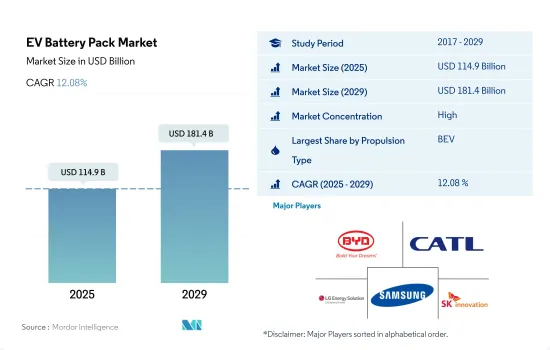

預計電動車電池組市場規模在 2025 年將達到 1,149 億美元,在 2029 年將達到 1,814 億美元,預測期內(2025-2029 年)的複合年成長率為 12.08%。

中國引領純電動車電池需求,歐洲和北美插電式混合動力車激增

- 過去幾年,全球汽車電氣化發展迅速,對電動車關鍵部件之一電池的需求產生了積極影響。電動車的普及得益於多種因素,包括人們對電動車的認知、政府對電動車普及的嚴格標準、電動車相對於傳統石化燃料汽車的優勢以及各國的零排放計畫。因此,電池產業也同步成長,2021 年全球整體銷量與 2017 年相比成長了 205%。

- PHEV 和 BEV 電池的主要需求在亞洲國家,其中中國是電動車行業最大的參與者之一。與插電式混合動力車相比,大多數市場對純電動車的需求更高,例如中國佔了 90% 的市場。歐洲、北美等地區對BEV和PHEV的需求也大幅成長,這也推動了全球整體電池需求的增加。因此,預計 2022 年全球整體電動車中鋰離子電池的使用量將比 2021 年增加 89%。

- 新產品的推出正在吸引消費者投資電動車。例如,中國汽車製造商比亞迪於 2022 年 11 月在印度推出了 Atto 3 電動 SUV,配備 60.48 kWh 電池,續航里程為 521 公里。該車已收到超過 2,000 份預訂單,預計將於 2023 年 1 月開始交車。此類發布吸引了大量客戶,預計在預測期內將進一步推動全球對 PHEV 和 BEV 車型電池的需求。

政府推動電動車發展和電池生產基礎設施建設將推動全球電動車電池組市場的發展

- 近年來,各國汽車電氣化發展迅速,也影響了電池產業的成長。世界各國政府對電動車實施的嚴格標準、電動車相對於傳統燃油汽車的各種優勢、包括補貼和退稅在內的稅收優惠等各種因素都促進了電動汽車的驚人成長,在歷史時期內電動汽車成長了約219.05%,從而對原始設備OEM以及售後市場供應商對電池的需求產生了積極影響。過去一段時期(2017-2021 年),電動車普及率的提高導致全球電池需求增加了 217.99%。

- 電動車是整體電池組銷售的最大貢獻者,其次是輕型卡車和巴士。 2022 年中國、美國和德國等各國電動車需求的成長主要受到亞太地區國家的推動,電池需求成長約 86.00%。因此,2022年全球電動車電池組需求與前一年同期比較增87.78%。預計印度和泰國等新興市場的電動車銷售將增加,進一步推動未來對電池組的需求。

- 世界各國政府都在支持電池製造商提高國內產量。 2023年5月,加拿大政府宣布將提供99億美元的製造業稅額扣抵,以及5.32億美元用於在該國建造電池製造廠。預計預測期內這些國家的發展將推動全球對電池的需求。

電動車電池組市場趨勢

比亞迪和特斯拉引領電動車市場並塑造未來

- 2022年,比亞迪在電動車銷量方面領先市場,佔13.3%的佔有率。比亞迪的主導地位得益於幾個因素。比亞迪專注於生產電動車及相關技術,是電動車產業的早期和主要參與者。作為一個較早進入該市場的品牌,比亞迪已經贏得了廣大消費者的認可。比亞迪也積極進行全球擴張、建立夥伴關係以及投資研發,所有這些都有助於鞏固主導地位。

- 特斯拉一直處於電動車創新的前沿,並在電動車的全球普及中發揮了關鍵作用。 2022 年,特斯拉是電動車產業的重要參與者,市場佔有率為 12.2%。特斯拉強大的品牌形象、最尖端科技和廣泛的超級充電網路為其成功做出了貢獻。

- 在電動車市場的其他主要企業中,還有其他幾家公司佔有相當大的市場佔有率。 BMW在汽車產業享有盛譽,並且正在不斷擴大其市場佔有率,同時也透過其子品牌 BMW i 致力於電動車的發展。同樣,大眾汽車在 2022 年的市場佔有率為 3.9%,在「大眾汽車集團」的保護下,正在大力投資電動車。這些公司與梅賽德斯·奔馳、起亞和現代等其他公司一起,利用現有的品牌知名度,推出引人注目的電動車車型,並投資於提高電動車續航里程和性能的技術,重新佔領電動車行業。

特斯拉和比亞迪在 2022 年最暢銷的電動車車型中佔據主導地位

- 2022 年最暢銷的電動車車型由兩大原始OEM製造商主導:特斯拉和比亞迪。特斯拉以兩款車型Model Y和Model 3分別佔據第一和第三的位置,確立了市場強勢地位。特斯拉的Model Y是最受歡迎的插電式電動車,2022年全球銷量約77.13萬輛。同年,特斯拉Model 3和Model Y的銷量突破120萬輛,成為特斯拉最暢銷的車型,與前一年同期比較成長36.77%。最暢銷的五款插電式電動車 (PEV) 車型中有兩款是特斯拉品牌,但這家電池電動車製造商在 2022 年面臨亞洲品牌的競爭。由於其豐富的插電式混合動力電動車車型陣容,總部位於中國的比亞迪將在 2022 年超越特斯拉成為最暢銷的 PEV 品牌。緊接在特斯拉Model Y之後的是比亞迪宋Plus(BEV+PHEV),以477,090輛的銷售量獲得第二名。比亞迪在中國市場佔有重要地位,以生產可靠、技術先進的電動車而聞名,這可能促成了宋 Plus 車型的強勁銷售表現。

- VolkswagenID.4是唯一一款進入前十名的歐洲PEV(插電式電動車),並在最暢銷的電動車車型中脫穎而出。 ID.4 在 2022 年的銷量為 174,090 輛,彰顯了大眾汽車對電動車的承諾及其在電動車市場日益成長的影響力。

- 總體而言,特斯拉和比亞迪的這些頂級電動車車型,以及五菱宏光 MINI EV 和大眾 ID.4 等其他知名競爭對手,都顯示消費者對電動車的需求日益成長。

電動汽車電池組產業概況

電動車電池組市場相當集中,前五家公司佔據了125.96%的市場佔有率。市場的主要企業有:比亞迪股份有限公司、寧德時代新能源科技股份有限公司(CATL)、LG 能源解決方案有限公司、三星 SDI 和 SK Innovation(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電動汽車銷售

- 電動車銷量(按OEM)

- 最暢銷的電動車車型

- 具有首選電池化學成分的OEM

- 電池組價格

- 電池材料成本

- 每種電池化學成分的價格表

- 誰供給誰?

- 電動車電池容量和效率

- 發布的電動車車型數量

- 法律規範

- 比利時

- 巴西

- 加拿大

- 中國

- 哥倫比亞

- 法國

- 德國

- 匈牙利

- 印度

- 印尼

- 日本

- 墨西哥

- 波蘭

- 泰國

- 英國

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 體型

- 公車

- LCV

- M&HDT

- 搭乘用車

- 推進類型

- BEV

- PHEV

- 電池化學

- LFP

- NCA

- NCM

- NMC

- 其他

- 容量

- 15kWh~40kWh

- 40kWh~80kWh

- 超過80度

- 少於15千瓦時

- 電池形狀

- 圓柱形

- 小袋

- 方塊

- 方法

- 雷射

- 金屬絲

- 成分

- 陽極

- 陰極

- 電解

- 分隔符

- 材料類型

- 鈷

- 鋰

- 錳

- 天然石墨

- 鎳

- 其他材料

- 地區

- 亞太地區

- 按國家

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 匈牙利

- 義大利

- 波蘭

- 瑞典

- 英國

- 其他歐洲國家

- 中東和非洲

- 北美洲

- 按國家

- 加拿大

- 美國

- 南美洲

- 亞太地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- BYD Company Ltd.

- China Aviation Battery Co. Ltd.(CALB)

- Contemporary Amperex Technology Co. Ltd.(CATL)

- ENVISION AESC UK Ltd.

- EVE Energy Co. Ltd.

- Farasis Energy(Ganzhou)Co. Ltd.

- Guoxuan High-tech Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Primearth EV Energy Co. Ltd.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- TOSHIBA Corp.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 54316

The EV Battery Pack Market size is estimated at 114.9 billion USD in 2025, and is expected to reach 181.4 billion USD by 2029, growing at a CAGR of 12.08% during the forecast period (2025-2029).

China leads battery demand for BEVs, PHEVs surge in Europe and North America

- The electrification of vehicles in various countries globally has grown significantly over the past few years, making a positive impact on the demand for batteries as it is one of the major components of electric vehicles. The adoption of electric vehicles is growing due to various factors, including awareness of electric vehicles, strict norms from the government for EV adoption, advantages of EVs over the old fossil fuel vehicles, and zero-emission programs in various countries. As a result, the battery industry has grown parallelly and witnessed sales growth of 205% in 2021 over 2017 globally.

- The major demand for batteries for PHEVs and BEVs is from Asian countries, with China as one of the biggest players in the electric automotive industry. The demand for BEVs is higher compared to the PHEVs in the majority of the market; for instance, 90% is acquired by China. Various regions, such as Europe and North America, are also witnessing a significant growth in the demand for BEV and PHEV, which has also contributed to the growth of the demand for batteries across the globe. As a result, the use of lithium-ion batteries in battery electric vehicles grew by 89% in 2022 over 2021 globally.

- Launching of new products is attracting consumers to invest in EVs. For instance, in November 2022, the Chinese automaker BYD launched its electric SUV Atto 3 in India, which is equipped with a 60.48 kWh battery and offers a range of 521 km. The car has already got more than 2,000 bookings, and deliveries started in January 2023. Such launches are attracting customers, which is further expected to raise the demand for batteries with PHEV and BEV models during the forecast period in various countries globally.

Governmental push for EVs and development in battery production infrastructure are driving the global EV battery pack market

- The electrification of vehicles has been growing significantly across various countries over the past few years and also impacting the growth of the battery industry. Various factors, such as the introduction of stringent norms by governments worldwide for electric vehicles, the various advantages of EVs over conventional fuel vehicles, subsidies, and tax benefits, including rebates, aided the tremendous growth of EVs by around 219.05% in the historical period, thus, positively impacting the battery demand from OEMs and aftermarket suppliers. The rise in EV adoption rates increased the battery demand by 217.99% in the historical period (2017-2021) worldwide.

- Electric cars are among the major contributors to the overall battery pack sales, followed by light trucks and buses. Growth in the demand for EVs in 2022 in various countries such as China, the United States, and Germany increased the demand for batteries by around 86.00% in 2022, majorly driven by APAC countries. As a result, global demand for EV battery packs witnessed a growth of 87.78% in 2022 over the previous year. Various emerging markets, such as India and Thailand, are expected to register increased sales of EVs, which would further boost their demand for battery packs in the future.

- The governments of various countries worldwide are supporting battery manufacturers in enhancing their production of batteries domestically. In May 2023, the Government of Canada announced that it would provide USD 9.90 billion in manufacturing tax credits and USD 532 million to construct a battery manufacturing plant in the country. Such developments in various countries are expected to enhance the demand for batteries during the forecast period globally.

EV Battery Pack Market Trends

BYD AND TESLA ARE LEADING THE CHARGE IN THE EV MARKET AND SHAPING THE FUTURE

- In 2022, BYD was the market leader in electric vehicle sales and held a share of 13.3%. BYD's leading position can be attributed to several factors. It has been an early and prominent player in the EV industry, with a strong focus on producing electric vehicles and related technologies. The company's early entry into the market allowed it to establish a solid foundation and gain recognition among consumers. BYD has also been actively expanding its operations globally, forging partnerships, and investing in research and development, all of which contribute to its leading position.

- Tesla has been at the forefront of electric vehicle innovation and has played a crucial role in popularizing EVs worldwide. Tesla was a significant player in the EV industry in 2022, with a market share of 12.2%. Tesla's strong brand image, cutting-edge technology, and extensive Supercharger network have contributed to its success.

- Among the other players in the EV market, there are several notable companies that hold significant market shares. BMW's established reputation in the automotive industry, coupled with its commitment to electric mobility through its "BMW i" sub-brand, has contributed to its market presence. Similarly, Volkswagen, which held a market share of 3.9% in 2022, has been actively investing in electric mobility under its "Volkswagen Group" umbrella. These companies, along with others like Mercedes-Benz, Kia, and Hyundai, are recolonizing the EV industry by leveraging their existing brand recognition, introducing compelling electric vehicle models, and investing in technology to enhance the range and performance of their electric offerings.

TESLA AND BYD DOMINATED THE BEST-SELLING EV MODELS OF 2022

- The best-selling EV models in 2022 were dominated by two key OEMs: Tesla and BYD. Tesla held a strong market position with two of its models, the Model Y and Model 3, capturing the first and third spots, respectively. The Tesla Model Y was the most popular plug-in electric vehicle, with global unit sales of roughly 771,300 in 2022. That year, deliveries of Tesla's Model 3 and Model Y surpassed 1.2 million, a Y-o-Y increase of 36.77% for Tesla's best-selling models. While two of the five best-selling plug-in electric vehicle (PEV) models were Tesla-branded, the battery electric vehicle manufacturer faced competition from Asian brands in 2022. China-based BYD overtook Tesla as the best-selling PEV brand in 2022, relying on a large offering of plug-in hybrid electric models. Following closely behind the Tesla Model Y, the BYD Song Plus (BEV + PHEV) secured the second spot, with sales reaching 477,090 units. BYD's established presence in the Chinese market, along with its reputation for producing reliable and technologically advanced electric vehicles, likely contributed to the strong sales performance of the Song Plus models.

- The Volkswagen ID.4 stood out among the best-selling EV models as the only European PEV (Plug-in Electric Vehicle) in the top ten. With a sales volume of 174,090 units in 2022, the ID.4 demonstrated Volkswagen's commitment to electric mobility and its growing presence in the EV market.

- Overall, these top-performing EV models from Tesla and BYD, along with other notable contenders like the Wuling Hong Guang MINI EV and Volkswagen ID.4, demonstrate the increasing consumer demand for electric vehicles.

EV Battery Pack Industry Overview

The EV Battery Pack Market is fairly consolidated, with the top five companies occupying 125.96%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Samsung SDI Co. Ltd. and SK Innovation Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Belgium

- 4.11.2 Brazil

- 4.11.3 Canada

- 4.11.4 China

- 4.11.5 Colombia

- 4.11.6 France

- 4.11.7 Germany

- 4.11.8 Hungary

- 4.11.9 India

- 4.11.10 Indonesia

- 4.11.11 Japan

- 4.11.12 Mexico

- 4.11.13 Poland

- 4.11.14 Thailand

- 4.11.15 UK

- 4.11.16 US

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

- 5.9 Region

- 5.9.1 Asia-Pacific

- 5.9.1.1 By Country

- 5.9.1.1.1 China

- 5.9.1.1.2 India

- 5.9.1.1.3 Japan

- 5.9.1.1.4 South Korea

- 5.9.1.1.5 Thailand

- 5.9.1.1.6 Rest-of-Asia-Pacific

- 5.9.2 Europe

- 5.9.2.1 By Country

- 5.9.2.1.1 France

- 5.9.2.1.2 Germany

- 5.9.2.1.3 Hungary

- 5.9.2.1.4 Italy

- 5.9.2.1.5 Poland

- 5.9.2.1.6 Sweden

- 5.9.2.1.7 UK

- 5.9.2.1.8 Rest-of-Europe

- 5.9.3 Middle East & Africa

- 5.9.4 North America

- 5.9.4.1 By Country

- 5.9.4.1.1 Canada

- 5.9.4.1.2 US

- 5.9.5 South America

- 5.9.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 China Aviation Battery Co. Ltd. (CALB)

- 6.4.3 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.4 ENVISION AESC UK Ltd.

- 6.4.5 EVE Energy Co. Ltd.

- 6.4.6 Farasis Energy (Ganzhou) Co. Ltd.

- 6.4.7 Guoxuan High-tech Co. Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Primearth EV Energy Co. Ltd.

- 6.4.11 Samsung SDI Co. Ltd.

- 6.4.12 SK Innovation Co. Ltd.

- 6.4.13 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.14 TOSHIBA Corp.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219