|

市場調查報告書

商品編碼

1687072

塑膠瓶和容器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Plastic Bottles and Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

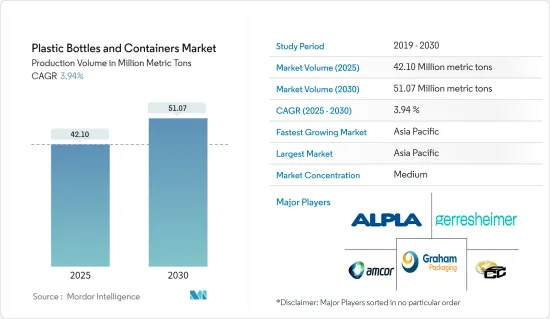

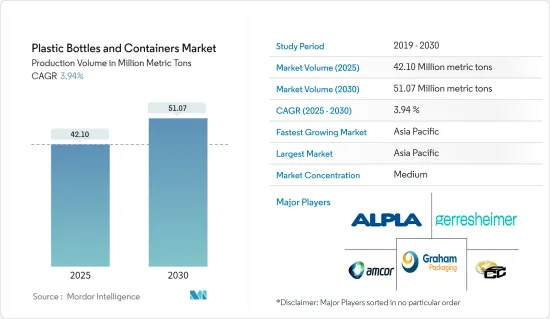

根據生產量計算,塑膠瓶和容器的市場規模預計將從 2025 年的 4,210 萬噸擴大到 2030 年的 5,107 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.94%。

由聚對苯二甲酸乙二酯、聚丙烯和聚乙烯等材料製成的塑膠瓶和容器因其重量輕、抗破碎、易於物料輸送而廣泛應用。甚至製造商也更喜歡塑膠包裝,因為它的生產成本低。在預計預測期內,成本效益和對包裝加工食品以及各種食品和飲料產品的高度依賴將對塑膠瓶和容器市場產生影響。

塑膠因其重量輕的特性而擴大被採用,因為輕質塑膠包裝可以在運輸包裝貨物時節省能源並減少排放。

塑膠瓶和容器市場價值鏈正以策略方針實現顯著發展。這些策略舉措旨在加強對分銷、供應鏈和生產流程的控制,展現對市場需求的動態響應和對永續成長的追求。該產業可能會透過橫向整合、培育規模經濟和增強競爭優勢來實現進一步整合。

生質塑膠和再生材料等環保材料的迅速普及正在根據循環經濟措施和全球環境目標重塑行業格局。

技術進步將重新定義包裝功能,用於可追溯性的2D碼和最佳保存期限標籤等智慧功能將變得越來越普遍。塑膠包裝中融入的抗菌特性解決了日益成長的衛生問題,尤其是對於藥瓶而言。

隨著人們對塑膠污染的擔憂日益加劇,製造商和消費者也開始轉向其他具有環保特性的包裝材料。由於鋁和玻璃環保且可回收性高,其消費量可能會增加。

塑膠製造業依賴原料(包括原油和天然氣)的成本和供應。這些價格的任何波動都可能影響該行業的盈利和永續性。根據Lindum Packaging Limited介紹,石油是廣泛用於包裝材料的原料。因此,如果需求激增、供應鏈出現問題或價格上漲,包裝製造商將面臨挑戰。

塑膠瓶和容器的市場趨勢

飲料業將經歷顯著成長

- 由於瓶裝水和非酒精飲料的需求不斷增加,飲料行業的塑膠瓶市場預計將擴大。瓶裝水的需求源自於消費者對高品質飲用水的傾向、對感染疾病(尤其是飲用受污染的自來水後)的擔憂,以及瓶裝水的便攜性和便利性。

- 寶特瓶水市場的發展受到全球消費者對包裝飲用水日益成長的需求的推動,因為與其他包裝方式相比,包裝飲用水更具成本效益、保存期限更長、使用更方便。

- 根據印度飲料協會統計,印度的寶特瓶回收率和再利用率最高,分別為85%和7%。大多數寶特瓶飲用水都以 PET 產品的形式出售,因此用戶的成本非常低。

- 碳酸飲料、果汁飲料、果汁、運動飲料、能量飲料等各個類別對寶特瓶的需求都很高,其中水瓶在印度顯示出潛在佔有率,有助於寶特瓶市場的成長。

- 印度鐵路餐飲和旅遊有限公司推出了其寶特瓶水品牌“Rail Neer”,將在火車上和火車站銷售,預計收入將從 2021 年的 5.724 億印度盧比(693 萬美元)大幅增加到 2023 年的 31.5 億印度盧比(3814 萬美元),表明該地區對寶特瓶水的需求呈現有機趨勢。

亞太地區預計將佔據主要市場佔有率

- 過去幾年來,該地區的飲料包裝市場取得了顯著成長。全部區域飲料包裝趨勢的快速變化是市場成長的主要驅動力。飲料包裝的新趨勢集中在結構變化、消費後回收等再生材料的開發、顧客接受度、安全性、較新的填充技術、耐熱寶特瓶的開發為市場提供了新的可能性和選擇,並提高了一些飲料的保存期限。

- 百事印度公司宣布,其產品百事黑可樂將於 2023 年 7 月成為印度首個採用 100% 再生寶特瓶生產的碳酸飲料產品。此項措施不包括在完全再生的瓶子上使用百事黑可樂標籤和瓶蓋。

- 中國等國家已大幅提高寶特瓶的回收率,並制定了多種策略來適應循環經濟,包括替代材料、投資開發生物基塑膠以及設計包裝以形成循環。

- 中國糖果零食公司瑪氏箭牌於2023年2月推出了首款消費後再生石油PET(rPET)包裝。瑪氏箭牌採用了本土巧克力品牌翠香的包裝。 216 克容器的包裝由 100% rPET 製成,符合當地的回收法律和措施。

塑膠瓶和容器市場概況

塑膠瓶和容器市場是一個半固態市場。主要參與者包括 Alpla Group、Amcor Group GmbH、Gerresheimer AG、加拿大 Graham Packaging and Container Corporation。食品和飲料需求增加等因素預計將為塑膠瓶和容器市場提供巨大的成長機會。

2024 年 1 月,ALPLA 收購了位於波多黎各的 Fortiflex。兩家公司一直合作為加勒比海和中美洲市場生產包裝產品。透過收購 Fortiflex,ALPLA 將加強其於 2023 年成立的大容量包裝解決方案工業部門,並擴大其作為完整客戶供應商的產品服務。 2023年,ALPLA和Fortiflex將在哥斯大黎加建立一條新的鏟鬥生產線。

2023年9月,Berry Global為歐洲高階水品牌NEUE Water開發了100%可回收的rPET塑膠瓶。瓶子設計用於包裝NEUE Artesian礦泉水,可再填充和重複使用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 評估地緣政治趨勢的影響

第5章 市場動態

- 市場促進因素

- 擴大採用輕量化包裝方法

- 市場挑戰/限制

- 與塑膠使用相關的環境問題

第6章 市場細分

- 按材質

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他材料

- 按最終用戶產業

- 飲料

- 食物

- 化妝品

- 藥品

- 家居用品

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- ALPLA Group

- Amcor Group Gmbh

- Gerresheimer AG

- Graham Packaging

- Container Corporation of Canada

- Altium Packaging

- Apex Plastics(Container Services, Inc.)

- Plastipak Holdings Inc.

- Resilux NV

- Greiner Packaging International Gmbh

- Comar

- Berry Global Inc.

- Retal Industries Limited

- Silgan Holdings Inc.

- Nampak Ltd

第8章投資分析

第9章 市場機會與未來趨勢

The Plastic Bottles and Containers Market size in terms of production volume is expected to grow from 42.10 million metric tons in 2025 to 51.07 million metric tons by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

Plastic bottles and containers that are made of polyethylene terephthalate, polypropylene, polyethylene, etc., are widely used as the material is lightweight and unbreakable, making it easier to handle. Even manufacturers prefer to use plastic packaging, owing to the lower cost of production. The cost-effective nature and dependence on packaged, processed food and various beverages are anticipated to influence the plastic bottles and containers market during the forecast period.

Plastics have been increasingly adopted due to their lightweight properties because lightweight plastic packaging can preserve energy in transporting packed goods and lower emissions.

The value chain of the plastic bottles and containers market is poised for notable developments driven by strategic approaches. These strategic moves aim to enhance control over distribution, supply chains, and production processes, indicating a dynamic response to market demands and a pursuit of sustainable growth. The industry may witness increased consolidation through horizontal integration, fostering economies of scale and bolstering competitiveness.

A surge in adopting eco-friendly materials, such as bioplastics and recycled content, is poised to reshape the industry landscape, aligning with circular economy initiatives and global environmental goals.

Technological advancements will redefine packaging functionality, with smart features like QR codes for traceability and shelf-life indicators becoming prevalent. Anti-microbial properties integrated into plastic packaging will address heightened hygiene concerns, particularly in pharmaceutical bottles.

With growing concerns about plastic pollution, manufacturers and consumers are also inclining themselves toward other packaging materials that offer environment-friendly properties. The consumption of aluminum and glass might witness rising adoption rates owing to their eco-friendly nature and high recyclability.

The plastic manufacturing industry depends on the cost and availability of raw materials, including crude oil and natural gas. Any changes in these prices can impact the industry's profitability and sustainability. According to Lindum Packaging Limited, oil is the raw material used for a broad range of packaging materials. So, when there is an upsurge in demand, a problem with the supply chain or increased prices is where packaging manufacturers will face difficulties.

Plastic Bottles and Containers Market Trends

Beverage Segment to Witness Major Growth

- With the rising demand for bottled water and non-alcoholic beverages, the plastic bottle market in the beverage industry is expected to expand. The demand for bottled water is due to customers' predisposition to want high-quality drinking water, specifically concern about contracting diseases after drinking tainted tap water and the portability and convenience of bottled water.

- The market for bottled water packaging in plastic bottles is driven by the rising demand for packaged drinking water among consumers worldwide because they are more cost-effective than other packaging options, have a longer shelf life, and are easier to use.

- According to the Indian Beverage Association, PET bottles have the greatest recycling and reuse rates in India, at 85% and 7%, respectively. Most packaged drinking water bottles are sold as PET products, which keeps the cost of the product very low for the user.

- Plastic bottles have a significant demand in India in various categories, such as carbonated soft drinks, juice drinks, fruit juices, and sports and energy drinks, out of which water bottles show a potential share in the country, aiding the growth of the plastic bottle market.

- Indian Railways Catering and Tourism Corporation Limited launched a pet bottled water brand, "Rail Neer," which is sold on trains and railway stations, showing significant growth in revenue from INR 572.40 million (USD 6.93 million) in 2021 to INR 3,150 million (USD 38.14 million) in 2023, indicating the organic trend in demand for plastic bottled water in the region.

Asia-Pacific is Expected to Hold Significant Market Share

- The market for beverage packaging has grown significantly over the last few years in the region. Rapid changes in beverage packaging trends across the region are key factors for market growth. The new trends in the packaging of beverages focus on structural changes, and the development of recycled materials like Post-consumer recycling, customer acceptance, safety, newer filling technologies, and the development of heat-resistant PET bottles provided new possibilities and options in the market and improved preservation of several drinks.

- PepsiCo India has announced that its product Pepsi Black will introduce the first 100 % recycled PET plastic bottles in the carbonated beverages category to be manufactured in India in July 2023. The manufacturer does not include the Pepsi Black label and cap for a completely recycled bottle in this initiative.

- Countries like China are witnessing significant recycling rates in plastic bottles, and multiple strategies have been developed to deal with the circular economy, which includes substituting for alternative materials, investments toward the development of bio-based plastics, and designing packaging to make the circular loop.

- Mars Wrigley, the Chinese confectionery company, released its first post-consumer recycled petrified PET (rPET) packaging in February 2023. Mars Wrigley has adopted the packaging of the local chocolate brand Cui Xiang. The packaging of the 216g container is 100% rPET to meet the recycling laws and initiatives in the region.

Plastic Bottles and Containers Market Overview

The plastic bottles and containers market is semi-consolidated in nature. Some of the major players are Alpla Group, Amcor Group GmbH, Gerresheimer AG, Graham Packaging, and Container Corporation of Canada., among others. Factors, including the increasing demand for food and beverages, are expected to provide considerable growth opportunities in the plastic bottles and containers market.

In January 2024, ALPLA acquired the Puerto Rico-based Fortiflex. The two companies have been working together to produce packaging products for Caribbean and Central American markets. ALPLA will reinforce its industrial division for large-volume packaging solutions, which was established in 2023 by acquiring Fortiflex and expanding its offering as a complete customer provider. In 2023, ALPLA and Fortiflex installed a new production line for buckets in Costa Rica.

In September 2023, Berry Global developed a 100% recycled rPET plastic bottle for NEUE Water, a European luxury water brand. The bottle is designed to package NEUE's artesian mineral water and is designed to be refillable and reusable.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Developments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.2 Market Challenges/Restraints

- 5.2.1 Environmental Concerns Regarding Use of Plastics

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Polyethylene Terephthalate (PET)

- 6.1.2 Polypropylene (PP)

- 6.1.3 Low-density Polyethylene (LDPE)

- 6.1.4 High-density Polyethylene (HDPE)

- 6.1.5 Other Material Types

- 6.2 By End-user Vertical

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALPLA Group

- 7.1.2 Amcor Group Gmbh

- 7.1.3 Gerresheimer AG

- 7.1.4 Graham Packaging

- 7.1.5 Container Corporation of Canada

- 7.1.6 Altium Packaging

- 7.1.7 Apex Plastics (Container Services, Inc.)

- 7.1.8 Plastipak Holdings Inc.

- 7.1.9 Resilux NV

- 7.1.10 Greiner Packaging International Gmbh

- 7.1.11 Comar

- 7.1.12 Berry Global Inc.

- 7.1.13 Retal Industries Limited

- 7.1.14 Silgan Holdings Inc.

- 7.1.15 Nampak Ltd