|

市場調查報告書

商品編碼

1626333

北美塑膠瓶和容器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)NA Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

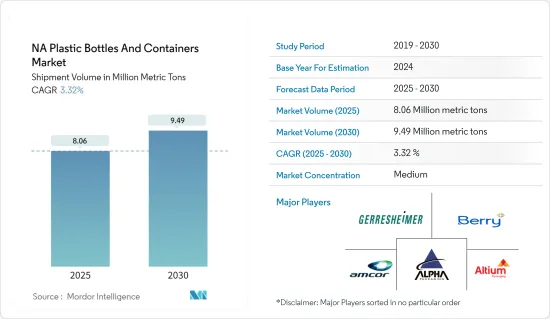

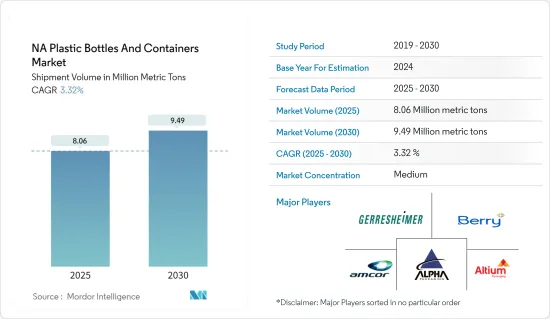

北美塑膠瓶及容器市場的出貨量預計將從2025年的806萬噸成長到2030年的949萬噸,預測期間(2025-2030年)年複合成長率為3.32%。

北美塑膠瓶和容器市場由成熟的製造能力和強勁的出口部門塑造。包裝在消費品和工業產品的消費中發揮著至關重要的作用。在北美,對永續和永續包裝解決方案不斷成長的需求正在推動市場成長。

主要亮點

- 在新興國家崛起的同時,美國在全球醫藥產業中保持主導地位。美國是各大製藥公司的所在地,不僅擁有較大的市場佔有率,也為消費者提供尖端的產品。這種強勁的製藥格局正在刺激塑膠瓶和容器市場的創新和進步。

主要亮點

- 例如,2023年2月,美國公司Berry Global宣布推出針對製藥和草藥市場的全面解決方案。該新產品被稱為 Berry Healthcare Bundle,包括各種尺寸從 20 毫升到 1,000 毫升的 28 毫米瓶頸寶特瓶,並具有八個砸道機啟和兒童防盜瓶蓋。

- 北美美容和個人護理行業,包括從化妝品到護膚的所有行業,對優質創新產品的需求正在激增。這一趨勢正在推動知名品牌擴大其產品陣容。

- 對個人保健產品的需求不斷成長,極大地推動了塑膠瓶和容器市場的發展。這種激增很大程度上歸功於塑膠包裝的實用性、成本效益和多功能性。隨著消費者傾向於化妝品和個人護理產品的便利性和創新設計,塑膠容器正在成為首選解決方案。塑膠瓶可以巧妙地滿足美容和個人護理行業的多樣化需求,包括乳液、乳霜、洗髮精和精華液。

- 機能飲料產業在北美不斷擴張,推動了市場的成長。這是由於塑膠包裝的便利性和便攜性,符合消費者對攜帶式和健康飲料日益成長的偏好。

- 2024年3月,美國飲料公司Roar Organic獲得當地公司1,000萬美元投資。這筆資金籌措旨在擴大 Roar 的產品組合,並將幫助該公司推出即飲和粉末形式的調味「功能」飲料。此類策略投資可能會支持未來幾年的市場成長。

- 在美國,PET 和 HDPE 佔據市場主導地位。 寶特瓶預計將佔據很大的市場佔有率,因為塑膠因其成本效益和易用性而受到青睞。

- 然而,隨著環保意識的增強,塑膠的使用預計會放緩。美國和加拿大發生了明顯的轉變,消費者傾向於環保包裝解決方案。認知到與塑膠相關的環境危害,兩國都頒布了嚴格的法規,與替代材料相比,塑膠的成長率較低。

- 也就是說,對永續塑膠瓶的需求不斷成長,為市場上的公司開闢了新的途徑,特別是在開發回收材料方面。

北美塑膠瓶及容器市場趨勢

飲料包裝需求不斷成長,聚對苯二甲酸乙二醇酯 (PET) 的使用量不斷增加

- 聚對苯二甲酸乙二醇酯 (PET) 因其對水蒸氣、氣體、稀酸、油和酒精的強大阻隔性而成為首選的飲料包裝材料。除了防護性能外,PET 還具有出色的抗碎性、適度的柔韌性和可回收性。其耐用性和穩定性使 PET 成為食品級產品(包括單一飲料瓶和容器)的理想選擇。

- 據地球日組織者稱,美國每分鐘售出一百萬個寶特瓶。

- 碳酸軟性飲料 (CSD) 產業中寶特瓶的使用量正在迅速增加,但目前在北美已達到飽和狀態。百事可樂、可口可樂和 Keurig Dr. Pepper 等產業巨頭都報告其北美 CSD 部門的銷售停滯不前。可口可樂的年報估計,這三家公司佔據了北美市場佔有率。這一優勢表明碳酸飲料行業對寶特瓶的需求將持續下去。

- 2024 年 3 月,美國飲料公司 Roar Organic 宣布計劃擴大其產品範圍,包括即飲和粉末形式的調味非碳酸「功能」飲料,並獲得當地公司 Factory 的 1000 萬美元投資。預計此類投資將在預測期內為市場創造機會。

- 由於 PET 具有出色的二氧化碳截留性能,聚對苯二甲酸乙二醇酯 (PET) 瓶成為軟性飲料包裝的主流。然而,PET 包裝的多功能性已從軟性飲料擴展到果汁、能量飲料、運動飲料以及葡萄酒、烈酒和啤酒等酒精飲料。美國的蒸餾酒銷量正在迅速成長,對 100% 寶特瓶的需求預計將推動該地區的市場成長。

化妝品行業塑膠包裝的採用迅速增加

- 塑膠成為化妝品包裝的首選材料。它的靈活性允許進行詳細設計,其保護功能可確保內部產品的安全。因此,塑膠瓶和容器在化妝品行業的包裝中佔據主導地位,佔據了重要的市場佔有率。

- 根據包裝器材工業協會(PMMI)的資料,瓶子、罐子、粉盒和管材等塑膠包裝在化妝品和個人護理品行業中佔據主導地位,佔 61% 的佔有率。其中,塑膠瓶脫穎而出,僅佔了30%的市場。

- 美國是化妝品、個人保養用品和香水的主要市場。美國擁有大量的千禧世代,支撐了市場需求。作為國家勞動力的一部分,千禧世代優先考慮除臭劑、香水和化妝品等個人保健產品,並強調外表的重要性。因此,隨著化妝品需求的飆升,全部區域對包裝(包括塑膠容器)的需求也同步成長。

- 為了共同努力實現永續性,化妝品公司擴大尋求環保的塑膠包裝解決方案。 2020 年 8 月,歐萊雅美國與其他 60 個品牌、政府代表、零售商和非政府組織合作,到 2025 年使美國所有塑膠包裝可重複使用、可回收或可堆肥。

北美塑膠瓶及容器市場概況

北美塑膠瓶和容器市場分散且由多家公司組成。從市場佔有率來看,目前該市場由少數大公司主導。這些公司專注於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估地緣政治趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 更多採用輕質包裝

- 塑膠包裝在化妝品行業的快速採用

- 市場限制因素

- 原物料價格波動

- 人們對塑膠使用日益成長的環境擔憂

第6章 市場細分

- 依材料類型

- 聚對苯二甲酸乙二酯 (PET)

- 聚對苯二甲酸乙二酯 (PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他材料類型

- 按行業分類

- 飲料

- 阿羅科爾飲料

- 非酒精飲料

- 食品

- 化妝品

- 藥品

- 家居用品

- 其他行業

- 飲料

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Alpha Packaging Inc.

- Altium Packaging(Loews Corporation)

- Gerresheimer AG

- Graham Packaging Company LP

- Berry Global Group Inc.

- Plastipak Holdings Inc.

- Amcor Plc

- Graham Packaging

- AptarGroup Inc.

- Comar LLC

第8章投資分析

第9章 市場未來展望

The NA Plastic Bottles And Containers Market size in terms of shipment volume is expected to grow from 8.06 million metric tons in 2025 to 9.49 million metric tons by 2030, at a CAGR of 3.32% during the forecast period (2025-2030).

Well-established manufacturing capabilities and a resilient export sector mark North America's plastic bottles and containers market landscape. Packaging plays a pivotal role in the consumption of both consumer and industrial products. In North America, the rising demand for sustainable and convenient packaging solutions is propelling the market's growth.

Key Highlights

- While several emerging nations are making their mark, the United States remains a dominant player in the global pharmaceutical arena. Home to major pharmaceutical companies, the United States not only commands a significant market share but also provides its consumers with access to cutting-edge products. This robust pharmaceutical landscape is spurring innovations and advancements in the plastic bottles and containers market.

- For example, in February 2023, Berry Global, a US company, unveiled a comprehensive solution tailored for the pharmaceutical and herbal markets. This new offering, known as the Berry Healthcare bundle, includes a diverse range of 28 mm neck PET bottles spanning sizes from 20 ml to 1,000 ml and features eight closures with tamper-evident and child-resistant attributes.

- The North American beauty and personal care industry, which includes everything from cosmetics to skincare, is witnessing a surge in demand for premium and innovative products. This trend is driving leading brands to enhance their offerings.

- The rising demand for personal care products is significantly boosting the plastic bottles and containers market. This surge is largely due to the practicality, cost-effectiveness, and versatility of plastic packaging. As consumers lean toward convenience and innovative designs in cosmetics and personal care, plastic containers are emerging as the go-to solution. Plastic bottles can adeptly cater to the diverse needs of the beauty and personal care industry, including lotions, creams, shampoos, and serums.

- The expanding functional beverage industry in North America is fueling market growth. This can be attributed to the convenience and portability of plastic packaging, resonating with consumers' increasing preference for on-the-go and health-centric beverages.

- In March 2024, Roar Organic, a beverage company based in the United States, secured a USD 10 million investment from a local firm. This funding aims to broaden Roar's product lineup, helping the company introduce flavored, non-carbonated "functional" drinks in both ready-to-drink and powdered formats. Such strategic investments are poised to bolster the market's growth in the coming years.

- In the United States, PET and HDPE dominate the market. With manufacturers favoring plastic for its cost-effectiveness and ease of use, PET bottles are expected to hold a significant market share.

- However, as environmental awareness grows, the momentum behind plastic usage is expected to decline. A notable shift is evident in the United States and Canada, where consumers are gravitating toward eco-friendly packaging solutions. Recognizing the environmental hazards linked to plastic, both countries have enacted stringent regulations, leading to a tempered growth rate for plastic compared to alternative materials.

- Nevertheless, the rising demand for sustainable plastic bottles is opening new avenues for companies in the market, particularly in terms of developing recycled materials.

Key Highlights

North America Plastic Bottles & Containers Market Trends

Rising Demand for Beverage Packaging Attributes is Increasing the Usage of Polyethylene Terephthalate (PET)

- Polyethylene terephthalate (PET) is a preferred choice for beverage packaging owing to its robust barrier properties against water vapor, gases, dilute acids, oils, and alcohol. Beyond its protective qualities, PET boasts shatter resistance, moderate flexibility, and recyclability. Its durability and steadfastness make PET an ideal choice for food-grade products, including individual drink bottles and containers.

- According to Earth Day Organizers, the United States sees a staggering sale of about 1 million plastic bottles every minute, primarily fueled by the region's demand for packaged drinking water.

- While the carbonated soft drinks (CSD) segment has seen a surge in plastic bottle usage, it is now reaching saturation in North America. Industry giants, including Pepsi, Coca-Cola, and Keurig Dr Pepper, reported stagnant sales in their North American CSD divisions. Coca-Cola's annual report estimated that these three companies commanded over 80% of the North American market share. This dominance suggests a continued demand for plastic bottles in the CSD segment.

- In March 2024, Roar Organic, a United States-based beverage company, attracted a USD 10 million investment from local firm Factory LLC to expand its product range, including flavored, non-carbonated "functional" drinks in ready-to-drink and powdered formats. Such investments are expected to create opportunities for the market during the forecast period.

- Soft drink packaging is predominantly led by polyethylene terephthalate (PET) bottles due to PET's superior CO2 retention. However, the versatility of PET packaging is not limited to soft drinks; it also encompasses fruit juices, energy drinks, sports drinks, and a range of alcoholic beverages, including wine, spirits, and beer. With the United States witnessing a surge in spirits sales, the demand for 100% PET bottles is projected to boost the regional market growth.

Plastic Packaging Adoption is Set to Surge in the Cosmetics Industry

- Plastic stands out as the preferred material for cosmetics packaging. Its flexibility enables detailed designs, and its protective nature ensures the safety of the products within. Consequently, plastic bottles and containers dominate the cosmetics industry's packaging landscape, securing a substantial market share.

- According to data from the Packaging Machinery Manufacturers Institute (PMMI), plastic packaging, including bottles, jars, compacts, and tubes, commanded a dominant 61% share in the cosmetics and personal care industries. Among these, plastic bottles were particularly prominent, accounting for a notable 30% of the market independently.

- The United States is a leading market for cosmetics, personal care items, and fragrances. A significant segment of the US millennial population fuels the market demand. As the dominant force in the nation's workforce, millennials prioritize personal care products-like deodorants, perfumes, and cosmetics-underscoring the importance of physical appearance. Consequently, as the demand for cosmetics surges, there is a parallel uptick in the demand for packaging, including plastic containers, across the region.

- In a concerted effort toward sustainability, cosmetic companies are increasingly pursuing eco-friendly plastic packaging solutions. Highlighting this dedication, in August 2020, L'Oreal USA, in collaboration with 60 other brands, government representatives, retailers, and NGOs, made a commitment to have all plastic packaging in the US be either reusable, recyclable, or compostable by 2025.

North America Plastic Bottles & Containers Market Overview

The North American plastic bottles and containers market is fragmented and consists of several players. In terms of market share, a few major players currently dominate the market. These players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Developments on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging

- 5.1.2 Plastic Packaging Adoption Set to Surge in the Cosmetics Industry

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Materials Prices

- 5.2.2 Growing Environment Concerns Over the Use of Plastics

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Polyethylene Terephthalate (PET)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 low-density polyethene (LDPE)

- 6.1.4 high-density polyethene (HDPE)

- 6.1.5 Others Materials Types

- 6.2 By End-user Vertical

- 6.2.1 Beverage

- 6.2.1.1 Alocholic Beverages

- 6.2.1.2 Non-Alocholic Bevearges

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-user Verticals

- 6.2.1 Beverage

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alpha Packaging Inc.

- 7.1.2 Altium Packaging (Loews Corporation)

- 7.1.3 Gerresheimer AG

- 7.1.4 Graham Packaging Company LP

- 7.1.5 Berry Global Group Inc.

- 7.1.6 Plastipak Holdings Inc.

- 7.1.7 Amcor Plc

- 7.1.8 Graham Packaging

- 7.1.9 AptarGroup Inc.

- 7.1.10 Comar LLC