|

市場調查報告書

商品編碼

1687178

歐洲塑膠瓶和容器市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

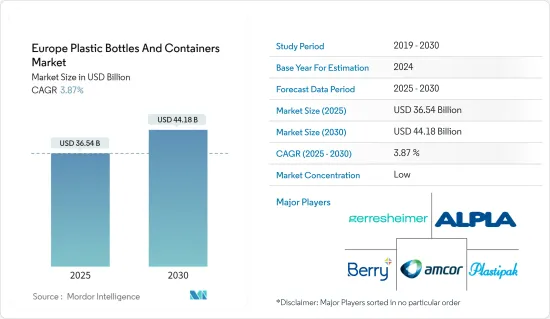

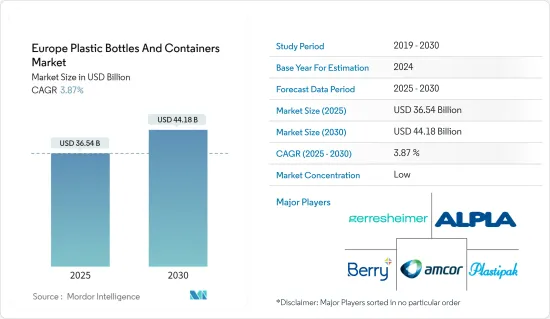

預計 2025 年歐洲塑膠瓶和容器市場規模為 365.4 億美元,到 2030 年將達到 441.8 億美元,預測期內(2025-2030 年)的複合年成長率為 3.87%。

關鍵亮點

- 由聚對苯二甲酸乙二醇酯、聚丙烯和聚乙烯等材料製成的塑膠瓶和容器佔據了包裝行業的主導地位。它重量輕且耐用,製造商主要因為其成本效益而選擇它。再加上世界對食品和飲料的依賴,這將為未來幾年塑膠瓶和容器市場產生重大影響奠定基礎。

- 塑膠的快速普及與其輕質特性直接相關。這不僅有助於節省運輸過程中的能源,還能減少排放。與玻璃等較重且需要更多運輸的替代品相比,塑膠的重量優勢更加明顯。

- 塑膠瓶和容器由多種材料製成,但由聚對苯二甲酸乙二醇酯 (PET) 製成的塑膠瓶和容器因其耐用性、多功能性和成本效益而脫穎而出。隨著歐洲食品、餐飲和製藥業的擴張和創新,對塑膠包裝,尤其是寶特瓶的需求也隨之成長。推出多種口味和包裝風格的新飲料的行業趨勢進一步推動了對硬質塑膠瓶的需求。

- 飲料業尤其嚴重依賴寶特瓶寶特瓶,這得益於對瓶裝水和非酒精飲料的持續需求。消費者選擇瓶裝水是因為他們想避免可能受污染的自來水,並且重視瓶裝水提供的便利性和便攜性。

- 歐盟委員會的一項關注環境問題的研究表明,海洋垃圾中含有大量寶特瓶及其瓶蓋。作為回應,歐洲理事會推出了嚴格的法規,旨在限制一次性塑膠的使用並設定雄心勃勃的回收目標。

- 隨著對塑膠污染的擔憂日益加劇,製造商和消費者都在探索環保的包裝替代品。這種變化明顯體現在鋁和玻璃的採用日益增加,這兩種材料都因其可回收和環保的特性而受到重視。

- 作為這一趨勢的體現,2024年3月,歐洲的Brookfield Drinks宣布推出一款100%不含海洋塑膠的瓶子,引起了廣泛關注。這款創新瓶是該公司 NEO WTR 系列的一部分,將在 250 家 Tesco超市有售。 Brookfield Drinks 的舉措標誌著一個重要的里程碑,它超越了主要的軟性飲料品牌,推出了一系列新的泉水,採用業內首個完全回收的海洋塑膠瓶,配有可回收的瓶蓋和標籤。

歐洲塑膠瓶和容器市場趨勢

飲料業預計將佔據主要市場佔有率

- 飲料業正在推動受調查市場的顯著成長。塑膠容器和瓶子在這一領域越來越受歡迎,鼓勵製造商滿足飲料以外的其他終端用戶行業的需求。輕量化包裝因其具有經濟高效和環境友好的雙重優勢,在包裝行業中變得極為重要。由於重量較輕,塑膠瓶和容器在運輸過程中所需的能量較少,從而減少燃料消耗、減少碳排放並降低經銷商和零售商的成本。

- 根據英國軟性飲料協會2024年年度報告,2023年英國瓶裝水消費量將達到30.27億公升,其中塑膠瓶將佔95.2%的絕對佔有率。隨著瓶裝水消費量的增加,飲料領域對硬質塑膠瓶的需求預計將激增。

- 寶特瓶因其成本效益和阻隔性佔據英國飲料市場的主導地位。根據英國軟性飲料協會統計,它佔軟性飲料的68%,碳酸飲料的53%,稀釋飲料的95%,運動和能量飲料的42%。

- 歐洲塑膠瓶和容器市場正在顯著增加永續性措施。這包括轉向更永續的原料,如生質塑膠,並將再生材料整合到產品線中,所有這些都是為了推動創新。 《一次性塑膠指令》雄心勃勃地設定了目標,即到 2025 年使用 25% 的再生塑膠,到 2030 年使用 30% 的再生塑膠,這將徹底改變該行業。這迫使製造商投資回收技術,並表明了對永續性的堅定承諾。

- 隨著飲料消費量的增加,瓶裝水、碳酸飲料、牛奶等寶特瓶和寶特瓶的需求激增。例如,在德國,人均軟性飲料消費量預計將從2020年的114.7公升增加到2023年的124.9公升,凸顯了該國對塑膠包裝的強勁需求。

德國:預計成長強勁

- 由於解決方案提供者和最終用戶的前瞻性舉措,德國對塑膠包裝解決方案的採用正在成長。 「德國製造」產品享有很高的消費者認知度,該地區的軟包裝公司對該產品尤其看好。

- 德國政府對塑膠包裝產業實施了嚴格的監管。雖然寶特瓶在各個領域都很流行,但聚乙烯 (PE) 瓶在飲料、化妝品、衛生和清潔劑領域佔據主導地位。

- 隨著化妝品消費量的激增和塑膠包裝技術的不斷創新,市場有望實現成長。塑膠以其重量輕、經濟高效和衛生的特性而聞名,特別適合保存期限較短的化妝品。透明、密封、高抗壓強度且易於成型的寶特瓶正在增強高階化妝品的視覺吸引力,預示著該領域前景光明。

- PET 通常用於製造瓶子和罐子,尤其適用於製造刺激性的化妝品。另一方面,聚氯乙烯(PVC) 通常會被避開,因為它可能與材料反應並導致變形,更不用說它與有害成分有關。該研究涵蓋了多種應用,包括護膚、頭髮護理、口腔護理、化妝、除臭劑和香水。

- 德國擁有強勁且快速成長的美容和個人護理市場。根據個人護理和洗滌劑行業協會的數據。 V.,市場規模將從 2021 年的 147.229 億美元飆升至 2023 年的 171.569 億美元。個人護理市場的擴張凸顯了德國在塑膠瓶和容器成長中的重要性。

歐洲塑膠瓶和容器行業概況

研究市場分為以下幾個部分:主要參與企業為 Alpha Group、Amcor PLC、Gerresheimer AG、Berry Global Inc.、Plastipak Holdings Inc.、Graham Packaging Company LP 等。

- 2023 年 10 月 - Berry Global Group 為其高階水品牌 NEUE 專門推出了 rPET 瓶。此次發布標誌著 Berry Global 向消費者推出採用 100% 再生寶特瓶NEUE 優質自流礦泉水邁出了重要一步。 NEUE Water 的設計充分考慮了現代快節奏的生活方式。除了環保結構外,該瓶子的創新扁平格式還使其易於攜帶,並可無縫放入各種運輸口袋、包和座椅靠背中。

- 2023 年 10 月 - Plastipak 和 PVG Liquids 合作設計了一種適用於 20L 可堆疊容器的 375G 預製件,可在未來幾年內顯著減少 500 噸 PET消費量。預計這項技術創新每年將減少二氧化碳排放量約200噸。 Plastipac 在義大利韋爾巴尼亞的工廠進行生產是減少運輸過程中排放的策略性舉措。容器本身由新型低結晶質樹脂與創新預製件結合而成。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 輕量化包裝方法的採用日益增多

- 人口和生活方式的變化

- 市場限制

- 人們對塑膠使用的環境擔憂日益加劇

- 貿易情景

- 進出口資料

- 貿易分析(前五大出口/進口國家、價格分析、主要港口等)

- 貿易分析(前五大出口/進口國家、價格分析、主要港口等)

- 行業法規、政策和標準

- 科技

- 價格趨勢分析

- 塑膠樹脂(當前價格和歷史趨勢)

第6章市場區隔

- 按樹脂

- 聚乙烯(PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他樹脂類型(聚苯乙烯、聚氯乙烯、聚碳酸酯等)

- 按產品

- 瓶子

- 瓶子

- 罐

- 盒子

- 加侖

- 標籤

- 其他

- 按最終用途行業

- 食物

- 飲料

- 瓶裝水

- 碳酸飲料

- 牛奶

- 其他飲料

- 製藥

- 個人護理和盥洗用品

- 工業的

- 日用化學品

- 畫

- 其他

- 按國家

- 法國

- 德國

- 義大利

- 英國

- 西班牙

- 波蘭

第7章競爭格局

- 公司簡介

- Amcor Group GmbH

- Gerresheimer AG

- Plastipak Holdings Inc.

- ALPLA Group

- Berry Global Inc.

- Alpha Packaging Inc.

- Graham Packaging

- Resilux NV

- Greiner Packaging International GmbH

- Comar LLC

- 熱圖分析

- 競爭對手分析-新興企業vs. 現有公司

第8章 回收與永續性前景

第9章:市場的未來

The Europe Plastic Bottles And Containers Market size is estimated at USD 36.54 billion in 2025, and is expected to reach USD 44.18 billion by 2030, at a CAGR of 3.87% during the forecast period (2025-2030).

Key Highlights

- Plastic bottles and containers manufactured from materials like polyethylene terephthalate, polypropylene, and polyethylene, dominate the packaging landscape. Their lightweight and durable nature makes them a preferred choice for manufacturers, primarily due to their cost-effectiveness. This, coupled with the global reliance on packaged foods and beverages, sets the stage for a significant impact on the plastic bottles and containers market in the coming years.

- The surge in plastic adoption is directly tied to its lightweight properties. This not only aids in energy conservation during transportation but also reduces emissions. Plastic's weight advantage becomes even more apparent when compared to heavier alternatives like glass, which necessitate more trips for transportation.

- While plastic bottles and containers can be crafted from various materials, those made from polyethylene terephthalate (PET) stand out for their durability, versatility, and cost-efficiency. As Europe's food, beverage, and pharmaceutical sectors expand and innovate, the demand for plastic packaging, especially PET bottles, rises in tandem. The industry's trend of introducing new beverages in diverse flavors and packaging styles further bolsters the demand for rigid plastic bottles.

- The beverage sector, in particular, heavily leans on plastic bottles, driven by the perpetual demand for bottled water and non-alcoholic drinks. Consumers seek bottled water for its perceived purity, shunning potentially contaminated tap water, and valuing the convenience and portability it offers.

- Highlighting environmental concerns, a European Commission study underscored the prevalence of PET bottles and their lids in ocean debris. In response, the European Council has rolled out stringent regulations, aiming to curb the use of single-use plastics and set ambitious recycling targets.

- Amid mounting worries over plastic pollution, both manufacturers and consumers are exploring eco-friendlier packaging alternatives. This shift is evident in the rising adoption rates of aluminum and glass, lauded for their recyclability and environmentally conscious attributes.

- Illustrating this trend, in March 2024, Europe's Brookfield Drinks made waves by announcing the launch of a 100% Prevented Ocean Plastic bottle. This innovative bottle, part of their NEO WTR range, is set to debut in 250 Tesco superstores. Brookfield Drinks' initiative marks a significant milestone, outpacing major soft drink brands by introducing a new spring water range in the industry's first fully recycled ocean-bound plastic bottle, complete with a recyclable cap and label.

Europe Plastic Bottles and Containers Market Trends

The Beverages Segment is Expected to Hold a Significant Market Share

- The beverage industry is driving significant growth in the market under study. Plastic containers and bottles are gaining popularity within this sector, prompting manufacturers to cater not only to beverages but also to other end-user industries. Lightweight packaging has emerged as a pivotal force in the packaging industry, owing to its dual benefits: economic efficiency and environmental friendliness. Given their lightweight nature, plastic bottles and containers reduce energy consumption during transportation, leading to lower fuel usage, reduced carbon emissions, and decreased costs for distributors and retailers.

- As per the 2024 Annual Report by the British Soft Drink Association, the United Kingdom consumed 3,027 million liters of bottled water in 2023, with plastic bottles representing a dominant 95.2% share. With bottled water consumption on the rise, the demand for rigid plastic bottles in the beverage sector is set to surge.

- Plastic bottles, due to their cost-effectiveness and barrier properties, hold a lion's share in the United Kingdom's beverage landscape. They make up 68% of soft drink consumption, 53% of carbonated drinks, 95% of dilutables, and 42% of sports and energy drinks, as highlighted in the British Soft Drink Association's findings.

- Across the European plastic bottles and containers market, there's a notable uptick in sustainability initiatives. These include a shift towards sustainable raw materials like bioplastics and integrating recycled content into product lines, all aimed at fostering innovation. The ambitious targets set by the Single-Use-Plastic Directive - 25% recycled content by 2025 and 30% by 2030 - are poised to revolutionize the industry. Manufacturers are thus compelled to invest in recycling technologies, signaling a steadfast commitment to sustainability.

- With beverage consumption on the rise, the demand for plastic bottles and containers for bottled water, carbonated drinks, or milk is surging. Germany, for instance, saw its per capita soft drink consumption climb from 114.7 liters in 2020 to a projected 124.9 liters in 2023, underscoring the country's robust appetite for plastic packaging.

Germany is Expected to Witness Significant Growth

- Germany is increasingly embracing plastic packaging solutions, driven by advancements from both solution providers and end users. The renowned consumer perception of "Made in Germany" products has notably favored the region's flexible packaging companies.

- The German government has implemented stringent regulations for the plastic packaging industry. While PET bottles are prevalent across various sectors, polyethylene (PE) bottles dominate sales in beverages, cosmetics, sanitary, and detergent segments.

- With a surge in cosmetic consumption and continuous innovation in plastic packaging technology, the market is poised for growth. Plastic, known for its lightweight, cost-effectiveness, and hygienic properties, is particularly well-suited for cosmetics, especially those with shorter shelf lives. Transparent, airtight, and easily moldable with good compressive strength, PET plastic bottles are enhancing the visual appeal of high-end cosmetics, indicating a promising future for this segment.

- PET finds common use in both bottles and jars, especially favored for aggressive cosmetics. On the other hand, polyvinyl chloride (PVC) is generally shunned due to its potential to react with and distort materials, not to mention its association with hazardous components. The study covers a range of applications, including skincare, haircare, oral care, makeup, deodorants, fragrances, and more.

- Germany boasts a robust beauty and personal care market, witnessing rapid growth. According to the Personal Care and Detergent Industry Association e. V., the market value surged from USD 14,722.9 million in 2021 to USD 17,156.9 million in 2023. This expanding personal care market underscores Germany's significance in the growth of plastic bottles and containers.

Europe Plastic Bottles and Containers Industry Overview

The market studied is fragmented, with some significant players such as Alpha Group, Amcor PLC, Gerresheimer AG, Berry Global Inc., Plastipak Holdings Inc., and Graham Packaging Company LP. These companies increase their market shares by launching new products and forming partnerships and mergers. Some of the recent developments are:

- October 2023 - Berry Global Group introduced a rPET bottle specifically for the upscale water brand, NEUE. This launch marks a significant step as Berry Globalprovides 100% recycled PET bottles for NEUE's premium artesian mineral water. NEUE Water is designed with the contemporary, fast-paced lifestyle in mind. In addition to its eco-friendly composition, the bottle's innovative flat shape ensures convenient portability, fitting seamlessly into pockets, bags, and even seatback storage on various modes of transport.

- October 2023 - Plastipak and PVG Liquids have jointly engineered a 375g preform tailored for a 20-liter stackable container, designed to significantly slash PET consumption by 500 tons in the coming years. This innovation is projected to curtail CO2 emissions by approximately 200 tons annually. The production, situated at Plastipak's Verbania plant in Italy, is a strategic move to minimize emissions during transit. The container itself is crafted from a novel low-crystallinity resin, paired with the innovative preform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Growing Environmental Concerns Over the Use of Plastics

- 5.3 Trade Scenario

- 5.3.1 EXIM Data

- 5.3.2 Trade Analysis (Top 5 Import-Export Countries, Price Analysis, and Key Ports, Among others)

- 5.4 Trade Analysis (Top 5 Import-Export Countries, Price Analysis, and Key Ports, Among others)

- 5.5 Industry Regulation, Policy and Standards

- 5.6 Technology Landscape

- 5.7 Pricing Trend Analysis

- 5.7.1 Plastic Resins (Current Pricing and Historic Trends)

6 MARKET SEGMENTATION

- 6.1 By Resin

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Resin Type (Polystyrene, PVC, Polycarbonate, etc.)

- 6.2 By Product

- 6.2.1 Bottles

- 6.2.2 Jars

- 6.2.3 Canisters

- 6.2.4 Boxes

- 6.2.5 Gallons

- 6.2.6 Tubs

- 6.2.7 Other Products

- 6.3 By End-use Industries

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.2.1 Bottled Water

- 6.3.2.2 Carbonated Soft Drinks

- 6.3.2.3 Milk

- 6.3.2.4 Other Beverages

- 6.3.3 Pharmaceuticals

- 6.3.4 Personal Care & Toiletries

- 6.3.5 Industrial

- 6.3.6 Household Chemicals

- 6.3.7 Paints & Coatings

- 6.3.8 Other End-use Industries

- 6.4 By Country

- 6.4.1 France

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 United Kingdom

- 6.4.5 Spain

- 6.4.6 Poland

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Gerresheimer AG

- 7.1.3 Plastipak Holdings Inc.

- 7.1.4 ALPLA Group

- 7.1.5 Berry Global Inc.

- 7.1.6 Alpha Packaging Inc.

- 7.1.7 Graham Packaging

- 7.1.8 Resilux NV

- 7.1.9 Greiner Packaging International GmbH

- 7.1.10 Comar LLC

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players