|

市場調查報告書

商品編碼

1626323

中東和非洲:塑膠瓶和容器市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

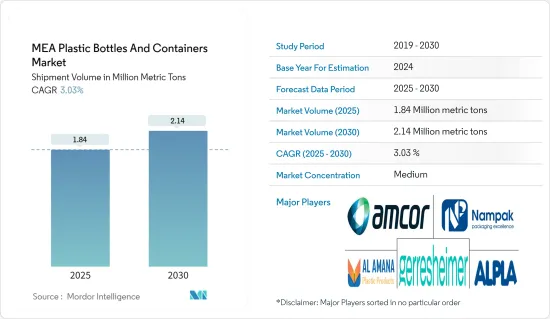

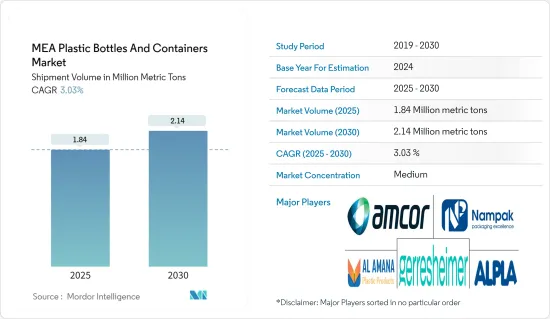

中東和非洲塑膠瓶和容器市場規模(以出貨量為準)預計將從2025年的184萬噸成長到2030年的214萬噸,預測期間(2025-2030年)複合年成長率為3.03%。將會完成。

主要亮點

- 塑膠包裝因其重量輕且易於處理而受到消費者的歡迎。同樣,由於生產成本較低,各大製造商也更喜歡使用塑膠包裝解決方案。此外,聚對苯二甲酸乙二醇酯(PET)和高密度聚苯乙烯(HDPE)聚合物的採用正在擴大塑膠瓶的應用。瓶裝水和軟性飲料市場對寶特瓶的需求不斷增加。

- 該地區擁有強大的消費基礎,推動了各種最終用戶(主要是食品和飲料、製藥和工業領域)對塑膠包裝形式的需求。以都市區為基礎的中東人口越來越受到全球文化的影響,導致對國際美食、即食食品和食品宅配平台的需求不斷成長。這些現代化趨勢刺激了對簡便食品包裝產品的需求。由於對寶特瓶和容器的持續需求,該地區的大規模生產也在有機成長。

- 此外,根據阿拉伯飲料協會 (ABA) 的數據,飲料業務是阿拉伯世界成長最快的業務之一。阿拉伯聯合大公國市場提供的主要產品包括果汁、麥芽、非酒精飲料、軟性飲料、水、運動飲料和甜酒。製造商正在積極投資該市場,並觀察到該國的顯著成長率。例如,西得樂最近為杜拜的一家寶特瓶公司安裝了最快的單線。該生產線是為阿拉伯聯合大公國水瓶製造商 Mai Dubai 創建的,是西得樂 Super Combi 解決方案的一部分。

- 預計市場將面臨重大挑戰,主要是由於環境問題日益嚴重而導致監管措施動態變化。該地區各國政府正在回應社會對塑膠包裝廢棄物,特別是塑膠包裝廢棄物的擔憂,並實施法規以盡量減少環境廢棄物並改善廢棄物管理流程。

- 雖然中東和非洲的整體塑膠包裝業務因疫情爆發而放緩,但瓶子和容器等塑膠包裝選擇重量輕、不易損壞且易於消費者使用,使其成為電器的熱門商品產品。此外,由於生產成本較低,主要製造商更喜歡塑膠包裝。

中東和非洲塑膠瓶和容器市場趨勢

飲料業預計將顯著成長

- 受該地區各國衛生署的主導的影響,對健康飲料的需求預計將增加。由於該地區許多國家都禁止飲酒,因此人們正在考慮將能量飲料和健康飲料等軟性飲料作為替代品。此外,根據 2023 年 3 月發表的《世界旅遊市場》報導,Z 世代消費者更喜歡新的飲料類別而不是酒精,例如無酒精調飲、大麻飲料、康普茶和新蘇打水。

- 該地區對瓶裝水的需求大幅增加。此外,消費者越來越意識到對健康飲食的需求。對瓶裝水的需求不斷成長預計將促進該地區瓶裝水包裝市場的成長。此外,包裝水和其他軟性飲料的寶特瓶也有大量需求。例如,Almarai 透過策略投資發展業務。

- 此外,生物分解性塑膠的出現預計也將影響不斷成長的消費市場。西得樂表示,更健康產品和永續性的需求是影響中東和非洲PET包裝產業的兩大趨勢。消費者的健康意識越來越強,轉向更有營養的產品,遠離含糖軟性飲料。從長遠來看,這些趨勢可能會影響所研究市場的成長。

- 據包裝設備製造商克朗斯稱,中東和非洲的包裝飲料消費量預計將從2021年的1,184億公升增加到2024年的1,271億公升。包裝飲料的持續成長預計將在預測期內加強該地區對塑膠瓶的需求。

- 日本對塑膠的使用有嚴格的規定。這迫使製造商選擇新的包裝替代品,例如Oxo可分解塑膠。公司越來越關注將 PET 回收到飲料容器等食品級產品的緊迫性。例如,可口可樂公司計劃在 2030 年之前在其容器中使用 50% 的回收 PET。

南非可望佔較大市場

- 南非是中東和非洲的主要貢獻者。由於可支配收入的增加和對偶爾飲酒的接受,市場正在擴大。由於都市化不斷提高以及製造商產品推出數量增加,南非飲料市場的開發前景盈利。

- InterGest South Africa 表示,食品和飲料產業的電子商務領域正在崛起。 2021年,電子商務產業將成長約12.2%,市場規模約9,525萬歐元(1.0444億美元)。 2021年至2025年,食品飲料電商板塊預計將以年均7.66%的成長。

- 此外,南非對奢華和體驗式瓶裝水的需求正在上升。由於需要清潔的飲用水,南非對瓶裝水的需求量很大。水侍酒師的興起和只提供最好的瓶裝水的餐廳的興起是這種優質化的明顯徵兆。一個典型的例子是位於約翰內斯堡海德公園的 KL Izakhaya 餐廳,該餐廳提供特殊的優質瓶裝水菜單,每瓶起價為 650 南非蘭特(35.42 美元)。

- 由於啤酒、葡萄酒和其他低度酒精飲料的優質化以及越來越多的富裕年輕人對酒精消費感興趣,預計南非酒精飲料市場將在預測期內擴大。塑膠瓶作為啤酒和其他酒精飲料的替代包裝形式越來越受歡迎。

- 南非擁有非洲大陸最大的化妝品和個人保健產品市場。雖然化妝品具有很大的價值,但它們也很容易腐爛。因此,包裝材料的品質以及適當的包裝、運輸、儲存和分銷條件對於維持產品完整性至關重要。聚乙烯 (PE) 是一種高度耐用的塑膠,以其耐化學性和成本績效而聞名。源自石油聚合物的PE耐環境破壞,主要分為高密度聚苯乙烯(HDPE)和低密度聚乙烯(LDPE)。

- 據南非貿易和工業部稱,化妝品和個人護理領域近年來一直呈成長趨勢,預計將從2018年的31億美元成長到2023年終的34億美元。塑膠瓶引領化妝品包裝市場。預計在預測期內,對旨在改善護膚和頭髮護理等狀況的產品的需求不斷成長,將推動瓶子使用量的成長。

中東和非洲塑膠瓶及容器產業概況

中東和非洲的塑膠瓶和容器市場本質上是半固體的。主要參與企業包括 Amcor PLC、Graham Packaging Company、Plastipak Holdings Inc. 和 ALPLA Group。食品和飲料需求的增加預計將為塑膠瓶市場帶來顯著的成長機會。因此,許多公司將這個市場視為新興市場。我想宣布一些最近的趨勢。

- 2024 年 5 月 2024 年 5 月:Alpla 與安哥拉飲料巨頭 Refriango 合作運作了第二家工廠,名為 Alpla Sopro。 Alpura 和 Refriango 正在應對安哥拉及其鄰國對優質飲料和瓶裝水日益成長的需求。全球包裝專家 Alpla 表示,作為一項戰略舉措,Refriango 維亞納工廠的新工廠專注於「安全、實惠且永續」的塑膠包裝。透過此次擴張,兩家公司的目標是提高效率和產能,同時最大限度地減少碳排放。

- 2023 年 2 月,Al Ain Water 在阿拉伯聯合大公國推出了第一個 100% 再生聚對苯二甲酸乙二酯 (rPET) 瓶。正如執行長艾倫史密斯所說,如果正確回收和再利用,塑膠是一種寶貴的資源。該公司正在與阿拉伯聯合大公國政府和其他相關人員密切合作,為 PET 包裝創建收集、回收和再利用系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 市場促進因素

- 更多採用輕量化包裝方法

- 對永續和創新食品包裝產品的需求不斷成長

- 市場問題

- 使用塑膠的環境問題

第5章市場區隔

- 按原料分

- 聚對苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他

- 按最終用戶產業

- 飲料

- 食物

- 化妝品

- 藥品

- 家居用品

- 其他

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

第6章 競爭狀況

- 公司簡介

- ALPLA Group

- Nampak Ltd

- Gerresheimer AG

- Amcor PLC

- Al Amana Plastic LLC

- Mpact Plastics

- Packnet SA

- Alpha Packaging

- Emirates Plastic Industries Factory

- Takween Advanced Industries

第7章 投資分析

第8章市場的未來

The MEA Plastic Bottles And Containers Market size in terms of shipment volume is expected to grow from 1.84 million metric tons in 2025 to 2.14 million metric tons by 2030, at a CAGR of 3.03% during the forecast period (2025-2030).

Key Highlights

- Plastic packaging is becoming popular among consumers as it is lightweight and easy to handle. Similarly, even major manufacturers prefer to use plastic packaging solutions owing to their lower production costs. Moreover, the introduction of polyethylene terephthalate (PET) and high-density polyethylene (HDPE) polymers is expanding the plastic bottling applications. The market is witnessing an increasing demand for PET bottles in the bottled water and soft drink markets.

- The region has a considerable consumer base that pushes the demand for plastic packing formats for different end users, mainly food and beverage, pharmaceutical, and industrial sectors. The urban-centric Middle Eastern population is increasingly influenced by global culture, leading to a heightened demand for international cuisines, ready-to-eat meals, and food delivery platforms. This trend toward modernization is fueling the demand for convenient food packaging products. With the constant demand for plastic bottles and containers, there is also an organic expansion for large-scale production in the region.

- Furthermore, the beverage business is one of the fastest growing in the Arab world, according to the Arab Beverages Association (ABA). The significant products offered at UAE's marketplaces include juices, malt, non-alcoholic beverages, soft drinks, water, sports drinks, and cordials. The manufacturers are actively investing in the market, observing significant growth rates in the country. For instance, recently, Sidel installed one of the fastest single lines for a PET bottle company in Dubai. The line was created for Mai Dubai, a water bottle manufacturer in the United Arab Emirates, and is one of Sidel's Super Combi solutions.

- The market is anticipated to be significantly challenged owing to the dynamic changes in regulatory measures, primarily due to increasing environmental concerns. Governments across the region are responding to public problems regarding plastic packaging waste, especially plastic packaging waste, and implementing regulations to minimize environmental waste and improve waste management processes.

- Although there has been slow down in the overall plastic packaging businesses in the Middle East and Africa owing to the breakout of the pandemic, plastic packaging options like bottles and containers have consequently become a popular choice for e-commerce products as it is lightweight and indestructible, making it easy for consumers to use. Also, major manufacturers prefer plastic packaging due to the low cost of production.

MEA Plastic Bottles And Containers Market Trends

The Beverages Segment is Expected to Witness Significant Growth

- The demand for health drinks is expected to increase, influenced by the campaigns led by the ministries of health in various countries in the region. Due to the ban on alcohol in many countries in the region, soft drinks, such as energy and health drinks, are considered substitutes. Also, according to the World Travel Market article published in March 2023, more than alcohol, Gen Z consumers prefer newer categories of drinks like mocktails, cannabis-infused drinks, kombucha, and new soda.

- The demand for bottled water increased significantly in the region. In addition, consumers are more conscious of the need for healthier diets. The increased demand for bottled water, in turn, is expected to augment the growth of the bottled water packaging market in the region. Moreover, there is a significant demand for PET bottles for water and other soft drinks packaging. For instance, Almarai developed its business through strategic investments.

- Moreover, the emergence of biodegradable plastics is also expected to impact the growing consumer markets. According to Sidel, the demand for healthier products and sustainability are the two biggest trends impacting the PET packaging industry in Middle East and Africa. Since consumers are becoming more health conscious, moving toward nutritional products and away from sugary soft drinks, etc. These trends can impact the growth of the studied market in the long term.

- According to packaging equipment manufacturer Krones, the consumption of packed beverages in Middle East and Africa is expected to increase from 118.4 billion liters in 2021 to 127.1 billion liters in 2024. This consistent growth of packaged beverages is expected to bolster the demand for plastic bottles in the region during the forecast period.

- Stringent regulations for the use of plastic are imposed in the country. This forces manufacturers to opt for new packaging alternatives, such as oxo-degradable plastics. Companies are increasingly focusing on the urgency of recycling PET into food-grade products, such as beverage containers. For instance, The Coca-Cola Company intends to use 50% recycled PET in its containers by 2030.

South Africa is Anticipated to Hold a Substantial Market

- South Africa is a major contributor to Middle East and Africa. The market is expanding due to rising disposable income and the acceptability of occasional drinking. The profitable prospect for developing the South African beverage market is being provided by increasing urbanization and manufacturers' growing launch of new products.

- According to InterGest South Africa, the e-commerce sector of the food and beverage industry is rising. In 2021, the e-commerce sector grew by approximately 12.2%, resulting in a market volume of approximately EUR 95.25 million (USD 104.44 million). From 2021 to 2025, the food and beverage e-commerce sector is expected to grow at an average annual rate of 7.66%.

- Moreover, in South Africa, bottled water is witnessing an increase in demand for high-end goods and experiences. Bottled water in South Africa is in high demand due to the need for clean drinking water. The rise of water sommeliers and restaurants serving only the best-bottled water are clear signs of this premiumization. A prime example is the KL Izakhaya restaurant in Hyde Park, Johannesburg, which offers a special menu of luxury bottled water with items starting at ZAR 650 (USD 35.42) a bottle.

- The market for alcoholic beverages in South Africa is anticipated to expand during the forecast period due to the country's premiumization of beer, wine, and other light alcoholic beverages and the rising number of affluent young adults becoming interested in alcohol consumption. The plastic bottle is becoming increasingly popular as an alternative packaging format for beer and other alcoholic beverages.

- South Africa boasts the continent's largest market for cosmetics and personal care products. While cosmetics hold significant value, they are also highly perishable. Therefore, the quality of packaging materials and the right conditions for packaging, transport, storage, and distribution are vital to preserving the product's integrity. Polyethylene (PE), a highly durable plastic, stands out for its chemical resistance and cost-effectiveness. Derived from petroleum polymers, PE is resilient against environmental hazards and is mainly categorized into high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- According to the Department of Trade and Industry, South Africa, the cosmetics and personal care sector has been increasing in the past few years, and it was forecasted to be valued at USD 3.4 billion by the end of 2023, up from USD 3.1 billion in 2018. Plastic bottles lead the cosmetics packaging market. The rising demand for products aimed at enhancing conditions like skin and hair care is projected to drive the growth of bottle usage during the forecast period.

MEA Plastic Bottles And Containers Industry Overview

The Middle East and Africa plastic bottles and containers market is semi-consolidated in nature. Some of the major players are Amcor PLC, Graham Packaging Company, Plastipak Holdings Inc., and ALPLA Group. Factors such as the increasing demand for food and beverages will provide considerable growth opportunities in the plastic bottle market. Therefore, many companies are seeing this market as an emerging market. Some of the recent developments are:

- May 2024: Alpla, in collaboration with Refriango, an Angolan beverage leader, inaugurated their second in-house facility, named Alpla Sopro. Alpla and Refriango are addressing the rising demand for premium beverages and bottled water in Angola and its neighboring nations. In a strategic move, the global packaging expert, this new plant, situated at Refriango's Viana site, emphasizes "safe, affordable, and sustainable" plastic packaging. With this expansion, both companies aim to boost efficiency and capacity, all while minimizing their carbon footprint.

- February 2023: Al Ain Water introduced the first locally produced 100% recycled polyethylene terephthalate (rPET) bottle in the United Arab Emirates. As per the Chief Executive Officer, Alan Smith, plastic is a valuable resource if recycled and reused correctly. The company is working closely with the government of the United Arab Emirates and other interested parties to create a collection, recycling, and reuse system for PET-based packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of Lightweight Packaging Methods

- 4.4.2 Rising Demand for Sustainable and Innovative Food Packaging Products

- 4.5 Market Challenges

- 4.5.1 Environmental Concerns Regarding the Use of Plastics

5 MARKET SEGMENTATION

- 5.1 By Raw Materials

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High Density Polyethylene (HDPE)

- 5.1.5 Other Raw Materials

- 5.2 By End-user Vertical

- 5.2.1 Beverages

- 5.2.2 Food

- 5.2.3 Cosmetics

- 5.2.4 Pharmaceuticals

- 5.2.5 Household Care

- 5.2.6 Other End-user Verticals

- 5.3 By Country

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ALPLA Group

- 6.1.2 Nampak Ltd

- 6.1.3 Gerresheimer AG

- 6.1.4 Amcor PLC

- 6.1.5 Al Amana Plastic LLC

- 6.1.6 Mpact Plastics

- 6.1.7 Packnet SA

- 6.1.8 Alpha Packaging

- 6.1.9 Emirates Plastic Industries Factory

- 6.1.10 Takween Advanced Industries