|

市場調查報告書

商品編碼

1689744

美國數位電子看板:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)US Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

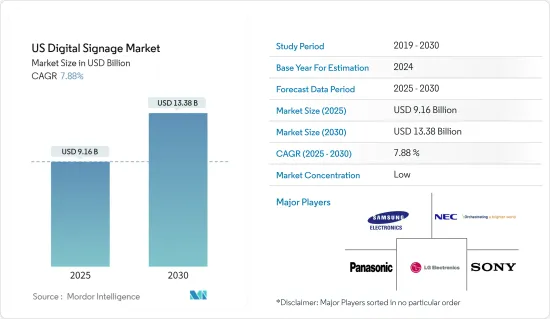

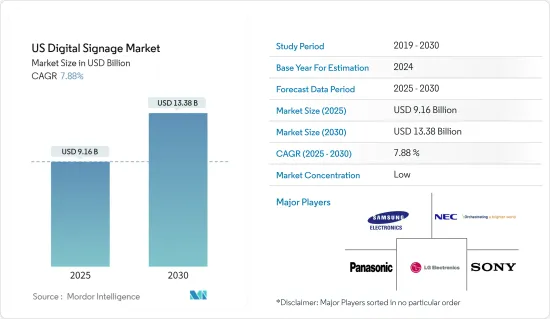

預計 2025 年美國數位電子看板市場規模為 91.6 億美元,到 2030 年將達到 133.8 億美元,預測期內(2025-2030 年)的複合年成長率為 7.88%。

數位電子看板系統傳遞和顯示數位影像、影片、串流媒體和資訊等內容。在內容管理系統中對展示的內容進行歸檔,並對日程資訊進行編輯。資料儲存在CMS中並傳送至媒體播放機。

主要亮點

- 由於顯示、連接和監控領域的技術進步,數位電子看板在美國越來越受歡迎。而且隨著顯示面板的普及,顯示面板的價格也大幅下降。

- 數位戶外指示牌是視聽市場的一部分,該市場在過去十年中穩步成長,並且這種成長速度仍在加速。數位戶外指示牌現在幾乎應用於每個行業,包括餐廳、飯店、零售店、交通和娛樂活動。根據Screen Fluency 2021的統計數據,指示牌吸引76%的美國消費者進入他們從未去過的商店。 68% 的美國人因為指示牌而購買產品或服務。

- 與靜態印刷標牌相比,數位內容更容易被消費者註意和記住。造成這種情況的原因有很多,但最主要的原因是人們被運動、色彩和新鮮感所吸引。

- 隨著對改善客戶體驗的需求日益成長,數位化整合舉措正被部署到整個連鎖店用於各種目的。承包解決方案在當前市場中需求龐大,以滿足此類需求並協調專業數位電子看板的所有元素。

- 對於廣告等數位電子看板應用,管理消費者隱私對於維護消費者信任至關重要。除非該行業採取強力的自我規範,否則可能會面臨消費者的強烈反對和政府的不情願監管,從而抑制創新。

- 在疫情期間,各公司開發了一些產品來教育消費者採取預防措施,以限制病毒的傳播。例如,Allsee 開發了乾洗手劑安卓廣告顯示器,它將可即時更新的 LCD 面板與自動洗手液分配器結合在一起。

美國數位電子看板市場趨勢

OLED 顯示器顯著成長

- OLED 技術使尖端的新型消費顯示器成為可能,並顯著提高了影像品質。它通常被譽為數位顯示器和螢幕的未來發展方向。

- OLED 提供的高真實感和動態形狀使其成為唯一能夠克服傳統顯示器缺點的技術。 有機發光二極體基於獨立發光光源,提供更出色的光線和色彩表現力。尖端有機發光二極體材料已被開發,使其具有柔韌性和高度透明性。

- 有機發光二極體顯示器沒有背光,因此具有極高的對比度(本質上是“無限”對比度)。 OLED 顯示器具有真正的黑色背景,這是 LCD 所沒有的。

- 由於 OLED 具有增強的媒體演示效果、能源效率和重量輕等特點,它擴大用於室內品牌和體驗媒體的數位電子看板。

- 一種被稱為量子點 OLED (QD-OLED) 的全新顯示技術將於 2022 年推出。由於SONY和三星推出的新電視以及戴爾的 Alienware 系列電腦顯示器,QD-OLED 已經開始改變電視格局。

零售業滲透率最高

- 為了利用先進的指示牌技術,零售商正在整合其可用的數位工具,以在店內共用相關的資訊內容,將數位廣告整合到零售地點,並增強店內用戶體驗。

- 公司正在融合數位和實體購物模式來創造一致的多通路體驗。

- 此外,零售商正在努力即時更新用戶互動螢幕,以反映商店中的當前趨勢,例如年齡和性別,促銷特定產品或從螢幕上移除售罄的商品。

- 據 Scala 數位電子看板稱,74% 的美國零售商認為創造引人入勝的店內顧客體驗非常重要,預計 42% 的銷售額將來自線上、行動和社交商務網站。

- 許多千禧世代的消費者造訪零售店是為了獲得互動體驗。由於零售商店中的多個螢幕上顯示多個廣告,超過 40% 的消費者往往會忽略指示牌,這給廣告內容提供者帶來了重大問題。

美國數位電子看板產業概況

美國數位電子看板市場相當整合,有許多大公司提供解決方案。市場參與者將產品創新視為增加市場佔有率的一條有利可圖的途徑。因此,現有參與者和新參與者都在大力投資研發能力,以推出新產品和開發市場,從而佔領最大的市場佔有率。

- 2022 年 4 月 -Sharp CorporationNEC 顯示解決方案將在巴塞隆納 ISE 2022 上展示兩種可實現更好的混合工作場所協作的顯示解決方案。 55 吋 NEC MultiSync WD551 Windows 協作顯示器和 70 吋Sharp Corporation PN-CD 701 協作顯示器。

- 2022 年 3 月—Planar 宣布推出兩個新的 LED電視牆顯示器系列,旨在滿足快節奏活動和高照度環境的需求:Planar Luminate Pro 系列和 Planar Venue Pro 系列。新系列採用機械元件,可加快臨時或移動活動的安裝和拆卸速度,同時還提供完整的前端安裝和可維護性,為更多永久壁掛式應用程式打開了大門。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 分銷通路分析

- 產業價值鏈分析

- 技術簡介

- 美國數位電子看板解決方案的演變

- 推動採用的關鍵技術趨勢

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 承包解決方案的演變

- 與傳統方法相比,推動情境廣告成長的趨勢

- 美國數位戶外媒體支出穩定成長,持續促進市場成長

- 市場挑戰/限制

- 對侵犯客戶隱私的擔憂

第6章 市場細分

- 按類型

- 硬體

- LCD/LED 顯示器

- OLED 顯示器

- 媒體播放機

- 投影機/投影螢幕

- 其他硬體

- 軟體

- 服務

- 硬體

- 按最終用戶

- 零售

- 運輸

- 飯店業

- BFSI

- 教育

- 政府

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- NEC Display Solutions Ltd.

- Samsung Electronics Co. Ltd.

- LG Display Co. Ltd.

- Panasonic Corporation

- Sony Corporation

- Sharp Corporation

- Planar Systems Inc.

- Hitachi Ltd.

- Barco NV

- Goodview Electronic Co Ltd.

- Cisco Systems Inc.

第 8 章 主要數位電子看板軟體供應商分析

第9章投資分析

第10章 市場機會與未來趨勢

The US Digital Signage Market size is estimated at USD 9.16 billion in 2025, and is expected to reach USD 13.38 billion by 2030, at a CAGR of 7.88% during the forecast period (2025-2030).

A digital signage system delivers and displays content, such as digital images, video, streaming media, and information. The displayed content is filed, and the schedule information is edited in the content management system. The data is stored in the CMS and distributed to the media players.

Key Highlights

- Digital signage is gaining popularity in the United States due to the recent technological advancement in the display, connectivity, and monitoring space. Furthermore, the increasing adoption has resulted in the prices of display panels coming down significantly.

- Digital outdoor signage is one part of the audio and visual market that has grown steadily over the last decade, and that growth is only accelerating. Digital outdoor signage is now being used in almost every industry, with applications in restaurants and hotels, retail places, transit facilities, and entertainment events. According to screen fluency 2021 statistics, because of the signage, 76% of American consumers enter stores they had never visited before. 68% of Americans have paid for a product or service because its signage drew their attention.

- Digital content is considerably more likely to be noticed and remembered by consumers than static print-based signs. There are several reasons at work here, but the primary one is that people are drawn to movement, color, and freshness.

- The rising need for enhanced customer experience has created a dramatic surge in digital integration initiatives rolling out on a chain-wide basis in various applications. Turnkey solutions are witnessing huge demand in the current market scenario to cater to this demand and organize and coordinate all elements of specialized digital signage.

- Control of consumer privacy is essential for digital signage applications, such as advertising, to maintain consumer trust, which, in turn, is crucial if the industry is to continue growing at its current explosive pace. Unless the industry adopts robust self-regulation, it will likely face consumer backlash and reactive government regulation that may stifle innovation.

- During the pandemic, companies developed products to make consumers aware of the preventive measures to reduce virus flow. For Example, Allsee created hand sanitizer Android advertising displays that combine an immediately updatable LCD panel with an automatic hand sanitizer dispenser.

United States Digital Signage Market Trends

OLED Displays to Grow Significantly

- OLED technology allows for cutting-edge new consumer display screens and noticeably increased image quality. It is usually praised as the future direction of digital displays and screens.

- Due to the heightened reality and dynamic form that OLED delivers, it is the only technology that gets around the drawbacks of traditional displays. OLED offers greater light and color expression based on light sources that generate light independently. Because of the creation of cutting-edge OLED materials, it is flexible and transparent.

- OLED displays perform remarkably well in contrast (basically delivering an "infinite" contrast ratio) since they don't have a backlight. OLED displays have an exact black backdrop, which LCDs do not have.

- OLED is increasingly being used in digital signage for indoor branding and experiential media because of its enhanced media presentation, energy efficiency, and lightweight.

- A brand-new display technology known as Quantum Dot OLED, or QD-OLED, was launched in the year of 2022. As a result of new TV models from Sony and Samsung, as well as computer monitors from Dell's Alienware line, QD-OLED has already begun to transform the TV landscape.

Retail Sector to Exhibit Maximum Adoption

- In order to leverage advanced signage technologies, the retail players are integrating the digital tools at their disposal to share relevant and profitable content at their premises and integrate digital ads into their retail stores to create a distinct in-store user experience.

- The companies are fusing the digital and physical modes of shopping to create a cohesive multichannel experience, thus, reshaping different parameters, such as prices, contents, features, mode of advertisement, etc.

- Moreover, retailers are striving to update the user-interactive screens in real-time to reflect the current trends in terms of in-store age or gender demographics to promote specific items or remove sold-out products from the screen.

- According to Scala Digital Signage, 74% of US retailers believe that creating an engaging in-store customer experience is important, and 42% of sales are projected to come from online, mobile, and social commerce sites.

- Most millennial shoppers visit retail stores to have an interactive experience. As retail stores display multiple ads on multiple screens, over 40% of consumers tend to ignore signage, which is a major problem for advertising content providers.

United States Digital Signage Industry Overview

The United States Digital Signage Market is moderately consolidated, with many major players in the United States providing the solution. The market players are viewing product innovation as a lucrative path toward expanding their market share. Hence, the new players, as well as the existing players, are significantly investing in their R&D capabilities and launching new products or making product developments to capture the maximum market share.

- April 2022 - Sharp NEC Display Solutions is about to showcase two display solutions for better hybrid workplace collaboration at ISE 2022, to be held in Barcelona. The 55'' NEC multisync WD551 windows collaboration display and the 70'' sharp PN- CD 701 collaboration display.

- March 2022 - Planar has launched two new LED video wall display families designed to serve the needs of fast-paced events and high-ambient light environments; the Planar Luminate Pro Series and Planar Venue Pro Series. The new families feature mechanical elements that accelerate set-up and takedown for temporary and mobile events but also feature full front installation and serviceability, opening the door to more permanent wall-mounted applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.5.1 Evolution of Digital Signage Solutions in the United States

- 4.5.2 Key Technological Trends to Drive Adoption

- 4.6 Assessment of the Impact Of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Turnkey Solutions

- 5.1.2 Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising

- 5.1.3 Steady Increase in DOOH Spending in the United States to Continue to Supplement Market Growth

- 5.2 Market Challenges/Restraints

- 5.2.1 Concerns Over Invasion of Customer Privacy

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 LCD/LED Display

- 6.1.1.2 OLED Display

- 6.1.1.3 Media Players

- 6.1.1.4 Projectors/ Projection Screens

- 6.1.1.5 Other Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.1.1 Hardware

- 6.2 By End User

- 6.2.1 Retail

- 6.2.2 Transportation

- 6.2.3 Hospitality

- 6.2.4 BFSI

- 6.2.5 Education

- 6.2.6 Government

- 6.2.7 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NEC Display Solutions Ltd.

- 7.1.2 Samsung Electronics Co. Ltd.

- 7.1.3 LG Display Co. Ltd.

- 7.1.4 Panasonic Corporation

- 7.1.5 Sony Corporation

- 7.1.6 Sharp Corporation

- 7.1.7 Planar Systems Inc.

- 7.1.8 Hitachi Ltd.

- 7.1.9 Barco NV

- 7.1.10 Goodview Electronic Co Ltd.

- 7.1.11 Cisco Systems Inc.