|

市場調查報告書

商品編碼

1577720

電信網路營運商市場回顧(2024年第2季):資本投資連續5季下降,以年化計算約3,000億美元,營收年減1.4%,但有逐步改善的跡象。Telecommunications Network Operators: 2Q24 Market Review - Capex Falls for Fifth Straight Quarter, Pushing Annualized Total Down to ~$300B, but Modest Turnaround Looms, Revenues Dip 1.4% YoY |

||||||

本報告回顧了電信網路營運商市場的成長和發展。本報告追蹤了2011年第一季至2024年第二季全球 140 家營運商的廣泛財務統計資料。

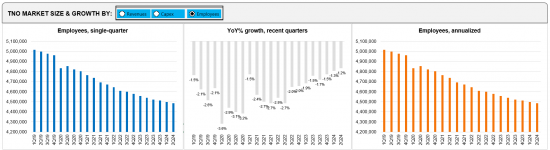

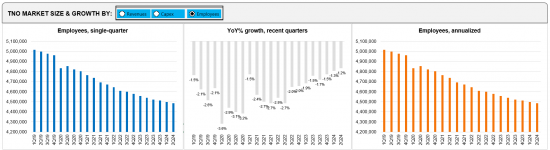

2024年第二季電信網路營運商年化收入為1.77兆美元(年增0.1%),人員費用為2629億美元(年增2.1%),資本投資3007億美元,下降6.9%。截至2024年6月員工人數約448萬人,較前一年減少1.2%。

資訊圖表

主要亮點:

- 營收:該航空公司的營收年減 1.4%,至 4,378億美元。2024年第二季年化營收為17,683億美元,年增0.1%。在營運商層面,2024年第二季營收成長(年化)前20名的公司中的5家是America Movil(8.0%)、STC(沙烏地電信)(5.8%)和BT(4.7%)、Telefonica (3.6%)。依照相同標準,同期成長最慢的是、NTT(-5.7%)、KDDI(-5.4%)、SoftBank(-4.7%)、Vodafone(-1.7%)、China Unicom(-1.6%)。

- 資本投資:截至2024年 6月的年度資本投資為 694億美元,比去年同期下降 8.0%。2024年第二季資本支出年化為3,007億美元,較去年同期下降6.9%。

- 財產稅/人員費用:2024年第二季電信業年化總OPEX為1,5027億美元,較去年同期小幅成長0.4%。剔除折舊及攤銷後,總營運成本較去年同期成長1.2%至11,722億美元。電信OPEX的關鍵要素之一是人員成本,包括薪資、薪資、獎金、福利、退休/退休福利等。2024年第二季年化人員費用年增2.1%,人員費用佔OPEX(不含D&A)的比例從2023年第二季的22.2%年化上升至2024年第二季本季略有上升至22.4 %。電信業從業人員448萬人,年減1.2%。

- 利潤率:2024年第二季的EBITDA 利潤率和 EBIT 利潤率以年化計算均較上季略有成長。與去年同期相比,結果好壞參半。年化息稅前利潤率從2023年第二季的15.3%下降至2024年第二季的15.0%,而2024年第二季 EBITDA 利潤率年化率為 34.4%,高於 33.7%。

- 地區趨勢:美洲地區超越亞洲,重新奪回最大地區的地位,2024年第二季的營收佔有率為 37.3%。然而,從資本投資的角度來看,亞洲超過了美洲,最新季的佔有率為 36.5%。2024年第二季,歐洲的年化資本強度最高,為 18.4%,其次是中東和非洲,為 17.4%。

目標業務業者

|

|

目標區域

|

|

目次

第1章 總結

第2章 市場概況

第3章 分析

第4章 截至2024年第二季的主要統計

第5章 勞動統計

第6章 營運商排名

第7章 公司深入分析

第8章 企業基準測試

第9章 依國家細分

第10章 依國家細分:依公司

第11章 區域細分

第12章 原始資料

第13章 訂閱者/流量

第14章 匯率

第15章 研究方法/範圍

第16章 關於本公司

This report reviews the growth and development of the telecommunications network operator (TNO, or telco) market. The report tracks a wide range of financial stats for 140 telcos across the globe, from 1Q11 through 2Q24. For the annualized 2Q24 period, telcos represented $1.77 trillion (T) in revenues (0.1% growth YoY), $262.9 billion (B) in labor costs (2.1% YoY), and $300.7B in capex (-6.9% YoY). They employed approximately 4.48 million people as of June 2024, down 1.2% from the prior year.

INFOGRAPHICS

Below are the key highlights of the report:

- Revenues: Telco topline declined by 1.4% year-over-year (YoY) to reach $437.8 billion (B) in the latest single quarter ending 2Q24. Revenues for the annualized 2Q24 period were $1,768.3B, up 0.1% YoY over the same period in the previous year. At the operator level, five of the top 20 best performing telcos by topline growth in 2Q24 on an annualized basis include America Movil (8.0%), STC (Saudi Telecom) (5.8%), BT (4.7%), Telefonica (3.6%), and Orange (2.9%). By the same criteria, the worst telco growth came from NTT (-5.7%), KDDI (-5.4%), SoftBank (-4.7%), Vodafone (-1.7%), and China Unicom (-1.6%) during the same period.

- Capex: Capex spending plunged by 8.0% on a YoY basis to post $69.4B in the latest single quarter ending June 2024. Capex for the annualized 2Q24 period was $300.7B, down 6.9% YoY over the same period in the previous year. At the operator level, five of the top 20 best performing telcos by capex growth in 2Q24 on an annualized basis include BSNL (128.2%), KDDI (23.6%), Telecom Italia (9.1%), Charter Communications (7.9%), and America Movil (7.6%). By the same criteria, the worst capex growth came from Verizon (-26.0%), Reliance Jio (-22.6%), Deutsche Telekom (-20.6%), Vodafone (-14.6%), and AT&T (-13.1%) during the same period.

- Opex and labor costs: Total opex for the telecom industry in the annualized 2Q24 period stood at $1,502.7B, a slight increase of 0.4% over the same period previous year. Excluding depreciation and amortization (D&A) costs, total opex increased by 1.2% on YoY basis to record $1,172.2B in the annualized 2Q24 period. One significant element of telco opex is labor costs, which include salaries, wages, bonuses, benefits, and retirement/severance costs. Labor costs grew by 2.1% YoY in the annualized 2Q24 period, pushing labor costs as a percentage of opex (excluding D&A) slightly up from 22.2% in 2Q23 to 22.4% in 2Q24 on an annualized basis. This growth occurred despite an ongoing reduction in industry headcount; the telco workforce ended 2Q24 at 4.48 million, down 1.2% YoY.

- Profitability margins: Both EBITDA and EBIT margins experienced a slight uptick in 2Q24 on an annualized basis compared to the previous quarter. Results were mixed when compared to the same period last year. Annualized EBIT margin dipped from 15.3% in 2Q23 to 15.0% in 2Q24, while the EBITDA margin for the annualized 2Q24 period stood at 34.4%, up from 33.7% in annualized 2Q23.

- Regional trends: The Americas region outpaced Asia to reclaim its position as the largest region by revenue, holding a 37.3% share in 2Q24. On a capex basis though, the Asia region outspent the Americas, capturing a 36.5% share in the latest quarter. Europe retained the highest annualized capital intensity, reaching 18.4% in 2Q24, followed by MEA at 17.4%.

Important note: We have made some significant enhancements to our telco market review report in 1Q24. The changes are designed to provide a more insightful and user-friendly experience:

- 'Market Snapshot' Tab: This tab now features an interactive dashboard view of the telco market, allowing users to interact with and analyze market data more effectively. Additionally, users can export the dashboard to PDF for convenient sharing and reference.

- Two distinct sections have been created from the previous 'Company Deepdive & Benchmarking' section for greater clarity and functionality:

- 1. 'Company Drilldown': Provides a comprehensive analysis of a selected company from the full set of 140 telcos. It covers various metrics including revenue, capex, employee counts, costs, profitability, cash and debt levels, and key ratios.

- 2. 'Company Benchmarking': Focuses on a sample of 79 telcos, representing approximately 82% of the global market. This section allows users to select and compare up to 5 telcos across multiple metrics such as labor costs, opex, EBIT, as well as revenues, capex, and employee counts. The sample includes operators from all regions and of varying sizes.

Both new sections also feature the capability to export graphics to PDF, enhancing the flexibility and utility of the data presented.

Operator coverage:

|

|

Regional coverage:

|

|

Table of Contents

1. Summary

2. Market snapshot

3. Analysis

4. Key stats through 2Q24

5. Labor stats

6. Operator rankings

7. Company drilldown

8. Company benchmarking

9. Country breakouts

10. Country breakouts by company

11. Regional breakouts

12. Raw Data

13. Subs & traffic

14. Exchange rates

15. Methodology & Scope

16. About

List of Figures and Charts:

- 1. TNO market size & growth by: Revenues, Capex, Employees - 1Q19-2Q24

- 2. Regional trends by: Revenues, Capex - 1Q19-2Q24

- 3. Opex & Cost trends

- 4. Labor cost trends: 1Q20-2Q24

- 5. Profitability margin trends: 1Q20-2Q24

- 6. Spending (opex, labor costs, capex): annual and quarterly trend

- 7. Key ratios: annual and quarterly trend

- 8. Workforce & productivity trends: 1Q14-2Q24

- 9. Operator rankings by revenue and capex: latest single-quarter and annualized periods

- 10. Top 20 TNOs by capital intensity: latest single-quarter and annualized periods

- 11. Top 20 TNOs by employee base: latest single-quarter

- 12. TNOs: YoY growth in single quarter revenues

- 13. TNOs: Annualized capital intensity, 1Q16-2Q24

- 14. TNOs: Revenue and RPE, annualized 1Q16-2Q24

- 15. TNOs: Capex and capital intensity (annualized), 1Q16-2Q24

- 16. TNOs: Total headcount trends, 1Q16-2Q24

- 17. TNOs: Revenue and RPE trends, 2011-23

- 18. TNOs: Capex and capital intensity, 2011-23 ($ Mn)

- 19. TNOs: Capex and capital intensity, 1Q16-2Q24 ($ Mn)

- 20. TNOs: Revenue and RPE trends, 1Q16-2Q24

- 21. TNOs by total opex, 2Q24

- 22. TNOs by labor costs, 2Q24

- 23. TNOs: Software as % of total capex

- 24. TNOs: Software & spectrum spend

- 25. TNOs: Total M&A, spectrum and capex (excl. spectrum)

- 26. TNOs by total debt: 2011-23

- 27. TNOs by total net debt: 2011-23

- 28. TNOs by long term debt: 2011-23

- 29. TNOs by short term debt: 2011-23

- 30. TNOs by total cash and short term investments ($M): 2011-23