|

市場調查報告書

商品編碼

1593159

網路營運商資本支出展望(2024 年第四季版):電信公司持平,但人工智慧驅動的生成式資料中心炒作將推動電信資本支出在 2024 年超過 6,000 億美元,其中 Scalers 預計將引領市場Network Operator Capex Forecast - 4Q24 Edition: Telco Flatlines but GenAI-driven Data Center Hype Drives Comms Capex above $600B in 2024, Webscale will Lead Market by 2028 |

|||||||

本報告提供了網路營運商市場的最新預測,包括三個細分市場的營運商群體:營運商、網路擴展商和 CNNO(營運商中立網路營運商)。該報告按季度涵蓋超過 175 家營運商,反映了截至 2024 年第三季末的市場狀況。該預測包括所有部門的總收入、資本支出和員工人數,以及每個部門的其他指標。

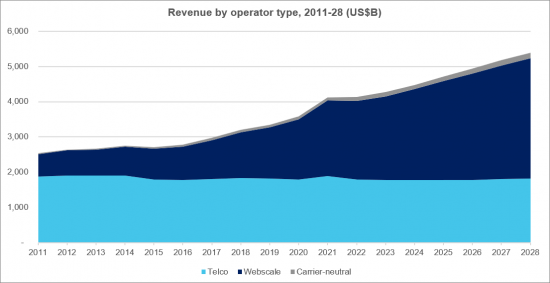

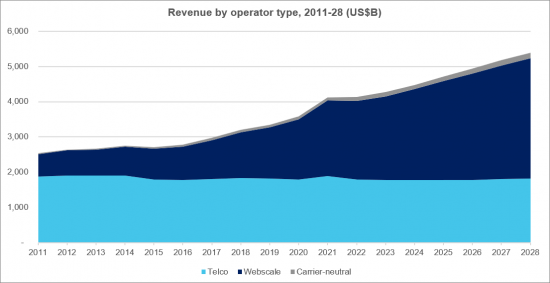

2024年三大業務集團營收規模為4.48兆美元(2023年:4.27兆美元),資本投資額為6,120億美元(2023年:5,480億美元),員工人數為預估為886 萬(2023 年:881 萬)。

報告要點:

供應商可瞄準的市場:技術供應商範圍從GPU 伺服器晶片到光纖接頭盒、無線天線、網路建設和雲端軟體,以及本次預測中追蹤的三個營運商每個細分市場銷售不同的產品和服務。這些產品包括各種各樣的東西,包括GPU伺服器晶片、光纖連接外殼、無線天線、網路建設、雲端軟體等等。

2011年,三大板塊的資本投資總額為3,360億美元,其中90%投資於業者。到2028年,這三個細分市場的總資本投資預計將達到6,380億美元,其中營運商僅佔44%。 2011年CNNO的資本支出僅60億美元,預計2028年將達到約540億美元。 2011年,Webscale資本支出為290億美元,佔營運商市場的8%。 2023年將達到1,930億美元(佔總數的35%),由於AI/生成AI的需求出現新的上升週期,Webscale目前正在蓬勃發展,2028年首次超過營運商,成為全球規模最大的產業,預計將達到3030億美元,或 48%。

提及的公司

|

|

目錄

主要部分是:

- 1.報告要點

- 2.摘要

- 3.網路營運商總數

- 4.通訊業者

- 5.通訊運營商-區域劃分

- 6.網路規模

- 7.CNNO

- 8.主要業者的支出預測

- 9.關於我們

以下是 "總計" 標籤上的數字清單:

- 按細分市場劃分的資本投資預測:2024 年第四季與 2023 年 12 月預測的差異 (%)

- 按細分市場劃分的資本投資預測:2024 年第四季與 2023 年 12 月預測的差異(金額)

- 所有業者的營收成長率:新舊預測

- 電信業者營收成長率:新舊預測的比較

- 資本強度:操作員:新舊預測

- 資本強度:網路縮放器:新舊預測

- 資本強度:CNNO:新舊預測

- 按業務類型劃分的收入

- 依業務類型劃分的資本投資金額

- 依業務類型劃分的資本投資金額

- 依業務類型劃分的資本強度

- 依業務類型劃分的員工人數

- 每業務類型劃分的每位員工收入

- 網路營運商收入(按類型)佔全球 GDP 的百分比

- 網路業者員工數量,佔世界人口的百分比

- 電信業者收入與用戶資金投入金額

- 2024 年第二季支出前 50 名的公司,資本投資額

- 以長期資本密集度排名的前 50 名營運商(2019 年第三季至 2024 年第二季的平均值)

This forecast presents our latest projections for the network operator market, spanning telecommunications operators (telcos), webscalers, and carrier-neutral network operators (CNNOs). The forecast is based on our quarterly coverage of over 175 operators, and reflects market realities through the end of 3Q24. Our forecast includes revenues, capex and employee totals for all segments, and additional metrics for each individual segment. In 2024, we expect the three operator groups to account for $4.48 trillion (T) in revenues (2023: $4.27T), $612 billion (B) in capex (2023: $548B), and 8.86 million (M) employees (2023: 8.81M). This report provides 2011-23 actuals and projections through 2028, and includes projections from the most recent full forecast (12/23) for reference.

VISUALS

Below are the key highlights of the report:

Vendor addressable market: Tech vendors sell various products and services to each of the three operator segments tracked in this forecast - everything from GPU server chips to fiber optic splice enclosures to radio antennas to network construction to cloud software. Their addressable market is directly related to capex, which captures most external technology purchases including a large portion of software & services expenses. In 2011, the starting point of our coverage, total three segment capex was $336 billion, 90% of which was telco. By 2028, three segment capex will reach $638 billion, and telco will account for only 44% of the total. In the intervening years, an important segment of third-party neutral operators of network capacity and space has evolved; CNNO capex was just $6B in 2011 but will hit about $54B by 2028. But the real story of the market is webscale: capex spend by webscalers has surged multiple times as these tech companies innovate, scale and capture more of the world's digital value. In 2011, webscale capex was $29B, or 8% of the comms operator market. In 2023, it reached $193B (35% of total), and AI/GenAI demand is currently fueling it through another up cycle, which will push webscale to about $303B by 2028, or 48% of total (and more than telco for the first time).

Telco

This report includes region- and country-level projections for the telecommunications network operator (TNO, or telco) market. These projections are based upon MTN Consulting's quarterly coverage of 140 telcos across the globe, spanning 1Q11 through 2Q24. For 2024, we expect global telco revenues of $1,772 billion (flat versus 2023), capex of $297B (down 5% YoY), and employees of 4.457 million (down 1.2% YoY). Labor costs per employee in 2024 will be about $60.8K, up from $58.7K in 2023.

Webscale

This report includes projections for the growth and development of the webscale network operator (WNO, or webscale) market. The projections are based on our quarterly coverage of 21 webscalers, spanning 1Q11-2Q24, and they break out China from the rest of the globe. For 2024, we expect global webscale revenues of $2,584 billion, up 9% YoY, $311B in R&D spending (+6% YoY), $267 billion in capex (+39% YoY), and 4.284 million employees (+2.4% YoY). Our forecast for webscale capex has significantly increased since the last update in late 2023. However, the unusual spike in capex underway in 2024 will be followed by two years of decline.

Carrier-neutral

This report also includes projections for the growth and development of the carrier-neutral network operator (CNNO) market. The CNNO market is the smallest of three operator segments tracked by MTN Consulting, but CNNOs play a crucial, complementary role in the communications sector and own and operate a large portion of the world's cell towers, data centers, and fiber networks. Our CNNO projections are based upon quarterly tracking of 47 CNNOs across the globe. Our CNNO tracking is focused on publicly traded companies but we also attempt to capture the significant private equity-led activity in this sector. In 2024, we expect CNNO revenues to total about $125B (+4% YoY), capex of $48B (+16% YoY), and about 120K employees (flat YoY). CNNOs' asset base includes over 1,500 data centers, 3.3 million cell towers, and 1.1 million fiber route miles.

Companies mentioned:

|

|

Table of Contents

Key sections include:

- 1. Report Highlights

- 2. Summary

- 3. Network Operator Totals

- 4. Telco

- 5. Telco - Regional Splits

- 6. Webscale

- 7. Carrier-neutral (CNNO)

- 8. Spending outlook for top operators

- 9. About

This report has a large number of figures on each of the main result tabs: totals, telco, telco - regional splits, webscale, and carrier-neutral (CNNO). For a full list of figures please contact us.

Here is a list of figures on the "Totals" tab:

- Capex forecast by segment: 4Q24 v. Dec 2023 forecasts, % difference

- Capex forecast by segment: 4Q24 v. Dec 2023 forecasts, $B difference

- Revenue growth rates, all operators: New vs. old forecast

- Revenue growth rates, Telcos: New vs. old forecast

- Capital intensity, Telcos: New vs. old forecast

- Capital intensity, Webscalers: New vs. old forecast

- Capital intensity, Carrier-neutral operators: New vs. old forecast

- Revenue by operator type, 2011-28 (US$B)

- Capex by operator type, 2011-28 (US$B)

- Capex by operator type, 2011-28: % of total

- Capital intensity by operator type, 2011-28

- Employees by operator type (M)

- Revenues/employee by operator type (US$K)

- Network operator revenues by type, % global GDP

- Network operator employees (M), and % global population

- Telco revenues and capex per sub, 2011-22

- Top 50 spending operators, annualized 2Q24 capex ($B)

- Top 50 operators based on long-term capital intensity (3Q19-2Q24 avg)