|

市場調查報告書

商品編碼

1684667

男性私密衛生用品市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Mens Intimate Hygiene Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球男性私密衛生用品市場價值為 132 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 8.9%,這得益於男性對個人衛生和自我照顧重要性的認知不斷提高。隨著男性對個人健康採取更積極主動的方法,對滿足衛生和美容需求的專門產品的需求日益成長。隨著社會規範的變化和對健康和保健的關注度不斷提高,這種轉變進一步加劇,男性現在積極尋求符合其特定要求的產品。

消費者對天然、有機和低過敏性配方的偏好正在重塑產品格局。對安全、溫和和有效的解決方案的重視正在推動創新,各大品牌推出了旨在舒緩和保護敏感部位的配方。電子商務和直接面對消費者的銷售管道的激增也使得這些產品比以往更容易獲得。線上市場和品牌網站等平台提供了便利、謹慎的購買以及廣泛的選擇。這些趨勢加上產品配方的進步,將維持市場的上升勢頭,因為消費者在日常衛生中更加重視舒適性和安全性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 132億美元 |

| 預測值 | 304億美元 |

| 複合年成長率 | 8.9% |

市場分為幾種產品類型,包括私密洗劑、濕紙巾、除臭劑和止汗劑、保濕霜、刮鬍護理產品等。其中,私密洗護產品佔主導地位,需求量和創收量最高。 2024 年,該部門的收入達到 37.9 億美元,預計到 2034 年將激增至 95.3 億美元。隨著消費者逐漸傾向於更安全、更親膚的選擇,許多私密洗液具有低過敏性和無化學物質的特性,這進一步增強了它們的吸引力。

在分銷方面,市場分為線上和線下通路。 2024 年,線下銷售佔據主導地位,佔據 52.28% 的市場佔有率,到 2034 年將創造 128.4 億美元的銷售收入 儘管線下銷售佔據主導地位,但得益於電子商務平台提供的便利性和多樣性,線上銷售正在迅速發展。這些平台使消費者能夠舒適地在家中探索和購買產品,許多品牌現在提供直接面對消費者的選項,以增強可訪問性和客戶體驗。

在美國,2024 年男性私密衛生用品市場價值為 25 億美元,預計到 2034 年將以 9.6% 的強勁複合年成長率成長。隨著人們對健康、自我照護和專業衛生產品的關注度不斷提高,市場繼續獲得發展動力,增強了其未來的擴張潛力。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 男性個人衛生和儀容意識增強

- 開發創新且專業的私人衛生產品

- 產業陷阱與挑戰

- 與使用男性私人衛生用品相關的文化禁忌和恥辱

- 缺乏關於私密健康重要性的教育

- 成長動力

- 成長潛力分析

- 消費者行為分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021-2034 年

- 主要趨勢

- 私密洗液

- 濕紙巾

- 除臭劑和止汗劑

- 保濕霜

- 刮鬍護理

- 其他(防擦傷凝膠等)

第 6 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 有機的

- 傳統的

第7章:市場估計與預測:依形式 2021-2034

- 主要趨勢

- 液體

- 奶油

- 凝膠

- 粉末

第 8 章:市場估計與預測:按價格 2021-2034

- 主要趨勢

- 低的

- 中等的

- 高的

第 9 章:市場估計與預測:按包裝 2021-2034

- 主要趨勢

- 氣溶膠

- 棍棒

- 走珠香水

- 瓶子

- 管

- 其他

第 10 章:市場估計與預測:按年齡層,2021-2034 年

- 主要趨勢

- 青少年

- 成年人

第 11 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 勃起功能障礙 (ED)

- 性交後護理

- 控汗、保持清新

- 皮膚狀況管理

- 其他

第 12 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 零售店

- 專賣店

- 其他(便利商店、藥局、藥妝店)

第 13 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 14 章:公司簡介

- Beiersdorf

- Burt's Bees

- Church & Dwight

- Colgate Palmolive

- Coty Inc.

- Cremo Company

- Edgewell Personal Care

- Hawkins & Brimble

- Kimberly-Clark

- L'Oreal

- Manscaped

- Procter & Gamble

- Reckitt and Benckiser

- The Man Company

- Unilever PLC

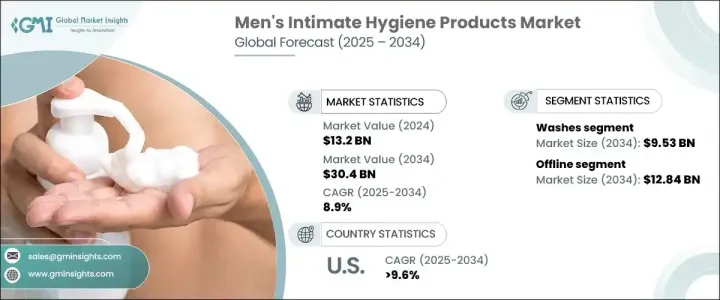

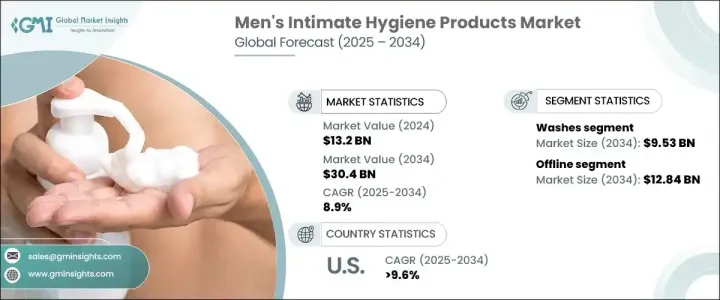

The Global Mens Intimate Hygiene Products Market, valued at USD 13.2 billion in 2024, is projected to expand at an impressive CAGR of 8.9% from 2025 to 2034, driven by increasing awareness among men regarding the importance of personal hygiene and self-care. As men adopt more proactive approaches to personal wellness, there is a growing demand for specialized products that cater to hygiene and grooming needs. This shift is further amplified by changing societal norms and an enhanced focus on health and wellness, with men now actively seeking products that align with their specific requirements.

Consumer preferences for natural, organic, and hypoallergenic formulations are reshaping the product landscape. The emphasis on safe, gentle, and effective solutions is driving innovation, with brands introducing formulations designed to soothe and protect sensitive areas. The surge in e-commerce and direct-to-consumer sales channels has also made these products more accessible than ever. Platforms such as online marketplaces and brand websites offer convenience, discreet purchasing, and an expansive range of options. These trends, coupled with advancements in product formulations, are poised to sustain the market's upward momentum as consumers prioritize comfort and safety in their hygiene routines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $30.4 Billion |

| CAGR | 8.9% |

The market is categorized into several product types, including intimate washes, wipes, deodorants and antiperspirants, moisturizers, shaving care, and others. Among these, intimate washes are leading the way, demonstrating the highest demand and revenue generation. In 2024, this segment achieved USD 3.79 billion in revenue and is expected to surge to USD 9.53 billion by 2034. Designed specifically to cleanse sensitive areas, these washes are formulated to maintain the natural pH balance of the skin, offering antibacterial, soothing, and moisturizing benefits. The hypoallergenic and chemical-free nature of many intimate washes further strengthens their appeal as consumers gravitate toward safer, skin-friendly options.

In terms of distribution, the market is segmented into online and offline channels. Offline sales dominated in 2024, accounting for 52.28% of the market share and generating USD 12.84 billion by 2034. Despite this dominance, online sales are rapidly gaining traction, fueled by the convenience and variety offered by e-commerce platforms. These platforms enable consumers to explore and purchase products from the comfort of their homes, with many brands now offering direct-to-consumer options that enhance accessibility and customer experience.

In the United States, the mens intimate hygiene products market was valued at USD 2.5 billion in 2024 and is forecasted to grow at a robust CAGR of 9.6% through 2034. This growth reflects a cultural shift, with men increasingly embracing grooming and hygiene as essential aspects of their lifestyle. With a rising focus on health, self-care, and specialized hygiene products, the market continues to gain momentum, reinforcing its potential for future expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier Landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of personal hygiene and grooming among men

- 3.6.1.2 Development of innovative and specialized intimate hygiene products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Cultural taboos and stigma associated with the use of men’s intimate hygiene products

- 3.6.2.2 Lack of education around the importance of intimate hygiene

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer behavior analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Intimate washes

- 5.3 Wipes

- 5.4 Deodorants & antiperspirants

- 5.5 Moisturizers

- 5.6 Shaving care

- 5.7 Others (anti-chafing gels, etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Form 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Liquid

- 7.3 Cream

- 7.4 Gel

- 7.5 Powder

Chapter 8 Market Estimates & Forecast, By Price 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Packaging 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Aerosols

- 9.3 Sticks

- 9.4 Roll-ons

- 9.5 Bottles

- 9.6 Tubes

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Teenagers

- 10.3 Adults

Chapter 11 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Erectile dysfunction (ED)

- 11.3 Post-sexual care

- 11.4 Sweat control and freshness

- 11.5 Skin condition management

- 11.6 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Online

- 12.2.1 E-commerce

- 12.2.2 Company website

- 12.3 Offline

- 12.3.1 Supermarkets/hypermarkets

- 12.3.2 Retail stores

- 12.3.3 Specialty stores

- 12.3.4 Others (convenience stores, pharmacies and drugstores)

Chapter 13 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 US

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 Middle East & Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Beiersdorf

- 14.2 Burt's Bees

- 14.3 Church & Dwight

- 14.4 Colgate Palmolive

- 14.5 Coty Inc.

- 14.6 Cremo Company

- 14.7 Edgewell Personal Care

- 14.8 Hawkins & Brimble

- 14.9 Kimberly-Clark

- 14.10 L’Oreal

- 14.11 Manscaped

- 14.12 Procter & Gamble

- 14.13 Reckitt and Benckiser

- 14.14 The Man Company

- 14.15 Unilever PLC