|

市場調查報告書

商品編碼

1699437

女性衛生洗護市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Feminine Hygiene Wash Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

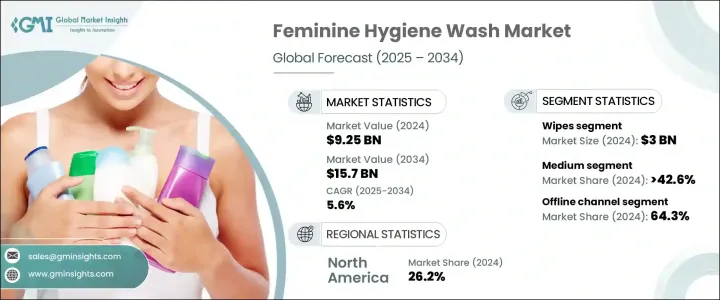

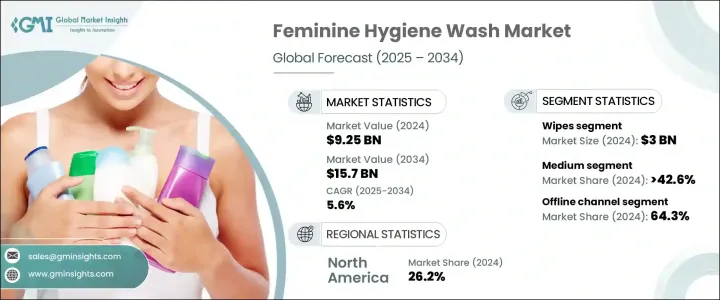

2024 年全球女性衛生洗護市場價值為 92.5 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.6%。透過政府措施、非政府組織和醫療保健組織提高人們對私密健康的認知,大大促進了市場擴張。強調月經衛生、私密護理和感染預防的宣傳活動在教育女性了解女性衛生用品方面發揮了關鍵作用。社群媒體、數位健康平台和有影響力的人進一步擴大了這一訊息,使衛生保健資訊更容易獲得。

隨著品牌與健康專家合作教育消費者並打破圍繞私密護理的恥辱感,對女性衛生洗液、濕紙巾和永續產品的需求持續上升。隨著意識的增強,越來越多的女性選擇經過皮膚科測試、pH 值平衡和有機的衛生解決方案。現在,越來越多的消費者優先考慮符合健康和衛生標準的安全、高品質產品,從而促進了市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92.5億美元 |

| 預測值 | 157億美元 |

| 複合年成長率 | 5.6% |

按產品類型細分,市場包括乳霜、濕紙巾、噴霧、肥皂、凝膠以及泡沫、粉末和清潔劑等其他產品。 2024 年,女性衛生濕紙巾的收入將達到 30 億美元,預計複合年成長率為 5.8%。它們的便利性和易用性使它們成為比液體洗滌劑更受歡迎的選擇,尤其是在旅行和日常生活中。隨著城市化進程的推進和越來越多的女性加入勞動力大軍,對便攜、pH 值平衡、環保的衛生產品的需求持續激增。融入抗菌特性、草藥成分和可生物分解材料的新產品開發進一步激發了人們的興趣。

人們對公共衛生間和共享空間衛生問題的日益關注也促進了攜帶式衛生解決方案的普及。可支配收入的增加和個人護理產品支出的增加支持了市場擴張,而網路零售和數位行銷活動則提高了產品的知名度和可及性。 2023年,城鎮女性勞動參與率上升至25.4%,反映出實用衛生解決方案的需求不斷成長。

女性衛生洗護市場按價格等級分類,中檔市場因其價格與品質之間的平衡而占主導地位。不同收入群體的女性都在尋求經皮膚科醫生認可、安全有效且價格不像奢侈品牌那麼昂貴的衛生產品。中檔衛生洗液通常經過婦科醫生測試並採用天然成分製成,仍能為廣大消費者所接受。這個細分市場對於發展中地區的城市和半城市地區來說尤其重要,因為在這些地區,負擔能力在購買決策中起著至關重要的作用。

市場進一步按分銷管道分類,到 2024 年,線下銷售將佔據 64.3% 的佔有率。實體店仍然是首選的購買方式,尤其是在發展中地區,消費者信任店內購買和藥劑師的推薦。藥局、超市和專賣店是主要的分銷點,為品牌提供直接接觸消費者的機會。強大的零售合作夥伴關係有助於主要品牌擴大影響力並影響購買決策。

2024 年,北美以 26.2% 的佔有率領先市場,創造了 24 億美元的收入。由於買家優先考慮天然和 pH 值平衡的產品,因此消費者的高意識和品牌忠誠度推動了市場主導地位。數位行銷、社群媒體推廣和有影響力的代言推動私人衛生產品成為主流,確保了零售和線上平台的穩定需求。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 女性健康意識不斷提高

- 健康和衛生教育舉措

- 改變生活方式和習慣

- 產業陷阱與挑戰

- 安全問題

- 產品功效和聲明

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 乳霜

- 濕紙巾

- 噴

- 酒吧

- 凝膠

- 其他

第6章:市場估計與預測:以價格,2021-2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場估計與預測:按最終用途,2021 - 2034 年(十億美元)

- 主要趨勢

- 女性青少年

- 成年雌性

第8章:市場估計與預測:按配銷通路,2021-2034 年(十億美元)

- 主要趨勢

- 離線

- 線上

第9章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Boots

- CB Fleet

- Combe

- Corman

- CTS Group

- Emerita

- Happy Root

- Healthy Hoohoo

- Lactacyd

- Lifeon

- Nature Certified

- Oriflame

- Sliquid Splash

- SweetSpot

- VWash

The Global Feminine Hygiene Wash Market was valued at USD 9.25 billion in 2024 and is set to expand at a CAGR of 5.6% from 2025 to 2034. Increasing awareness about intimate hygiene through government initiatives, NGOs, and healthcare organizations has significantly contributed to market expansion. Awareness campaigns highlighting menstrual hygiene, intimate care, and infection prevention have played a key role in educating women about feminine hygiene products. Social media, digital health platforms, and influencers further amplify this message, making information on hygiene care more accessible.

The demand for feminine hygiene washes, wipes, and sustainable products continues to rise as brands collaborate with health experts to educate consumers and break stigmas surrounding intimate care. Women increasingly choose dermatologically tested, pH-balanced, and organic hygiene solutions, driven by heightened awareness. More consumers now prioritize safe, high-quality products that align with health and hygiene standards, reinforcing market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.25 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 5.6% |

Segmented by product type, the market includes creams, wipes, sprays, bars, gels, and others like foams, powders, and cleansers. In 2024, feminine hygiene wipes generated USD 3 billion in revenue and are projected to grow at a CAGR of 5.8%. Their convenience and ease of use make them a preferred choice over liquid washes, especially for travel and daily routines. As urbanization progresses and more women join the workforce, demand for portable, pH-balanced, and eco-friendly hygiene products continues to surge. New product developments incorporating antibacterial properties, herbal ingredients, and biodegradable materials further drive interest.

Growing concerns about hygiene in public restrooms and shared spaces also contribute to the popularity of portable hygiene solutions. Increased disposable income and higher spending on personal care products support market expansion, while online retail and digital marketing campaigns boost product visibility and accessibility. The female labor force participation rate in urban areas rose to 25.4% in 2023, reflecting a rising need for practical hygiene solutions.

The feminine hygiene wash market is categorized by pricing tiers, with the mid-range segment dominating due to its balance between affordability and quality. Women from various income groups seek hygienic products that are dermatologist-approved, safe, and effective without the premium price of luxury brands. Mid-range hygiene washes, often gynecologist-tested and made with natural ingredients, remain widely accessible to a broad consumer base. This segment is especially relevant in urban and semi-urban areas of developing regions, where affordability plays a crucial role in purchasing decisions.

The market is further divided by distribution channels, with offline sales accounting for 64.3% of the share in 2024. Physical stores continue to be the preferred purchasing method, especially in developing regions, where consumers trust in-store purchases and pharmacist recommendations. Pharmacies, supermarkets, and specialty stores serve as primary distribution points, offering direct engagement opportunities for brands to educate consumers. Strong retail partnerships help major brands extend their reach and influence buying decisions.

In 2024, North America led the market with a 26.2% share, generating USD 2.4 billion in revenue. High consumer awareness and brand loyalty drive market dominance, as buyers prioritize natural and pH-balanced products. Digital marketing, social media promotions, and influencer endorsements have propelled intimate hygiene products into the mainstream, ensuring steady demand across both retail and online platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising awareness of feminine health

- 3.10.1.2 Health and hygiene education initiatives

- 3.10.1.3 Changing lifestyles and habits

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Safety concerns

- 3.10.2.2 Product efficacy and claims

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Creams

- 5.3 Wipes

- 5.4 Spray

- 5.5 Bar

- 5.6 Gel

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Female teenager

- 7.3 Female adult

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Boots

- 10.2 CB Fleet

- 10.3 Combe

- 10.4 Corman

- 10.5 CTS Group

- 10.6 Emerita

- 10.7 Happy Root

- 10.8 Healthy Hoohoo

- 10.9 Lactacyd

- 10.10 Lifeon

- 10.11 Nature Certified

- 10.12 Oriflame

- 10.13 Sliquid Splash

- 10.14 SweetSpot

- 10.15 VWash