|

市場調查報告書

商品編碼

1699278

適應原飲料市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Adaptogenic Beverages Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

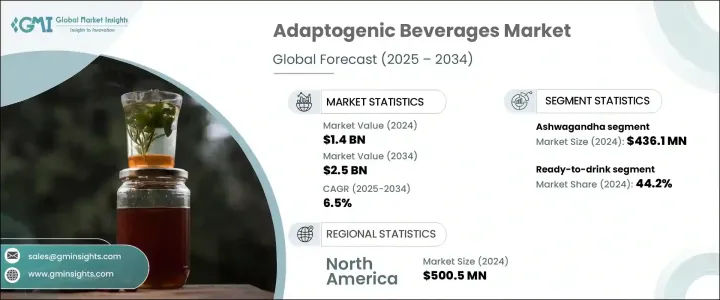

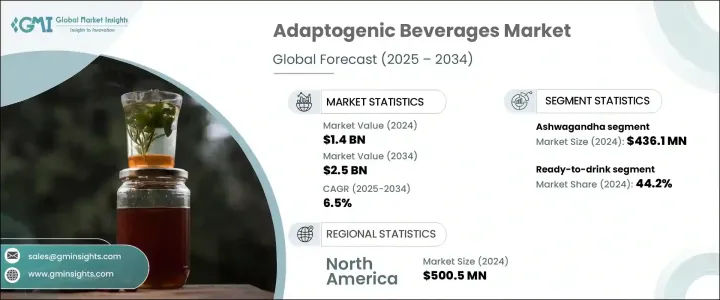

2024 年全球適應原飲料市場價值為 14 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 6.5%,這得益於消費者對緩解壓力和心理健康產品的興趣日益濃厚。消費者越來越重視心理健康和身體健康,這推動了對注入適應原的飲料的需求。隨著生活方式的壓力越來越大,添加有緩解壓力成分的功能性飲料越來越受歡迎。向天然和有機解決方案的轉變進一步增強了適應原飲料的吸引力。

市場按產品細分,其中主要成分為南非醉茄、蘑菇、聖羅勒、瑪卡和薰衣草。 2024 年,南非醉茄佔據了市場主導地位,佔有 31.7% 的佔有率,創造了 4.361 億美元的收入。其配方適應性以及公認的健康益處使其具有強大的影響力。南非醉茄的多功能性使其成為不同飲料類型的首選成分,滿足了消費者對整體健康解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 6.5% |

適應原飲料可透過線上和線下分銷管道購買。由於消費者青睞電子商務平台購物的便利性,預計 2025 年線上購物領域將獲得大幅成長。數位零售提供多種品牌和產品種類,同時提供具競爭力的價格、折扣和訂閱選項。小眾電子商務品牌的擴張也消除了傳統分銷的複雜性,簡化了全球市場的可及性。

產品細分包括即飲飲料、冰沙和果汁、茶飲料、咖啡飲料等。即飲類別在 2024 年佔據市場主導地位,產值達 6.087 億美元,佔總佔有率的 44.2%。此細分市場的主導地位源自於消費者對易於飲用、方便攜帶的健康飲品的偏好。這些飲料無需準備時間,並確保了一致的適應原濃度,從而增強了其吸引力。

從地理來看,北美是適應原飲料市場的領導者,2024 年的收入達到 5.005 億美元。在完善的零售和電子商務基礎設施的支持下,對健康和保健趨勢的高度關注繼續推動需求。該地區對適應原的認知不斷提高,加上飲食偏好的不斷變化,加速了產品創新和市場擴張。適應原飲料品牌的廣泛普及、策略行銷努力以及持續的產品開發進一步鞏固了北美在市場上的主導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 健康和保健意識不斷增強

- 對自然療法的需求不斷增加

- 功能性飲料市場擴張

- 產業陷阱與挑戰

- 療效的科學證據有限

- 建立消費者信任與認知

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 南非醉茄

- 菇

- 聖羅勒

- 瑪卡

- 薰衣草

- 其他

第6章:市場估計與預測:按飲料類型,2021 年至 2034 年

- 主要趨勢

- 即飲

- 茶基

- 冰沙和果汁

- 咖啡基

- 其他

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Adapt Drinks

- Four Sigmatic

- Kin Euphorics

- Om Mushroom

- Peak and Valley

- Rasa

- Rebbl

- Sunwink

The Global Adaptogenic Beverages Market was valued at USD 1.4 billion in 2024 and is projected to expand at a CAGR of 6.5% from 2025 to 2034, driven by increasing consumer interest in stress relief and mental wellness products. Consumers are increasingly prioritizing mental health alongside physical well-being, fueling demand for beverages infused with adaptogens. As lifestyles become more stressful, functional beverages incorporating stress-relieving ingredients have gained widespread popularity. The shift towards natural and organic solutions has further strengthened the appeal of adaptogenic beverages.

The market is segmented by product, with ingredients such as ashwagandha, mushrooms, holy basil, maca, and lavender leading the category. Ashwagandha dominated the market in 2024, capturing a 31.7% share and generating USD 436.1 million in revenue. Its adaptability in formulations and recognized health benefits contribute to its strong presence. The versatility of ashwagandha makes it a preferred ingredient across different beverage types, addressing consumer demand for holistic wellness solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 6.5% |

Adaptogenic beverages are available through both online and offline distribution channels. The online segment is expected to gain substantial traction in 2025 as consumers favor the convenience of purchasing from e-commerce platforms. Digital retail provides access to multiple brands and product varieties while offering competitive pricing, discounts, and subscription options. The expansion of niche e-commerce brands has also eliminated traditional distribution complexities, streamlining global market accessibility.

Product segmentation includes ready-to-drink beverages, smoothies and juices, tea-based drinks, coffee-based options, and others. The ready-to-drink category led the market in 2024, generating USD 608.7 million and accounting for 44.2% of the total share. The segment's dominance stems from consumer preference for easy-to-consume, on-the-go wellness drinks. These beverages eliminate preparation time and ensure consistent adaptogen concentrations, enhancing their appeal.

Geographically, North America leads the adaptogenic beverages market, recording USD 500.5 million in revenue in 2024. A strong focus on health and wellness trends continues to drive demand, supported by well-established retail and e-commerce infrastructure. The region's growing awareness of adaptogens, combined with evolving dietary preferences, accelerates product innovation and market expansion. The widespread availability of adaptogenic beverage brands, strategic marketing efforts, and continuous product development further solidify North America's dominant market position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing health and wellness consciousness

- 3.6.1.2 Increasing demand for natural remedies

- 3.6.1.3 Expansion of functional beverage market

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Limited scientific evidence for efficacy

- 3.6.2.2 Establishing consumer trust and awareness

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Ashwagandha

- 5.3 Mushrooms

- 5.4 Holy basil

- 5.5 Maca

- 5.6 Lavender

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Beverages Type, 2021 – 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Ready-to-drink

- 6.3 Tea-based

- 6.4 Smoothies & juices

- 6.5 Coffee-based

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adapt Drinks

- 9.2 Four Sigmatic

- 9.3 Kin Euphorics

- 9.4 Om Mushroom

- 9.5 Peak and Valley

- 9.6 Rasa

- 9.7 Rebbl

- 9.8 Sunwink