|

市場調查報告書

商品編碼

1708177

箱板紙包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Boxboard Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

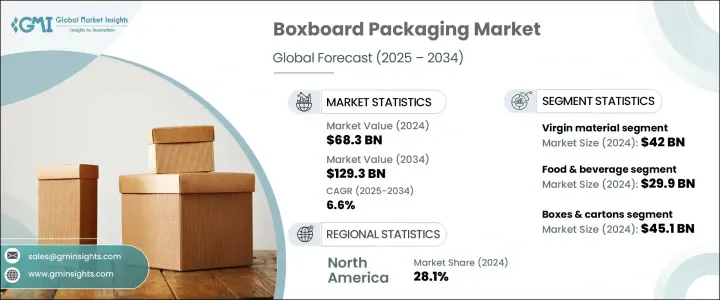

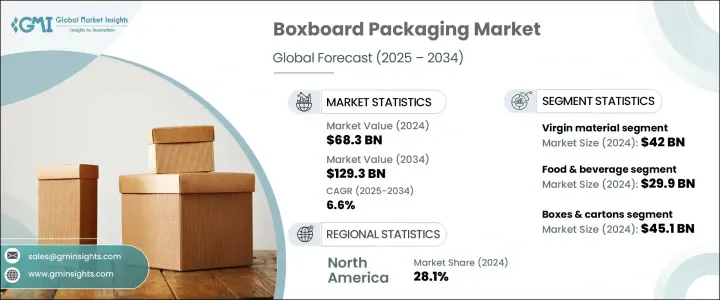

2024 年全球箱板紙包裝市場規模達 683 億美元,預估 2025 年至 2034 年的複合年成長率為 6.6%。受各行各業對永續、耐用、多功能包裝解決方案需求不斷成長的推動,市場將繼續保持穩定成長。隨著消費者偏好轉向環保和輕質包裝,紙板包裝因其適應性和可回收性而越來越受到重視。城市化進程的加速和生活方式的改變進一步提高了對緊湊、方便和即用型包裝的需求,尤其是在食品和飲料領域。

此外,電子商務的蓬勃發展,加上對美觀和保護性包裝的需求不斷成長,為箱板包裝製造商帶來了新的機會。公司目前正在大力投資符合環境要求和消費者期望的創新設計和材料。隨著世界各國政府加強對一次性塑膠的監管並強調循環經濟的重要性,預計紙板包裝市場仍將是全球包裝領域的重要組成部分。從高級化妝品到藥品和快速消費品,紙板包裝因其兼具外形、功能和永續性的能力而脫穎而出。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 683億美元 |

| 預測值 | 1293億美元 |

| 複合年成長率 | 6.6% |

市場主要以材料分為原生材料和再生材料兩大類,其中原生材料部分在 2024 年創造 420 億美元。原生箱板紙材料因其卓越的強度、光滑的表面和卓越的印刷品質而備受推崇,使其成為高階展示和強大保護至關重要的行業的理想選擇。它們能夠支持優質的飾面和詳細的圖形,使其成為奢侈品、化妝品和藥品包裝的首選。隨著品牌擴大尋求不僅能保護產品而且還能增強其在商店貨架上的視覺吸引力的包裝,對原生材料的需求預計將保持強勁。

按最終用途行業細分,食品和飲料行業在 2024 年的規模為 299 億美元,是紙板包裝市場中最大的佔有率之一。即食食品、外帶和簡便食品消費量的不斷成長直接影響了對輕量耐用包裝解決方案的需求。隨著消費者在不影響產品品質的情況下繼續優先考慮便利性,提供保護和延長保存期限的包裝變得至關重要。此外,線上雜貨配送和電子商務平台的快速擴張加劇了對堅固且可客製化的包裝的需求,以確保產品的安全運輸和儲存。

從地區來看,2024 年北美佔據了全球箱板紙包裝市場的 28.1%。這種主導地位很大程度上得益於食品和飲料、製藥和消費品等行業的強勁需求,這些行業都需要高品質和永續的包裝選擇。政府推出了嚴格的法規,鼓勵使用環保包裝並逐步淘汰一次性塑膠,這推動了塗層再生板和固體漂白硫酸鹽等可回收材料的採用。北美各地的公司正致力於增強其包裝產品組合,以滿足不斷變化的消費者需求和監管標準,從而進一步推動區域市場的成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 食品飲料業的成長

- 對永續和環保包裝的需求不斷成長

- 印刷技術的進步

- 電子商務產業快速擴張

- 消費品產業的崛起

- 產業陷阱與挑戰

- 供應鏈中斷

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 處女

- 回收利用

第6章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 盒子和紙箱

- 插頁和分隔頁

- 托盤

- 其他

第7章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 工業品

- 電子產品

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Cellmark

- CMPC Biopackaging

- Crusader Packaging

- Custom Boxes Zone

- DS Smith

- Folbb

- Graphic Packaging International

- Huhtamaki

- ITC

- James Cropper

- Metsa Group

- Mondi

- Netpak

- Nippon Paper Industries

- Sappi

- Smurfit Kappa

- Spento Papers

- Stora Enso

The Global Boxboard Packaging Market generated USD 68.3 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2034. The market continues to witness steady growth, fueled by the rising demand for sustainable, durable, and versatile packaging solutions across multiple industries. As consumer preferences shift toward eco-friendly and lightweight packaging, boxboard packaging is gaining prominence for its adaptability and recyclability. Increasing urbanization and changing lifestyles have further heightened the need for compact, convenient, and ready-to-use packaging, particularly within the food and beverage sector.

Additionally, the boom in e-commerce, coupled with the growing demand for attractive and protective packaging, is shaping new opportunities for boxboard packaging manufacturers. Companies are now investing heavily in innovative designs and materials that align with both environmental mandates and consumer expectations. With governments worldwide tightening regulations around single-use plastics and emphasizing the importance of circular economies, the boxboard packaging market is expected to remain a vital part of the global packaging landscape. From premium cosmetics to pharmaceutical products and fast-moving consumer goods, boxboard packaging stands out for its ability to combine form, function, and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.3 Billion |

| Forecast Value | $129.3 Billion |

| CAGR | 6.6% |

The market is primarily segmented by material into virgin and recycled categories, with the virgin material segment generating USD 42 billion in 2024. Virgin boxboard materials are highly valued for their superior strength, smooth surface, and exceptional print quality, making them an ideal choice for industries where high-end presentation and robust protection are crucial. Their ability to support premium finishes and detailed graphics makes them a preferred option for luxury goods, cosmetics, and pharmaceutical packaging. The demand for virgin materials is expected to hold strong as brands increasingly seek packaging that not only protects the product but also enhances its visual appeal on store shelves.

When segmented by end-use industries, the food and beverage sector accounted for USD 29.9 billion in 2024, representing one of the largest shares in the boxboard packaging market. The rising consumption of ready-to-eat meals, takeout, and convenience foods is directly impacting the demand for lightweight and durable packaging solutions. As consumers continue to prioritize convenience without compromising product quality, packaging that offers both protection and extended shelf life is becoming essential. Moreover, the rapid expansion of online grocery delivery and e-commerce platforms has intensified the need for sturdy and customizable packaging to ensure safe product transport and storage.

Regionally, North America held a 28.1% share of the global boxboard packaging market in 2024. This dominance is largely driven by robust demand from industries such as food and beverage, pharmaceuticals, and consumer goods, all of which require high-quality and sustainable packaging options. Stringent government regulations encouraging eco-friendly packaging and phasing out single-use plastics are driving the adoption of recyclable materials like coated recycled boards and solid bleached sulfate. Companies across North America are focusing on enhancing their packaging portfolios to meet evolving consumer demands and regulatory standards, further boosting the regional market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of food & beverage industry

- 3.2.1.2 Rise in demand for sustainable and Eco-friendly packaging

- 3.2.1.3 Advancement in printing technology

- 3.2.1.4 Rapid expansion of E-commerce industry

- 3.2.1.5 Rise in consumer goods industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption

- 3.2.2.2 Fluctuation in raw materials price

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Virgin

- 5.3 Recycled

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Boxes & cartons

- 6.3 Inserts & dividers

- 6.4 Trays

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Pharmaceuticals

- 7.4 Industrial goods

- 7.5 Electronics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cellmark

- 9.2 CMPC Biopackaging

- 9.3 Crusader Packaging

- 9.4 Custom Boxes Zone

- 9.5 DS Smith

- 9.6 Folbb

- 9.7 Graphic Packaging International

- 9.8 Huhtamaki

- 9.9 ITC

- 9.10 James Cropper

- 9.11 Metsa Group

- 9.12 Mondi

- 9.13 Netpak

- 9.14 Nippon Paper Industries

- 9.15 Sappi

- 9.16 Smurfit Kappa

- 9.17 Spento Papers

- 9.18 Stora Enso