|

市場調查報告書

商品編碼

1690799

印度紙和紙板包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

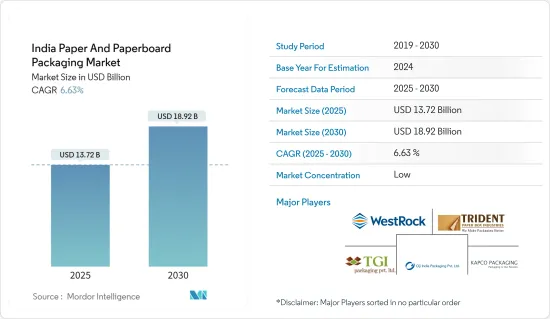

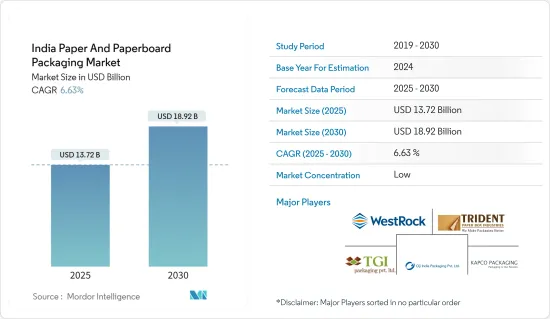

印度紙和紙板包裝市場規模預計在 2025 年為 137.2 億美元,預計到 2030 年將達到 189.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.63%。

主要亮點

- 過去十年,由於基材選擇的轉變、全球市場的擴大、所有權動態的演變以及政府主導的擺脫塑膠的舉措,紙包裝產業經歷了顯著的成長。隨著對永續性和環境友好的日益重視,印度準備透過紙張和紙板包裝領域的各種創新來塑造行業趨勢。

- 紙質包裝,尤其是食品儲存包裝的最新進展值得關注。一個典型的例子就是瓦楞包裝,它在運輸生鮮食品方面越來越受歡迎。為了有效去除細菌,必須在高溫下將紙板層黏合在一起。而且,這種瓦楞紙板是可回收的,因此可以重複使用,同時最大限度地降低交叉污染的風險。

- 近年來,許多廠商都採用了無菌紙包裝。該過程包括將食物及其包裝放入熱的過氧化氫浴中進行消毒。使用這種無菌紙,牛奶、咖啡、生鮮食品等就不會受到污染,並且能長時間保持新鮮。為體現這一趨勢,產業參與者正在加大對可堆肥包裝開發的投資。

主要亮點

- 例如,2023 年 10 月,Pakka 與共用永續性願景的棗類食品製造商 Brawny Bear 合作推出了印度首款可堆肥軟包裝。此次發布標誌著 Packer 取得的一項重大成就,也標誌著印度龐大包裝產業(價值超過 700 億美元)的一個轉捩點。

- 此外,隨著該地區傾向於環保,永續包裝正在成為減少包裝材料對環境影響的關鍵因素。永續包裝透過利用生物分解性、可回收和可堆肥的材料,顯著減少廢棄物並加強循環經濟。此外,採取此類環保做法的公司往往會獲得更高的客戶忠誠度。這些趨勢正在推動印度對紙質包裝的需求激增。

- 隨著紙質包裝越來越受歡迎,印度造紙廠紛紛增加資本投資,轉向生產手提袋和草紙等小眾產品。 2023 年 12 月,安得拉紙業生產阻隔塗佈產品,並投資對其設施進行現代化改造。 APL發揮自身優勢,調整產品結構以滿足市場需求。我們積極開發和推出手提袋和草紙等小眾產品,同時提供杯紙、藥品印刷和高 BF 原生牛皮紙等增值產品。

- 紙包裝有許多優點:它完全可回收、經濟高效,而且通常比許多塑膠更環保。產業資料突顯了一個顯著的轉變,多家企業從塑膠包裝轉向更永續的包裝,如紙本和袋子包裝產品。然而,我們必須意識到紙質包裝所帶來的環境挑戰,例如其易受潮濕影響、生產過程中消費量高、運輸過程中佔地面積大等。

印度紙和紙板包裝市場趨勢

瓦楞包裝可望佔據主要市場佔有率

- 瓦楞紙箱因其耐用性和靈活性而成為電子商務包裝必不可少的材料。這些盒子具有凹槽內部結構,可吸收衝擊並抵抗壓縮,從而提供卓越的產品保護。因此,我們保證您的產品將完好無損地送達,無論您的產品尺寸或精緻程度如何。不同尺寸、顏色和重量的瓦楞紙箱用於電子商務包裝。

- 瓦楞紙箱大大減少了電子商務領域因包裝損壞而造成的退貨。其堅固的結構和保護性緩衝最大限度地降低了運輸過程中損壞的風險,確保產品完好無損地到達您的客戶手中。透過保護產品免受誤操作和環境因素的影響,瓦楞紙箱可以改善整體客戶體驗,從而減少退貨和換貨。

- 據印度品牌股權基金會(IBFC)稱,電子商務行業的成長已經改變了印度商業,並開闢了 B2B、D2C、C2C 和 C2B 等多個領域。近年來,D2C、B2B、C2C等領域都出現了顯著成長。預計到 2027 年,印度 D2C 市場規模將達到 600 億美元。

- 瓦楞紙箱的可回收性符合永續性目標,吸引了有環保意識的消費者並提高了品牌聲譽。瓦楞包裝是印度電子商務供應鏈的重要組成部分,它提供了經濟高效的解決方案,同時也解決了與產品退貨相關的挑戰。

- 根據EBANX的報告,到2023年,印度的線上零售額將達到1,030億美元。隨著該國電子商務產業的蓬勃發展,瓦楞紙箱滿足了人們對高效可靠包裝解決方案日益成長的需求。

- 這些瓦楞紙箱可以訂製以容納從電子產品到服飾等各種產品,並確保安全運輸。可堆疊的設計也最佳化了倉庫和運輸車輛的儲存空間,增強了電子商務公司的物流業務。

食品和飲料預計將大幅成長

- 紙和紙板包裝在印度食品產業的各個領域發揮著至關重要的作用,包括烘焙和零嘴零食。紙板管有幾個優點,特別是在包裝香辛料、茶和零嘴零食等乾貨時。其圓柱形狀便於高效存放和運輸,最大限度地利用貨架空間並最大限度地減少浪費。

- 紙板管可以採用鮮豔的印刷和標籤進行客製化,以提高品牌知名度和消費者吸引力。這些包裝解決方案具有環保和可回收的特點,符合現代企業的永續性目標,並吸引了有環保意識的消費者。

- 食品製造商,尤其是知名的快速消費品品牌,已經設定了雄心勃勃的目標,減少食品包裝中的塑膠使用,並採用新的、更環保的材料。因此,紙質包裝在印度越來越受歡迎。

- 紙和紙板包裝可滿足餐廳和速食連鎖店等餐飲服務機構的需求。印度年輕人對快餐的興趣日益濃厚,導致對有效包裝解決方案的需求激增,尤其是針對披薩和蛋糕等潮濕和油膩的食品。

- 截至 2023 年 3 月 31 日,達美樂披薩在印度 393 個城市擁有 1,816分店。紙板,包括白襯紙板和實心漂白表面紙板,具有防油性,這對於包裝披薩等產品至關重要。這些材料可以保護披薩免受潮濕和油脂的影響,確保披薩在運輸和儲存過程中保持新鮮。

- 根據加拿大農業及食品部的新聞稿,到 2023 年,印度的高纖維早餐產品的市場價值可能達到 3 億美元。早餐用麥片穀類和高纖維零嘴零食等健康包裝食品受益於紙和紙板包裝,既能確保新鮮度,又能保留營養價值,同時也是環保的解決方案。

- Bikaji 預計,2022 年印度包裝食品的市值將達到 513.5 億美元。與前一年相比,這一數字有所增加。預計到 2026 年包裝食品市場價值將成長並達到 702.2 億美元。

- 對包裝食品的需求不斷成長,也推動了對永續、可回收和環保的包裝解決方案的需求。紙和紙板是生物分解性和可再生的材料,因此由於人們對永續性的日益關注,它們比塑膠越來越受到青睞。

- 這種向環保包裝的轉變預計將推動食品業用於紙盒、紙箱和軟質包裝的紙板消費量增加。

印度紙和紙板包裝產業概況

印度紙和紙板包裝產業分散,參與者眾多。隨著包裝應用需求的不斷成長,許多公司透過增加生產設施和產品系列來擴大其市場佔有率。該市場的一些主要參與者包括 WestRock Company、Trident Paper Box Industries、TGI Packaging Pvt。 Ltd、Kapco Packaging 和 Avon Pacfo Services LLP。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 注重循環經濟的產業價值鏈分析

- 印度紙和紙板包裝市場 - PESTEL 分析

- 印度包裝產業現狀及主要趨勢

- 印度的包裝法規和政策、補貼和影響包裝業務的關鍵變化

第5章 市場動態

- 市場促進因素與限制因素分析

- 需求分析及產業趨勢

- 軟包裝需求構成比(%)

- 組織與非組織

- 直接銷售與間接/經銷商銷售

- 紙和紙板包裝印刷技術趨勢

- 主要紙和紙板包裝形式的三年生產趨勢

- 紙與紙板原料分析

- 紙和紙板包裝貿易 -瓦楞紙箱、折疊紙盒、其他

第6章 印度造紙業統計

- 國內紙張需求

- 瓦楞紙及再生瓦楞紙產能

- 原紙板和再生紙板進口量

- 瓦楞紙和紙板

- 進口額及數量

- 出口額及數量

- 箱板

- 箱板紙 - 產值及產量

- 箱板紙 - 進口數量和金額

- 箱板紙出口量及金額

第 7 章 依論文類型進行定性分析

- 紙板 - 按等級

- WLC-白板(GD/UD 和 GT/UT)

- FBB - 折疊紙板 (GC1/UC1 和 GC2/UC2)

- SBB-未漂白硫酸鹽板(SBS)

- SUB-未漂白硫酸鹽固態板(SUS)

- 瓦楞紙板原紙 - 按等級

- 白色牛皮紙

- 未漂白牛皮紙

- 白色頂部測試襯墊

- 未漂白測試襯墊

- 廢棄物製瓦楞紙

- 半化學凹槽

第 8 章市場細分

- 按最終用戶產業

- 瓦楞紙板包裝

- 加工食品

- 生鮮食品

- 飲料

- 個人護理及化妝品

- 家居用品

- 電子商務

- 其他終端用戶產業(運輸及物流、醫療保健、耐用消費品等)

- 折疊式紙盒

- 飲食

- 個人護理及化妝品

- 醫療保健和製藥

- 菸草

- 電氣和金屬製品

- 其他終端使用者產業(玩具、服飾、汽車、家居用品等)

- 液體包裝

- 牛奶

- 汁

- 能量飲料

- 其他終端用戶產業(乳製品,如酪乳、奶油、冰沙等)

- 瓦楞紙板包裝

- 按地區

- 東方

- 西方

- 北

- 南

第9章 競爭格局

- 公司簡介

- TCPL Packaging Ltd

- KCL Limited

- Borkar Packaging Pvt. Ltd

- Canpac Trends Pvt. Ltd

- Trident Paper Box Industries

- Westrock India(Westrock Company)

- TGI Packaging Pvt. Ltd

- Asepto(Uflex)

- Tetra-pak India Private Limited

- Parksons Packaging Ltd

- Kapco Packaging

- OJI India Packaging Pvt. Ltd

- List of Customers by Region in India

- List of Major Unorganized Market Players in India by Region

第10章印度包裝產業的永續性趨勢

第11章 市場展望

The India Paper And Paperboard Packaging Market size is estimated at USD 13.72 billion in 2025, and is expected to reach USD 18.92 billion by 2030, at a CAGR of 6.63% during the forecast period (2025-2030).

Key Highlights

- Over the past decade, the paper packaging industry has witnessed significant growth, driven by shifts in substrate choices, global market expansions, evolving ownership dynamics, and government-led initiatives to phase out plastics. With an ongoing emphasis on sustainability and environmental concerns, India is poised to see industry trends shaped by various innovations in paper and paperboard packaging.

- Recent advancements in paper-based packaging, especially for food preservation, have been noteworthy. A prime example is the rising popularity of corrugated board packaging for transporting fresh produce. To effectively eliminate bacteria, the layers of the corrugated board must bond at elevated temperatures. Furthermore, the recyclability of these grooved boards allows for repeated use while minimizing the risk of cross-contamination.

- In recent years, many manufacturers have adopted aseptic paper packaging. This process involves sterilizing the food product and its packaging through a hot hydrogen peroxide bath. Such aseptic paper ensures that items like milk, coffee, and fresh produce remain uncontaminated and fresh for extended periods. Reflecting this trend, industry players are increasingly investing in the development of compostable packaging.

- For instance, in October 2023, Pakka teamed up with Brawny Bear, a date-based food producer sharing Pakka's sustainability vision, to unveil India's inaugural compostable flexible packaging. This launch underscores a significant achievement for Pakka and marks a pivotal moment for India's expansive packaging industry, which boasts a valuation exceeding USD 70 billion.

- Moreover, as the region leans more toward eco-friendliness, sustainable packaging emerges as a crucial player in mitigating the environmental repercussions of packaging materials. Sustainable packaging significantly curtails waste and bolsters the circular economy by utilizing biodegradable, recyclable, and compostable materials. Furthermore, businesses adopting these eco-conscious practices often enjoy heightened customer loyalty, as consumers favor brands that resonate with their environmental beliefs. Such dynamics are fueling the surging demand for paper packaging in India.

- As paper packaging gains traction, Indian paper mills are responding by increasing capital expenditures to diversify into niche products like carry bags and straw paper. In December 2023, Andhra Paper produced barrier-coated products and invested in modernizing its facilities. APL capitalized on its strengths, adjusting its product mix to meet market demands. The company proactively developed and introduced niche offerings, including carry bags and straw paper, alongside value-added products like cup stock, pharma print, and high BF virgin kraft.

- Paper packaging boasts numerous advantages: it's fully recyclable, cost-effective, and generally more eco-friendly than many plastics. Industry data highlights a notable shift, with multiple organizations moving away from plastic-based packaging in favor of sustainable options like paper and sack-based products. Yet, it's crucial to acknowledge the environmental challenges associated with paper packaging, including susceptibility to moisture, higher energy consumption during production, and a larger transportation footprint.

Key Highlights

India Paper and Paperboard Packaging Market Trends

Corrugated Packaging is Expected to Hold a Significant Market Share

- Corrugated boxes are essential in e-commerce packaging due to their durability and flexibility. These boxes offer superior product protection through their fluted, structured interior that absorbs impact and resists compression. This ensures products arrive intact, regardless of size or sensitivity. E-commerce packaging utilizes corrugated boxes in various sizes, colors, and weight capacities.

- Due to damaged packaging, corrugated boxes significantly reduce product returns in the e-commerce sector. Their robust construction and protective cushioning minimize the risk of damage during shipping, ensuring products arrive at customers' doorsteps intact. By safeguarding items against mishandling and environmental factors, corrugated boxes improve the overall customer experience, leading to fewer returns and exchanges.

- According to the India Brand Equity Foundation (IBFC), the growth of the e-commerce industry has transformed business in India, opening up various segments such as B2B, D2C, C2C, and C2B. Segments like D2C, B2B, and C2C have experienced significant growth in recent years. The D2C market in India is projected to reach USD 60 billion by 2027.

- The recyclability of corrugated boxes aligns with sustainability goals, appealing to environmentally conscious consumers and enhancing brand reputation. Corrugated boxes are integral components of the e-commerce supply chain in India, providing cost-effective solutions while addressing challenges associated with product returns.

- EBANX reports that online retail sales in India generated USD 103 billion in 2023. As the country's e-commerce industry grows rapidly, corrugated boxes have adapted to meet the increasing demand for efficient and reliable packaging solutions.

- These boxes can be customized to accommodate a wide range of products, from electronics to clothing, ensuring secure transit. Their stackable design also optimizes storage space in warehouses and delivery vehicles, enhancing logistics operations for e-commerce companies.

Food and Beverage is Expected to Show Significant Growth

- Paper and paperboard packaging has become crucial in various sectors of India's food industry, including bakeries and snacks. Paperboard tubes offer several advantages, particularly in packaging dry goods such as spices, tea, and snacks. Their cylindrical shape provides efficient storage and transportation, maximizing shelf space and minimizing waste.

- Paperboard tubes can be customized with vibrant printing and labeling, enhancing brand visibility and consumer appeal. With their eco-friendly and recyclable properties, these packaging solutions align with modern businesses' sustainability goals and appeal to environmentally conscious consumers.

- Food producers, especially prominent FMCG brands, have set ambitious targets to reduce the use of plastics in food packaging and adopt new eco-friendly materials. Consequently, paper-based packaging materials are gaining popularity in India.

- Paper and paperboard packaging aligns with the needs of food service outlets, such as restaurants and fast-food chains. The increasing demand for fast food among India's youth has driven a surge in demand for effective packaging solutions, especially for moist or greasy items like pizza and cakes.

- As of March 31, 2023, India reported 1,816 Domino's Pizza stores across 393 cities. Paperboards, including white line chipboard and solid bleached surface board, provide essential grease-resistant properties for packaging products like pizza. These materials protect against moisture and grease, ensuring the pizza remains fresh and intact during transportation and storage.

- According to Agriculture and Agri-Food Canada news, high-fiber breakfast products in India generated a market value of USD 0.3 billion in 2023. Healthy packaged foods like breakfast cereals and high-fiber snacks benefit from paper and paperboard packaging, which ensures freshness and preserves nutritional value while offering eco-friendly solutions.

- According to Bikaji, in 2022, the estimated market value of packaged food was USD 51.35 billion in India. This was an increase as compared to the previous year. Packaged food's market value will likely increase and reach USD 70.22 billion in 2026.

- The increasing demand for packaged food is driving a parallel need for sustainable, recyclable, and eco-friendly packaging solutions. Paper and paperboard, being biodegradable and renewable materials, are gaining preference over plastic due to growing sustainability concerns.

- TThis shift toward more environmentally friendly packaging is expected to drive higher consumption of paperboard for boxes, cartons, and flexible packaging in the food industry.

India Paper and Paperboard Packaging Industry Overview

India's paper packaging industry is fragmented and has many players. With the rising demand for packaging applications, many companies are expanding their market presence by increasing their production facilities and product portfolio. The largest companies in this market include WestRock Company, Trident Paper Box Industries, TGI Packaging Pvt. Ltd, Kapco Packaging, and Avon Pacfo Services LLP.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Defintion

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis with Emphasis on Circular Economy

- 4.3 India Paper & Paperboard Packaging Market - PESTEL Analysis

- 4.4 Packaging Industry Landscape in India and Key Trends

- 4.5 Packaging Regulations, Policies, and Subsidies in India and Key Changes Impacting the Packaging Operations

5 MARKET DYNAMICS

- 5.1 Market Drivers & Restraints Analysis

- 5.2 Demand Analysis and Industry Trends

- 5.3 Demand Split for Flexible Packaging (%)

- 5.3.1 Organized vs. Unorganized

- 5.3.2 Direct vs. Indirect/Dealers Sales

- 5.4 Printing Technology Trends for Paper & Paperboard Packaging

- 5.5 Production Trends over the Past Three Years for Key Paper & Paperboard Packaging Formats

- 5.6 Raw Material Analysis for Paper & Paperboard

- 5.7 Trade Scenario for Paper & Paperboard Packaging - Corrugated Boxes, Folding Cartons, and Others

6 INDIA PAPER INDUSTRY STATISTICS

- 6.1 Domestic Paper Demand

- 6.2 Total Containerboard Capacity (Virgin and Recycled)

- 6.3 Import of Virgin and Recycled Container Board

- 6.4 Corrugated Paper or Paperboard

- 6.4.1 Import Value and Quantity

- 6.4.2 Export Value and Quantity

- 6.5 Cartonboard

- 6.5.1 Carton Board - Production Value and Volume

- 6.5.2 Carton Board - Import Quantity and Value

- 6.5.3 Carton Board - Export Quantity and Value

7 QUALITATIVE ANALYSIS BY PAPER GRADE

- 7.1 Cartonboard - By Grade

- 7.1.1 WLC - White Lined Chipboard (GD/UD and GT/UT)

- 7.1.2 FBB - Folding Boxboard (GC1/UC1 and GC2/UC2)

- 7.1.3 SBB - Solid Bleached Sulphate Board (SBS)

- 7.1.4 SUB - Solid Unbleached Sulphate Board (SUS)

- 7.2 Containerboard - By Grade

- 7.2.1 White Top Kraftliner

- 7.2.2 Unbleached Kraftliner

- 7.2.3 White Top Testliner

- 7.2.4 Unbleached Testliner

- 7.2.5 Waste-based Fluting

- 7.2.6 Semi-chemical Fluting

8 MARKET SEGMENTATION

- 8.1 By End-user Industry

- 8.1.1 Corrugated Packaging

- 8.1.1.1 Processed Food

- 8.1.1.2 Fresh Produce

- 8.1.1.3 Beverage

- 8.1.1.4 Personal Care & Cosmetics

- 8.1.1.5 Household Care

- 8.1.1.6 E-commerce

- 8.1.1.7 Other End-user Industries (Transportation & Logistics, Healthcare, and Consumer Durables, among Others)

- 8.1.2 Folding Cartons

- 8.1.2.1 Food & Beverage

- 8.1.2.2 Personal Care & Cosmetics

- 8.1.2.3 Healthcare & Pharmaceuticals

- 8.1.2.4 Tobacco

- 8.1.2.5 Electrical & Hardware

- 8.1.2.6 Other End-user Industries (Toy, Apparel, Automotive, and Household, among Others)

- 8.1.3 Liquid Cartons

- 8.1.3.1 Milk

- 8.1.3.2 Juices

- 8.1.3.3 Energy Drinks

- 8.1.3.4 Other End-user Industries (Dairy Products such as Buttermilk, Cream, Smoothies, etc.)

- 8.1.1 Corrugated Packaging

- 8.2 By Region

- 8.2.1 East

- 8.2.2 West

- 8.2.3 North

- 8.2.4 South

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 TCPL Packaging Ltd

- 9.1.2 KCL Limited

- 9.1.3 Borkar Packaging Pvt. Ltd

- 9.1.4 Canpac Trends Pvt. Ltd

- 9.1.5 Trident Paper Box Industries

- 9.1.6 Westrock India (Westrock Company)

- 9.1.7 TGI Packaging Pvt. Ltd

- 9.1.8 Asepto (Uflex)

- 9.1.9 Tetra-pak India Private Limited

- 9.1.10 Parksons Packaging Ltd

- 9.1.11 Kapco Packaging

- 9.1.12 OJI India Packaging Pvt. Ltd

- 9.2 List of Customers by Region in India

- 9.3 List of Major Unorganized Market Players in India by Region