|

市場調查報告書

商品編碼

1564672

鋰離子電池用矽負極 - 專利形勢的分析(2024年)Silicon Anode for Li-ion Batteries - Patent Landscape Analysis 2024 |

|||||||

人們認識到矽基負極在鋰離子電池中的潛力,因此進行了大量投資,將該技術推向市場。

鋰離子電池中的矽基負極具有優異的電化學性能,包括更高的能量密度、更大的重量和體積容量、合適的熱力學鋰化電位和更高的平均電壓。

如今,在鋰離子電池中使用矽基陽極正在成為現實,數十億美元流入矽陽極新創公司(IDTechEx,2021)和鋰離子電池矽陽極材料市場。 (IDTechEx,2024)。多家材料製造商宣布商業化生產用於鋰離子電池的矽活性材料,包括Advano、Sila Nanotechnology、Elkem、Group14、NanoGraf、OneD Materials 和Nexeon。同樣,Amprius、Sionic Energy(以前稱為NOHMS)、Farasis Energy、Enovix、StoreDot、三星、松下、PPES(豐田和松下的合資企業) 、包括Murata和Enevate/EnerTech在內的多家電池製造商已經宣布矽負極鋰離子電池的商業化應用。 特斯拉於 2019 年收購了電池製造商 Maxwell Technologies,並於 2021 年收購了電池新創公司 SiLion。同年,PPES與Nexeon宣佈建立合作夥伴關係,重點開發矽負極,StoreDot與EVE Energy b>並與Group14 Technologies 簽訂戰略框架協議,以加速StoreDot 電動車XFC 鋰矽電池的商業化。此外,戴姆勒、保時捷、通用汽車等汽車原始設備製造商正在認識到矽陽極的潛力,並正在投資矽陽極公司或與矽陽極公司合作。

本報告對鋰離子電池矽負極產業進行了調查和分析,提供了有關技術和智慧財產權(IP)的專利狀況以及主要公司的策略的資訊。

報告涵蓋的公司(部分)

LG Chem/LG Energy Solution,Panasonic/Sanyo,Samsung,Murata Manufacturing/Sony,Toyota,ATL(Amperex Technology),COSMX/COSLIGHT,Guoxuan High Tech Power Energy/Gotion,CATL(Contemporary Amperex Technology Ltd),Global Graphene,SVOLT/Fengchao Energy Technology,General Motors,NEC,SK Group,Enevate,Resonac(Showa Denko/Hitachi Chemical),Shanshan Energy Technology,Mitsubishi Chemical,BYD,EVE Energy,Bosch/SEEO,A123 Systems(Wanxiang group),Sunwoda,Nissan,Tafel New Energy Technology/Zenergy,BTR New Energy Material,Amprius/Berzelius,Nexeon,Mitsui Mining & Smelting,Envision/AESC,Tinci Materials Technology,TDK,Hitachi 、JEVE(天津 EV Energy),Huawei,Hyundai/Kia,WeLion New Energy Technology,Wacker Chemie,BAK Battery,Hitachi Maxell,GS Yuasa,Mitsui Chemicals,Tianmu Energy Anode Material,CALB(China Aviation Lithium Battery),Yinlong Energy,Furukawa,Toshiba,Kaijin New Energy Technology,Smoothway Electronic Materials,Kunlunchem,Chery Automobile,Fujifilm,MU Ionic Solutions,Ube Corporation,Shin Etsu Chemical,Sumitomo Electric Industries,MGL New Materials,Sound Group,Zeon,FAW(China First Automobile Works),BMW,Umicore,Sekisui Chemical,Capchem Group,Novolyte Technologies,其他

目錄

簡介

- 報告的背景和目的

- 調查範圍

- Excel 資料庫

- 知識產權基礎知識,以便更好地理解本報告

- 電池領域的挑戰

- 矽負極的主要優缺點

- 矽負極鋰離子電池存在的主要問題及改良措施

摘要整理

專利形勢概要

主要趨勢與IP企業

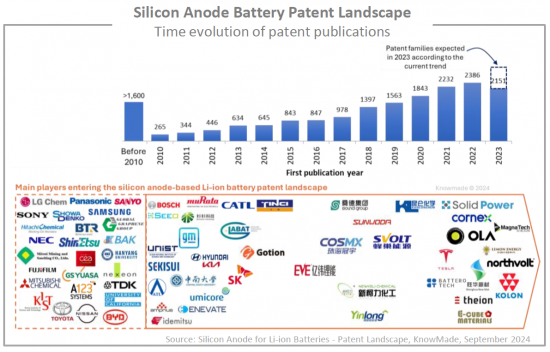

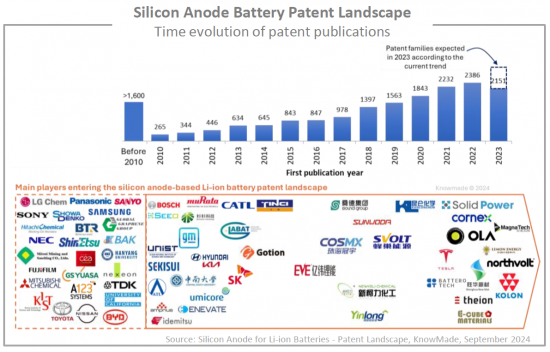

- 專利公佈和主要專利申請人的時間變化

- 專利公開趨勢:依國家劃分

- 主要專利權人:依專利族數量分類

- 主要專利申請人:依公司分類、原籍國

- 涉足專利領域的主要新創公司和純粹參與者

- 主要知識產權公司的時間表

- 2021 年後的智慧財產權公司與新進者

- 主要智慧財產權公司:依供應鏈細分(負極材料、負極、電池)

- 專利目前的法律狀態(已授權、待審、已過期)

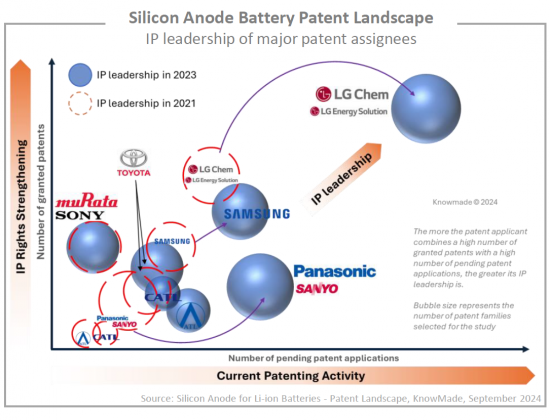

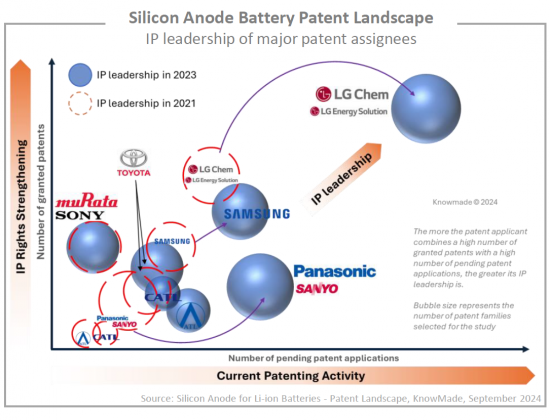

- 主要受託人的智慧財產權領導力以及 2021 年以來的演變

- 主要公司專利的地理範圍

- 主要申請人的智慧財產權策略(國內策略與全球策略)

- 主要知識產權公司和新進入者

主要企業的近幾年的專利活動

- Samsung,LG Chem/LG Energy Solution,Panasonic/Sanyo,ATL,COSMX,Nexeon,Enevate,Ionobell,Enwires

Start-Ups和pure企業的考察

- 繪製了矽負極電池專利格局中超過 290 家新創公司和純粹參與者的地圖

- 中國新創公司與純粹參與者

- 韓國新創公司和純企業

- 日本新創公司和純企業

- 北美的新創公司和純粹的參與者

- 歐洲新創公司與純粹參與者

- 其他(台灣、以色列、印度、新加坡、澳洲等)

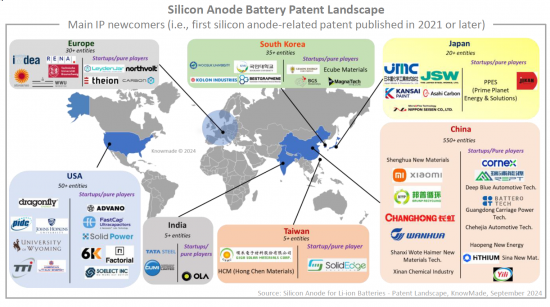

2021年以後的IP新加入企業的考察

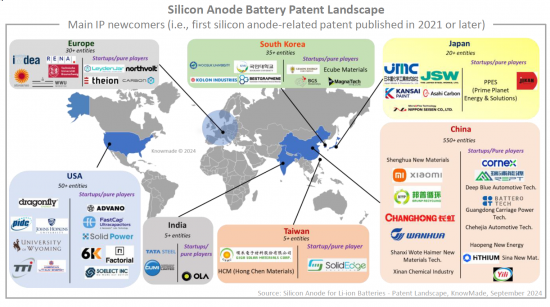

- 繪製了自 2021 年以來已發布首個與矽負極電池相關專利的 650 多個智慧財產權新進者的地圖

- 中國知識產權新進者

- 韓國 IP 新進者

- 日本IP新進入者

- 美國知識產權新進者

- 歐洲知識產權新進入者

- 其他(台灣、加拿大、印度等)

附錄

Knowmade的簡報

Who are the key players and newcomers in the global IP race for the promising silicon anode-based Li-ion batteries?

KEY FEATURES:

- PDF >100 slides

- Excel file >18,200 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments of the supply chain.

- Key players' IP position and the relative strength of their patent portfolio.

- Patents categorized by categorized by supply chain segments (materials, anode, battery cell, other battery components).

- Recent patenting activities of key players.

- Focus on startups, pure players, and IP newcomers.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

The recognized potential of the silicon-based anode for Li-ion batteries has led to significant investments in bringing this technology to market

Silicon-based anodes in Li-ion batteries offer superior electrochemical performance, including higher energy density, greater gravimetric and volumetric capacity, suitable thermodynamic lithiation potentials, and higher average voltage.

Today, the use of silicon-based anodes in Li-ion batteries is becoming a reality, with billions od dollars flowing into silicon anode start-ups (IDTechEx, 2021) and a market for silicon anode material for Li-ion batteries projected to reach $24 billion by 2034 (IDTechEx, 2024) . Several material manufacturers, such as Advano, Sila Nanotechnology, Elkem, Group14, NanoGraf, OneD Materials, and Nexeon, have announced the commercial production of silicon active materials for Li-ion batteries. Likewise, several battery manufacturers have announced the commercial availability of silicon anode Li-ion cells, including Amprius, Sionic Energy (formerly NOHMS), Farasis Energy, Enovix, StoreDot, Samsung, Panasonic, PPES (a joint venture between Toyota and Panasonic), Murata, and Enevate/EnerTech. In the automotive sector, there have been significant strategic acquisitions and partnerships. Tesla acquired battery manufacturer Maxwell Technologies in 2019 and battery start-up SiLion in 2021. That same year, PPES and Nexeon announced a partnership focused on silicon anode development, and StoreDot entered into a strategic framework agreement with EVE Energy, while partnering with Group14 Technologies to accelerate commercialization of StoreDot's XFC lithium-silicon cells for electric vehicles. Additionally, automotive OEMs such as Daimler, Porsche, and GM have recognized the potential of silicon anodes and have invested in and partnered with silicon anode companies.

In this highly competitive and dynamic environment, it is increasingly crucial to have a strong understanding of the patent landscape and the strategies of key players in technology and intellectual property (IP) . To meet this need, Knowmade is releasing a new Silicon Anode Batteries Patent Landscape report, which aims to clarify the current positions of IP players, analyze their IP strategies, and reveal where industry leaders, newcomers, and start-ups are focusing their R&D efforts.

A dynamic IP landscape

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the silicon anode Li-ion battery market. In this report, Knowmade's analysts provide a comprehensive overview of the competitive IP landscape and latest technological developments in this field. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and patented technologies. It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

Evolution of leading players' positions and entry of new patent applicants

LG Chem/LGES is leading the silicon anode battery patent landscape, with strong IP competition from Samsung, Murata, Panasonic/Sanyo, and Toyota. Additionally, we have identified over 290 start-ups and pure players involved in the patent landscape, and more than 650 new entrants who filed their first silicon anode-related patents in 2021 or later, most of whom are Chinese entities. In dedicated sections of the report, we focus on the IP portfolios held by key players, start-ups, and newcomers from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (anode material, anode, battery cell, other battery cell components).

Companies mentioned in the report (non-exhaustive)

LG Chem/LG Energy Solution, Panasonic/Sanyo, Samsung, Murata Manufacturing/Sony, Toyota, ATL (Amperex Technology), COSMX / COSLIGHT, Guoxuan High Tech Power Energy / Gotion, CATL (Contemporary Amperex Technology Ltd), Global Graphene, SVOLT / Fengchao Energy Technology, General Motors, NEC, SK Group, Enevate, Resonac (Showa Denko / Hitachi Chemical), Shanshan Energy Technology, Mitsubishi Chemical, BYD, EVE Energy, Bosch/SEEO, A123 Systems (Wanxiang group), Sunwoda, Nissan, Tafel New Energy Technology / Zenergy, BTR New Energy Material, Amprius / Berzelius, Nexeon, Mitsui Mining & Smelting, Envision / AESC, Tinci Materials Technology, TDK, Hitachi , JEVE (Tianjin EV Energy), Huawei, Hyundai/Kia, WeLion New Energy Technology, Wacker Chemie, BAK Battery, Hitachi Maxell, GS Yuasa, Mitsui Chemicals, Tianmu Energy Anode Material, CALB (China Aviation Lithium Battery), Yinlong Energy, Furukawa, Toshiba, Kaijin New Energy Technology, Smoothway Electronic Materials, Kunlunchem, Chery Automobile, Fujifilm, MU Ionic Solutions, Ube Corporation, Shin Etsu Chemical, Sumitomo Electric Industries, MGL New Materials, Sound Group, Zeon, FAW (China First Automobile Works), BMW, Umicore, Sekisui Chemical, Capchem Group, Novolyte Technologies, and more.

TABLE OF CONTENTS

INTRODUCTION

- Context & objectives of the report

- Scope of the report

- Excel database

- Basic knowledge of IP to better understand this report

- Challenges in battery field

- Main advantages and drawbacks of silicon anode

- Main challenges and improvement solutions for silicon anode lithium-ion battery

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

Main trends and IP players

- Time evolution of patent publications and main patent applicants

- Time evolution of patent publications by country

- Main patent assignees according to the number of their patent families

- Main patent assignees by companies' typology and originating countries

- Main start-ups and pure players involved in the patent landscape

- Timeline of main IP players

- Historical IP players and new entrants since 2021

- Main IP players by supply chain segments (anode material, anode, battery cell)

- Current legal status of patents (granted, pending, dead)

- IP leadership of main assignees and evolution from 2021

- Geographical coverage of main players' patents

- IP strategy of main patent applicants (domestic strategy vs. global strategy)

- Key IP players and newcomers

Recent patenting activity of key players

- Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, ATL, COSMX, Nexeon, Enevate, Ionobell, Enwires

Focus on start-ups and pure players

- Mapping of 290+ startups and pure players involved in the silicon anode battery patent landscape

- Chinese startups and pure players

- South Korean startups and pure players

- Japanese startups and pure players

- North American startups and pure players

- European startups and pure players

- Others (Taiwanese, Israeli, Indian, Singaporean, Australian, etc.)

Focus on IP newcomers since 2021

- Mapping of 650+ IP newcomers that published their first patent related silicon anode batteries in 2021 or later.

- Chinese IP newcomers

- South Korean IP newcomers

- Japanese IP newcomers

- American IP newcomers

- European IP newcomers

- Others (Taiwanese, Canadian, Indian, etc.)

ANNEX

- Methodology for patent search, selection and analysis

- Terminology