|

市場調查報告書

商品編碼

1636420

德國電動車電池負極:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

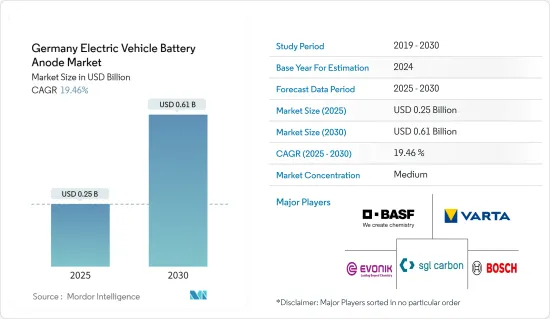

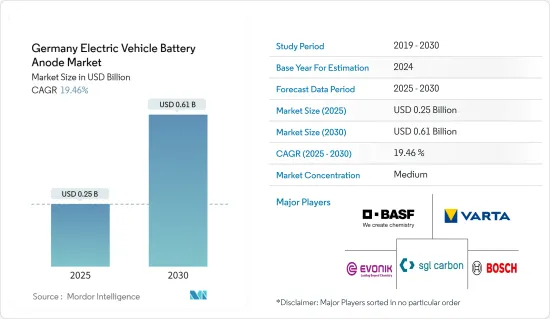

德國電動車電池陽極市場規模預計到2025年為2.5億美元,預計到2030年將達到6.1億美元,預測期內(2025-2030年)複合年成長率為19.46%。

主要亮點

- 從中期來看,電動車普及率的提高和陽極材料的技術進步預計將在預測期內推動電動車電池陽極的需求。

- 另一方面,先進的負極材料,特別是那些仍處於實驗階段的材料,生產成本較高,這會顯著抑制德國電動車電池負極市場的成長。

- 對回收和循環經濟的日益關注為開發永續陽極材料提供了機會,回收過程預計將在不久的將來為電動車電池陽極市場提供重大機會。

德國電動車電池負極市場趨勢

鋰離子電池類型主導市場

- 在德國,鋰離子電池,尤其是電動車 (EV) 領域的鋰離子電池,對於向永續交通的轉變至關重要。作為世界汽車強國,德國政府大力投資開發先進的電動車電池技術,特別關注鋰離子電池的關鍵零件負極。

- 負極是鋰離子電池的主要特性,大大影響電池的效能,包括容量、壽命、充電速度。此外,鋰離子電池的成本對電動車定價也有重大影響。因此,德國電動車電池陽極市場在更大的鋰離子電池領域中佔有最重要的地位。

- 例如,根據彭博社NEF報道,2023年德國電池價格將降至139美元/kWh,較上年下降13%。隨著技術創新和製造流程的不斷改進,電池組價格預計到2025年將進一步降至113美元/kWh,2030年達到80美元/kWh。隨著製造效率的提高和鋰離子電池產量的擴大,預計預測期內電池負極的單價也將下降。

- 此外,陽極材料的持續創新不僅提高了電池性能,而且使電動車相對於傳統內燃機汽車的競爭力日益增強。在此背景下,近年來地方政府大力支持電動車電池技術創新。

- 例如,2024 年 5 月,總部位於柏林的電池創新公司 Theion 公佈了電池技術的突破性飛躍,突顯了其新穎的陽極化學。 Theion的創新是一種具有特殊塗層的輕質聚合物主體,旨在取代石墨和富矽石墨等傳統陽極材料。最重要的是,這項進步擁有超過 2,000 次充電/放電循環的令人印象深刻的記錄。電池技術的進步將加強該地區先進電池的生產,並增加電池製造中對負極的需求。

- 在德國,負極材料的主要應用是電動車(EV)的鋰離子電池。這些電池為各種電動車提供動力,從乘用車、商用車到公共交通系統。國內領導者已啟動多個電池製造計劃,以滿足所有電動車類別不斷成長的需求。

- 例如,2024 年 1 月,瑞典著名鋰離子電池製造商 Northvolt 獲得歐盟批准,其來自德國的國家支持包裝價值 9.02 億歐元(9.8643 億美元)。該資金將支持在德國海德建立電動車(EV)電池生產設施。該舉措將在短期內加強當地電動車電池的生產並增加對負極材料的需求。

- 從這些發展中可以清楚看出,此類舉措和創新將擴大該地區的鋰離子電池產量,同時也將增加未來幾年對電動車電池陽極的需求。

擴大電動車普及率正在推動市場發展

- 德國電動車電池負極市場是受到消費者偏好和監管要求變化影響的電動車需求激增的推動。在政府獎勵和電池技術進步的推動下,這種勢頭為市場的持續成長奠定了基礎。

- 根據國際能源總署(IEA)的報告,2023年德國電動車銷量將達70萬輛,比2019年成長5.5倍。隨著政府推出一系列支持措施,電動車銷量預計在未來幾年將進一步成長。

- 此外,德國政府旨在遏制碳排放和支持電動車的補貼和獎勵在推動市場方面發揮關鍵作用。這些舉措包括對電動車購買的財政支持、稅收優惠和增強的充電基礎設施,所有這些都將推動電動車的採用,進而增加鋰離子電池製造中對電池陽極的需求。

- 根據「2025高科技戰略」和「歐洲電池創新計劃」,政府正在積極支持電池技術和以電動車為重點的研究。值得注意的是,政府宣布了一項重大補貼計畫。新電動車買家最多可獲得 6,000 歐元(6,500 美元)的優惠,插電式混合動力買家最多可獲得 4,500 歐元(4,900 美元)的折扣。這些措施預計將促進電動車的生產,進而在一段時間內增加對電池陽極的需求。

- 此外,很明顯該地區的工業正在轉向電動車。主要公司正在加緊投資和計劃以提高電動車產量。 2023年6月,福特宣布將斥資20億美元在科隆建立一座電動車工廠,目標年產量25萬輛。科隆工廠是福特實現到 2026 年每年生產 200 萬輛電動車的宏偉目標的基石。此類舉措不僅擴大了電動車產量,還顯示對電池負極的需求不斷成長。

- 總而言之,這些共同努力和策略將促進電動車銷量,因此未來幾年對負極電池材料的需求也將增加。

德國電動車電池負極產業概況

德國電動車電池負極市場溫和。主要參與企業(排名不分先後)包括BASF SE、Varta AG、SGL Carbon SE、Evonik Industries AG 和 Robert Bosch GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 負極材料的進展

- 抑制因素

- 生產成本高

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料類型

- 鋰

- 石墨

- 矽

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BASF SE

- Varta AG

- SGL Carbon SE

- Evonik Industries AG

- Robert Bosch GmbH

- Innolith AG

- Leclanche GmbH

- Heraeus Holding GmbH

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 循環經濟和回收

簡介目錄

Product Code: 50003595

The Germany Electric Vehicle Battery Anode Market size is estimated at USD 0.25 billion in 2025, and is expected to reach USD 0.61 billion by 2030, at a CAGR of 19.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing EV adoption and technological advancements in anode materials are expected to drive the demand for electric vehicle battery anode during the forecast period.

- On the other hand, the high production costs of advanced anode materials, particularly those that are still in the experimental phase can significantly restrain the growth of the Germany electric vehicle battery anode market.

- Nevertheless, the growing focus on recycling and the circular economy presents opportunities for developing sustainable anode materials and the recycling processe are expected to create significant opportunities for electric vehicle battery anode market in the near future.

Germany Electric Vehicle Battery Anode Market Trends

Lithium-Ion Battery Type to Dominate the Market

- In Germany, the lithium-ion battery, especially in the electric vehicle (EV) sector, is pivotal to the nation's shift towards sustainable transportation. Being a global automotive powerhouse, Germany's government is deeply invested in pioneering advanced EV battery technologies, with a particular emphasis on the anode, a vital lithium-ion battery component.

- The anode, a key player in lithium-ion batteries, greatly affects the battery's performance, encompassing capacity, lifespan, and charging speed. Furthermore, the cost of lithium-ion batteries significantly impacts the pricing of electric vehicles. Thus, Germany's EV battery anode market holds paramount importance in the larger lithium-ion battery landscape.

- For instance, a Bloomberg NEF report highlighted that in 2023, battery prices in Germany dropped to USD 139/kWh, marking a 13% decline from the previous year. With ongoing technological innovations and manufacturing refinements, projections suggest battery pack prices will further dip to USD 113/kWh by 2025 and reach USD 80/kWh by 2030. As manufacturing efficiencies improve and lithium-ion battery production ramps up, the unit cost of battery anodes is also expected to decline during the forecast period.

- Moreover, ongoing innovations in anode materials are not only boosting battery performance but also making EVs increasingly competitive against traditional internal combustion engine vehicles. In light of this, regional governments have been fervently championing EV battery innovations in recent years.

- For instance, in May 2024, Theion, a Berlin-based battery innovator, showcased a groundbreaking leap in battery technology, spotlighting its novel anode chemistry. Theion's innovation, a lightweight polymer host with specialized coatings, aims to replace conventional anode materials such as graphite and silicon-rich graphite. Notably, this advancement boasts an impressive achievement of over 2,000 charging and discharging cycles. Such strides in battery technology are poised to bolster advanced battery production in the region, subsequently amplifying the demand for anodes in battery manufacturing.

- In Germany, the predominant use of anode materials is in crafting lithium-ion batteries for electric vehicles (EVs). These batteries power a diverse range of EVs, from passenger cars and commercial vehicles to public transportation systems. Major companies in the country have initiated multiple battery manufacturing projects to meet the surging demand across all EV categories.

- For instance, in January 2024, Northvolt, a prominent Swedish lithium-ion battery manufacturer, secured EU endorsement for a hefty EUR 902 million (USD 986.43 million) state aid package from Germany. This funding is earmarked for establishing an electric vehicle (EV) battery production facility in Heide, Germany. This initiative is set to bolster regional EV battery output and heighten the demand for anode materials in the foreseeable future.

- Given these developments, it's evident that such initiatives and innovations are poised to amplify lithium-ion battery production in the region, concurrently driving up the demand for EV battery anodes in the coming years.

Growing EV Adoption Drives the Market

- Germany's EV battery anode market is being driven by a surge in electric vehicle demand, influenced by changing consumer preferences and regulatory mandates. This momentum is bolstered by government incentives and technological advancements in batteries, setting the stage for continued market growth.

- As reported by the International Energy Agency (IEA), Germany witnessed electric vehicle sales reaching 0.7 million in 2023, a remarkable 5.5-fold surge since 2019. With the government rolling out a series of supportive policies, EV sales are poised for further growth in the coming years.

- Moreover, the German government's subsidies and incentives, aimed at curbing carbon emissions and championing electric mobility, play a crucial role in propelling the market. These initiatives encompass financial backing for EV purchases, tax incentives, and bolstering charging infrastructure, all of which amplify EV adoption and, consequently, the demand for battery anodes in lithium-ion battery production.

- Under the High-Tech Strategy 2025 and the European Battery Innovation project, the government is actively backing battery technology and EV-centric research. Notably, the government unveiled a substantial subsidy scheme: new EV buyers can avail up to EUR 6,000 (USD 6,500), while plug-in hybrid buyers can benefit from up to EUR 4,500 (USD 4,900). Such measures are set to boost EV production and, in turn, the demand for battery anodes in the foreseeable future.

- Additionally, the regional industry's pivot towards electric vehicles is evident. Major companies are ramping up investments and projects to bolster EV production. A case in point: Ford's announcement in June 2023 to inaugurate a USD 2 billion EV factory in Cologne, targeting an annual output of 250,000 vehicles. This Cologne facility is a stepping stone towards Ford's ambitious goal of 2 million annual EVs by 2026. Such undertakings not only amplify EV production but also signal a heightened demand for battery anodes.

- In summary, these concerted efforts and strategies are set to boost EV sales and, consequently, the demand for anode battery materials in the coming years.

Germany Electric Vehicle Battery Anode Industry Overview

The Germany electric vehicle battery anode market is moderate. Some of the key players (not in particular order) are BASF SE, Varta AG, SGL Carbon SE, Evonik Industries AG, Robert Bosch GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Anode Materials

- 4.5.2 Restraints

- 4.5.2.1 High Production Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Varta AG

- 6.3.3 SGL Carbon SE

- 6.3.4 Evonik Industries AG

- 6.3.5 Robert Bosch GmbH

- 6.3.6 Innolith AG

- 6.3.7 Leclanche GmbH

- 6.3.8 Heraeus Holding GmbH

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Circular Economy and Recycling

02-2729-4219

+886-2-2729-4219