|

市場調查報告書

商品編碼

1636449

南美洲電動車電池負極:市場佔有率分析、產業趨勢、成長預測(2025-2030)South America Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

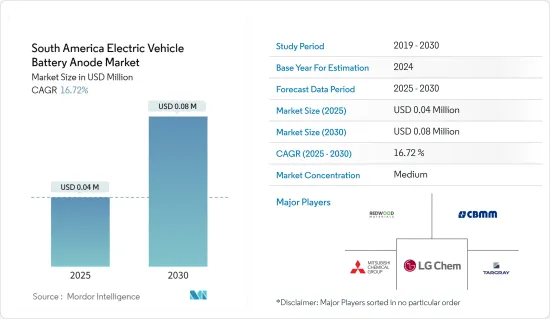

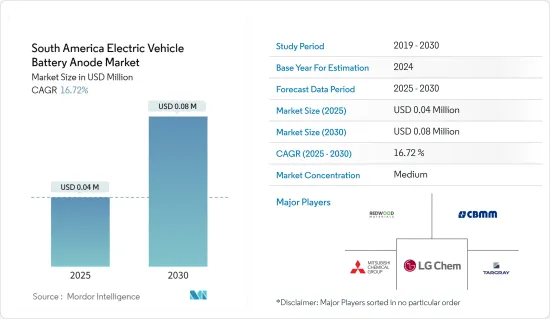

南美洲電動車電池陽極市場規模預計到2025年為4000萬美元,預計到2030年將達到8000萬美元,預測期內(2025-2030年)複合年成長率為16.72%。

主要亮點

- 電動車普及率的提高、政府的支持措施以及鋰離子電池價格的下降將推動預測期內的市場成長。

- 然而,該地區電池零件嚴重依賴進口,這給未來的市場擴張帶來了挑戰。

- 然而,負極材料和高效電解質的持續研究和進展為市場成長提供了有希望的機會。

- 由於汽車產業對陽極材料的需求不斷成長,巴西可能會引領市場。

南美洲電動車電池負極市場趨勢

鋰離子電池預計將佔較大佔有率

- 由於鋰資源豐富,南美洲鋰離子電動車電池市場預計將成長。鋰三角橫跨阿根廷、玻利維亞和智利部分地區,蘊藏量全球一半以上的鋰蘊藏量,使南美洲在全球電動車供應鏈中發揮至關重要的作用。

- 這些巨大的蘊藏量,加上 2023 年鋰離子電池組價格下降 14%(降至 139 美元/千瓦時),為國內電動車電池及其組件(如陽極)的製造提供了大量機會。

- 鑑於這些發展,許多電池製造商正在投資探勘該地區的鋰蘊藏量。探勘和生產的爆炸性成長將擴大電動車鋰離子電池的需求,並增加其生產中對電池陽極的需求。

- 例如,2024年7月,法國礦業集團Eramet和中國青山在阿根廷薩爾塔推出鋰生產工廠,以滿足電動車產業不斷成長的需求。這項 8.7 億美元的戰略投資凸顯了該地點的重要性。

- 隨著該地區因蘊藏量豐富而擴大對鋰離子電池製造的投資,電動車用鋰離子陽極市場也不斷成長。為了支持這一前景,玻利維亞總統於 2024 年 3 月宣布,他打算在 2026 年開始出口電池,包括電動車電池。

- 隨著電動車擴大採用鋰離子電池及其價格暴跌,鋰離子電池負極市場將在未來幾年大幅成長。

巴西預計將佔很大佔有率

- 巴西是南美洲最大的汽車市場,擁有強大的製造基地,擁有許多全球汽車製造商。隨著行業轉向電氣化,這一趨勢正在無縫地轉移到關鍵部件的生產中,特別是電池和電池陽極。

- 此外,巴西在電動車電池製造領域的地位不斷上升,正在塑造電動車電池負極市場的發展軌跡。隨著巴西吸引大量外國投資並建立全球夥伴關係關係以建立電池生產設施,對鋰離子電池必需的優質陽極材料的需求正在增加。

- 例如,2023年9月,中國比亞迪在巴西推出了第一家電池工廠。除了電動車(EV)外,比亞迪還計劃在巴西生產電動公車並使用當地製造的電池。這些戰略舉措預計將擴大巴西電動車電池負極市場的需求。

- 此外,隨著巴西電動車銷量的激增,電池製造商正在加大對當地生產的投資,進一步推動了對電動車電池負極的需求。根據國際能源總署的報告,2023年巴西電動車銷量將達到52,000輛,比2022年的18,500輛大幅成長。

- 展望未來,在政府對電動車電池領域的支持下,電池負極市場可望成長。巴西政府最近的政策變化引發了汽車製造商的新一波投資浪潮。這些投資旨在實現設備現代化和加強研發,強調永續性以及電動和混合動力汽車的生產。巴西汽車工業協會強調了 2024 年(至 2032 年)投資 220 億美元的里程碑承諾。

- 鑑於電動車的快速普及和電池製造的快速成長,巴西可能在未來幾年引領市場。

南美洲電動車電池負極產業概況

南美洲電動車電池負極市場半集中。市場主要企業包括(排名不分先後)Redwood Materials Inc.、三菱化學集團公司、CBMM、LG Chem Ltd 和 Targray Industries Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府對電池製造的措施和投資

- 電池原物料成本下降

- 抑制因素

- 電池零件依賴進口

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子

- 鉛酸

- 其他電池類型

- 材料

- 鋰

- 石墨

- 矽

- 其他

- 地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Redwood Materials Inc.

- Anovion LLC

- Mitsubishi Chemical Group Corporation

- CBMM

- NEI Corporation

- Targray Industries Inc.

- Nexeon Lid.

- LG Chem Ltd

- Tokai Carbon Co., Ltd.

- Resonac Holdings Corporation

- 市場排名分析

- 其他知名公司名單

第7章 市場機會及未來趨勢

- 加大其他負極材料的研發力度

簡介目錄

Product Code: 50003716

The South America Electric Vehicle Battery Anode Market size is estimated at USD 0.04 million in 2025, and is expected to reach USD 0.08 million by 2030, at a CAGR of 16.72% during the forecast period (2025-2030).

Key Highlights

- In the forecast period, the market is poised for growth, driven by the rising adoption of electric vehicles, supportive government initiatives, and declining prices of lithium-ion batteries.

- However, the region's heavy reliance on importing battery components poses a challenge to future market expansion.

- Yet, ongoing research and advancements in anode materials and efficient electrolytes present promising opportunities for market growth.

- Brazil is set to lead the market, fueled by the increasing demand for anode materials in the automotive sector.

South America Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- South America's lithium-ion EV battery market is poised for growth, thanks to the region's abundant lithium resources. The Lithium Triangle, spanning parts of Argentina, Bolivia, and Chile, harbors over half of the world's lithium reserves, cementing South America's pivotal role in the global EV supply chain.

- With these vast reserves and a 14% drop in lithium-ion battery pack prices in 2023 (down to USD139/kWh), there's a burgeoning opportunity for domestic manufacturing of electric vehicle batteries and their components, such as anodes.

- In light of these developments, many battery companies are channeling investments into exploring the region's lithium reserves. This surge in exploration and production is set to amplify the demand for lithium-ion batteries in electric vehicles, subsequently heightening the need for battery anodes in their production.

- For example, in July 2024, French mining group Eramet and China's Tsingshan launched a lithium production plant in Salta, Argentina, addressing the electric car industry's rising demands. This strategic investment, amounting to USD 870 million, underscores the site's significance.

- Looking ahead, as the region ramps up investments in lithium-ion battery manufacturing, buoyed by its rich reserves, the market for lithium-ion anodes in EVs is on an upward trajectory. Bolstering this outlook, Bolivia's President, in March 2024, unveiled ambitions to commence battery exports, including EV batteries, by 2026.

- Given the rising adoption of lithium-ion batteries in electric vehicles and their plummeting prices, the lithium-ion battery anode segment is set for substantial growth in the coming years.

Brazil is Expected to have a Significant Share

- Brazil stands as South America's largest automotive market, boasting a robust manufacturing base that hosts numerous global automakers. As the industry pivots towards electrification, this trend has seamlessly transitioned to the production of essential components, notably batteries and battery anodes.

- Moreover, Brazil's rising stature in the EV battery manufacturing arena is shaping the trajectory of its EV battery anode market. With Brazil drawing substantial foreign investments and forging global partnerships to set up battery production facilities, there's a heightened demand for premium anode materials, vital for lithium-ion batteries.

- For example, in September 2023, BYD, a Chinese firm, launched its first battery factory in Brazil. Beyond electric vehicles (EVs), BYD is set to produce electric buses in Brazil, leveraging batteries manufactured on-site. Such strategic moves are poised to amplify the demand for the country's EV battery anode market.

- Furthermore, as electric vehicle sales surge in Brazil, battery manufacturers are increasingly investing in local production, further fueling the demand for EV battery anodes. The International Energy Agency reported that in 2023, Brazil's EV car sales reached 52,000 units, a significant jump from 18,500 units in 2022.

- Looking ahead, bolstered by government backing in the EV battery sector, the battery anode market is poised for growth. Recent policy shifts by Brazil's government have ignited a wave of new investments from vehicle manufacturers. These investments, targeting facility modernization and enhanced R&D, emphasize sustainability and the production of electric and hybrid vehicles. The Brazilian Association of Vehicle Manufacturers highlighted a landmark commitment of USD 22 billion in 2024 investments, extending through 2032.

- Given the surging adoption of EVs and the burgeoning battery manufacturing landscape, Brazil is set to lead the market in the coming years.

South America Electric Vehicle Battery Anode Industry Overview

The South America electric vehicle battery anode market is semi-concentrated. Some of the major players in the market (in no particular order) include Redwood Materials Inc., Mitsubishi Chemical Group Corporation, CBMM, LG Chem Ltd, and Targray Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Battery Imported Components

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Redwood Materials Inc.

- 6.3.2 Anovion LLC

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 CBMM

- 6.3.5 NEI Corporation

- 6.3.6 Targray Industries Inc.

- 6.3.7 Nexeon Lid.

- 6.3.8 LG Chem Ltd

- 6.3.9 Tokai Carbon Co., Ltd.

- 6.3.10 Resonac Holdings Corporation.

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Anode Materials

02-2729-4219

+886-2-2729-4219