|

市場調查報告書

商品編碼

1636421

法國電動車電池負極:市場佔有率分析、產業趨勢、成長預測(2025-2030)France Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

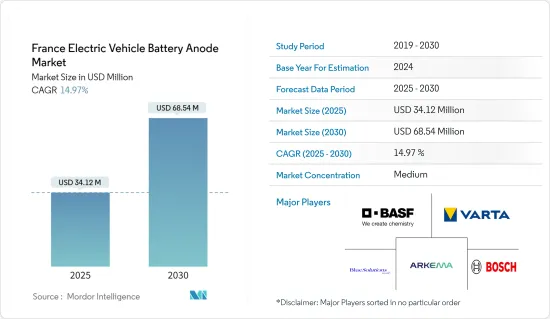

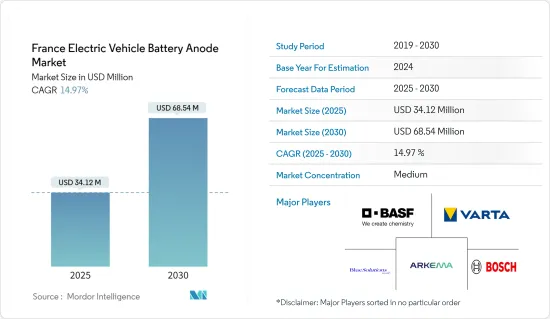

預計2025年法國電動車電池負極市場規模為3,412萬美元,2030年預計將達6,854萬美元,預測期內(2025-2030年)複合年成長率為14.97%。

主要亮點

- 從中期來看,電動車普及率的提高和陽極材料的技術進步預計將在預測期內推動電動車電池陽極的需求。

- 另一方面,先進的負極材料,尤其是那些仍處於實驗階段的材料,生產成本較高,這會顯著抑制德國電動車電池負極市場的成長。

- 對回收和循環經濟的日益關注為開發永續陽極材料提供了機會,回收過程預計將在不久的將來為電動車電池陽極市場提供重大機會。

法國電動車電池負極市場趨勢

鋰離子電池類型主導市場

- 在德國,鋰離子電池,尤其是電動車 (EV) 領域的鋰離子電池,對於向永續交通轉型至關重要。作為汽車產業的世界領導者,德國政府致力於推進和生產尖端的電動車電池技術,特別重視鋰離子電池的關鍵零件負極。

- 負極對於鋰離子電池至關重要,影響容量、壽命和充電速度。此外,這種電池的成本對電動車的定價有重大影響。因此,國內電電動車電池負極市場是更廣泛的鋰離子電池領域中最重要的市場。

- 例如,根據彭博新能源財經報道,2023年電池價格將降至139美元/kWh,較上年下降13%。持續的技術進步和製造改進預計將進一步將電池組價格在 2025 年降低至 113 美元/kWh,在 2030 年降低至 80 美元/kWh。由於製造效率的提高,鋰離子電池的產量增加,預計電池負極的單價將在預測期內下降。

- 此外,陽極材料的技術創新正在提高鋰離子電池的性能,使電動車相對於傳統內燃機汽車的競爭力日益增強。該地區各國政府正積極支持電動車電池創新,各大公司最近都啟動了增強電動車電池負極材料的計劃。

- 例如,2023 年 12 月,HPQ Silicon Inc. 宣布其位於法國的子公司 NOVACIUM SAS 獲得了 90,000 歐元(約 99,000 美元)的法國科技新興補助金。這筆津貼旨在支持加強先進二氧化矽基電池負極材料整個價值鏈的計劃。鋰電池領域的一個顯著趨勢是在石墨複合電極中使用 5% 至 10% 的氧化矽 (SiOx) 添加劑。這些進步將支持該地區先進的電池生產,並推動未來幾年電池製造中對負極的需求。

- 在法國,負極材料的主要應用是電動車(EV)的鋰離子電池。這些電池為從乘用車到商用車和公共運輸的各種電動車提供動力。主要企業啟動了多個電池製造計劃,以滿足所有電動車類別快速成長的需求。

- 例如,2024 年 5 月,法國 Blue Solutions 宣布計劃在法國東部建造一座超級工廠,投資約 20 億歐元(21.7 億美元)。該工廠的目標是生產一種新型電動車固態電池,快速充電時間為 20 分鐘,預計 2030 年開始生產。預計此類措施將推動鋰離子電池作為清潔能源解決方案的採用,並在預測期內推動對負極材料的需求。

- 這些計劃和創新將擴大該地區的鋰離子電池產量,並在未來幾年大幅增加對電動車電池陽極的需求。

擴大電動車普及率正在推動市場發展

- 在法國,由於消費者偏好的變化和強制性法規,對電動車(EV)的需求迅速增加,推動了電動車電池陽極市場的發展。這一勢頭得到了政府激勵措施和電池開發技術進步的進一步支持,為市場的持續擴張奠定了基礎。

- 近年來,該地區電動車的銷量激增。例如,國際能源總署(IEA)報告稱,2023年法國電動車銷量為47萬輛,較2022年成長38.2%。預測全部區域電動車銷量將大幅成長,電池負極材料的需求也會隨之增加。

- 此外,法國政府旨在遏制碳排放和支持電動車的補貼和獎勵在推動市場方面發揮關鍵作用。這些努力包括對電動車購買的財政支持、稅收優惠以及增加充電基礎設施的投資。總的來說,這些不僅支持了電動車的普及,而且還增加了對電池負極的需求,而電池負極對於鋰離子電池的生產至關重要。

- 例如,2024年5月,法國政府與頂級汽車製造商簽署協議,制定了2027年銷售80萬輛電動車的雄心勃勃的目標。此外,政府也撥款15億歐元(約16億美元),透過各種措施加強電動車的生產和採購。這些戰略舉措不僅將加速電動車的生產,還將擴大對電池陽極材料的需求。

- 此外,向電動車的過渡對於實現零淨碳排放的目標至關重要。該地區的主要企業正在積極投資和推出計劃,以提高電動車產量。

- 例如,中國著名電動車製造商比亞迪於2024年6月宣布,計劃在法國建立電動車生產設施,並在全國推出插電式混合動力汽車(PHEV)。該設施預計將於年終投入營運。這些努力將支持電動車的生產,進而擴大對電池和陽極的需求。

- 總而言之,這些共同努力和策略預計將在短期內加強電動車銷售,並相應增加對負極電池材料的需求。

法國電動車電池負極產業概況

法國電動車電池負極市場溫和。主要企業(排名不分先後)包括BASF SE、Varta AG、Blue Solutions、Arkema SA 和 Robert Bosch GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 負極材料的進展

- 抑制因素

- 生產成本高

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料類型

- 鋰

- 石墨

- 矽

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BASF SE

- Varta AG

- Blue Solutions

- Arkema SA

- Robert Bosch GmbH

- TotalEnergies SE

- STMicroelectronics

- NAWA Technologies

- Solvay SA

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 循環經濟和回收

簡介目錄

Product Code: 50003596

The France Electric Vehicle Battery Anode Market size is estimated at USD 34.12 million in 2025, and is expected to reach USD 68.54 million by 2030, at a CAGR of 14.97% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing EV adoption and technological advancements in anode materials are expected to drive the demand for electric vehicle battery anode during the forecast period.

- On the other hand, the high production costs of advanced anode materials, particularly those that are still in the experimental phase can significantly restrain the growth of the Germany electric vehicle battery anode market.

- Nevertheless, the growing focus on recycling and the circular economy presents opportunities for developing sustainable anode materials and the recycling processe are expected to create significant opportunities for electric vehicle battery anode market in the near future.

France Electric Vehicle Battery Anode Market Trends

Lithium-Ion Battery Type Dominate the Market

- In Germany, the lithium-ion battery, particularly in the electric vehicle (EV) sector, is crucial to the nation's transition towards sustainable transportation. As a global automotive leader, Germany's government is dedicated to advancing and producing state-of-the-art EV battery technologies, with a special focus on the anode, a vital component of lithium-ion batteries.

- The anode is essential in lithium-ion batteries, influencing their capacity, lifespan, and charging speed. Moreover, the cost of these batteries significantly affects electric vehicle pricing. Consequently, the nation's EV battery anode market is of paramount importance in the broader lithium-ion battery landscape.

- For example, a Bloomberg NEF report highlighted that in 2023, battery prices fell to USD 139/kWh, marking a 13% drop from the prior year. With ongoing technological advancements and manufacturing improvements, battery pack prices are projected to further decline, estimating costs at USD 113/kWh by 2025 and USD 80/kWh by 2030. As lithium-ion battery production ramps up due to enhanced manufacturing efficiencies, the unit cost of battery anodes is expected to decrease during the forecast period.

- Moreover, innovations in anode materials are boosting lithium-ion battery performance, making EVs increasingly competitive against traditional internal combustion engine vehicles. Governments in the region are actively championing EV battery innovations, and major companies have recently embarked on projects to enhance anode materials in EV batteries.

- For instance, in December 2023, HPQ Silicon Inc. revealed that its affiliate, NOVACIUM SAS, based in France, obtained a French Tech Emergence Grant of EUR 90,000 (around USD 99,000). This grant is intended to support projects that enhance the entire value chain of advanced SiOx-based anode materials for batteries. A notable trend in the lithium battery domain is the use of 5% to 10% silicon oxide (SiOx) additives in graphite composite electrodes. Such advancements are poised to boost sophisticated battery production in the region and elevate the demand for anodes in battery manufacturing in the years ahead.

- In France, the primary use of anode materials is in lithium-ion batteries for electric vehicles (EVs). These batteries power a range of EVs, from passenger cars to commercial vehicles and public transport. Leading French companies have initiated multiple battery manufacturing projects to meet the surging demand across all EV categories.

- For example, in May 2024, Blue Solutions, a French firm, unveiled plans for a gigafactory in eastern France, with an investment of about 2 billion euros (USD 2.17 billion). This facility aims to produce a new solid-state battery for EVs, boasting a rapid 20-minute charging time, with production slated to commence by 2030. Such initiatives are set to bolster the adoption of lithium-ion batteries as a clean energy solution and heighten the demand for anode materials in the forecast period.

- Thus, these projects and innovations are poised to amplify lithium-ion battery production in the region and escalate the demand for EV battery anodes in the coming years.

Growing EV adoption drives the Market

- In France, the surging demand for electric vehicles (EVs), driven by changing consumer preferences and regulatory mandates, is propelling the EV battery anode market. This momentum is further bolstered by government incentives and technological strides in battery development, setting the stage for continued market expansion.

- Sales of electric vehicles in the region have seen a meteoric rise in recent years. For instance, the International Energy Agency (IEA) reported that in 2023, France sold 0.47 million electric vehicles, marking a 38.2% increase from 2022. Projections indicate a substantial uptick in electric vehicle sales across the region, subsequently amplifying the demand for battery anode materials.

- Moreover, the French government's subsidies and incentives, aimed at curbing carbon emissions and championing electric mobility, play a crucial role in propelling the market. These initiatives encompass financial backing for EV purchases, tax incentives, and bolstered investments in charging infrastructure. Collectively, they not only boost electric vehicle adoption but also heighten the demand for battery anodes essential for lithium-ion battery production.

- For example, in May 2024, the French government inked a deal with top car manufacturers, setting an ambitious target of 800,000 electric vehicle sales by 2027, a significant leap from 200,000 in 2022. Additionally, the government allocated a substantial 1.5 billion euros (approximately USD 1.6 billion) to bolster electric vehicle production and purchases through diverse initiatives. Such strategic moves are poised to not only accelerate EV production but also amplify the demand for battery anode materials.

- Furthermore, the transition to electric vehicles is pivotal in realizing net-zero carbon emission aspirations. Major companies in the region are actively investing and launching projects to bolster electric vehicle production.

- For instance, in June 2024, BYD Company, a prominent Chinese electric vehicle manufacturer, declared its plans to establish an EV production facility in France, with intentions to introduce plug-in hybrid vehicles (PHEVs) nationwide. This facility is slated to commence operations by the end of next year. Such endeavors are set to boost EV production and, in turn, escalate the demand for battery anodes.

- In summary, these concerted efforts and strategies are anticipated to bolster EV sales and subsequently elevate the demand for anode battery materials in the foreseeable future.

France Electric Vehicle Battery Anode Industry Overview

The France electric vehicle battery anode market is moderate. Some of the key players (not in particular order) are BASF SE, Varta AG, Blue Solutions, Arkema S.A., Robert Bosch GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Anode Materials

- 4.5.2 Restraints

- 4.5.2.1 High Production Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Varta AG

- 6.3.3 Blue Solutions

- 6.3.4 Arkema S.A.

- 6.3.5 Robert Bosch GmbH

- 6.3.6 TotalEnergies SE

- 6.3.7 STMicroelectronics

- 6.3.8 NAWA Technologies

- 6.3.9 Solvay S.A.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Circular Economy and Recycling

02-2729-4219

+886-2-2729-4219