|

市場調查報告書

商品編碼

1404462

貿易管理軟體:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Trade Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

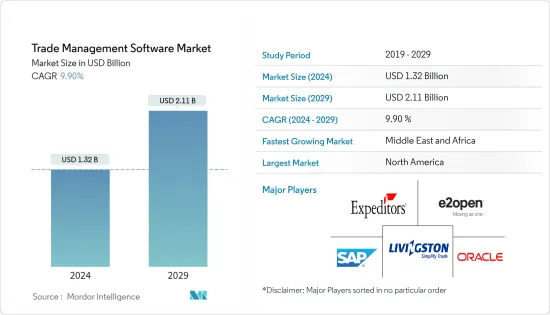

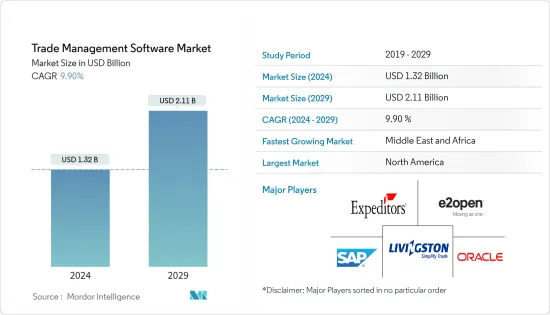

貿易管理軟體市場規模預計到2024年為13.2億美元,預計到2029年將達到21.1億美元,在預測期內(2024-2029年)複合年成長率預計為9.90%。

主要亮點

- 對貿易管理自動化技術的需求不斷成長以及減少組織支出的願望不斷成長是推動市場成長的關鍵因素。各種最終用戶應用程式的貿易管理軟體的銷售收入可計算市場規模。

- 此外,貿易管理軟體提供的功能可協助商家和企業減少供應鏈和法律風險。該軟體將進口商和出口商與其他國家的供應商、經紀人、物流服務供應商和貨運代理聯繫起來。該軟體被公司用來監控和追蹤跨境業務。透過自動化跨境流程,該應用程式可降低風險並幫助您管理進出口以及法律和監管要求。

- 全球化和外包使供應網路變得越來越複雜和分散。這些進步擴大了供應鏈可視性解決方案的產品範圍,增加了國際貿易量、對改善貿易的解決方案的需求以及受合規、海關和關稅約束的項目數量。

- COVID-19 的爆發擾亂了國際貿易。為了防止冠狀病毒的傳播,許多國家當局實施了全球運輸和貿易限制。這些限制和社會排斥阻礙了分銷網路和國際貿易。在美國、歐盟和中國等已開發國家,化學品和汽車的銷售量大幅下降。紡織品、辦公設備、精密設備、通訊設備等貿易額均大幅下降。

- 然而,在疫情大流行後,該行業加速了各種規模和類型的公司的數位化。這種快速的數位轉型將擴大全球貿易、商業和創造就業機會。例如,根據亞洲開發銀行的《2022年亞洲經濟整合研究》,數位產業規模成長20%預計將在2022年至2028年間使全球產出增加4.3兆美元。

貿易管理軟體市場趨勢

消費品驅動市場

- 進出口管制、受限方審查、貿易合規、海關申報、自由貿易區和跨境貿易管制都是消費品公司可以使用貿易管理軟體處理的貿易相關程序。國家之間的經濟交流稱為國際貿易。服裝和電視等消費品、機械、原料和食品等資本財定期交換。

- 許多全球消費品企業依賴單一平台從不同市場和管道收集貿易支出資料,以進行企業範圍內的報告和決策。基於逆向工程研究,該空間通常包含有關交易對手保證金需求的資料,並清楚地表明交易對手想要什麼樣的安排。

- 貿易促銷管理 (TPM) 和最佳化 (TPO) 是消費品製造商用來規劃、管理和執行需要零售合作夥伴協作促銷參與的活動的程序和技術。

- 消費品業務面臨多項挑戰,包括通貨膨脹導致的成本上升、淨利率壓縮以及全球供應鏈問題,這些可能導致銷售額和品牌忠誠度下降。由於經濟的不確定性,消費品產業正在尋求數位解決方案,以提高業務的效率和穩健性。

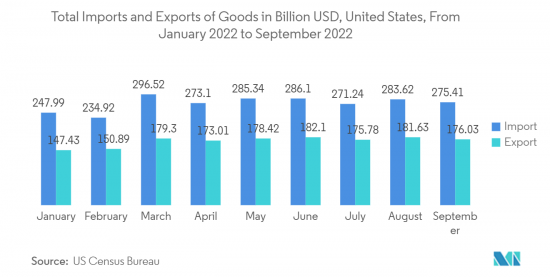

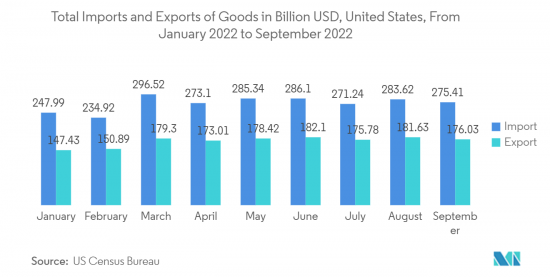

- 例如,根據美國人口普查局的數據,2022年9月美國進口額約為2,754.1億美元。當月出口額約為 1,760 億美元,而美國進口總額約為 2,479 億美元。當月出口額約 1,474 億美元。進口量不斷增加,組織開始轉向貿易管理軟體來降低國際貿易的成本和風險。

- 透過整合銷售規劃,消費品製造商可以使用貿易管理軟體將其零售合作夥伴的貿易投資需求與其自身的收益和銷售成長目標結合起來,以獲得更高的利潤和投資報酬率。

北美預計將佔據主要市場佔有率

- SAP、 Oracle和 Amber Road Inc. 等知名競爭對手的出現預計將使北美在貿易管理軟體市場中佔據重要的市場佔有率。

- 此外,該地區快節奏且嚴格的貿易法正在推動對這些解決方案的需求,以實現無縫合規並避免錯過稅收和關稅期限。

- 美國政府正在努力增加本地生產產品的使用。因此,出口成長等於國際進口成長。因此,使用貿易管理軟體來追蹤和遵守國家監管標準的情況預計將進一步增加。

- 此外,北美雲端基礎的解決方案產業的興起可能有利於貿易管理軟體市場。

- 據世界貿易組織(WTO)稱,加拿大將於2022年3月捐贈200萬美元(約150萬美元),幫助開發中國家和最不開發中國家更積極參與全球農產品貿易。標準和貿易開拓基金(STDF)資金幫助各國滿足國際食品、植物和動物健康標準,並促進進入區域和全球市場。

- BEA的數據顯示,2022年第一季美國進口的商品和服務總值從2021年第一季的7,955億美元增加至1,0185億美元。隨著越來越多的商品和服務進口到美國,對貿易管理軟體的需求可能會增加。

- 其他地區公司正在進行收購、併購和聯盟等各種行動,這可能會增加對貿易管理軟體的需求。

貿易管理軟體產業概況

全球貿易管理軟體產業有多家公司。預計預測期內市場競爭將相對激烈。

2022 年 7 月,清關、貨運代理和全球貿易諮詢服務供應商 Livingston International 宣布推出 Livingston Direct。這種完全數位化、用戶主導的工具現在為美國進口商提供了對線上清關的更大可見性和控制力。 Livingstone Direct 的推出是該公司不斷努力為尋求簡化清關流程的企業提供更廣泛的數位服務的最新舉措。

2022 年 4 月,原 RedSpark Group 旗下會計自動化軟體公司 Gestta Technology Ltda.(「Gestta」)宣布收購 Thomson Technology Ltda.,後者是一家為企業和專業人士提供智慧型資訊的全球供應商。已被路透社收購。透過增加新技術和人力專業知識,此次收購將加速巴西會計師事務所的數位轉型。此外,Gesta 的會計軟體解決方案使客戶能夠實現員工管理、客戶服務和安全文件歸檔等流程的自動化。超過 600 萬家公司和組織在 Gesta 客戶使用的系統中註冊。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 全球貿易的高效處理

- 收緊國際貿易中的政府監管

- 市場抑制因素

- 組織中的採用率緩慢

第6章市場區隔

- 按成分

- 解決方案

- 供應商管理

- 進出口管制

- 出貨單管理

- 其他(財務、合規等)

- 服務

- 諮詢

- 執行

- 解決方案

- 按發展

- 在雲端

- 本地

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶產業

- 防禦

- 製藥

- 能源

- 運輸/物流

- 消費品

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Oracle

- Expeditors International of Washington Inc.

- Amber Road Inc.(e2open, LLC.)

- SAP SE

- Livingston International

- Thomson Reuters Corporation

- Cognizant

- United Parcel Service of America, Inc.

- The Descartes Systems Group Inc.

- MIC

- Bamboo Rose LLC

- OCR Services Inc.

第8章投資分析

第9章市場的未來

The Trade Management Software Market size is estimated at USD 1.32 billion in 2024, and is expected to reach USD 2.11 billion by 2029, growing at a CAGR of 9.90% during the forecast period (2024-2029).

Key Highlights

- Growing demand for trade management automation technologies and the increasing desire to reduce organizational expenditures are among the primary drivers driving market growth. The income from trade management software sales for various end-user applications calculates the market size.

- Furthermore, trade management software provides features that help merchants and enterprises reduce supply chain and legal risks. It links importers and exporters with suppliers, brokers, logistic service providers, and carriers in other countries. The software is used by businesses to monitor and track cross-border operations. By automating cross-border processes, the application decreases risk and assists in properly managing and administrating imports-exports and legal and regulatory requirements.

- Supply networks have grown increasingly complicated and fragmented due to globalization and outsourcing. These advancements strengthen the product range of supply chain visibility solutions, the amount of international commerce, the demand for solutions to improve it, and the number of items subject to compliance, customs, and tariffs.

- The COVID-19 epidemic impeded international trade. To prevent the spread of the coronavirus, authorities in numerous countries enforced worldwide transportation and commerce restrictions. Such constraints and social alienation hampered the distribution network and international trade. Chemical and automobile sales have fallen dramatically in industrialized economies such as the United States, the European Union, and China. Textiles, office machinery, precision instruments, and communications equipment have all seen significant declines in trade.

- However, following the pandemic, the industry saw a faster digital transition for businesses of all sizes and industries. This rapid digital transformation will increase global trade, business, and job creation. For instance, according to the Asian Development Bank's Asian Economic Integration Study 2022, a 20% growth in digital sector size is predicted to boost global output by USD 4.3 trillion between 2022 and 2028.

Trade Management Software Market Trends

Consumer Goods to Drive the Market

- Import/export management, restricted party screening, trade compliance, custom filings, free trade zones, and cross-border trade management are all trade-related procedures that consumer products firms can use trade management software to handle. Economic exchanges between countries are referred to as international commerce. Consumer items like apparel and television sets and capital goods like machinery, raw materials, food, and other things are regularly exchanged.

- Many global consumer products businesses utilize a single platform to collect trade spending data from diverse markets and channels for reporting and decision-making throughout the company. Based on reverse-engineering research, the venue usually incorporates data regarding trade partners' margin needs to clarify what sort of arrangement trading partners want.

- Trade promotion management (TPM) and optimization (TPO) are procedures and technology consumer goods manufacturers use to plan, manage, and execute activities that need collaborative promotional involvement from their retail partners.

- The consumer products business faces several challenges, including inflation-driven cost increases, narrower margins, and global supply chain issues, which can lead to decreasing sales and brand loyalty. As a result of economic uncertainty, the consumer products industry is looking for digital solutions to improve the efficiency and robustness of its operations.

- For instance, according to the US Census Bureau, United States imports in September 2022 were about USD 275.41 billion. Its exports were valued at roughly USD 176 billion that month, whereas the total value of US imports was nearly USD 247.9 billion. That month, its exports were worth around USD 147.4 billion. Imports are increasing, and organizations use trade management software to reduce the costs and hazards of international commerce.

- Through integrated sales planning, consumer goods manufacturers may use Trade Management Software to match retail partners' trade investment demands with their own revenue and volume growth goals, as well as more significant margins and ROI.

North America Expected to Hold Major Market Share

- The existence of prominent rivals such as SAP, Oracle, and Amber Road Inc. is expected to provide North America with a significant market share in the trade management software market.

- Furthermore, the region's rapid and severe trade laws raise demand for these solutions to ensure seamless compliance and no missed tax and duty deadlines.

- The United States government seeks to increase its use of locally produced items. As a result, export growth will be equivalent to international import growth. As a result, the use of trade management software to track and conform to each country's regulatory standards is projected to rise further.

- Furthermore, the rising cloud-based solutions industry in North America will benefit the trade management software market.

- According to the World Trade Organization (WTO), in March 2022, Canada donated $2,000,000 (USD 1.5 million) to assist developing and least-developed nations in becoming more active participants in global agricultural trade. The Standards and Trade Development Facility (STDF) funding assists nations in meeting international food, plant, and animal health standards, allowing them to access regional and global markets more easily.

- According to BEA, In the first quarter of 2022, the total value of goods and services imported into the United States increased from USD 795.5 billion in the first quarter of 2021 to USD 1,018.5 billion. The demand for trade management software will increase as more goods and services are imported into the US.

- Other regional firms are engaged in different actions such as acquisition, merger, and partnership, which will likely enhance demand for trade management software.

Trade Management Software Industry Overview

There are several companies in the worldwide trade management software industry. The market's competitive competition is predicted to be relatively intense during the projected period.

In July 2022, Livingston International, a supplier of customs brokerage, freight forwarding, and worldwide trade consultancy services, introduced Livingston Direct. This entirely digital, user-directed tool allows US importers better visibility and control over online customs clearance. The introduction of Livingston Direct is the company's newest move in its continuous drive to deliver expanded digital services to businesses wishing to streamline customs procedures.

In April 2022, The accounting automation software company Gestta Technology Ltda. ("Gestta"), which was once a part of the Redspark Group, has been acquired by Thomson Reuters, a global provider of intelligent information for businesses and professionals. With the addition of new technology and human expertise, the acquisition will assist Brazilian accounting firms in hastening their digital transition. Additionally, customers may automate processes like staff administration, customer service, and secure document archiving with Gestta's accounting software solution. Over 6,00,000 businesses and organizations are registered in the systems used by Gestta's clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 An Assessment of The Impact of COVID-19 on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Efficient Handling of Global Trade

- 5.1.2 Increasing Government Regulations in International Trade

- 5.2 Market Restraints

- 5.2.1 Slow Adoption Rates Among Organizations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.1.1 Vendor Management

- 6.1.1.2 Import/Export Management

- 6.1.1.3 Invoice Management

- 6.1.1.4 Other Solutions (Finance, Compliance, Etc.)

- 6.1.2 Service

- 6.1.2.1 Consulting

- 6.1.2.2 Implementation

- 6.1.1 Solution

- 6.2 By Deployment

- 6.2.1 On-Cloud

- 6.2.2 On-Premise

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 Defense

- 6.4.2 Pharmaceuticals

- 6.4.3 Energy

- 6.4.4 Transportation and Logistics

- 6.4.5 Consumer Goods

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle

- 7.1.2 Expeditors International of Washington Inc.

- 7.1.3 Amber Road Inc. (e2open, LLC. )

- 7.1.4 SAP SE

- 7.1.5 Livingston International

- 7.1.6 Thomson Reuters Corporation

- 7.1.7 Cognizant

- 7.1.8 United Parcel Service of America, Inc.

- 7.1.9 The Descartes Systems Group Inc.

- 7.1.10 MIC

- 7.1.11 Bamboo Rose LLC

- 7.1.12 OCR Services Inc.