|

市場調查報告書

商品編碼

1627185

熱成像系統:市場佔有率分析、產業趨勢、成長預測(2025-2030)Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

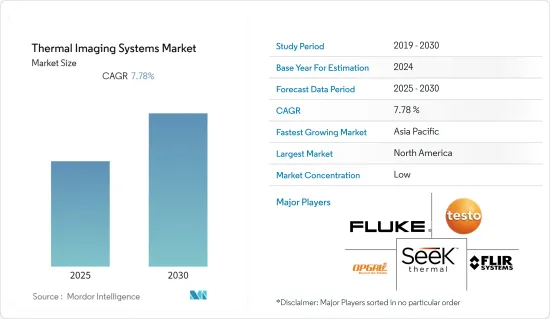

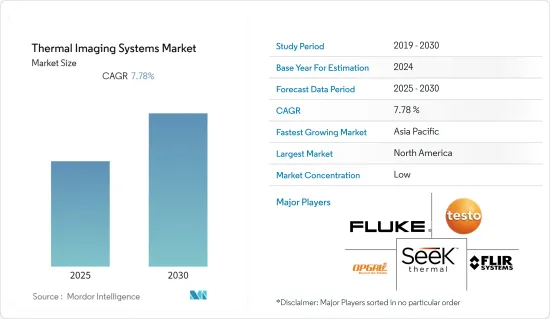

熱成像系統市場預計在預測期內複合年成長率為 7.78%

主要亮點

- 科技的進步使得熱感變得更小、更強大、更容易使用。手持式紅外線/熱成像系統因其便攜性而受到歡迎,並用於包括醫院在內的各種行業,以幫助節省維修時間和加熱成本。

- 此外,汽車應用預計在未來五年內將變得更加普遍。在汽車領域,熱像儀等熱成像系統的使用不斷增加,特別是為了降低夜間駕駛的風險,這是該應用熱成像市場成長的關鍵原因。

- 此外,冷卻碲化汞鎘(MCT 或 HgCdTe)紅外線檢測器技術的最新發展使得高性能紅外線相機的開發能夠滿足各種要求苛刻的紅外線成像應用。

- 各產業監控需求不斷增加、紅外線攝影機成本逐漸下降、高速紅外線攝影機快速發展等因素導致紅外線攝影機需求量增加,進而帶動市場發展。

- 然而,與相機相關的不準確測量和影像顏色問題給市場成長帶來了挑戰。嚴重依賴紅外線攝影機的產業有軍事、國防和汽車。

- COVID-19 大流行增加了醫療保健、生命科學和交通運輸等各個行業對熱成像解決方案的需求。多家公司正在減少其所在地的疾病傳播。中國和其他地方的當局正在使用熱感像儀和眼鏡產品來識別高溫下的行人。警方也使用人工智慧驅動的熱感智慧頭盔來掃描和識別體溫升高的人。

熱成像系統市場趨勢

軍事應用推動市場成長

- 熱感的最初應用是在軍事和國防部門。國防部門對監視、紅外線和熱成像系統的投資增加,預計採用率將進一步增加。

- 在軍事領域,世界各國政府正在投資下一代技術改進,為軍事人員提供改進和準確的資訊。這尤其影響了短波長紅外線攝影機的成長,導致國防部門擴大採用紅外線熱成像設備。

- 作為全球趨勢,犯罪和暴力呈上升趨勢。這一因素增加了國防安全保障部隊採購先進保護系統和設備的預算。現代戰爭已經變得不對稱,非致命和致命武器不斷增加。

- 市場上的主要企業不斷致力於熱感系統的研究,以引入技術進步。例如,2021 年 6 月,雷神技術研究中心與柯林斯航空航太公司和普惠公司合作開發動力解決方案,支援未來軍用飛機,同時支援現有飛機的更新並在溫度控管技術方面取得新突破。

- 2021年,北約成員國軍事人員總數約330萬人,高於前一年的327萬人。 2021年北約國家國防支出總額約1.17兆美元,是2014年至2021年北約成員國國防支出總額最高的。

北美佔據主要市場佔有率

- 由於監控、威脅偵測、汽車和預測性維護等應用擴大採用熱成像產品和服務,預計在預測期內,北美將在熱成像系統市場中佔據重要的市場佔有率。

- 該地區的公司正在開發新產品和解決方案,以利用成長機會。例如,2021年2月,FLIR Systems基於玻色子的熱感攝影機安裝在Veoneer的第四代夜視系統中,並作為與FLIR Systems的熱感汽車開發套件(ADK)相同的選項首次包含在新款凱迪拉克Escalade中。新型熱感視覺系統提供了更寬的視野,解析度是上一代產品的四倍,增加了道路覆蓋範圍,提高了情境察覺,並為駕駛員提供了更清晰的影像。

- 根據北約的一項研究,預計2021年美國將把國內生產總值的3.52%用於國防支出。這使其成為2021年國防預算支出佔GDP比例最高的國家。該地區的這些投資正在推動市場。

- 大多數公司熱衷於開發先進的紅外線攝影機,提供詳細的紅外線資訊,以獲得相對於競爭對手的競爭優勢。例如,2021 年 4 月,Seek 熱感推出了 Reveal FirePro X,這是其最新的消防員個人熱感像儀 (TIC)。這款升級後的手持式熱感現在配備了新的充電端口,更加耐用,並且在您需要時更容易使用。

- 加拿大的自動駕駛汽車應用正在取得進展。此外,優步等公司正在亞利桑那州鳳凰城和賓州匹茲堡測試無人駕駛技術。

熱成像系統產業概述

在預測期內,熱成像系統市場被大量區域和全球公司分割。 Flir Systems Inc.、Opgal Optronic Industries Ltd.、Fluke Corporation、Testo Inc. 和 Seek Thermal Inc. 等市場主要企業正試圖透過產品創新來增加市場佔有率。 2022 年 6 月,Teledyne FLIR Systems Inc. 宣布將 E52 相機加入其 Exx 熱成像產品線中,該產品線包括 E54、E96、E86 和 E76。新款E52相機具有專業級的熱解析度,並具有相機路由功能,可確保照片可視性並提高現場調查效率。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業供應鏈分析(包括熱感像儀製造商、熱感成像器/探測器供應商、鏡頭組供應商等清單)

- 產業吸引力——波特五力

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對熱成像產業的影響

- 世界價格分析 - 按應用與技術

第5章市場動態

- 市場促進因素

- 降低熱成像系統的成本有助於其在各種最終用戶中的廣泛使用

- 政府和國防活動支出增加

- 市場限制因素

- 缺乏定期的支援和服務

第6章 市場細分

- 按用途

- 熱成像

- 軍事用途

- 監視

- 個人視覺系統

- 消防部門

- 智慧型手機

- 其他用途(汽車、船舶、其他商業)

- 按外形規格

- 攜帶式成像設備和系統

- 固定式(旋轉式、非旋轉式)

- 按國家/地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Flir Systems Inc.

- Opgal Optronic Industries Ltd

- Fluke Corporation

- Testo Inc.

- Seek Thermal Inc.

- Trijicon Inc.

- Bullard GmbH

- HT Italia Srl

- Raytheon Co.

第8章 涉及紅外線成像的研究機構名單

第9章投資分析

第10章投資分析市場的未來

The Thermal Imaging Systems Market is expected to register a CAGR of 7.78% during the forecast period.

Key Highlights

- Companies have also miniaturized IR and thermal imaging sensors due to technological advancements, making them highly efficient, thereby increasing their ease of use. Handheld IR and thermal imaging systems gain traction for their portability and find their applications in various industry verticals, such as hospitals, saving repair times and heating costs.

- Further, automotive applications are expected to gain traction in the next five years. The increasing use of thermal imaging systems such as thermal cameras in the automotive sector to reduce the risks in driving, especially at night, is a significant reason for this application's thermal imaging market growth.

- Moreover, recent developments in cooled mercury cadmium telluride (MCT or HgCdTe) infrared detector technology have made the development of high-performance infrared cameras possible for various demanding thermal imaging applications.

- The factors, such as rising demand for surveillance across various verticals, gradually decreasing thermal cameras cost, and rapid development of high-speed infrared cameras, lead to increased demand for IR cameras, consequently driving the market growth.

- However, inaccurate measurements and image color issues associated with the cameras are challenging market growth. The industries heavily relying on IR cameras are military, defense, and automotive.

- The COVID-19 Pandemic has increased demand for thermal imaging solutions across various industries, including healthcare, life science, transportation, and others. Several firms have reduced the transmission of illness at their locations. Authorities in nations such as China use thermal cameras and eyewear to identify pedestrians in high temperatures. Personnel addition, police are scanning and identifying persons with elevated body temperatures using AI-powered thermal smart helmets.

Thermal Imaging Systems Market Trends

Applications in Military to Drive the Market Growth

- Military and defense were the first applications of IR and thermal imaging systems. With the defense sector's rising investments in surveillance, IR, and thermal imaging systems, adoption is expected to increase further.

- In the military sector, governments worldwide invest in improving next-generation technology by providing military personnel with improved and accurate information. This has impacted the growth of especially short-wavelength IR cameras, as the adoption of IR thermography devices has increased in the defense sector.

- Globally, there is a growing trend of rising crimes and violence. This factor has raised the homeland security forces' budgets to procure advanced protective systems and gadgets. Modern warfare has become more asymmetric, with increasing non-lethal and lethal weapons.

- The key players in the market are constantly working on thermal imaging systems to introduce technological advancements. For instance, in June 2021, Raytheon Technologies Research Center is working with the Collins Aerospace and Pratt & Whitney businesses to break new ground on power and thermal management technologies that will enable future military aircraft while supporting updates to the present fleet.

- The combined number of military personnel among NATO member countries was approximately 3.3 million in 2021, increasing from 3.27 million the previous year. NATO nations' total defense spending in 2021 was approximately USD 1.17 trillion, the maximum amount NATO members have collectively spent on defense from 2014 to 2021.

North America to Hold the Significant Market Share

- North America is expected to hold a significant market share for the thermal imaging systems market during the forecast period due to the increasing adoption of infrared imaging products and services by organizations in the region for applications such as surveillance, threat detection, automotive, predictive maintenance, and others.

- Companies in the region are developing new products or solutions to leverage the growing opportunity. For instance, in February 2021, the FLIR Boson-based thermal camera premiered in Veoneer's fourth-generation Night Vision System as an option on the all-new Cadillac Escalade, identical to the FLIR Thermal Automotive Development Kit (ADK). The new thermal-vision system offers a broader field of view with four times the resolution compared to the previous generation, extending road coverage, improving situational awareness, and displaying a sharper image to the driver.

- According to a survey conducted by NATO, in 2021, the United States is estimated to spend 3.52%of its gross domestic product on defense expenditures. This makes them the country with the highest share of GDP spent on the defense budget in 2021. Such investments in the region drive the market.

- Most companies are keen on developing an advanced IR camera to provide detailed infrared information to gain a competitive edge over others. For instance, in April 2021, Seek Thermal launched Reveal FirePro X, the latest personal thermal imaging camera (TIC) for firefighters. The upgraded handheld thermal imaging camera provides a new charging port, making it even more durable and easier to access when needed.

- Autonomous cars have been witnessing significant adoption in Canada. In addition, companies such as Uber have also tested driverless technology in Phoenix, Arizona, and Pittsburgh, Pennsylvania.

Thermal Imaging Systems Industry Overview

The thermal imaging system market is fragmented during the forecast period, with a considerable number of regional and global players. The major players in the market, such as Flir Systems Inc., Opgal Optronic Industries Ltd, Fluke Corporation, Testo Inc., and Seek Thermal Inc., are trying to gain more market share with product innovations. In June 2022, Teledyne FLIR Systems Inc. announced the addition of an E52 camera to their Exx thermal Imaging device line, which now includes the E54, E96, E86, and E76 versions. The new E52 camera features professional-level thermal resolution to guarantee photos are simple to see and on-camera routing functionality to boost field survey efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis (Includes list of Thermal Camera Manufacturers, Thermal Imager/Detector Suppliers, Lens Set Suppliers, etc.)

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Thermal Imaging Industry

- 4.5 Global Pricing Analysis - By Application and By Technology

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reducing Cost of Thermal Imaging Systems has Led to the Adoption Across various End Users

- 5.1.2 Increasing Spending by Government and Defense Activities

- 5.2 Market Restraints

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Thermography

- 6.1.2 Military

- 6.1.3 Surveillance

- 6.1.4 Personal Vision Systems

- 6.1.5 Fire Fighting

- 6.1.6 Smartphones (Ruggedized)

- 6.1.7 Other Applications (Automotive, Maritime, and other commercial)

- 6.2 By Form Factor

- 6.2.1 Handheld Imaging Devices and Systems

- 6.2.2 Fixed Mounted (Rotary and Non-Rotary)

- 6.3 By Country

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Flir Systems Inc.

- 7.1.2 Opgal Optronic Industries Ltd

- 7.1.3 Fluke Corporation

- 7.1.4 Testo Inc.

- 7.1.5 Seek Thermal Inc.

- 7.1.6 Trijicon Inc.

- 7.1.7 Bullard GmbH

- 7.1.8 HT Italia S.r.l.

- 7.1.9 Raytheon Co.