|

市場調查報告書

商品編碼

1640362

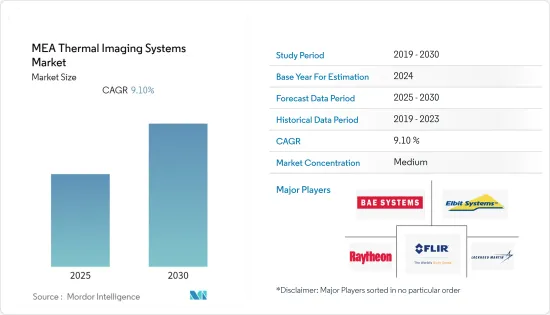

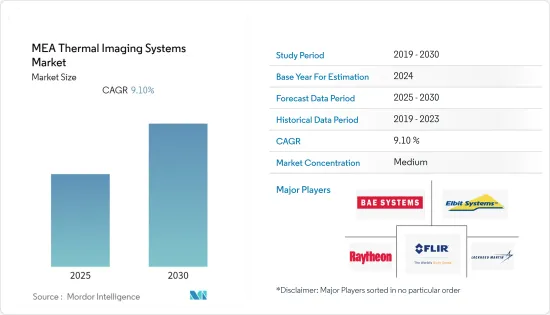

中東和非洲熱成像系統市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

中東和非洲熱成像系統市場預計在預測期內複合年成長率為 9.1%

主要亮點

- 在中東和非洲,伊斯蘭國、蓋達組織、青年黨、博科聖地和其他恐怖組織之間的衝突仍在持續。無論是在非洲或中東,地緣政治動盪始終存在。中東是軍需物資的重要買家。熱成像技術正在協助該地區的軍隊在該地區崎嶇的地形上打擊叛亂分子和恐怖分子。最近,卡達軍方花了116億美元,成為中東地區第五大軍費開支國。

- 此外,熱感像儀在救援行動、犯罪調查和道路安全等領域的應用不斷擴大,也推動了整體市場的成長。熱感像儀還可以幫助消防員發現熱點並透視煙霧,有助於防止重大事故。此外,人們對 ADAS(高級駕駛輔助系統)的日益偏好以及對無線溫度感測器不斷成長的需求正在推動所研究市場的成長。

- 例如,今年 2 月,總部位於阿拉伯聯合大公國的 Teledyne FLIR 推出了 FLIR Cx5,這是一款新型袖珍熱像儀,適用於危險環境中的狀態監測。 FLIR Cx5 具有符合 ATEX 標準的堅固外殼,可安全監控高溫作業區域的電氣和機械設備。

- 根據新的軍事戰略,沙烏地阿拉伯軍方計劃透過取得高科技和有效的武器系統來實現軍隊現代化,從而獲得軍事優勢。為了保護沙烏地阿拉伯免受極端主義和恐怖主義等內部威脅,沙烏地阿拉伯國防理論 (SDD) 概述了加強軍事結構和能力的幾個目標。此外,沙國政府計劃在2030年將國內軍事裝備支出增加50%。該地區政府的此類發展預計將在預測期內推動市場成長。

- 各行業監控需求不斷增加、熱感相機成本持續降低、高速熱感相機快速發展等因素推動了熱感相機需求的不斷成長。另一方面,與相機相關的不準確測量和影像色彩問題是威脅該行業成長的因素。軍事和國防工業以及汽車嚴重依賴紅外線攝影機。

- COVID-19的爆發和蔓延阻礙了該地區的經濟發展。 COVID-19 已經影響了多個領域,包括熱成像系統。企業正在做好準備並努力維持業務。公司遇到的主要障礙是製造和分銷產品。為了控制疫情蔓延,全球一些國家實施或延長封鎖措施,擾亂了熱成像系統市場的供應鏈。此外,由於該地區是汽車、航太和國防等多個行業的所在地,預計該市場在預測期內將會成長。

中東和非洲熱成像系統市場趨勢

汽車產業可望推動市場成長

- 在汽車行業,熱成像被用作安全系統的一部分(例如,識別道路上的動物和人類,並在駕駛員遇到這些潛在危險之前發出警告)。在美國銷售的所有新型輕型車輛都必須配備後視系統(倒車相機)。隨著自動駕駛汽車的出現,該技術可以透過區分物體的大小來促進自動煞車。

- 此外,去年 1 月,全球半導體解決方案開發商 OmniVision(包括先進數位影像處理、類比、觸控和顯示技術)在 CES 上推出了其突破性 Nyxel 近紅外線 (NIR) 技術系列的最新產品。新型 OX05B1S 是首款用於汽車產業 (IMS) 車載監控系統的 500 萬像素 (MP) RGB-IR BSI 世界百葉窗感測器。像素尺寸為2.2m,近紅外線靈敏度為940nm,在照度條件下表現最佳。它具有廣闊的視野和足夠的像素,可以看到駕駛員和乘客。

- 根據韓國國際貿易協會預測,沙烏地阿拉伯汽車銷售預計2022年將達到483,240輛,2023年將達到497,000輛,持續呈上升趨勢。此外,作為 2030 年願景改革計畫的一部分,中國正在發展汽車製造城市。此舉預計將增加研究市場的需求。

- 此外,2022 年 1 月,Teledyne FLIR 宣布擴展其用於 ADAS(高級駕駛員輔助系統)和自動駕駛汽車研發的免費熱感資料。擴展後的入門資料大約是業界第一個原始免費資料集的兩倍,包含在美國、英國和法國拍攝的 26,000 多張帶註釋的白天和夜間影像。類別數量也增加了兩倍,包括人、自行車、汽車、摩托車、巴士、火車、卡車、交通燈、消防栓、路標、狗、滑板、嬰兒Scooter和其他車輛標籤。免費 Starter 熱影像資料的擴展現在使汽車產業和學術界能夠快速評估車輛安全演算法的性能。

- 此外,汽車產業目前擴大採用高科技自動駕駛汽車,也稱為 ADAS(高級駕駛員輔助系統)或無人駕駛汽車。這些汽車的駕駛員使用多種感測器,包括熱感攝影機、無線電探測和測距 (RADAR)、光探測和測距 (LIDAR) 感測器以及接近感測器,以實現自動駕駛、導航和更好的情境察覺。

- 該地區汽車行業的此類發展可能會為所研究的市場帶來顯著成長。

航太和國防佔據主要市場佔有率

- 熱成像系統讓地面部隊偵測與無生命物體和敵軍的溫差。這些儀器收集相機視野內的紅外光,並使用這些資訊來創建影像。此外,軍用熱感是狩獵和現代戰爭必不可少的光學儀器之一。無論是霧天還是灰塵、白天或夜晚,熱感都能在任何時間、任何天氣條件下提供靈活性、多功能性和戰術性優勢。

- 該地區各國政府正在投資下一代技術,以便為軍隊提供更好、更準確的資訊。紅外線熱成像設備在軍事工業領域的使用不斷擴大,影響紅外線相機,特別是短波長紅外線相機的崛起。

- 例如,去年4月,Teledyne Technologies Inc.旗下的Teledyne FLIR宣布推出其高性能Hadron 640R紅外線測溫儀和可見光雙相機模組。 Hadron640R 專為整合無人駕駛飛機系統、無人駕駛地面車輛、機器人平台和新興的人工智慧應用程式而設計,其中電池壽命和運行時間是關鍵任務。

- 該地區的犯罪和暴力呈上升趨勢。由於這個因素,國防安全保障部隊的預算正在增加,用於購買先進的保護系統和設備。由於非致命和致命武器的擴散,現代戰爭變得越來越不對稱。據 Global Firepower 稱,截至去年,阿爾及利亞的國防支出為非洲最高,約 100 億美元。其次是奈及利亞(約 59 億美元)和摩洛哥(約 54 億美元)。

- 此外,GAMI主席宣布,沙烏地阿拉伯政府(SAG)正在考慮在未來10年內向軍事工業投資200億美元。這筆投資的一半將用於一般國防工業,另一半用於研發。此外,該國計劃在2030年下半年將軍事研發支出從佔軍費開支的0.2%增加到4%左右。該地區政府的此類發展預計將在預測期內推動市場成長。

中東和非洲熱成像系統產業概況

中東和非洲熱成像系統市場部分細分,由幾家主要公司組成。 Flir、Bae Systems、Elbit Systems Ltd.、Raytheon Co.和L-3 Communications等主要公司已經進入熱成像系統市場。然而,許多公司正在透過贏得新契約和開拓新市場,利用新解決方案擴大市場佔有率。

- 2022 年 6 月 - Teledyne Technologies Incorporated 旗下部門 Teledyne FLIR 已將 E52 相機加入其 Exx 熱成像產品線中,該產品線包括 E96、E86、E76 和 E54 型號。新款E52相機具有專業的熱解析度,可確保清晰的影像,並具有機上路由功能,可提高現場勘察的效率。

- 2022 年 1 月 - Xenics 推出新型高性能、高解析度熱成像長波長紅外線 (LWIR) 相機 Ceres T 1280。 Xenics 透過 Ceres T 1280 擴展了其高性能熱像儀產品組合。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 擴大熱感成像的應用

- 紅外線成像系統的技術改進

- 市場限制因素

- 缺乏定期的支援和服務

第6章 市場細分

- 按解決方案

- 硬體

- 軟體

- 服務

- 依產品類型

- 固定熱成像

- 手持式熱成像儀

- 按用途

- 安全與監控

- 監控/檢查

- 檢測/測量

- 按最終用戶

- 航太/國防

- 車

- 醫學生命科學

- 石油和天然氣

- 飲食

- 其他

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東/非洲

第7章 競爭格局

- 公司簡介

- Flir Systems, Inc.

- L-3 Communications Holdings

- Lockheed Martin

- BAE Systems plc

- DRS Technologies, Inc.

- Elbit Systems Ltd.

- Raytheon Co.

- Thermoteknix Systems Ltd.

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 51888

The MEA Thermal Imaging Systems Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- In the Middle East and Africa, there is a lot of conflict between ISIS, Al-Qaeda, Al-Shabaab, Boko Haram, and other terrorist groups. In both Africa and the Middle East, there is always geopolitical upheaval. The Middle East is a significant buyer of military hardware. Thermal imaging technology aids the military forces in the region in their war against rebels and terrorists in the region's rough terrains. Recently, Qatar's military spent USD 11.6 billion, making it the fifth largest spender in the Middle East.

- Furthermore, the growing applications of thermal cameras, such as rescue operations, crime investigation, road safety, and so on, have boosted the overall market growth. Thermal cameras can also help firefighters locate hotspots and see through smoke, which can help prevent catastrophic accidents. Furthermore, the growing preference for Advanced Driver-Assistance Systems and rising demand for wireless temperature sensors drive the studied market growth.

- For instance, in February this year, UAE-based Teledyne FLIR announced the launch of the FLIR Cx5, a new pocket-portable thermal camera for condition monitoring in hazardous environments. The FLIR Cx5 has a robust ATEX-compliant case, which authorizes users of this camera to monitor electrical or mechanical assets in hot working zones safely.

- According to the new military strategy, the Saudi Arabian armed forces will modernize their military capabilities by acquiring high-tech and effective weapon systems that provide them with military superiority. To protect Saudi Arabia against internal threats such as extremism and terrorism, the Saudi Arabian Defense Doctrine (SDD) outlines several goals to enhance its military structure and capabilities. Further, the government of the Kingdom plans to increase the local military equipment spending to 50% by 2030. Such developments by governments in the region are anticipated to drive the growth of the market during the forecast period.

- Increased demand for IR cameras is driven by factors such as the growing need for surveillance across various industries, the continual reduction of thermal camera costs, and the rapid development of high-speed infrared cameras. Inaccurate measurements and picture color problems associated with cameras, on the other hand, pose a threat to the industry's growth. The military and defense industries, as well as vehicles, rely heavily on infrared cameras.

- COVID-19's breakout and spread have caused a halt in the region's economic development. It has harmed several sectors, including thermal imaging. Companies were preparing and trying to keep their operations running. The primary obstacles that businesses encounter are product manufacturing and distribution. To restrict the spread of the epidemic, some nations worldwide have implemented or extended lockdowns, causing interruptions in the thermal imaging market's supply chain. Furthermore, the market is expected to grow in the forecast period as various industries such as Automotive, Aerospace and Defense, and many others are proliferating in the region.

Middle East and Africa Thermal Imaging Systems Market Trends

Automotive Sector is Expected to Drive the Market Growth

- The automotive industry uses thermal imaging as part of the safety system (E.g., identification of animals or humans on the road and warning the drivers before they encounter these potential hazards). Rear-view visibility systems (backup cameras) are now becoming mandatory on all new light vehicles sold in the United States. With autonomous cars coming into the picture, this technology can facilitate automatic breaking by distinguishing based on object size.

- Furthermore, in January last year, OmniVision, a global developer of semiconductor solutions such as advanced digital imaging, analog, and touch and display technology, announced the latest addition to its ground-breaking Nyxel near-infrared (NIR) technology family at CES. The new OX05B1S is the first 5-megapixel (MP) RGB-IR BSI global shutter sensor for in-cabin monitoring systems in the automotive industry (IMS). It has a 2.2m pixel size and 940 nm NIR sensitivity for the best performance in low light conditions; it has a wide field of view and enough pixels to see both the driver and the occupants.

- According to Korea International Trade Association, The volume of vehicle sales in Saudi Arabia recorded 483.24 thousand units in 2022, and it is forecasted at 497 thousand units for 2023, continuing the upward trend. Further, the country is developing a car manufacturing city as a part of the 2030 Vision reform plan. This move is expected to increase the demand for studied market.

- Moreover, in January 2022, Teledyne FLIR announced the availability of an expanded free thermal dataset for researchers and developers working on Advanced Driver Assistance Systems (ADAS) and self-driving vehicles. The expanded starter dataset nearly doubles the original, industry-first free dataset and includes over 26,000 annotated images from the United States, England, and France in day and nighttime conditions. It also triples the number of categories, with people, bikes, cars, motorcycles, buses, trains, trucks, traffic lights, fire hydrants, street signs, dogs, skateboards, stroller scooters, and other vehicle labels now included. The expanded free starter thermal imaging dataset enables the automotive and academic communities to evaluate the performance of vehicle safety algorithms quickly.

- Furthermore, the automobile industry is now gaining traction with high-tech autonomous cars, also known as Advanced Driver-Assistance Systems (ADAS) or driverless vehicles. Multiple sensors, including thermal cameras, Radio Detection and Ranging (RADAR), Light Detection and Ranging (LIDAR) sensor, and proximity sensor, substitute drivers in these cars to enable automated driving, navigation, and better situational awareness.

- Such developments in the automotive industry in the region may further create significant growth in the studied market.

Aerospace and Defense Holds Significant Market Share

- Thermal imaging systems allow ground troops to detect differences in temperature between inanimate objects and enemy forces. These devices collect the infrared radiation in the camera's field of vision and use that information to create an image. In addition, the military thermal imager is one of the essential optical devices for hunting or modern combat. Fog or dust, day or night, the thermal imaging device delivers flexibility, versatility, and tactical superiority at any time of the year and in any weather.

- Governments all across the region are investing in next-generation technology by giving better and more accurate information to military troops. The use of IR thermography equipment in the military industry has grown, influencing the rise of infrared cameras, particularly short-wavelength IR cameras.

- For instance, in April last year, Teledyne FLIR, part of Teledyne Technologies Inc., announced the release of its high-performance Hadron 640R combined radiometric thermal and visible dual camera module. The Hadron 640R design is optimized to integrate uncrewed aircraft systems, unmanned ground vehicles, robotic platforms, and emerging AI-ready applications where battery life and run-time are mission-critical.

- There is a significant trend of increasing crime and violence in the region. As a result of this element, the budgets of the homeland security forces have increased to purchase advanced protection systems and devices. With an expanding number of non-lethal and deadly weapons, modern combat has grown increasingly asymmetric. According to Global Firepower, as of the last year, Algeria had the highest defense spending budget in Africa, around USD 10 billion. Nigeria and Morocco followed, with a budget of roughly USD 5.9 billion and USD 5.4 billion.

- Furthermore, the governor of GAMI announced that the Saudi Arabia Government (SAG) is looking forward to investing USD 20 billion in its military industry for the next decade. Out of the investment, half of this amount shall be dedicated to the general defense industry, and the remaining half will be invested in R&D. Furthermore, the country plans to increase its military R&D spending from 0.2% to approx. Around 4% of its armament's expenditure by late 2030. Such developments by governments in the region are anticipated to drive the growth of the market during the forecast period.

Middle East and Africa Thermal Imaging Systems Industry Overview

The Middle East and Africa Thermal Imaging Systems market is partially fragmented and consists of several major players. Some major players like Flir, Bae Systems, Elbit Systems Ltd., Raytheon Co., and L-3 Communications are already present in the thermal imaging systems market. However, many companies are increasing their market presence with innovative solutions by securing new contracts and tapping new markets.

- June 2022 - Teledyne FLIR, a division of Teledyne Technologies Incorporated, has added an E52 camera to its Exx thermal Imaging device line, which already includes the E96, E86, E76, and E54 models. The new E52 camera has a professional thermal resolution to ensure clear images and on-camera routing to improve field survey efficiency.

- January 2022- Xenics has launched the Ceres T 1280, a new high-performance, high-resolution thermographic long-wave infrared (LWIR) camera. Xenics is expanding its high-performance thermographic camera line with the Ceres T 1280.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Thermal imaging is becoming increasingly used in a variety of applications

- 5.1.2 Technological Upgradation in Thermal Imaging Systems

- 5.2 Market Restraints

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Product Type

- 6.2.1 Fixed Thermal Cameras

- 6.2.2 Handheld Thermal Cameras

- 6.3 By Application

- 6.3.1 Security and Surveillance

- 6.3.2 Monitoring and Inspection

- 6.3.3 Detection and Measurement

- 6.4 By End-user

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare and Life Sciences

- 6.4.4 Oil and Gas

- 6.4.5 Food and Beverages

- 6.4.6 Others

- 6.5 By Country

- 6.5.1 Saudi Arabia

- 6.5.2 United Arab Emirates

- 6.5.3 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Flir Systems, Inc.

- 7.1.2 L-3 Communications Holdings

- 7.1.3 Lockheed Martin

- 7.1.4 BAE Systems plc

- 7.1.5 DRS Technologies, Inc.

- 7.1.6 Elbit Systems Ltd.

- 7.1.7 Raytheon Co.

- 7.1.8 Thermoteknix Systems Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219