|

市場調查報告書

商品編碼

1637892

歐洲熱感成像系統市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

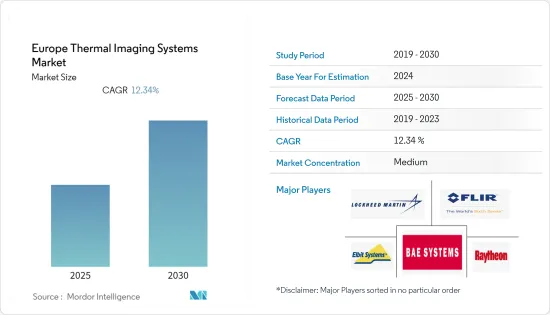

預計預測期內歐洲熱感成像系統市場複合年成長率將達到 12.34%。

主要亮點

- 歐洲是世界上技術最先進的地區之一。軍費開支最大的國家是法國、英國和義大利。

- 該地區的許多國家都曾是曾在阿富汗和伊拉克作戰的北約部隊成員。熱感成像和其他突破性技術已被廣泛採用,並仍在阿富汗等具有挑戰性的地形中使用。

- 技術的進步使得熱熱感攝影機變得更小、更有效率、更易於使用。手持式紅外線和熱感成像系統由於其移動性而越來越受歡迎。它們被用於包括醫院在內的各個行業,有助於節省維護時間和暖氣成本。

- 各產業監控需求的不斷擴大、紅外線熱像儀成本的持續下降、以及高速紅外線熱像儀的快速發展,推動了紅外線熱像儀需求的不斷成長。

- 與相機相關的測量不準確性和影像顏色問題對不斷成長的行業構成了挑戰。軍事/國防和汽車是兩個嚴重依賴熱成像攝影機的行業。

歐洲熱感成像系統市場趨勢

軍事和國防部門可望引領市場

- 軍事和國防工業是最早採用熱熱感攝影機的領域之一。隨著對國防監視的投資不斷增加,熱熱感攝影機的使用預計也會成長。

- 歐洲各國政府都在投資下一代技術,以便向軍隊提供更好、更準確的資訊。紅外線熱成像設備在軍事工業的應用日益擴大,影響紅外線熱像儀特別是短波長紅外線熱像儀的興起。

- 該地區的犯罪和暴力事件明顯增加。因此,國防安全保障部隊的預算正在增加,用於購買先進的保護系統和設備。隨著非致命武器和致命武器的擴散,現代戰爭變得越來越不對稱。

- 世界各國的軍隊都在對其武器系統進行現代化改造,並為士兵配備最新的作戰和監視技術,以滿足多樣化、不對稱、多維和致命戰場的需求。運動偵測是自動目標辨識 (ATR) 和周界監控系統的重要組成部分。熱熱感攝影機是這些系統的重要組成部分,因為它們可以在所有天氣條件下工作。

- 手持式熱熱感攝影機的一個主要且不斷成長的應用領域是國防和安全領域。美國計劃向執行作戰任務的士兵提供數千副新型護目鏡。據國防視覺資訊分發服務(DVIDS)稱,新護目鏡將有助於提高步兵的情境察覺。

熱感成像將廣泛應用於車輛

- 汽車製造商看到了熱熱感攝影機改善駕駛員視野的好處。汽車夜視系統使駕駛者能夠偵測和監視道路上和附近的潛在危險,從而有更多的時間對危險做出反應。

- 由於 ADAS 是自動駕駛汽車的關鍵組件,用於夜視系統的微測輻射熱像儀預計將在汽車中變得越來越普及。相機製造商開始推出無縫整合第二個可見光相機的新機型。

- 目前,汽車產業對高科技自動駕駛汽車(也稱為 ADAS(高級駕駛輔助系統)或無人駕駛汽車)的使用正在增加。多種感測器,包括紅外線攝影機、無線電檢測和測距儀 (RADAR) 和光檢測和測距儀 (LIDAR) 感測器以及接近感測器,可以替代駕駛員,實現自動駕駛、導航和提高情境察覺。

- 此外,熱感成像攝影機也被整合到無人駕駛汽車中,以提高夜間可視性,在霧天、人群和薄霧中識別人和動物,並立即停止車輛以避免人員傷亡。

- 熱熱感攝影機用於汽車行業,幫助駕駛員在惡劣的燈光和天氣條件下看清道路,有助於避免事故並確保安全。汽車製造商和熱感成像解決方案供應商正在共同合作為汽車產業開發創新的紅外線解決方案。

- 紅外線熱成像技術也用於汽車零件和微部件的無損檢測,以確保車輛安全,同時節省時間和成本。例如,紅外線熱成像攝影機 ImageIR 9400 hp、ImageIR 10300 和 VarioCAM HD exam 900 是由德國 InfraTec GmbH 專門為汽車用途開發的。

歐洲熱感成像系統產業

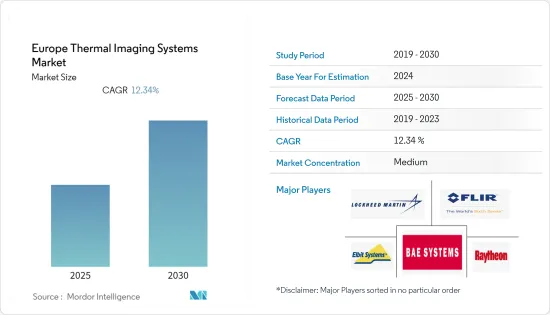

歐洲熱感成像系統市場部分分散,有幾個大型參與者。一些大公司已經進入熱感成像系統市場,包括FLIR、Bae Systems、Elbit Systems Ltd、Raytheon Co.和L-3 Communications。然而,許多公司正在透過創新解決方案擴大其市場佔有率,贏得新契約並拓展新市場。

- 2022 年 12 月 - Teledyne FLIR 與 RealWear 合作,首次透過語音控制、完全免持的熱感相機模組將熱感成像引入穿戴式設計設備。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 擴大熱感成像的應用範圍

- 熱感成像系統技術改進

- 市場挑戰

- 缺乏定期支援和服務

第6章 市場細分

- 按解決方案

- 硬體

- 軟體

- 服務

- 依產品類型

- 固定熱成像

- 手持式熱成像儀

- 按應用

- 安全與監控

- 監督檢查

- 檢測與測量

- 按最終用戶

- 航太和國防

- 車

- 醫療保健和生命科學

- 石油和天然氣

- 飲食

- 其他最終用戶

- 按國家

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Flir Systems Inc.

- L-3 Communications Holdings

- Lockheed Martin

- BAE Systems PLC

- DRS Technologies Inc.

- Elbit Systems Ltd

- Raytheon Co.

- Sofradir Group

- Thermoteknix Systems Ltd

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 48287

The Europe Thermal Imaging Systems Market is expected to register a CAGR of 12.34% during the forecast period.

Key Highlights

- Europe is one of the most technologically advanced regions in the world. Its major military spenders are France, the United Kingdom, and Italy.

- Many nations in this region were members of the NATO forces that fought in Afghanistan and Iraq. Thermal imaging and other technological breakthroughs were widely employed and are still used in challenging terrains like Afghanistan.

- Due to technological improvements, companies have also downsized IR and thermal imaging sensors, making them very efficient and enhancing their simplicity of use. Handheld infrared and thermal imaging systems are gaining popularity due to their mobility. They are finding uses in various industries, including hospitals, where they may save maintenance times and heating costs.

- Increased demand for IR cameras is driven by the expanding need for surveillance across many verticals, constantly declining thermal camera costs, and the rapid development of high-speed infrared cameras.

- Inaccurate measurements and picture color difficulties linked with the cameras are posing a challenge to industry expansion. Military and defense and automobiles are two businesses that significantly rely on IR cameras.

Europe Thermal Imaging Systems Market Trends

Military and Defense Sector is Expected to Drive the Market

- The military and defense industries were among the first to use infrared and thermal imaging devices. With the defense sector's increased investment in surveillance, the use of infrared and thermal imaging equipment is projected to grow.

- Governments all across Europe are investing in next-generation technology by giving better and more accurate information to military troops. The use of IR thermography equipment in the military industry has grown, influencing the rise of infrared cameras, particularly short-wavelength IR cameras.

- The region has a significant trend of increasing crime and violence. As a result, the homeland security forces' budgets have increased to purchase advanced protection systems and devices. With an expanding number of non-lethal and deadly weapons, modern combat has grown increasingly asymmetric.

- Global armies are modernizing their military arsenal and getting soldiers equipped with the latest combat and surveillance technology to cope with diversely asymmetric, multi-dimensional, and highly lethal battlefield imperatives. Motion detection is one of the essential element of Automatic Target Recognition (ATR) and perimeter monitoring systems. Thermal imaging has become an integral part of these systems because of its ability to operate in all weather conditions.

- The primary application of handheld thermal imaging is increasing in the defense and security sector. The US Army is aiming to provide thousands of new goggles to its soldiers engaged in combat missions. According to the Defense Visual Information Distribution Service (DVIDS), the new goggles will help enhance infantry troops' situational awareness.

Thermal Imaging is Being More Widely Used in Vehicles

- Vehicle manufacturers have discovered the benefits of thermal imaging for enhancing driver vision. The automotive night-vision systems enable drivers to detect and monitor potential hazards on or near the road, allowing more time to react to danger.

- With ADAS being the most significant factor of autonomous cars, microbolometer IR cameras for night vision systems in automobiles are expected to be increasingly incorporated. Camera manufacturers have begun introducing new models that feature the seamless integration of a second visible light camera.

- The automobile industry is now gaining traction with high-tech autonomous cars, also known as Advanced Driver-Assistance Systems (ADAS) or driverless vehicles. Multiple sensors, including thermal cameras, radio detection and ranging (RADAR), light detection and ranging (LIDAR) sensors, and proximity sensors, substitute drivers in these cars, providing automated driving, navigation, and better situational awareness.

- Further, thermal imaging cameras are integrated into driverless cars to increase night vision and identify people or animals in foggy, crowded areas, and foggy situations, instantly stopping the vehicle from avoiding any casualties.

- Thermal imaging cameras are used in the automobile industry to allow drivers to see in harsh lighting and weather situations to avoid accidents and assure safety. Automotive manufacturers and thermal imaging solution suppliers are working together to develop innovative thermal solutions for the automotive industry.

- Thermal imaging technology is also utilized for non-destructive inspection of automotive parts and micro-components to assure vehicle safety while saving time and money. ImageIR 9400 hp, ImageIR 10300, and VarioCAM HD examine 900 thermal imaging cameras, for example, are specifically built for automotive applications by InfraTec GmbH (Germany).

Europe Thermal Imaging Systems Industry Overview

Europe's thermal imaging systems market is partially fragmented and consists of several major players. Some major players, like FLIR, Bae Systems, Elbit Systems Ltd, Raytheon Co., and L-3 Communications, are already present in the thermal imaging systems market. However, many companies are increasing their market presence with innovative solutions by securing new contracts and tapping new markets.

- December 2022 - Teledyne FLIR collaborated with RealWear to launch thermal imaging to wearable design equipment using a voice-controlled, fully hands-free thermal camera module for the first time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Thermal Imaging is Becoming Increasingly Used in a Variety of Applications

- 5.1.2 Technological Upgradation in Thermal Imaging Systems

- 5.2 Market Challenges

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Product Type

- 6.2.1 Fixed Thermal Cameras

- 6.2.2 Handheld Thermal Cameras

- 6.3 By Application

- 6.3.1 Security and Surveillance

- 6.3.2 Monitoring and Inspection

- 6.3.3 Detection and Measurement

- 6.4 By End User

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare and Life Sciences

- 6.4.4 Oil and Gas

- 6.4.5 Food and Beverages

- 6.4.6 Other End Users

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Flir Systems Inc.

- 7.1.2 L-3 Communications Holdings

- 7.1.3 Lockheed Martin

- 7.1.4 BAE Systems PLC

- 7.1.5 DRS Technologies Inc.

- 7.1.6 Elbit Systems Ltd

- 7.1.7 Raytheon Co.

- 7.1.8 Sofradir Group

- 7.1.9 Thermoteknix Systems Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219