|

市場調查報告書

商品編碼

1628712

亞太地區熱成像系統:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)APAC Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

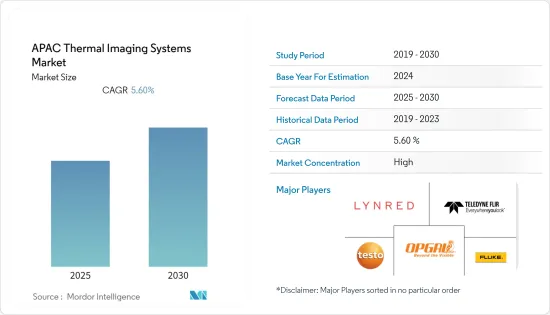

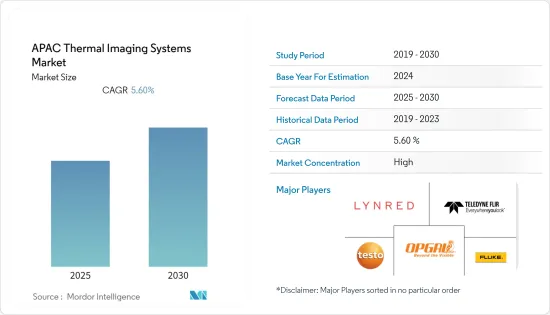

亞太地區熱成像系統市場預計在預測期內複合年成長率為 5.6%

主要亮點

- 紅外線成像使用稱為紅外線成像儀的特殊高性能相機來檢測人眼看不見的電磁波頻譜的長紅外線區域。近年來,熱成像系統由於在軍事和國防應用中的使用不斷增加而經歷了模式轉移。陸軍和海軍使用熱熱感儀進行邊境監視和執法。它也用於船舶防撞和導引系統,以及航空工業,以顯著降低照度和夜間飛行風險。

- 為了滿足日益不對稱、多維和致命的戰場的需求,世界各國軍隊正在對其軍事武庫進行現代化改造,並為士兵配備最新的戰鬥和監視技術。運動偵測是自動目標辨識(ATR)和周界監視系統的關鍵要素之一。由於熱感能夠在所有天氣條件下運行,因此已成為這些系統不可或缺的一部分。

- 此外,智慧型手機作為具有成本效益的手持式/可攜式熱感的出現預計將增加該技術的採用。 Caterpillar (Cat) 正在為其 Cat S60 和新型 Cat S61 智慧型手機配備 FLIR 熱熱感儀。

- 此外,辦公室、多用戶住宅、商場等建築物中的電氣設備往往安裝在通風不良的區域。同樣,需要有效的維護計劃來避免災難。跨多個行業的研究表明,使用熱像儀進行預測性維護可將維護成本降低高達 40%,並將工廠停機時間降低高達 50%。有鑑於此,手持熱成像市場前景光明。

- 此外,與 SAE 自動化 2 級和 3 級相容的熱成像技術可能會在 2022 年或 2023 年開始大規模採用,預計年成長率很高。根據瑞銀、英偉達和英特爾預測,註冊自動駕駛汽車的佔有率預計將從2021 年的0.1% 升至2030 年的12%,而熱成像將幫助自動駕駛汽車達到5 級,這可能是一項必要的技術。這些趨勢正在加速亞太地區對熱成像系統的需求。

亞太地區熱成像系統市場趨勢

政府和國防活動支出增加

- 熱感的最初應用是在軍事和國防部門。國防部門對監視、熱感成像和熱感成像系統的投資正在增加,並且預計將繼續下去。

- 由於技術滲透率不斷提高、國防費用高以及許多中小企業 (SME) 的存在,亞太地區提供了潛在的成長機會。

- 例如,根據斯德哥爾摩國際和平研究所的數據,中國、印度和日本等國家在 2020 年分別花費了 2,520 億美元、720 億美元和 491 億美元,成為該地區最多的國家。因此,市場為供應商提供了各種商機。

- 此外,該地區的許多新興企業因其熱感成像技術的使用而引起了政府的關注。例如,2021 年 9 月,印度陸軍和喀拉拉邦警方對新興企業表現出了濃厚的興趣,該公司正在開發熱成像監控系統。為此,歐扎克科技及其研發部門決定合作生產國防用熱感。

印度預計將佔據較大市場佔有率

- 由於該地區擴大採用熱成像產品和服務,用於監控、威脅偵測、汽車和預測性維護等應用,預計印度在預測期內將佔據熱成像系統市場的重要佔有率。

- 大多數公司都在努力開發更好的熱像儀,提供詳細的熱資訊,使他們比競爭對手更具競爭優勢。例如,Telops 推出了一款高速紅外線相機,最大資料吞吐量超過 1 GB。這款紅外線相機能夠在全解析度和子視窗模式(64 x 4 像素)下以 1900 fps 的速度擷取影像。

- 此外,2021年6月,我們宣布加強使用熱感的邊境監控。預計這將有助於軍隊防禦空中邊境入侵。此外,據印度國防部稱,將部署結合擴增實境和熱成像的 ARHMD 技術來加強印度邊防安全。

- 隨著太陽能不斷普及,太陽能板變得昂貴且脆弱的產品,適當的安全性變得越來越重要。許多太陽能園區業主選擇使用熱感的安全系統來保護他們的投資。例如,根據國際可再生能源機構的數據,2020年印度太陽能發電量將增加至39,211兆瓦,而2019年為25,089兆瓦。

亞太熱成像系統產業概況

熱成像系統市場由大量區域和全球公司整合。該市場的主要企業正在尋求透過產品創新擴大市場佔有率。

- 2021 年 2 月 - FLIR Systems 推出了 Veoneer 第四代夜視系統中採用的基於玻色子的熱感攝影機,與 FLIR Systems 的熱感汽車開發套件(ADK) 相同,作為新款凱迪拉克Escalade 的選裝件。新型熱感視覺系統提供了更寬的視野,解析度是上一代產品的四倍,增加了道路覆蓋範圍,提高了情境察覺,並為駕駛員提供了更清晰的影像。

- 2021年9月-Ray Technology推出配備Ray 熱感 CMOS技術的手持熱感像儀P200和M200A。配備0-90°旋轉鏡頭,可檢查各種通常較困難的情況,例如狹小的間隙和汽車底盤下,為客戶提供精確、高效和便攜的期望。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業供應鏈分析(包括熱感像儀製造商、熱感成像器/探測器供應商、鏡頭組供應商等清單)

- COVID-19 對熱成像產業的影響

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介(了解冷凍型和非製冷型之間的區別,以及系統建構中使用的波長,例如短波紅外線、中波紅外線和長波紅外線)

第5章 市場促進因素

- 熱成像系統成本的降低使其被眾多最終用戶所採用。

- 政府和國防活動支出增加

第6章 市場限制因素

- 缺乏定期的支援和服務

第7章 市場區隔

- 按申請

- 熱成像

- 海上/海岸監視

- 邊境監視

- 反無人機/無人機

- 關鍵基礎設施

- 其他(戰鬥、智慧型手機(強化)、醫療、個人視覺系統)

- 按類型

- 手持式成像設備和系統

- 固定系統

- 熱感模組

- 依產品

- 熱感像儀

- 熱感範圍

- 熱感模組

- 按最終用戶

- 航太/國防

- 執法

- 衛生保健

- 車

- 石油和天然氣

- 製造業

- 其他(住宅、公共設施、化學)

- 按國家名稱

- 中國

- 日本

- 印度

- 東南亞

- 其他亞太地區

第8章 競爭格局

- 公司簡介

- Fluke Corporation

- Flir Systems Inc.

- Opgal Optronic Industries Ltd

- Testo Inc.

- Trijicon Inc.

- Dongguan Xintai Instrument Co., Ltd .

- LYNRED

- Thermoteknix Systems Ltd.

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 51723

The APAC Thermal Imaging Systems Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- Thermal imaging detects a long IR range of the electromagnetic spectrum, which is invisible to the human eye by means of special and sophisticated cameras called Infrared Imagers. Thermal imaging systems have witnessed a paradigm shift in recent years due to their increasing use in military and defense applications. The army and navy popularly use it for border surveillance and law enforcement. It is also used in ship collision avoidance and guidance systems, whereas in the aviation industry, it has greatly mitigated the risks of flying in low light and night conditions.

- To cope with diversely asymmetric, multi-dimensional, and highly lethal imperatives of the battlefield, global armies are modernizing their military arsenal and getting soldiers geared up with the latest in combat and surveillance technology. Motion detection is one of the important element of Automatic Target Recognition (ATR) and perimeter monitoring systems. Thermal imaging has become an integral part of these systems because of its ability to operate in all weather conditions.

- Further, the advent of smartphones as cost-effective handheld/portable thermal imaging devices is expected to increase technology adoption. Caterpillar(Cat) companies have integrated FLIR's thermal imaging camera in the Cat S60 and the latest Cat S61 smartphones.

- Moreover, electrical installations in buildings like an office complex, residential complex, or shopping complex like a mall are mostly located at places with poor air ventilation. Again, it requires an effective maintenance schedule to avoid any mishap. Various surveys in different sectors have shown that predictive maintenance using thermal imaging has saved up to 40% of the maintenance cost and 50% of the plant process's downtime. These factors have a positive outlook on the handheld thermal imaging equipment market.

- Furthermore, It has been expected that the adoption of significant volumes of thermal cameras for SAE automation levels 2 and 3 will likely start in 2022 or 2023, with high annual growth rates. According to UBS, Nvidia, and Intel, the expected autonomous vehicle registration share would reach 12% in 2030 from 0.1% in 2021, and thermal imaging might be the technology autonomous vehicles need to reach level five. Such trends are accelerating the need for thermal imaging systems in the Asia Pacific.

APAC Thermal Imaging Systems Market Trends

Increasing Spending by Government and Defense Activities

- Military and defense were the very first applications of IR and thermal imaging systems. With the defense sector's rising investments in surveillance, IR, and thermal imaging systems, adoption is expected to increase in the future.

- The Asia-Pacific region offers potential growth opportunities due to the rise in technology penetration and high defense spending, and the presence of many small and medium enterprises (SMEs).

- For instance, according to Stockholm International Peace Research Institute, countries like China, India, and Japan have the highest military spending in the region as the countries spent USD 252 billion, USD 72 billion, and USD 49.1 billion respectively in 2020. This drives various opportunities for the vendors in the market.

- Moreover, many startups in the region are gaining attention from the government to utilize thermal imaging systems. For instance, in September 2021, The Indian Army and the Kerala Police developed a keen interest in a startup called Panther that develops thermal imaging surveillance systems. This led to the collaboration with Ozak Technologies and its R&D division to manufacture the thermal imaging equipment for the defense.

India is expected to hold significant market share

- India is expected to hold a significant market share for the thermal imaging systems market during the forecast period due to the increasing adoption of infrared imaging products and services by organizations in the region for applications, such as surveillance, threat detection, automotive, predictive maintenance, and others.

- Most companies are keen on developing a better IR camera to provide detailed infrared information to gain a competitive edge over others. For instance, Telops introduced a high-speed infrared camera, which features a maximum data throughput of larger than 1 Gigapixels. The infrared camera can acquire images at 1900 fps in the full resolution, which can be increased up to 90,000 fps in sub-window mode (64 x 4 pixels.).

- Moreover, in June 2021, the country announced boosting border surveillance through thermal imaging displays for the operator. This is expected to help the army to defend against airborne border incursions. Further, according to the Defence Ministry, ARHMD technology is deployed that incorporates augmented reality and thermal imaging to boost Indian border patrols.

- Solar power is becoming increasingly popular, and solar panels are becoming a costly and vulnerable commodity, leading to the increasing importance of decent security. Many solar park owners opt for a security system based on thermal imaging cameras to protect their investment. For instance, according to International Renewable Energy Agency, India's solar energy capacity rose to 39,211 megawatts in 2020 compared to 25,089 megawatts in 2019

APAC Thermal Imaging Systems Industry Overview

The thermal imaging system market is consolidated, with a considerable number of regional and global players. The major players in the market are trying to gain more market share with product innovations.

- February 2021 - FLIR Systems launched Boson-based thermal camera in Veoneer's fourth-generation Night Vision System as an option on the all-new Cadillac Escalade, identical to the FLIR Thermal Automotive Development Kit (ADK). The new thermal-vision system offers a broader field-of-view with four times the resolution compared to the previous generation, extending road coverage, improving situational awareness, and displaying a sharper image to the driver.

- September 2021 - Iray Technology launched P200 and M200A handheld thermal cameras with Ray thermal CMOS technology. The cameras are expected to offer customers accuracy, efficiency, and portability as it is equipped with a 0-90° rotary lens that enables users to inspect narrow gaps and under car chassis, among multiple other scenarios, where it is usually challenging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis (Includes list of Thermal Camera Manufacturers, Thermal Imager/Detector Suppliers, Lens Set Suppliers, etc.)

- 4.3 Impact of COVID-19 on the Thermal Imaging Industry

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot (Diffrence between Cooled and Un cooled Thermal imaging sysytem, an understanding on wavelenths susch as shortwave infrared, mid-wave infrared, longwave infrared used to build the system)

5 Market Drivers

- 5.1 Reducing Cost of Thermal Imaging Systems has Led to the Adoption Across various End Users

- 5.2 Increasing Spending by Government and Defense Activities

6 Market Restraints

- 6.1 Lack of Regular Support and Services

7 MARKET SEGMENTATION

- 7.1 Application

- 7.1.1 Thermography

- 7.1.2 Maritime and Costal Surveillance

- 7.1.3 Border Surveillance

- 7.1.4 C-UAS/Drones

- 7.1.5 Critical Infrastructure

- 7.1.6 Others( Fighting, Smartphones (Ruggedized), Medical, Personal Vision Systems)

- 7.2 Type

- 7.2.1 Handheld Imaging Devices and Systems,

- 7.2.2 Fixed Mounted Systems

- 7.2.3 Thermal Module

- 7.3 Product

- 7.3.1 Thermal Camera

- 7.3.2 Thermal Scope

- 7.3.3 Thermal Module

- 7.4 End-User vertical

- 7.4.1 Aerospace and Defense

- 7.4.2 Law Enforcement

- 7.4.3 Healthcare

- 7.4.4 Automotive

- 7.4.5 Oil and Gas

- 7.4.6 Manufacturing

- 7.4.7 Others(Residential, Utility, Chemical)

- 7.5 Country

- 7.5.1 China

- 7.5.2 Japan

- 7.5.3 India

- 7.5.4 Southeast Asia

- 7.5.5 Rest of Asia Pacific

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fluke Corporation

- 8.1.2 Flir Systems Inc.

- 8.1.3 Opgal Optronic Industries Ltd

- 8.1.4 Testo Inc.

- 8.1.5 Trijicon Inc.

- 8.1.6 Dongguan Xintai Instrument Co., Ltd .

- 8.1.7 LYNRED

- 8.1.8 Thermoteknix Systems Ltd.

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219