|

市場調查報告書

商品編碼

1640430

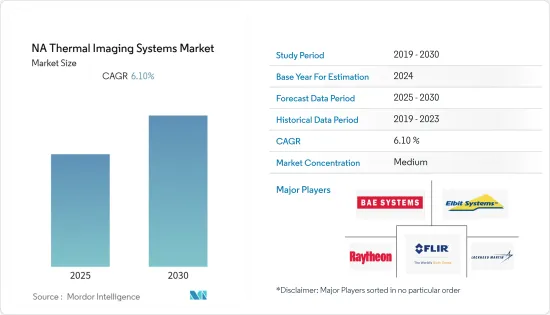

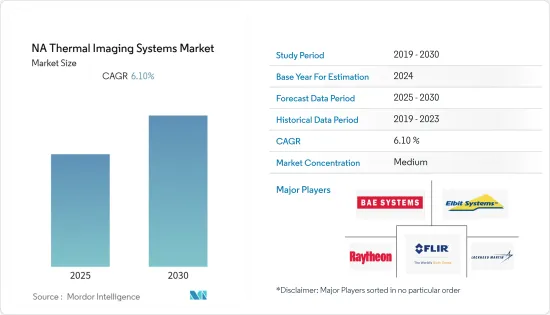

北美熱成像系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)NA Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,北美熱成像系統市場預期複合年成長率為 6.1%

關鍵亮點

- 智慧型手機作為具有成本效益的手持/可攜式熱像儀的出現預計將增加該技術的採用。Caterpillar (Cat) 正在為其 Cat S60 和最新的 Cat S61 智慧型手機配備 FLIR Systems 的熱成像攝影機。

- 美國參與各種國際活動,包括維和行動和對外國政府的援助。隨著美國在世界各地捲入各種小規模戰役和衝突,擁有適當的技術來保護我們的軍隊變得更加重要。

- 美國和加拿大士兵在黑暗和艱苦的條件下作戰。因此,即使是小小的技術進步也能帶來巨大的改變。熱成像技術可幫助軍隊在黑暗中與敵人和恐怖分子作戰,從而消除威脅。

- 熱成像技術最初應用於軍事,目前已廣泛應用於各行各業。熱成像正在透過軍事、個人手持相機和行動電話等各種應用改變世界。紅外線攝影機用途廣泛,但能夠挽救生命的攝影機是革命性的。這些設備現在更緊湊、更易於使用,並且能夠生成高解析度影像。

- 紅外線熱像儀需求的不斷成長,受到各行各業監控需求的不斷增加、紅外線熱像儀成本的持續下降、高速紅外線熱像儀的快速發展等因素的推動。與相機相關的不準確測量和影像色彩問題正在威脅該行業的發展。軍事和國防工業以及汽車行業嚴重依賴熱成像攝影機。

北美熱成像系統市場趨勢

軍事和國防部門可望引領市場

- 近年來,熱成像攝影機由於在軍事和國防應用中的廣泛應用而經歷了模式轉移。陸軍和海軍使用紅外線攝影機進行邊境監視和執法。它們也用於船舶防撞和引導系統以及航空工業,大大降低了在照度和夜間飛行的風險。

- 軍事和國防工業是熱成像攝影機的早期採用者。隨著國防工業加大對監控的投資,熱成像攝影機的使用預計將會成長。

- 該地區各國政府正在投資下一代技術,為其軍隊提供更好、更準確的資訊。紅外線熱成像設備在軍事工業的應用日益擴大,影響紅外線熱像儀特別是短波長紅外線熱像儀的興起。

- 該地區的犯罪和暴力事件明顯增加。因此,國防安全保障部隊的預算正在增加,用於購買先進的防護系統和設備。隨著非致命武器和致命武器的擴散,現代戰爭變得越來越不對稱。美國的軍費開支比其他國家都多。

- 為了滿足日益不對稱、多面向和致命的戰場需求,世界各國的軍隊都在對其武器系統進行現代化改造,並為士兵配備最新的作戰和監控技術。運動偵測是自動目標辨識 (ATR) 和周界監控系統的關鍵組成部分。熱成像攝影機是此類系統的重要組成部分,因為它們無論天氣如何都能運作。

- 手持式熱成像攝影機的主要應用領域正在國防和安全領域不斷成長。美國計劃向執行作戰任務的士兵提供數千副新型護目鏡。最近,2021 年 3 月,美國正在為近戰部隊開發 IAVS 護目鏡。 IAVS 系統可透過安裝在步槍上的紅外線夜視鏡與班隊的武器整合。據國防視覺資訊發送服務(DVIDS)稱,新型護目鏡將有助於增強步兵的情境察覺。

紅外線攝影機在汽車中的普及

- 汽車產業擴大採用高科技自動駕駛汽車,也稱為 ADAS(高級駕駛輔助系統)和無人駕駛汽車。紅外線攝影機、雷達(無線電探測和測距)、LiDAR(光探測和測距)感測器和接近感測器等多種感測器可實現自動駕駛、導航和增強的情境察覺,因此這些汽車無需駕駛員即可行駛。

- 熱成像攝影機被整合到無人駕駛汽車中,以提高夜間可視度,並在有霧、擁擠和有薄霧的環境中識別人和動物,迅速使車輛停下來,以防止人員傷亡。 。

- 熱成像攝影機用於汽車行業,幫助駕駛員在不利的光照和天氣條件下看清情況,防止事故並確保安全。汽車製造商和熱成像解決方案供應商共同努力為汽車產業開發創新的熱解決方案。

- 熱成像技術也用於汽車零件和微型零件的無損檢測,節省時間和金錢,同時確保車輛安全。

北美熱成像系統產業概況

北美熱成像系統市場部分細分,由幾家領先的公司組成。一些大公司已經進入熱成像市場,包括 FLIR、Bae Systems、Elbit Systems Ltd.、Raytheon Co. 和 L-3 Communications。然而,憑藉創新的解決方案,許多公司正在透過贏得新契約和探索新市場來擴大其市場佔有率。

- 2022 年 5 月-Teledyne Technologies 旗下的 Teledyne FLIR Defense 獲得一份新的五年期、價值 5.002 億美元的契約,為美國交付先進的熱成像系統。該公司將為單兵武器瞄準具系列(FWS-I)計畫交付熱成像系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 擴大紅外線成像的應用

- 改進熱成像系統

- 市場限制

- 缺乏定期支援和服務

第6章 市場細分

- 按解決方案

- 硬體

- 軟體

- 服務

- 依產品類型

- 固定熱成像

- 手持式熱成像儀

- 按應用

- 安全和監控

- 監測和檢查

- 檢測與測量

- 按最終用戶

- 航太和國防

- 車

- 醫學生命科學

- 石油和天然氣

- 飲食

- 其他

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Flir Systems Inc.

- L-3 Communications Holdings

- Lockheed Martin

- BAE Systems PLC

- DRS Technologies Inc.

- Elbit Systems Ltd

- Raytheon Co.

- Sofradir Group

- Thermoteknix Systems Ltd

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 52898

The NA Thermal Imaging Systems Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- The advent of smartphones as cost-effective handheld/portable thermal imaging devices is expected to increase technology adoption. Caterpillar (Cat) companies have integrated FLIR's thermal imaging camera in the Cat S60 and the latest Cat S61 smartphones.

- The United States is involved in various international activities, including peacekeeping missions and assisting foreign governments. As the United States becomes involved in various minor engagements and skirmishes worldwide, appropriate technology to defend the troops becomes increasingly critical.

- The US and Canadian soldiers have fought in the dark and under challenging conditions. Thus, even small advances in technology may make a significant difference. Thermal imaging technology has aided armies in combating the enemy and terrorists in the dark, allowing them to neutralize the danger.

- Thermal imaging is an example of a technology that began in military applications and is now employed in various industries. Thermal imaging is transforming the world with uses spanning from military to personal portable cameras and cellphones. Though it has a wide range of applications, some connected to saving lives have proven to be game-changers. These devices have grown more compact, user-friendly, and capable of producing high-resolution pictures.

- Increased demand for IR cameras is driven by factors such as the growing need for surveillance across a wide range of industries, the continual reduction of thermal camera costs, and the rapid development of high-speed infrared cameras. Inaccurate measurements and picture color problems associated with cameras are posing a threat to the industry's growth. The military and defense industries, as well as vehicles, rely heavily on infrared cameras.

North America Thermal Imaging System Market Trends

Military and Defense Sector is Expected to Drive the Market

- Thermal imaging systems have witnessed a paradigm shift in recent years due to their increasing use in military and defense applications. The army and navy popularly use it for border surveillance and law enforcement. It is also used in ship collision avoidance and guidance systems, whereas in the aviation industry, it has greatly mitigated the risks of flying in low light and night conditions.

- The military and defense industries were among the first to use infrared and thermal imaging devices. With the defense sector's increased investment in surveillance, the use of infrared and thermal imaging equipment is projected to grow.

- Governments all across the region are investing in next-generation technology by giving better and more accurate information to military troops. The use of IR thermography equipment in the military industry has grown, influencing the rise of infrared cameras, particularly short-wavelength IR cameras.

- There is a significant trend of increasing crime and violence in the region. As a result of this element, the budgets of the homeland security forces have increased in order to purchase advanced protection systems and devices. With an expanding number of non-lethal and deadly weapons, modern combat has grown increasingly asymmetric. The US spends more money on its military than any other country.

- To cope with diversely asymmetric, multi-dimensional and highly lethal imperatives of the battlefield, global armies are modernizing their military arsenal and getting soldiers geared up with the latest in combat and surveillance technology. Motion detection is one of an important element of Automatic Target Recognition (ATR) and perimeter monitoring systems. Thermal imaging has become an integral part of these systems because of its ability to operate in all weather conditions.

- The major application of handheld thermal imaging is increasing with the defense and security sector. The US Army is aiming to provide thousands of new goggles to its soldiers engaged in combat missions. Recently, in March 2021, the IAVS goggles are being developed by the US Army for close-combat forces. IAVS system can integrate with troops' weapons through a rifle-mounted thermal imaging night vision scope. According to Defense Visual Information Distribution Service (DVIDS), the new goggles will help enhance infantry troops' situational awareness.

Thermal Imaging is Being More Widely Used in Vehicles

- The automobile industry is gaining traction with high-tech autonomous cars, also known as advanced driver-assistance systems (ADAS) or driverless vehicles. Multiple sensors, including thermal cameras, radio detection and ranging (RADAR), light detection and ranging (LIDAR) sensors, and proximity sensors, substitute drivers in these cars to enable automated driving, navigation, and better situational awareness.

- To increase night vision and identify people or animals in foggy, crowded areas, and foggy situations, thermal imaging cameras are integrated into driverless cars, which instantly stop the vehicle to avoid any casualties.

- Thermal imaging cameras are used in the automobile industry to allow drivers to see in harsh lighting and weather situations to avoid accidents and assure safety. Automotive manufacturers and thermal imaging solution suppliers are working together to develop innovative thermal solutions for the automotive industry.

- Thermal imaging technology is also utilized for non-destructive inspection of automotive parts and micro-components to assure vehicle safety while saving time and money.

North America Thermal Imaging System Industry Overview

North America's thermal imaging systems market is partially fragmented and consists of several major players. Some major players, like FLIR, Bae Systems, Elbit Systems Ltd., Raytheon Co., L-3 Communications, are already present in the thermal imaging systems market. However, with innovative solutions, many companies are increasing their market presence by securing new contracts and tapping new markets.

- May 2022 - Teledyne Technologies' Teledyne FLIR Defense received a new five-year contract of USD 500.2 million for delivering advanced thermal imaging systems to the US Army. The company would deliver the thermal imaging systems for the Family of Weapons Sights-Individual (FWS-I) program.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Thermal Imaging is Increasingly Being Used in a Variety of Applications

- 5.1.2 Technological Upgradation in Thermal Imaging Systems

- 5.2 Market Restraints

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Product Type

- 6.2.1 Fixed Thermal Cameras

- 6.2.2 Handheld Thermal Cameras

- 6.3 By Application

- 6.3.1 Security and Surveillance

- 6.3.2 Monitoring and Inspection

- 6.3.3 Detection and Measurement

- 6.4 By End User

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare and Life Sciences

- 6.4.4 Oil and Gas

- 6.4.5 Food and Beverages

- 6.4.6 Other End Users

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Flir Systems Inc.

- 7.1.2 L-3 Communications Holdings

- 7.1.3 Lockheed Martin

- 7.1.4 BAE Systems PLC

- 7.1.5 DRS Technologies Inc.

- 7.1.6 Elbit Systems Ltd

- 7.1.7 Raytheon Co.

- 7.1.8 Sofradir Group

- 7.1.9 Thermoteknix Systems Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219